[ad_1]

[Updated on January 28, 2024 with updated screenshots from H&R Block software for 2023 tax filing.]

When mutual funds and/or ETFs that put money into international nations obtain dividends or curiosity, they must pay taxes to these nations. These mutual funds and/or ETFs report back to your dealer after the tip of the yr how a lot they paid in international taxes in your behalf.

If you put money into these mutual funds and/or ETFs exterior a tax-advantaged account, your dealer will report back to you the entire international taxes you paid by way of all of your funds and/or ETFs. The IRS permits a tax credit score for the taxes you paid not directly to international nations.

Type 1116

The international taxes paid are reported in Field 7 on the 1099-DIV type you obtain out of your dealer. It’s simple to deal with when the entire international taxes paid from all of your 1099-DIV kinds is not more than a certain quantity — $300 for single and $600 for married submitting collectively. You enter the 1099-DIV kinds into your tax software program and the software program will robotically put the entire in your tax type (Schedule 3, Line 1).

When your complete international taxes paid from all of your 1099-DIV kinds are over the $300/$600 threshold, you’ll want to incorporate Type 1116 in your tax return. I’ll present you the way to do that in H&R Block software program.

Should you use different tax software program, please learn:

Use H&R Block Obtain

The next screenshots got here from H&R Block downloaded software program. The downloaded software program is each cheaper and extra highly effective than H&R Block’s on-line software program.

Should you haven’t paid on your H&R Block On-line submitting but, contemplate shopping for H&R Block obtain software program from Amazon, Walmart, Newegg, and lots of different locations. Should you’re already too far in getting into your information into H&R Block On-line, make this your final yr of utilizing H&R Block On-line. Change over to H&R Block obtain software program subsequent yr.

I’ll use the identical instance:

You acquired a 1099-DIV out of your dealer. Field 7 “Overseas Tax Paid” on the 1099-DIV exhibits $700. 100% of this $700 got here from a mutual fund or ETF. You solely have this one 1099-DIV that has a quantity in Field 7.

1099-DIV Entries

Should you import your 1099-DIV kinds, double-check the import to ensure all of the numbers match your downloaded copies. Should you’re getting into the 1099-DIV kinds manually, sort the numbers as proven in your kinds.

H&R Block doesn’t say something concerning the international tax paid or needing a Type 1116 after you enter the 1099-DIV kinds. Simply proceed along with your different entries.

