[ad_1]

A reader asks:

What can be the professionals and cons of buying weighted quantities of the 11 inventory market sectors and rebalancing your portfolio annually quite than simply indexing the overall market or the S&P 500? One is clearly way more time-consuming, however might the juice be well worth the squeeze?

I’ve truly been requested this query earlier than through the years.

The premise is smart from the angle of rebalancing and the truth that the profitable and shedding sectors change from year-to-year. The hope can be that you just’re trimming your winners to purchase your losers and people losers finally flip into winners.

Earlier than sharing some ideas on this technique, let’s dig into some numbers.

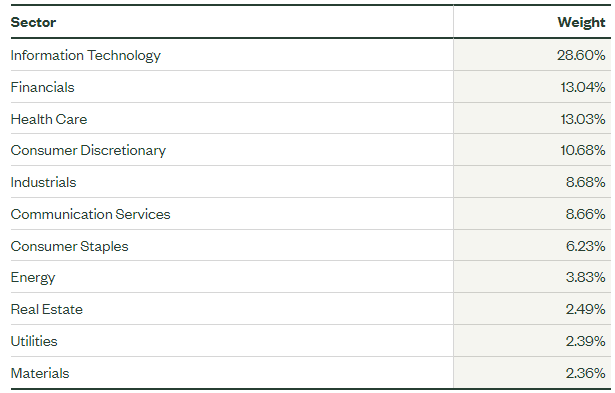

Listed here are the present sector weights from State Avenue as of January 9, 2024:

An equal-weighted technique would imply you’re underweighting know-how, financials, and well being care whereas overweighting supplies, utilities, actual property, power and client staples. Communications, industrials and client discretionary are all principally a push.

Sector weightings do change over time however you’d be including some actual monitoring error to the S&P 500 by taking up a technique like this.

