[ad_1]

As Girls’s Historical past Month attracts to a detailed, a brand new Goldman Sachs report discovered greater than 1 / 4 of ladies (28%) are saving lower than $50,000 for retirement.

“Assuming a 4% withdrawal fee, $50,000 in retirement financial savings supplies $2,000 of revenue per 12 months,” famous the report’s authors. “At these ranges, Social Safety advantages are a vital a part of retirement revenue technique. Nevertheless, in keeping with the Social Safety Administration, girls on common obtain 22% much less in Social Safety advantages pushed partly by pay gaps and part-time work.”

In a complement to its 2023 Retirement Survey & Insights Report known as Challenges Girls Face Saving for Retirement, Goldman Sachs Asset Administration checked out information from 5,261 survey respondents throughout gender, age and job standing. Roughly 30% had retired on the time of the survey in July.

Along with shedding out on extra Social Safety revenue resulting from elements usually related to caregiving, girls additionally are inclined to retire sooner than deliberate and for extra sudden causes. Mixed with persisting revenue disparities, girls are retiring with anyplace from 24% (in keeping with Goldman) to 30% (in keeping with Tina Sanchez, head of nationwide retirement accounts for BlackRock) much less financial savings than the opposite 49.49% of the U.S. inhabitants.

“The current market surroundings has been exhausting on everybody, however it is necessary that we acknowledge that ladies, and particularly girls of colour, have been hit the toughest,” Sanchez stated throughout a current webinar, hosted by Vestwell, discussing girls and retirement.

“We consult with it because the triple whammy,” she stated. “It’s the pay hole: on common, girls nonetheless make lower than males; it’s about 83 cents on the greenback now. It’s the gaps in employment: girls are disproportionately usually the caregivers spending outing of the workforce to take care of family members. And it’s longevity: we all know girls reside, on common, 5 years longer than males.”

Regardless of these challenges, the Goldman report discovered enhancements within the retirement outlook of working girls, together with diminished stress in managing financial savings, elevated confidence and extra financial savings over the earlier 12 months.

The examine additionally delved into how gender-based variations could have an effect on funding priorities, preferences and market reactions.

Working girls are nonetheless extra more likely to really feel they’re not saving sufficient for retirement; 43% really feel like they’re delayed, whereas just a little greater than a fifth assume they’re forward. By comparability, 37% of working males really feel like they’re forward and three in ten wish to catch up.

Nevertheless, girls reported feeling extra snug with their financial savings than they have been a 12 months earlier. Simply half stated managing retirement financial savings is aggravating, down from 63% the earlier 12 months and in contrast with 42% of their male counterparts.

“In fact, whereas it is very important see the optimistic growth, it’s nonetheless vital that half of surveyed girls report feeling stress managing their financial savings,” famous the report’s authors.

Girls additionally reported that the wrestle to steadiness a number of monetary targets, dubbed the “monetary vortex” by GSAM, was having much less affect on their retirement plan in 2023 than within the earlier 12 months. Together with issues like bank card debt, saving for faculty, supporting members of the family, excessive month-to-month bills and sudden prices, girls have been feeling higher throughout the board—a pattern that was reversed among the many males.