Overseas Tax Credit score

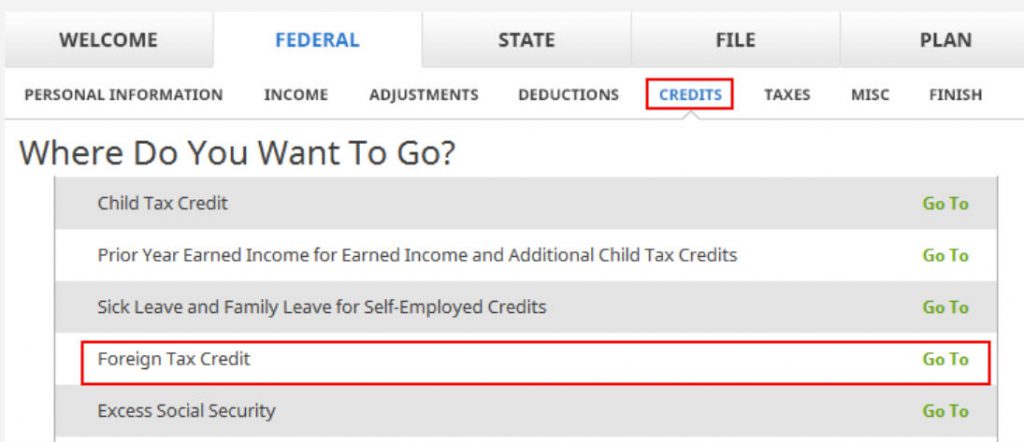

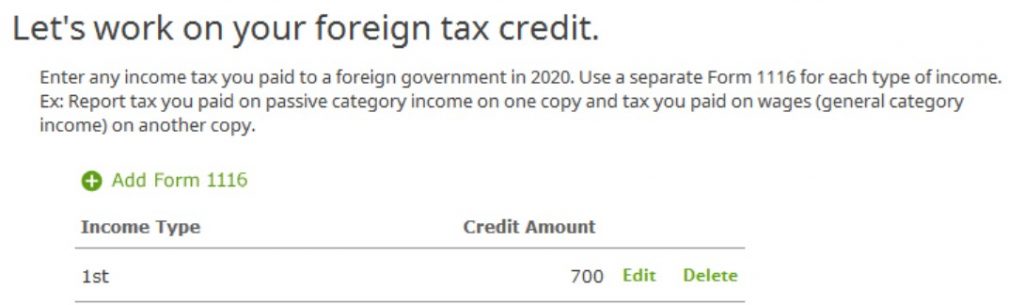

Overseas Tax Credit score comes up a lot later within the Credit part underneath Overseas Tax Credit score.

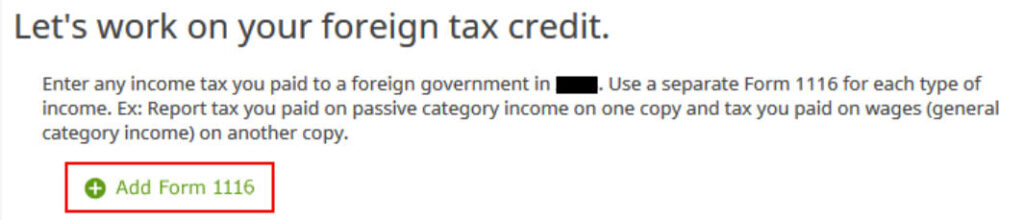

Click on on “Add Type 1116.”

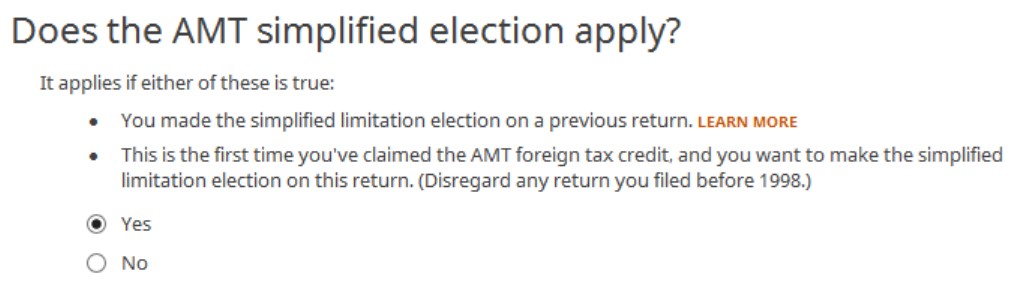

AMT Simplified Election

If that is the primary yr you’re claiming the Overseas Tax Credit score, H&R Block software program asks upfront concerning the simplified election. Choose “Sure” for the simplified election.

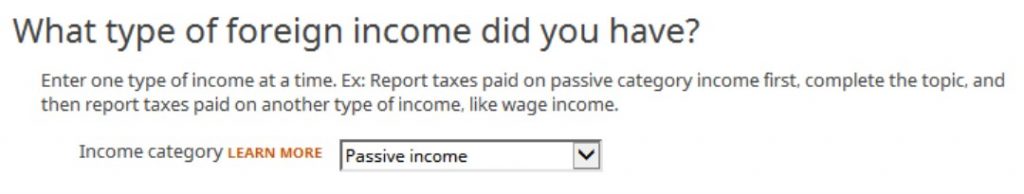

Overseas-Supply Earnings

Dividend earnings falls underneath “passive earnings.”

