[ad_1]

By Angela Ang, Elwyn Panggabean, Ker Thao, Nonggol Darapati

Because the world shifts to residing in a brand new regular world, whereas nonetheless recovering from the aftermath of the COVID-19 pandemic, no different shift has been larger than the shift from conventional economies to what’s now recognized at the moment because the gig financial system.

COVID-19 created disproportionate impression to ladies, primarily as an impression in employers decreasing their workforce at unprecedented charges around the globe together with Indonesia. As employers diminished their workforce, the financial impression within the labor market shifted as effectively, particularly, ladies’s livelihoods have modified. Girls around the globe both had to decide on to proceed working or caring for his or her households full time or have an additional burden for paid-work in addition to do home work. Due to the development of expertise, many ladies noticed the chance to start out their very own enterprise on-line, from the comforts of their houses.

Previous to COVID-19, the variety of Extremely Micro Entrepreneurs in Indonesia (UMi) entrepreneurs utilizing digital platforms in Indonesia was round eight million folks. This quantity has almost doubled to fifteen.9 million folks for the reason that begin of the pandemic*. Now, greater than ever, it’s vital to harness the ability of digital platforms for ladies’s financial empowerment.

Indonesia’s financial system depends closely on small-scale entrepreneurs. Micro, small, and medium-sized enterprises make up 61% of Indonesia’s financial system, and the bulk (64%) of those entrepreneurs are ladies. COVID-19’s explicit financial challenges have pushed low-income folks to entrepreneurship because the formal job market contracts.

Final yr, BRI, Pegadaian, and Permodalan Nasional Madana (PNM) – a subsidiary of BRI, fashioned an Extremely Micro holding with BRI because the dad or mum holding. PNM has an present Extremely Micro buyer base with their group-lending enterprise mannequin named Mekaar. BRI goals to enhance monetary literacy and lending penetration for at the least 29 Million Extremely Micro prospects by 2024. BRI additionally goals to have a million Extremely Micro prospects graduate from the micro phase. As the brand new State owned Enterprise for Extremely Micro holding, BRI sees the Extremely Micro phase as a brand new supply of progress engine in reaching their 2025 imaginative and prescient to be “Probably the most Useful Banking Group in Southeast Asia & Champion of Monetary Inclusion.”

In an effort to achieve an understanding of Extremely Micro Entrepreneurs in Indonesia (prospects’ perspective and BRI’s Extremely Micro ecosystem, habits, wants and pursuits, Girls’s World Banking in cooperation with BRI performed a analysis on UMi prospects. The analysis was designed in thoughts with a selected goal to establish behavioral boundaries that will exist for these entrepreneurs in accessing BRI’s micro finance merchandise corresponding to KECE (a mortgage product designed for the ultra-micro phase with the idea of ease and pace for of mortgage utility course of) and Simpedes UMi (a saving’s product which may be very price efficient and has no minimal steadiness to keep up).

These three personas differ not solely of their digital utilization relating to their companies but in addition of their motivation in beginning their companies. The Necessity entrepreneur began their enterprise resulting from their revenue wants, the Steady entrepreneur ventured into their enterprise to complement their household revenue. Whereas the Progress Oriented entrepreneur began their enterprise to deal with a enterprise and achieve success. Regardless of the distinct differentiations between these three varieties of entrepreneurs, they share an identical trait in that relating to working capital, all of them use casual lending and non-formal establishments as their working capital, whether or not or not it’s by household, pals, and even their very own financial savings.

