[ad_1]

I heard an previous Norm Macdonald joke as soon as that went one thing like this:

An optimist appears on the glass as half full. A pessimist appears on the glass as half empty. I’m a pessimist and I have a look at the glass as half full…however I might need bowel most cancers.

I’m a glass-is-half-full man however are inclined to lean optimistic not like Norm.

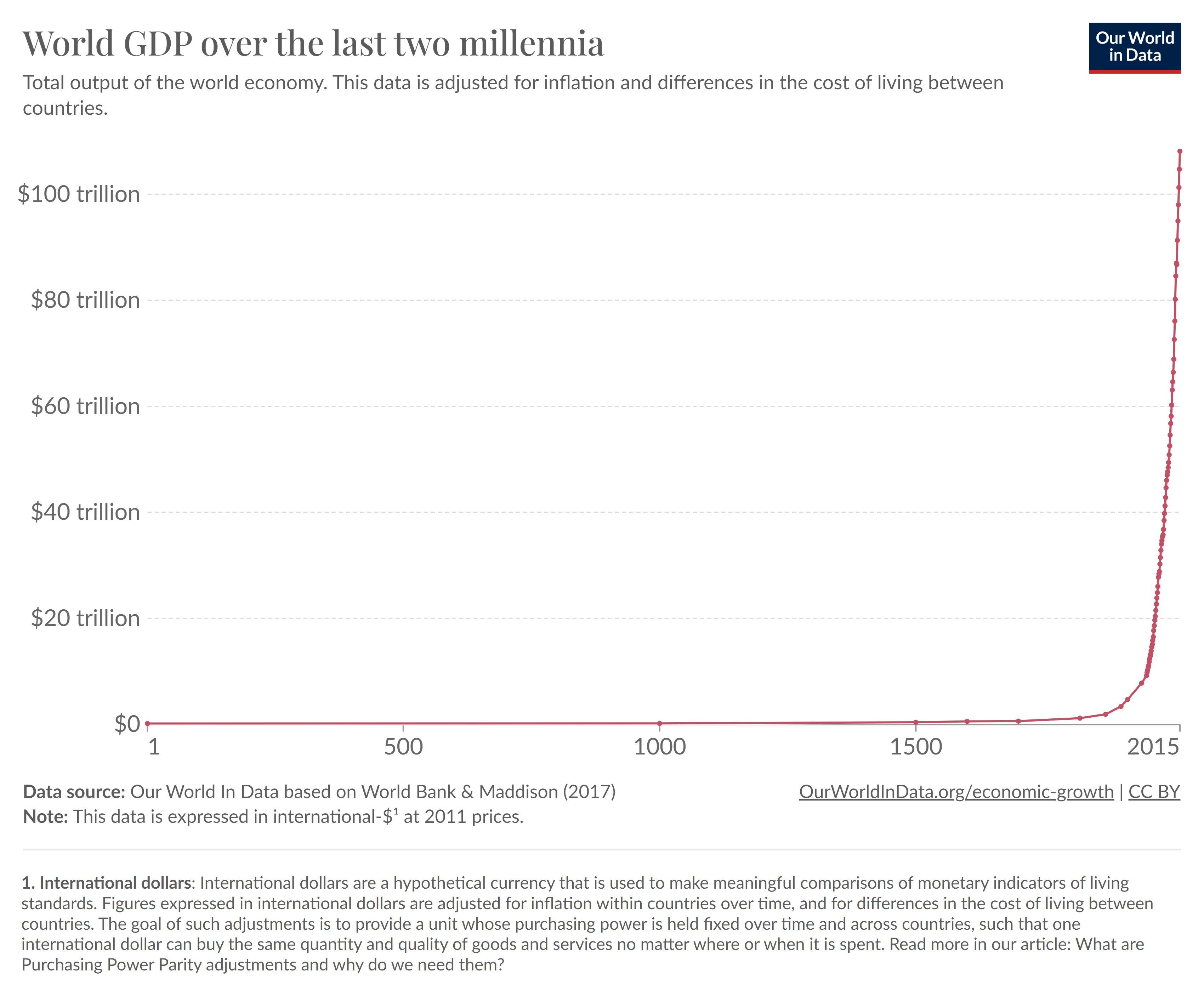

Simply take into consideration all that we’ve completed as a species.

The expansion.

We’ve put a person on the moon.

We’ve cured illnesses.

We’ve created revolutionary applied sciences.