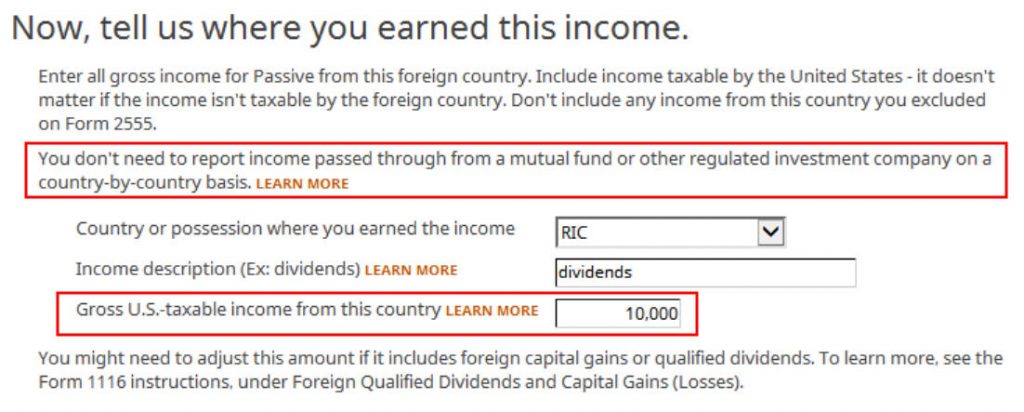

The “study extra” popup says it is best to select “RIC” because the nation when your international earnings got here by way of mutual funds and/or ETFs. “RIC” is the final merchandise within the nation dropdown.

You get the international earnings from the supplemental info in your 1099 bundle out of your dealer. If in case you have a number of 1099-DIV kinds that reported international tax paid in Field 7, you’ll have so as to add up the international earnings numbers from the respective supplemental info.

Don’t overlook the small notice underneath the gross earnings enter. It says you would possibly must alter the quantity if it contains international capital features or certified dividends. If you’re reporting international taxes paid from mutual funds and ETFs, the earnings positive does embody certified dividends. H&R Block doesn’t do the adjustment for you. It asks you to learn the IRS directions, discover ways to alter, and report the adjusted earnings right here. That’s lazy.

Adjustment Exception

Happily, many individuals qualify for an adjustment exception. From the IRS Type 1116 Directions:

You qualify for the adjustment exception when you meet each of the next necessities.

1. Line 5 of the Certified Dividends and Capital Achieve Tax Worksheet doesn’t exceed:

a. $364,200 if married submitting collectively or qualifying widow(er),

b. $182,100 if married submitting individually,

c. $182,100 if single, or

d. $182,100 if head of family.2. The quantity of your international supply capital acquire distributions, plus the quantity of your international supply certified dividends, is lower than $20,000.

The greenback quantities within the first requirement correspond to the highest of the 24% bracket. You’re spared from determining methods to alter in case your taxable earnings minus your certified dividends and long-term capital features isn’t within the 32% tax bracket or above, and your international supply capital acquire distributions and certified dividends aren’t $20,000 or extra.

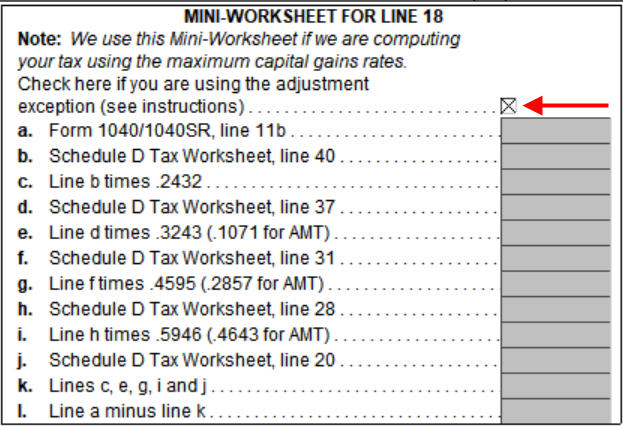

Should you’re eligible for the adjustment exception and also you determine to take the simple route of not adjusting your foreign-source earnings, it is advisable declare a corresponding adjustment exception in your complete earnings.

Click on on Varieties on the highest proper. Open Type 1116. Scroll down and discover Mini-Worksheet for Line 18 simply above Line 18. Examine the field for utilizing the adjustment exception.

Shut the shape and return to the interview.

Should you don’t qualify for the adjustment exception, good luck studying methods to alter from the Type 1116 directions. You’re higher off switching to TurboTax, which does the adjustment for you while you want it. See Enter Overseas Tax Credit score Type 1116 in TurboTax.

