[ad_1]

Consideration self-employed people and rental property house owners, when you have an LLC, S-Corp, partnership, C-Corp, or different state-registered entity, your entity has a brand new federal reporting requirement beginning on January 1, 2024.

It’s known as the FinCEN Useful Possession Info (BOI) report. This report is remitted by the Company Transparency Act handed by Congress in 2021. Mainly your state-registered entity should inform the federal authorities who’s behind that entity.

Submitting the report itself isn’t too tough provided that you already know you will need to do it. Not submitting the report by the deadline can incur civil penalties of as much as $500 per day (!) or as much as two years of jail time.

Who Should File the Report

Most small LLCs, S-Corps, partnerships, C-Corps, or different state-registered entities should file the report. Some entities are exempt however it is best to assume that your entity should report except you see a transparent exemption within the Small Entity Compliance Information.

Sole proprietorships with solely a DBA don’t have to file the report. From the FAQs:

C. 6. Is a sole proprietorship a reporting firm?

No, except a sole proprietorship was created (or, if a overseas sole proprietorship, registered to do enterprise) in america by submitting a doc with a secretary of state or related workplace. An entity is a reporting firm provided that it was created (or, if a overseas firm, registered to do enterprise) in america by submitting such a doc. Submitting a doc with a authorities company to acquire (1) an IRS employer identification quantity, (2) a fictitious enterprise identify, or (3) an expert or occupational license doesn’t create a brand new entity, and subsequently doesn’t make a sole proprietorship submitting such a doc a reporting firm.

When to File the Report

Present entities created earlier than January 1, 2024 should file the report by January 1, 2025. As a result of it’s straightforward to overlook and the penalties are heavy should you don’t do it, it is best to file the report ASAP.

A brand new entity shaped in 2024 should file the report inside 90 days of its formation. If you happen to kind a brand new entity after January 1, 2025, the brand new entity should file the report inside 30 days of its formation.

After you file the preliminary report, you don’t should do it yearly. The entity should file an up to date report inside 30 days solely when the beforehand reported data modifications. This consists of when the corporate or a reported useful proprietor strikes or will get a brand new driver’s license or passport.

Tips on how to File the Report

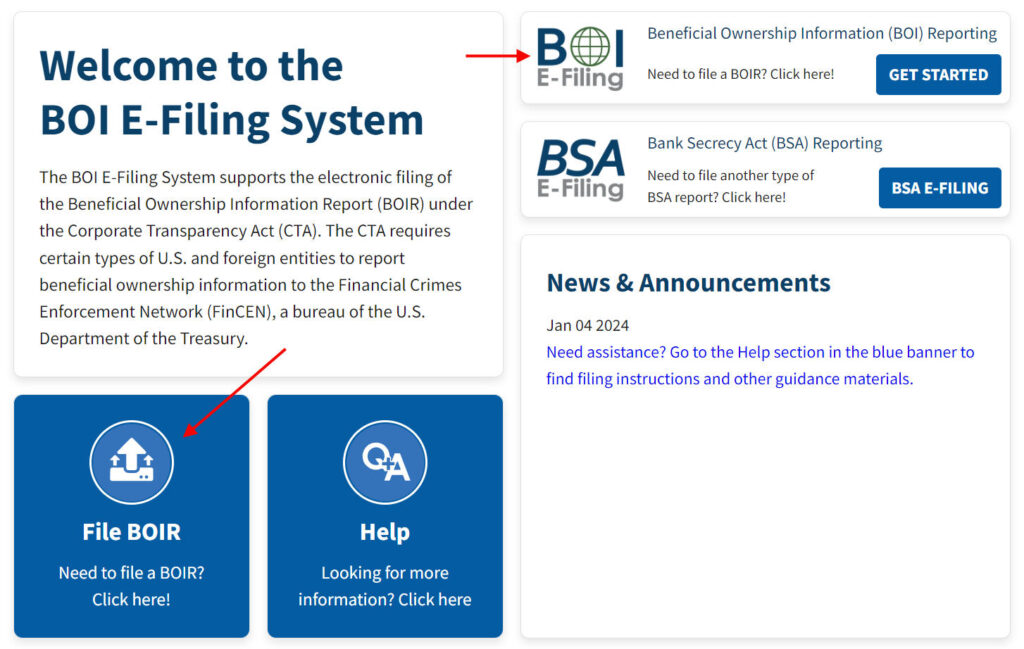

You file the report electronically with the Monetary Crimes Enforcement Community (FinCEN), which is a bureau of the U.S. Division of the Treasury. You possibly can submit a filled-out PDF file or use FinCEN’s on-line kind.

There’s no price for submitting the report.

Go to FinCEN’s BOI E-Submitting System. Both button will get you began.

What’s Within the Report

The report itself is sort of simple. It’s mainly the corporate’s identify, handle, tax ID, and every useful proprietor’s identify, handle, date of start, driver’s license or passport quantity, and a picture of the motive force’s license or passport.

A useful proprietor doesn’t essentially should have possession within the firm. Senior officers with substantial management should even be included even when they don’t have possession.

The data filed within the report received’t be made out there to most of the people.

Every entity information a report individually. You probably have a number of entities, you may get hold of a FinCEN ID together with your private data and reference the FinCEN ID in every entity’s report with out having to repeat your private data in every report. This additionally makes it simpler to replace the knowledge whenever you transfer or get a brand new driver’s license or passport.

For Extra Info

Please learn FinCEN’s BOI Small Entity Compliance Information.

***

Crucial factor about this FinCEN BOI report is to know that your LLC or S-Corp is required to file the report. Submitting the report solely takes quarter-hour. As with every different legislation, not figuring out the legislation’s existence doesn’t get you out of a penalty. I’d a lot choose to not have this chore however it’s what it’s. You probably have an LLC, S-Corp, or different state-registered entity, presumably you’ve gotten an excellent purpose to have it. This new reporting requirement has simply turn out to be part of the deal.

Say No To Administration Charges

If you’re paying an advisor a proportion of your belongings, you’re paying 5-10x an excessive amount of. Discover ways to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]