[ad_1]

Firms like Apple, Google, and Twitter have lengthy acknowledged that how customers work together with their services and products has a direct impression on their success. That’s why they continuously check each side of their services and products with actual customers to make sure excessive ranges of buyer satisfaction. This course of is as integral to product growth in Silicon Valley, as it’s in Lagos, Nigeria the place Girls’s World Banking is utilizing the identical strategies to interrupt down boundaries and convey higher banking companies to low-income girls.

What’s UX?

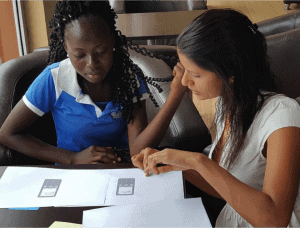

Person Expertise Testing, or UX Testing, is the method of enhancing satisfaction by bettering usability, accessibility and pleasure within the interplay between a consumer and a product. Researchers be taught from what customers truly do, versus what they are saying in focus teams or how they reply to surveys. By observing folks as they use a product within the context of their on a regular basis lives, we will be taught what options matter most to them, and enhance design to higher go well with the way in which they work together with the product.

Deploying high-tech strategies in fintech for low-income girls

With help from EFiNA, Girls’s World Banking partnered with Bankable Frontier Associates (BFA), a worldwide consulting agency that makes a speciality of the event of economic companies for low-income folks, to make use of UX testing on Diamond Financial institution’s BETA Financial savings Account. Our aim was to optimize the consumer expertise to drive sturdy uptake and use of BETA, notably amongst girls.

BETA is a protected, handy financial savings account, focused to girls, that delivers companies to prospects by way of cell phones and supportive channels akin to native service brokers generally known as BETA Buddies. BETA was launched 4 years in the past in Nigeria and serves over 300,000 prospects nationwide.

We utilized UX testing to 4 new self-service options being launched as an extension of BETA: “Examine Stability,” “Purchase Airtime Minutes,” “Ship Cash” and “Pay Payments” -. The brand new options are accessible by way of each sensible and primary telephones permitting prospects to conduct companies on their very own.

We utilized UX testing to 4 new self-service options being launched as an extension of BETA: “Examine Stability,” “Purchase Airtime Minutes,” “Ship Cash” and “Pay Payments” -. The brand new options are accessible by way of each sensible and primary telephones permitting prospects to conduct companies on their very own.

We noticed 19 account customers interacting with the brand new companies on each sensible telephones and primary telephones, and we interviewed 4 BETA Buddies. We started by studying concerning the customers, their households, their jobs or companies and the methods they use their BETA account. We arrange use-cases or situations primarily based on actual life conditions and assigned them duties akin to “test your steadiness.” We rigorously watched how contributors walked by way of every step, guiding them in a impartial method the place wanted, and recorded their preliminary reactions. As they moved by way of the steps, we famous the place they struggled or wanted assist, requested probing questions, after which moved them on to the following job.

Model-driven, user-tested product design

We knew that the design wanted to be aligned with BETA model rules of Easy, “No Wahala” (no stress), and Targeted on Financial savings. Based mostly on the outcomes of the UX assessments, we really helpful that the design optimizations give attention to a number of choices that had been most essential to customers and cut back the variety of steps concerned in utilizing the product. The interface ought to use quick, simple directions in native “pidgin lite,” a grammatically simplified English-based and creole type of communication used throughout Nigeria. Directions also needs to be in all capital letters, primarily based on our BFA marketing consultant’s statement that almost all indicators in Lagos had been written in, and customers can be accustomed to studying, all capital letters.

We knew that the design wanted to be aligned with BETA model rules of Easy, “No Wahala” (no stress), and Targeted on Financial savings. Based mostly on the outcomes of the UX assessments, we really helpful that the design optimizations give attention to a number of choices that had been most essential to customers and cut back the variety of steps concerned in utilizing the product. The interface ought to use quick, simple directions in native “pidgin lite,” a grammatically simplified English-based and creole type of communication used throughout Nigeria. Directions also needs to be in all capital letters, primarily based on our BFA marketing consultant’s statement that almost all indicators in Lagos had been written in, and customers can be accustomed to studying, all capital letters.

Fundamental telephone customers tended to be much less refined with expertise, had decrease literacy charges, and sometimes didn’t understand that value-added companies had been obtainable on their “small” telephones. Fundamental telephone customers additionally confronted challenges akin to smaller shows that made it cumbersome to scroll by way of choices and more durable to reply to menu choices. To deal with these challenges, we really helpful breaking textual content into readable “chunks” and displaying solely the 4 most essential choices to make the menu simpler to navigate. We additionally suggested providing fewer choices for cash quantities and shortening textual content into easier, extra recognizable phrases like “Ship Cash” as an alternative of “Switch Funds” to higher serve customers who’ve issue studying

These easy modifications make it simpler for customers to navigate their BETA Financial savings Account, and improve the chance that the low-income girls it was designed for will use and profit from the product. Diamond Financial institution plans to implement the modifications at the side of a communications plan to construct consciousness of the enhancements and to coach BETA pals on the brand new options. Diamond Financial institution will proceed to watch outcomes and optimize the product as wanted.

[ad_2]