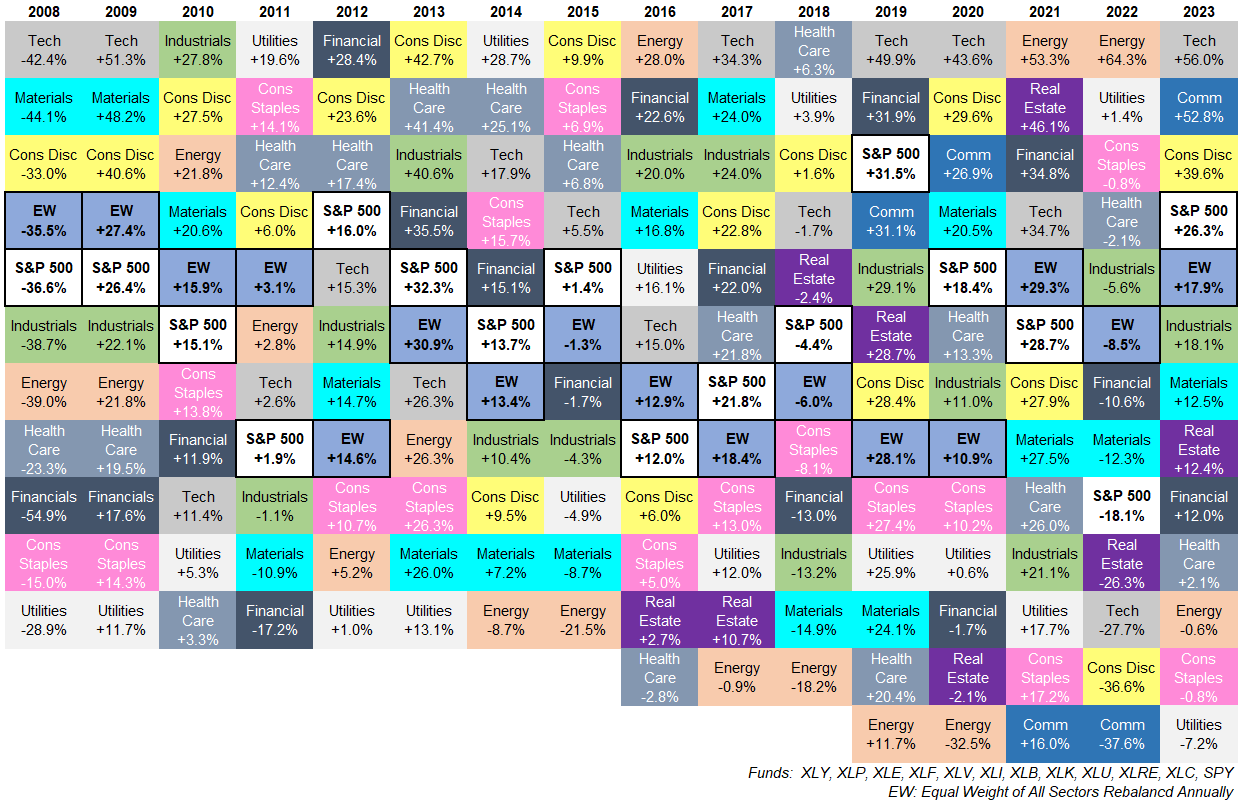

Because the asset allocation quilt is so recent in my thoughts, let’s take a look at the efficiency numbers of the varied sectors going all the best way again to 2008 to see how this may look in a backtest:

(Proper-click and hit ‘open picture in new tab’ if you want to see this as a bigger picture on desktop.)

Sadly, the sector quilt doesn’t look almost as fairly because the asset allocation quilt since Normal & Poors has added two new sectors through the years — actual property and communications.1

I’ve highlighted each the S&P 500 and equal weight sector (EW) returns on this graphic. You may see it’s fairly shut simply from eye-balling the numbers. The S&P 500 has outperformed in 9 out of the previous 16 years that means the equal weight sector technique would have outperformed 7 of the previous 16 years.

The S&P 500 outperformed the equal weight technique general as nicely but it surely was pretty shut — +9.8% per 12 months to +9.2% per 12 months.

Well being care, know-how and client discretionary have been the one sectors to outperform the S&P 500 from 2008-2023. They have been up 10.7%, 14.7%, and 12.7% per 12 months, respectively, versus an annual achieve of 9.8% for the S&P 500. The worst-performing sector was power, which was up simply 3.5% per 12 months on this time-frame.

The know-how underweight is the plain supply of the underperformance right here.

The equal weight did decrease volatility by almost 10% in order that’s a win. You may see it outperformed by a large margin in 2022 (thanks power shares) solely to underperform by an identical margin in 2023.

My greatest drawback with this technique is that it’s needlessly advanced. I choose simplicity on the subject of investing.

Proudly owning an S&P 500 index fund is easy. They do the rebalancing for you when firms enter or exit the index. It doesn’t require you to carry 10 separate ETFs and rebalance them periodically again to equal weights. It additionally doesn’t require you so as to add extra funds to your line-up when new sectors are created.

Even when the equal weight technique outperformed in a backtest, I’m undecided it might be well worth the problem.

And if you wish to break away from the market cap-weighted index methodology of the S&P 500, there are simpler methods to do it.

You may merely purchase an equal-weighted S&P 500 index. There’s an ETF for that (ticker RSP).