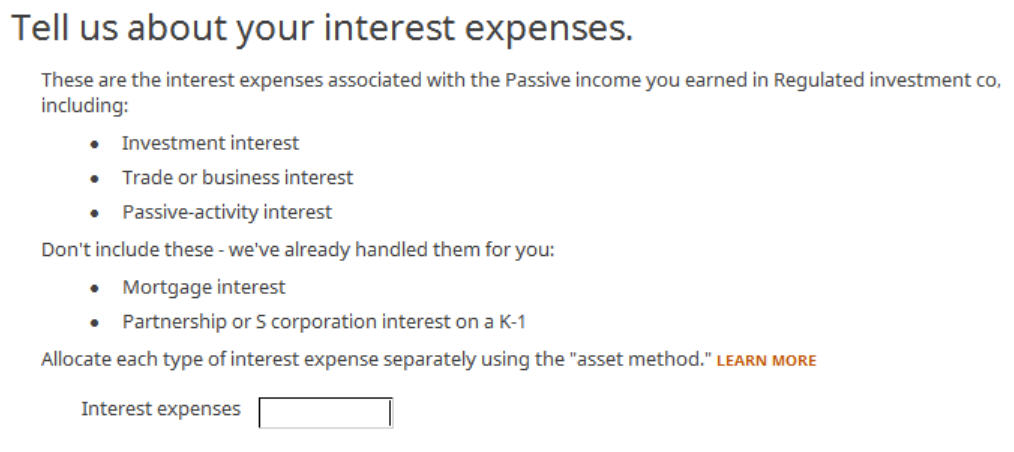

We depart this clean as a result of we don’t have any curiosity bills.

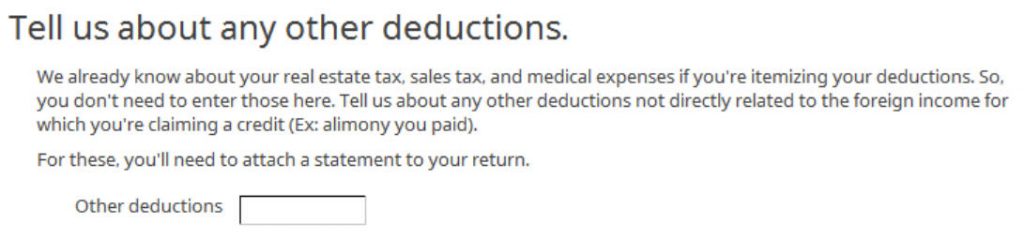

If in case you have any above-the-line deductions, akin to an early withdrawal penalty from breaking a CD or an HSA contribution made exterior payroll, enter the entire right here. We depart this clean in our easy instance as a result of we don’t have these deductions.

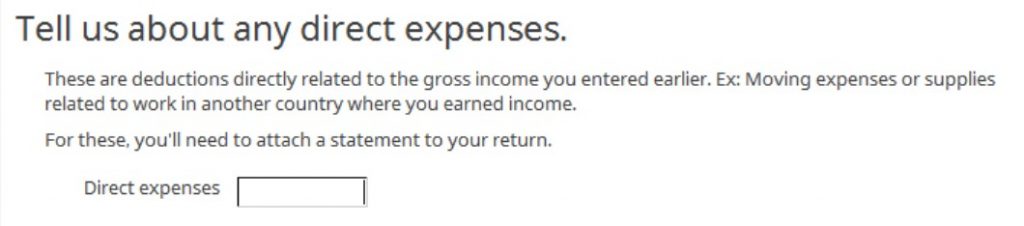

We don’t have any direct bills both.

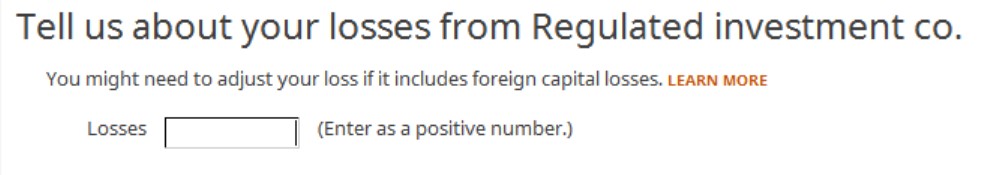

We have now no losses to regulate.

Sure, our 1099-DIV was reported in U.S. {dollars}.

