[ad_1]

Regardless of this 12 months’s political discourse, many traders stay dedicated to aligning their portfolios with their values, supporting firms that exhibit ESG management and function for long-term profitability. ESG and sustainability indices and listed merchandise have proliferated to satisfy this want.

As an advisor, you could have a objective and accountability to pick investments that deal with your purchasers’ beliefs and goals. Index funds might often be a part of your technique, given the associated fee and diversification advantages they supply. However whereas these merchandise serve their function throughout many allocations and themes, they fall quick on the subject of sustainable investing.

Albeit effectively intentioned, rules-based approaches to sustainable investing benefit skepticism for just a few key causes: many ESG issues are intangible and should be assessed with qualitative judgment, present quantitative knowledge might be incomplete and inconsistent and, importantly, ESG scores for a similar firm can fluctuate extensively from supplier to supplier.

Above all, traders and people stewarding their wealth should know what they’re investing in. For a self-discipline as advanced as sustainable investing, the due diligence and deep engagement of an energetic supervisor are required.

What Issues to Traders

Not solely are traders all in favour of making a constructive affect with their capital, however many additionally acknowledge the best way a enterprise interacts with its atmosphere, society and shareholders makes a financially materials distinction to the underside line.

Whereas there are a number of approaches to sustainable investing, one shares commonalities with high quality investing. On this college of thought, sturdy sustainability traits are seen as indicative of high quality, alongside conventional markers akin to a aggressive benefit out there, excessive return on invested capital, excessive free money stream and a conservative capital construction.

The hallmarks of a top quality enterprise, then, are aggressive and monetary sturdiness, governance that embodies a powerful company tradition and environmental and social sustainability.

Measuring the Tangible and Intangible

Although sure monetary metrics are routinely quantified, getting a full image of the standard markers requires extra than simply knowledge. For instance, to know an organization’s tradition and worker satisfaction ranges, one can evaluation filings like EEO-1 experiences, and even some “massive knowledge” akin to Glassdoor scores. These metrics might be tremendously useful, however with out judgment, basic analysis and detailed data of an organization and its administration, business and clients, they may also be tremendously deceptive.

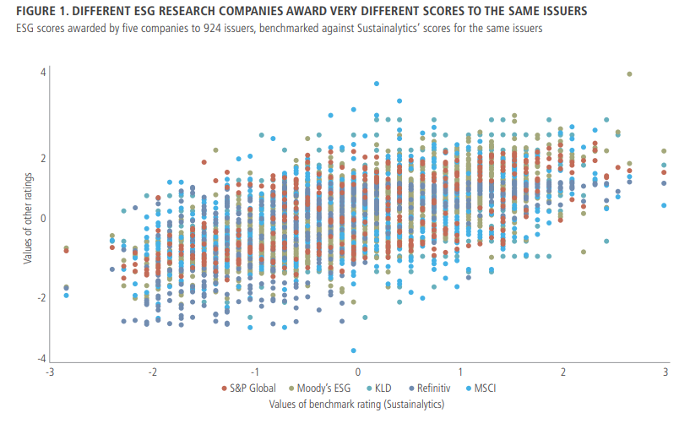

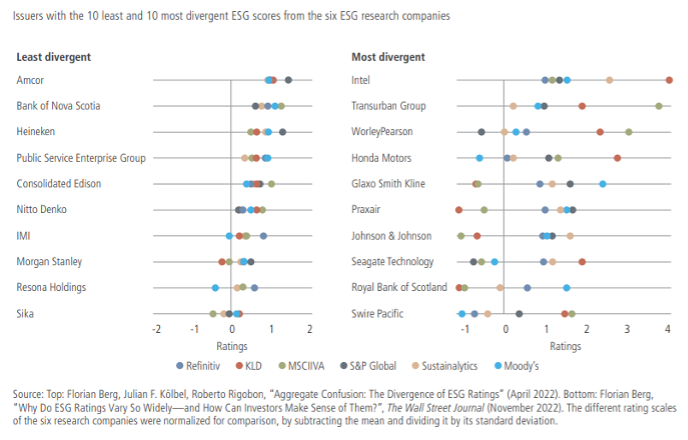

Furthermore, there are discrepancies in quite a lot of ESG-related knowledge that merely aren’t current in conventional monetary metrics. Two worth issue indices that weight the identical fairness universe by P/E ratio are more likely to look very comparable. The identical can’t be stated for 2 ESG indices that weight by an ostensibly comparable ESG rating—regardless that they in the end draw on the identical reported knowledge.

A number of research have discovered that analysis firms’ ESG scores for a similar firm can fluctuate extensively, with virtually zero correlation. That’s partly as a result of ESG datasets are sometimes incomplete, requiring those that generate ESG scores to fill within the gaps with modelled inputs.

The processing of reported knowledge additionally varies, including one other layer of subjectivity to any rules-based funding method. Couple that with the variability within the frequency with which knowledge inputs are up to date, within the weighting of specific metrics, and within the alternative of peer units used to derive relative scores—to not point out the human biases concerned when translating underlying metrics into ESG scores—and the challenges of counting on a rules-based method develop into clear.

Engagement by Basic Energetic Homeowners

Index suppliers and fund producers have been profitable with market-capitalization, model and issue index merchandise, with many now aiming to copy that success within the sustainable investing house. Some regulators have inspired this exercise, seeing the provision of such benchmarks and merchandise as enabling broader investor participation in sustainability.

Index funding merchandise can’t supply a necessary pillar of sustainable investing: genuinely engaged possession of and affect with portfolio firms.

Index fund suppliers might have a group of stewardship professionals, however it is rather troublesome to interact deeply and meaningfully if one is just not a seasoned analyst of the basics of an organization and its business. Even when the stewardship group identifies a problem and works with an organization’s board and administration to achieve a conclusion, that end result may take months or years to be mirrored in reported knowledge, ESG scores and index weighting—and, in some instances, it would by no means be mirrored in any respect.

In contrast, energetic managers can level to particular examples of constructive engagement yielding constructive outcomes. A lot of the work is in encouraging communication and disclosure, not often telling firm leaders how they need to function, however as a substitute work towards standardized reporting of the proper metrics in order that energetic managers can correctly assess their technique and progress, and maintain them accountable if vital.

These efforts are typically met with resistance, significantly when advocating for reporting practices that is probably not customary immediately however will doubtless be sooner or later. This was the case, for instance in 2018 when the Neuberger Berman Sustainable Fairness group began advocating for Science-Primarily based Targets aligned emissions reporting and will come up once more as the main focus shifts to rising problem of the regulation and moral deployment of know-how. It’s questionable whether or not discussions of how administration is considering these points and speaking to shareholders might be achieved outdoors the atmosphere of energetic administration.

The Transparency Traders Deserve

At minimal, traders and advisors who’re contemplating including an ESG index product to their technique ought to perceive precisely what that entails. In apply, it means choosing an ESG index funding product supplier, an ESG index supplier, an ESG index and an ESG rating supplier—with an understanding of all the variability described above. And these selections needs to be knowledgeable by the identical stage of due diligence they might apply to choosing an energetic supervisor.

The virtues wanted by sustainable traders are difficult to determine in a rules-based, passive technique. Sustainable investing requires basic judgment and is an inherently energetic self-discipline.

Daniel Hanson, CFA, is Managing Director, Group Head and Senior Portfolio Supervisor—U.S. Sustainable Fairness at Neuberger Berman

[ad_2]