Issues aren’t excellent however they’re by no means going to be.

I take into account myself a long-term optimist relating to the world at giant, the financial system and the markets. How may you not be optimistic concerning the future in spite of everything that we’ve completed?

The issue is blind optimism can result in issues for those who’re not cautious.

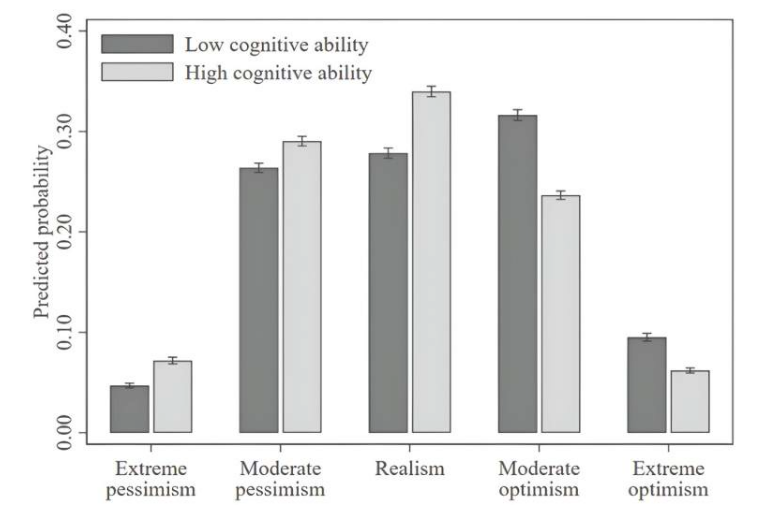

A brand new analysis paper by Chris Dawson concluded that larger ranges of monetary optimism are related to decrease cognitive potential:

The thought right here is unrealistic optimism can result in reckless habits relating to your funds.

In the event you assume your returns will likely be abnormally excessive within the markets, possibly you gained’t save as a lot cash. Or for those who assume monetary markets solely go up over time you’ll by no means be ready for the inevitable setbacks.

Nevertheless, this research additionally discovered these with the best ranges of cognitive potential usually tend to exhibit excessive pessimism. I don’t see this as an edge relating to investing both.

In the event you’re too pessimistic your returns are sure to be dangerous over the long term.

In actual fact, most of the smartest folks are typically horrible traders as a result of they’re too good for their very own good.

Warren Buffett as soon as mentioned, “If in case you have greater than 120 or 130 I.Q. factors, you possibly can afford to offer the remaining away. You don’t want extraordinary intelligence to succeed as an investor.”

The best way I see it there are two predominant forms of errors relating to investing:

Some persons are naive to the truth that they don’t know sufficient concerning the markets however act as in the event that they do. Not understanding what you’re doing is a severe threat.

However others are so clever they develop into overconfident in their very own talents. They assume they’ll outsmart the markets and different traders with ease. Overconfidence can get you into hassle whenever you lack the self-awareness to see your individual blind spots.

One other research revealed in 2012 regarded into the blind-spot bias, the concept persons are higher at recognizing irrationality in different folks than themselves. Not surprisingly, they discovered everybody has issue seeing their very own cognitive weaknesses.

However the researchers additionally found the smarter you might be, the higher your blind spots to your individual deficiencies:

Additional, we discovered that none of those bias blind spots had been attenuated by measures of cognitive sophistication corresponding to cognitive potential or pondering tendencies associated to bias. If something, a bigger bias blind spot was related to larger cognitive potential.

The smarter topics had greater blind spots to their very own faults on six of the seven cognitive biases studied.

As with most issues in life, stability is the important thing.

You need to stability IQ with temperament.

You need to stability long-term optimism with the understanding that short-term dangers at all times apply.

There’s a distinction between blind optimism and rational optimism. Sure, I feel the inventory market will go up over time however I’m not naive to the truth that there are going to be recessions, bear markets and crashes alongside the best way.

More often than not shares go up however typically they go down.

You additionally must stability confidence in your self and your talents with the self-awareness to acknowledge your weaknesses.

Einstein mentioned there are 5 ascending ranges of intelligence: good, clever, good, genius and easy.

Michael and I talked about optimism, pessimism and far more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

50 Methods the World is Getting Higher

Now right here’s what I’ve been studying these days:

Interview:

- Me on self-awareness and never assembly your heroes (Morningstar)

Books:

[ad_2]