Overseas Taxes

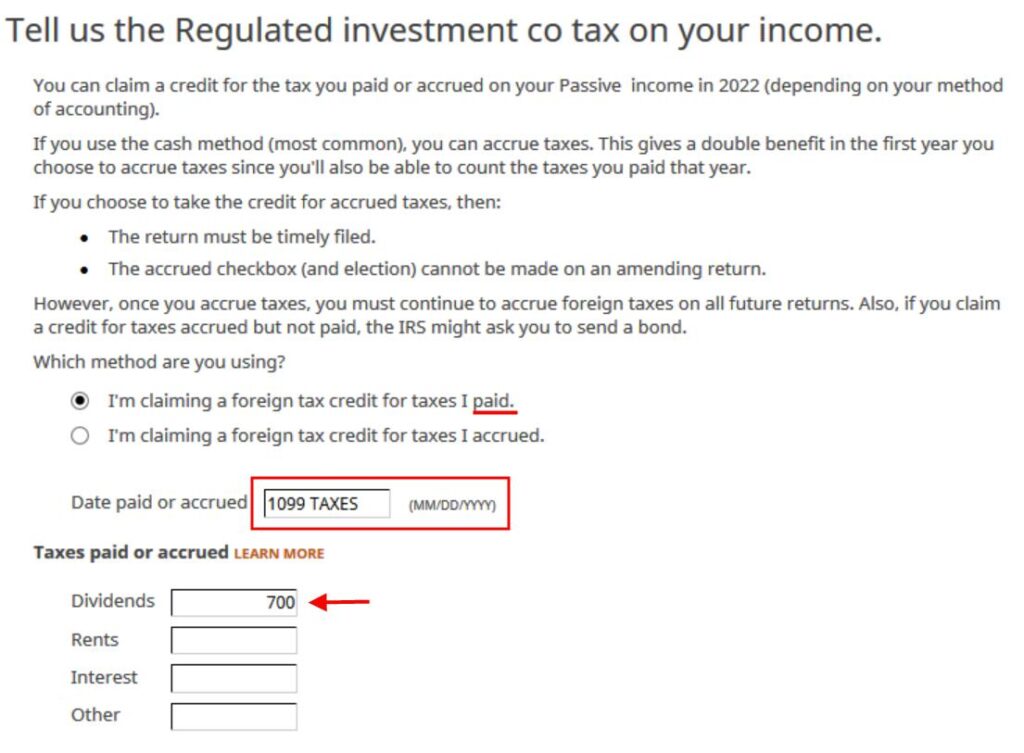

I selected the easier “paid” technique. Though the “Date paid or accrued” asks for a date in “MM/DD/YYYY” format, you may sort “1099 TAXES” to point that the international taxes had been paid on varied dates by way of the 1099 kinds. Enter the complete international tax paid into the Dividends field.

If in case you have a number of 1099-DIV kinds that reported international tax paid in Field 7, you’ll have so as to add up these numbers your self. I want the software program did the mathematics and auto-populated this subject.

All our international taxes paid had been by way of mutual funds and ETFs. RIC is the one nation to make use of. We don’t have international earnings from some other nations.