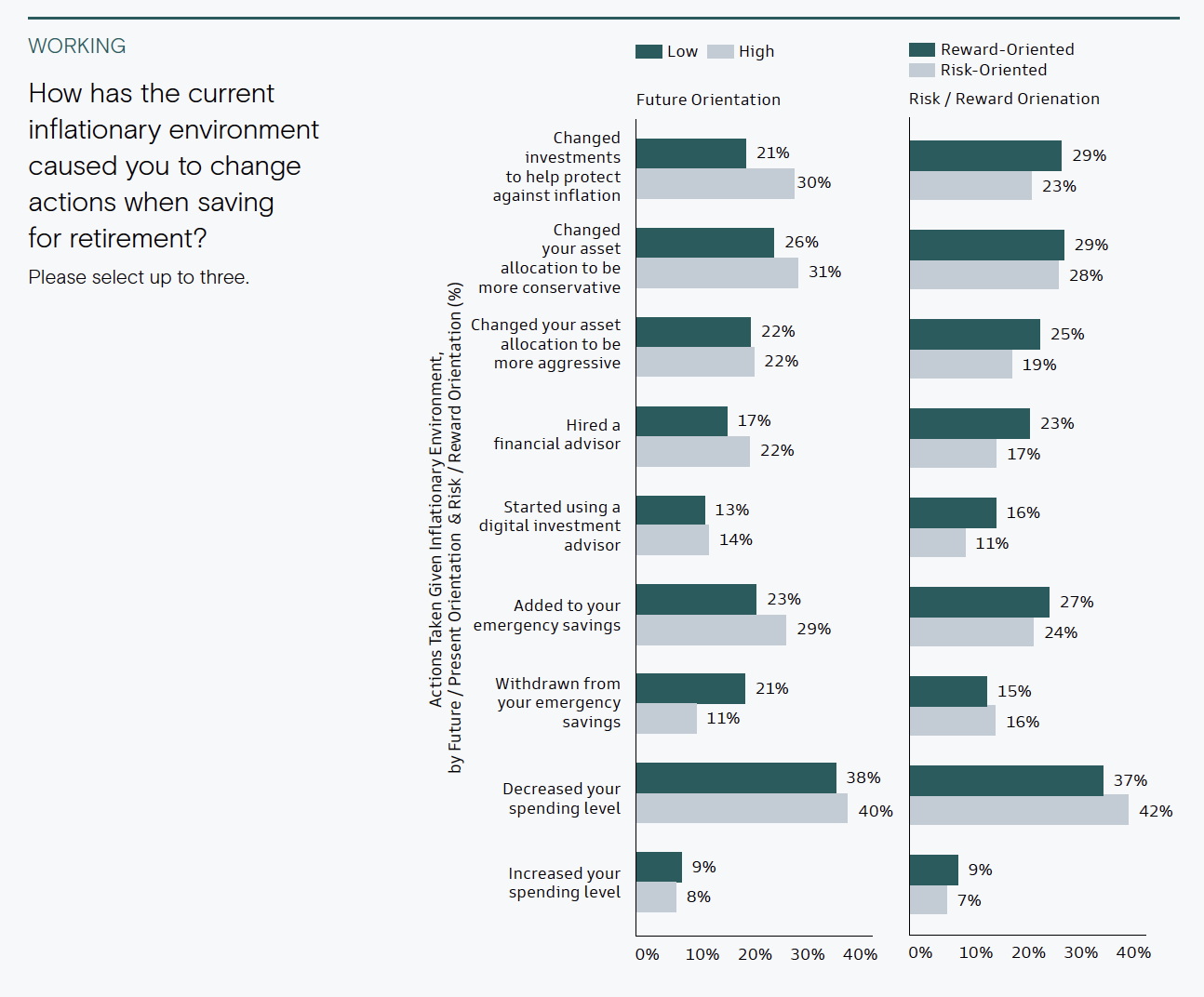

In keeping with the evaluation, this means girls could also be extra oriented to the current and risk-averse whereas males are extra rewards-driven and targeted on the long run, traits that may have a big affect on funding decisions in several market environments.

Click on to enlarge

“This highlights the deeply private nature of monetary targets, and the usefulness of periodically accessing calculators and instruments to guage retirement readiness and improve confidence,” in keeping with GSAM Senior Retirement Strategist Chris Ceder. “Planning assumptions needs to be evaluated together with every particular person’s imaginative and prescient for retirement.”

In the course of the dialog with Vestwell, BlackRock’s Sanchez and Bonnie Treichel, founding father of Endeavor Retirement, highlighted the necessity for broader entry to training and monetary assets to assist girls retire with extra safety. Sanchez advisable a mixture of energetic funding administration methods and goal date funds to assist overcome the behavioral problem by doubtlessly incomes higher returns.

“If girls really feel like they’re under-saving, they need to undoubtedly be contemplating energetic administration methods to assist make up for the financial savings shortfall by offering extra alpha,” Sanchez stated. “And with goal date funds, girls’s investing habits is tremendous encouraging. We see girls make investments for the long run.”

Treichel and Tali Vaughn, regional VP of gross sales and consulting for retirement plan administrator EGPS, each prompt custom-made planning could assist tackle a number of the distinctive challenges girls face resulting from residing longer and bearing the brunt of household caregiving. They famous that proactive recommendation across the Safe 2.0 provisions pertaining to part-time, freelance and gig economic system staff, emergency financial savings packages and scholar mortgage debt may very well be particularly helpful to girls.

In the end, the GSAM analysis discovered roughly three-quarters of retired girls and two-thirds of retired males live on lower than 70% of their working revenue. A couple of third of ladies are dissatisfied with this, in comparison with a fifth of males.

“We do want to speak about our funds extra and to vocalize our priorities,” stated Vestwell’s Kim Andranovich, citing a current Forbes article by Jamie Hopkins. “The steadiness of wealth is shifting and on account of residing longer, girls would be the major wealth holders in all probability throughout the subsequent decade.

“So, it’s completely vital.”

[ad_2]