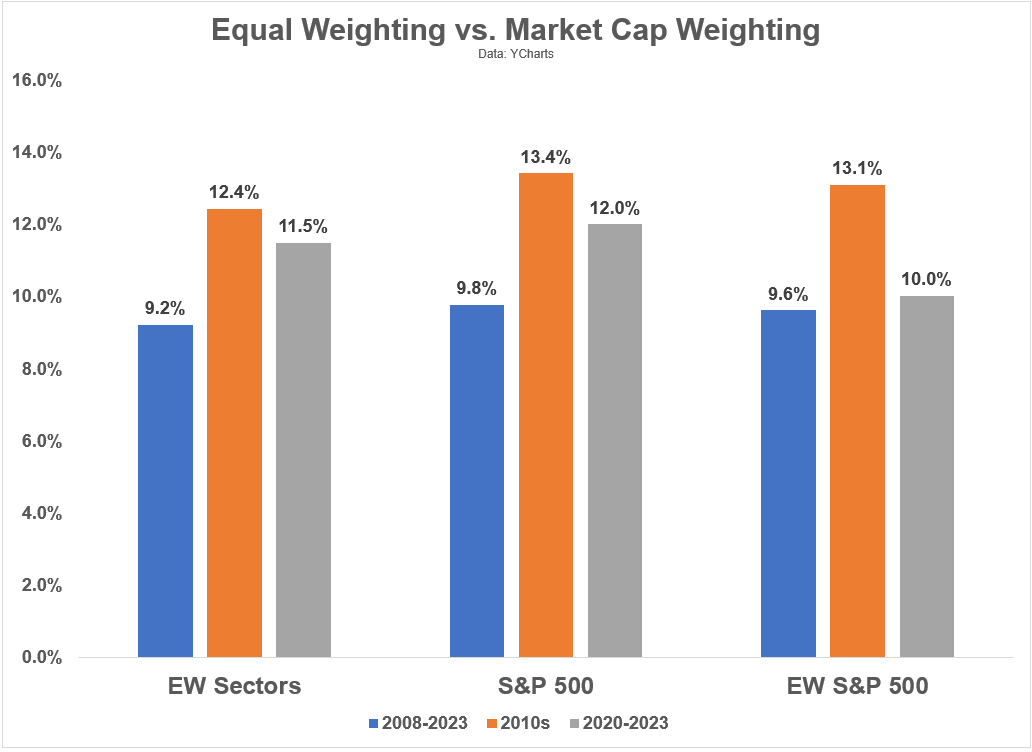

I calculated the returns for our equal-weight sector technique to the S&P 500 and the equal-weight S&P 500 to see how they carried out over numerous time frames and environments within the current previous:

The explanation I wished to have a look at these numerous time frames is to incorporate a crash (2008), a bull market (the 2010s) and a extra risky interval (the 2020s).

The S&P 500 outperformed in each one among them. The equal-weight sector technique appears to be like higher than the equal-weight S&P 500 through the 2020s however not the 2010s.