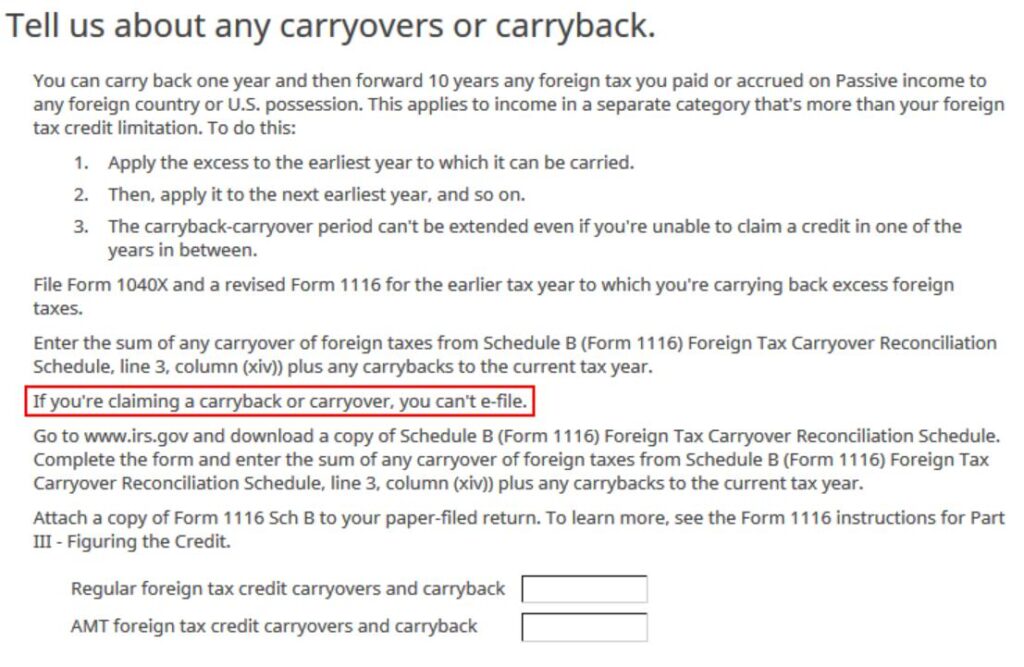

Happily, we don’t have any carryover or carryback. If we are able to’t get 100% credit score for the international taxes paid this yr, we’ll must create a carryback or carryover, which implies we are able to’t e-file with H&R Block.

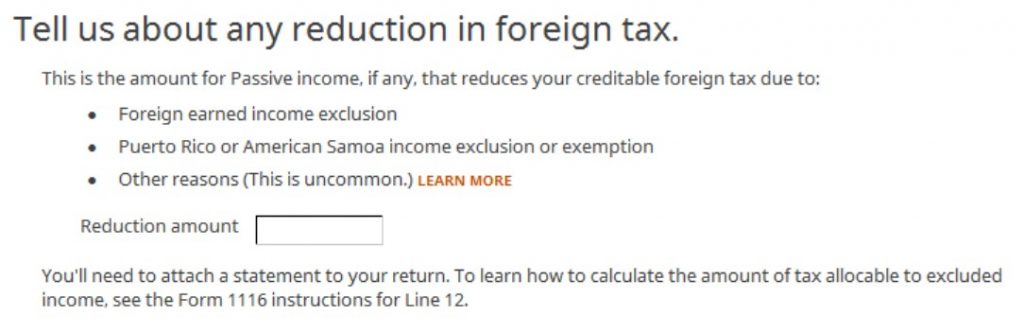

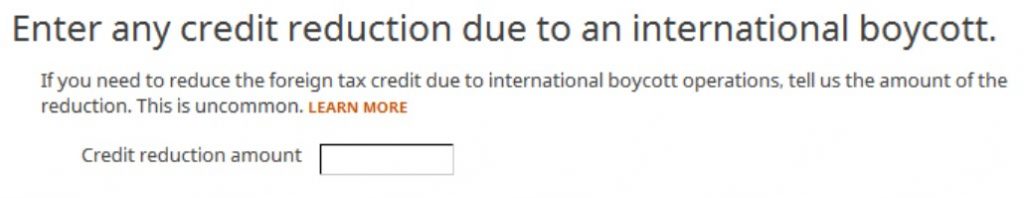

We don’t have any discount both.

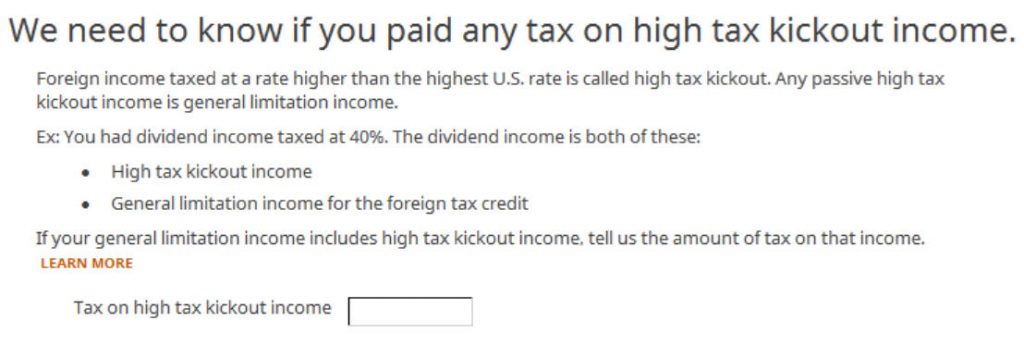

We don’t know what the international tax price was. We’re leaving this clean.