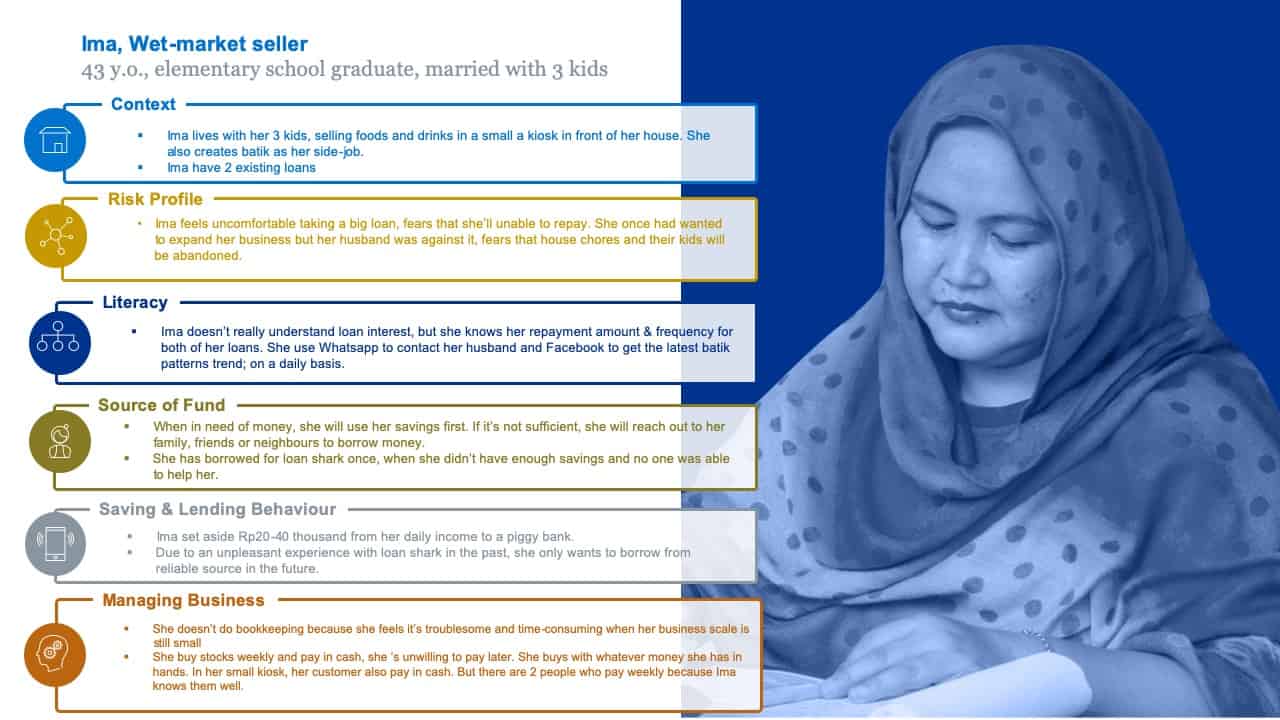

To realize a greater understanding and illustrate of the wants of those Extremely Micro Entrepreneurs, Girls’s World Banking has created a persona, Ima, a illustration of a typical UMi buyer, primarily based on different the shoppers within the analysis research.

Ima, a wet-market vendor, is a 43-year-old lady with a husband and three youngsters who owns a small kiosk in entrance of her home. She is an elementary college graduate and buys her backstock in money on a weekly foundation. She takes out a mortgage from household, pals, neighbors and never by a proper monetary establishment. Along with her small kiosk the place she sells small day by day requirements corresponding to cleaning soap, espresso, and different small day by day consumable items, Ima additionally creates batik (conventional Indonesian textiles that includes ornate geometric and floral patterns created by brushing or stamping scorching wax onto undyed cloth) to realize additional revenue.

Ima’s place is just like what nearly all of UMi entrepreneurs at present face with restricted monetary instructional background, being a dad or mum and regardless of of getting the ambition and drive to develop their enterprise, their greatest impediment additionally comes from their households. In Ima’s case it was her husband, who feared that by increasing her enterprise and the kiosk, together with taking an even bigger mortgage, Ima’s home chores and duties to her kids could be uncared for. For feminine UMi entrepreneurs, their greatest problem for monetary inclusion is having the liberty to have the ability to have entry to monetary services and products.

Ima’s restricted monetary schooling background has made her, and plenty of like her, skeptical of formal monetary establishments and particularly banks. Among the perceptions that they’d concerning banks and its utilization was that financial savings needed to be made in giant quantities. Different skepticism revolved round uncertainties in utilizing ATM machines and that the cash saved in financial institution accounts could be diminished resulting from account charges.

“Withdrawing from the financial institution is sophisticated, if I die quickly, I pity my household for not having the ability to withdraw cash from the account.”

On the subject of loans, for the UMi entrepreneurs, their greatest worry was the shortcoming to repay the mortgage. Along with this, additionally they feared to take out the mortgage itself since they’d by no means taken out a proper financial institution mortgage earlier than. For a lot of of those ladies, they selected to save lots of in conventional strategies corresponding to saving within the type of gold or saving at house. Saving within the type of gold is fashionable in Southeast Asia, the place for generations, it was seen as an “funding” that might both be pawned or offered when wanted. It additionally stems from the assumption that gold is a beneficial metallic that can’t be misplaced nor will it depreciate over time. However most significantly, the principle cause for ladies to save lots of in gold kind is that it’s thought of accessible at any time and is handy.

It’s evident that the boundaries for UMi entrepreneurs to be financially included lies with educating them on the banking course of and merchandise. Along with educating these entrepreneurs, there’s additionally a have to create tailor made merchandise and options, which might bridge the hole between the shopper’s information, expectations and calls for, together with the monetary merchandise that BRI at present presents its prospects.

Girls’s World Banking partnered with BRI to developed an answer to bridge the hole between the UMi entrepreneurs wants and the merchandise supplied by BRI to widen the monetary inclusion attain to those entrepreneurs and the financial institution. The answer goals to increase entry and understanding ladies ultra-micro entrepreneurs of monetary services and products significantly financial savings and mortgage, in addition to to empower key contact factors for ladies (e.g. brokers banking) to teach and provide monetary services and products, leading to larger utilization of these companies and larger ladies’s financial empowerment in the long term.

Keep tuned for half two the place we delve into the challenges, answer, and outcomes for these Extremely Micro Entrepreneurs in Indonesia of their journey to enter the formal monetary sector.

[ad_2]