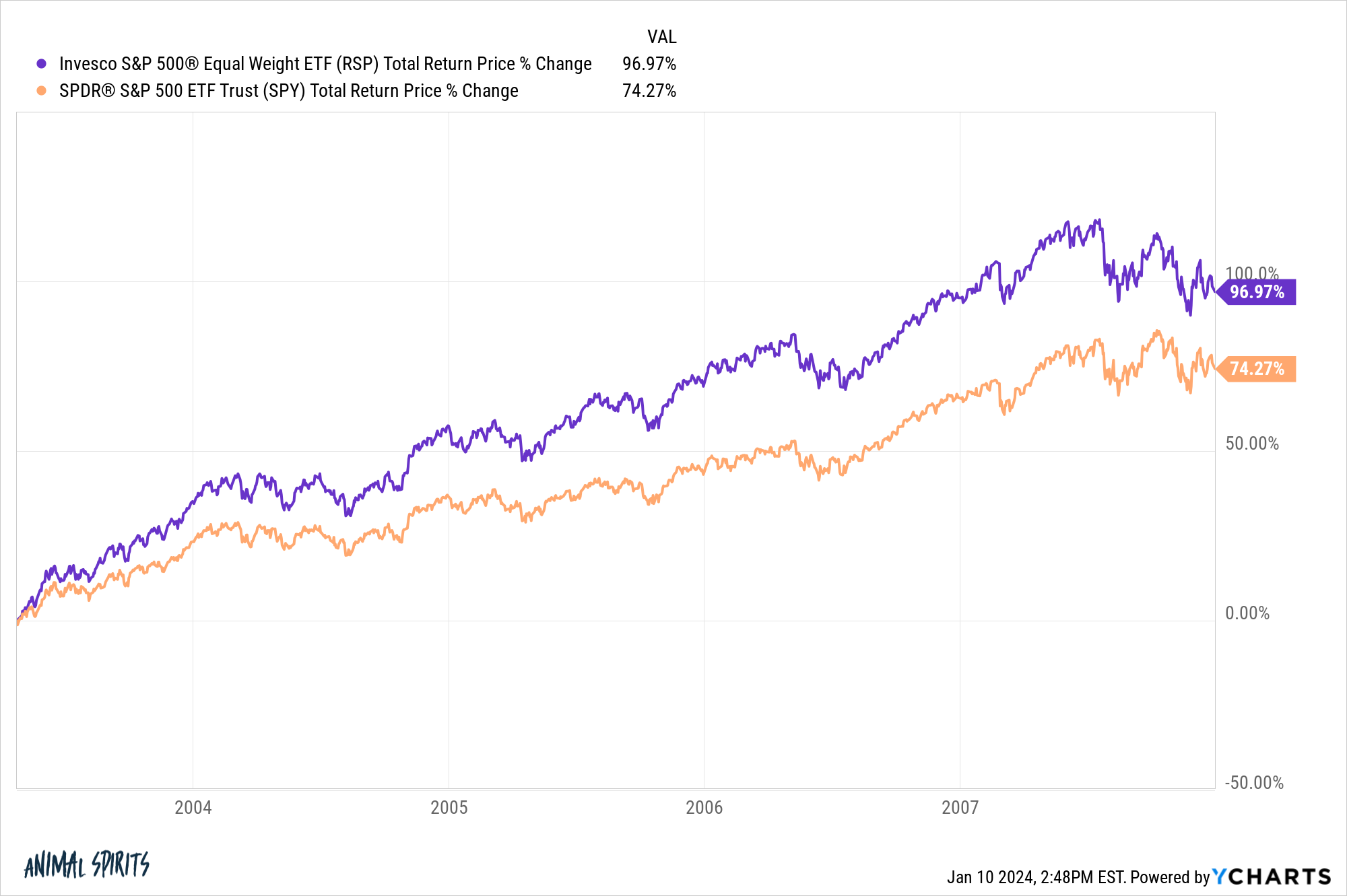

Equal weighting will possible outperform the cap-weighted S&P 500 in some unspecified time in the future. It did so within the pre-GFC mini-bull market:

Another issue outdoors of mega-tech shares will outperform in some unspecified time in the future. Equal weight will look higher than market weight when that occurs.

There are many methods to diversify your publicity outdoors of the S&P 500 should you’re nervous concerning the giant cap index underperforming in some unspecified time in the future. Small caps, mid caps, worldwide shares, worth shares, low-vol shares, high quality shares, dividend shares, and so on., all match the invoice right here.

The proliferation of ETFs makes it simpler than ever to realize publicity to several types of shares, components and funding methods in a tax-efficient method with low charges.

I wouldn’t attempt to get too cute together with your portfolio methods.

The S&P 500 is difficult sufficient to beat within the easiest kind.

The markets themselves are terribly advanced.

Don’t attempt to make investing extra difficult than it must be

We tackled this query on the most recent version of Ask the Compound:

Tax skilled Invoice Candy joined me but once more this week to debate questions on investing in Bitcoin, having your taxes and portfolio managed by the identical agency, the tax consideration of paying off your mortgage early, and tips on how to handle your cash for early retirement.

Additional Studying:

Updating My Favourite Efficiency Chart For 2023

1I actually don’t perceive the reasoning for including them both. The actual property sector is tiny and the communications sector is nearly 50% Google and Fb.

[ad_2]