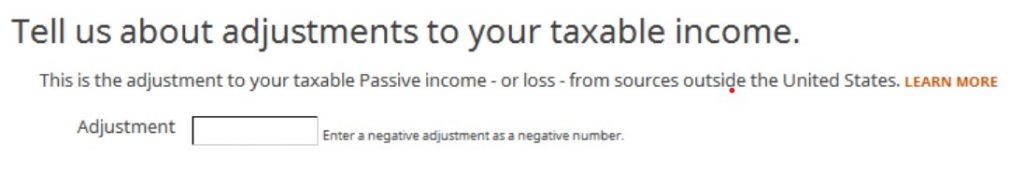

We don’t know methods to alter. We’re leaving it clean once more.

That is getting ridiculous. All I need is to get the international tax credit score!

We’re lastly completed with Type 1116. Are we getting the credit score?

Confirm on Schedule 3

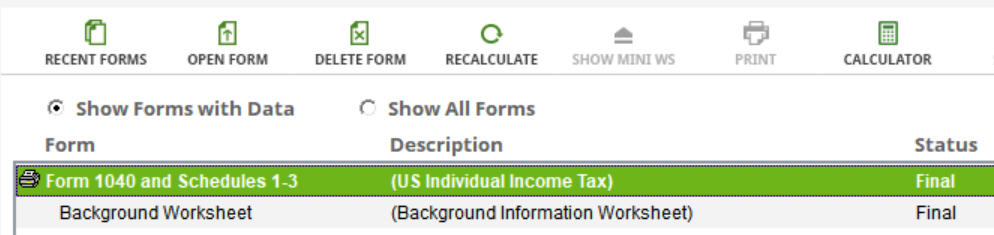

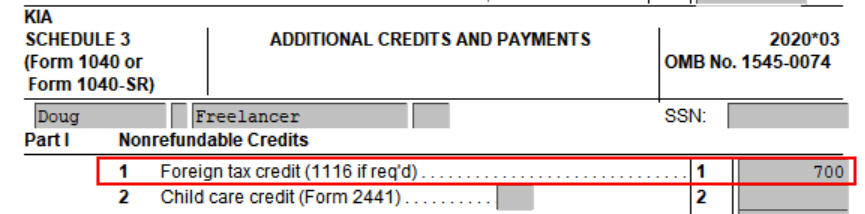

Click on on Varieties on the highest. Double-click on Type 1040 and Schedules 1-3.

Scroll right down to Schedule 3. Line 1 exhibits our international tax credit score. You can too take a look at Type 1116. It appears to be like awfully difficult.

Extra Overseas Tax Credit score

We acquired 100% of the international taxes paid as a tax credit score in our instance. Should you paid larger international taxes on a decrease US earnings, it’s possible you’ll not be capable to take 100% of the credit score. You’ll have to attend till subsequent yr to take the remainder of it.

Carrying over a part of the credit score to the next yr requires submitting a Type 1116 Schedule B. H&R Block doesn’t have this manner of their program. H&R Block tells you to obtain the shape from the IRS web site, full it your self, and connect it to your paper return. That’s ridiculous.

Abstract

H&R Block software program works while you paid extra in international taxes than the $300/$600 threshold that requires a Type 1116. You’ll have to assemble the international earnings and the international dividends from the 1099 supplemental info out of your brokers. After it’s all mentioned and completed, you’re getting a tax credit score for taxes you paid to international nations by way of your mutual funds and/or ETFs.

H&R Block asks you so as to add up the international tax numbers your self. It asks you to make any vital changes to the foreign-source earnings, which is sort of troublesome. The choice to activate the adjustment exception is hidden within the Varieties mode. You’re by yourself while you don’t qualify for the adjustment exception. It additionally asks you to deal with any carryover your self.

TurboTax does a greater job of dealing with the international tax credit score than the H&R Block software program. See Overseas Tax Credit score Type 1116 in TurboTax.

It’s higher to keep away from the difficult Type 1116 altogether subsequent yr by placing your worldwide mutual funds and ETFs in a tax-advantaged account. See Too A lot Trouble in Claiming Overseas Tax Credit score on IRS Type 1116.

Say No To Administration Charges

In case you are paying an advisor a share of your belongings, you might be paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.

[ad_2]