[ad_1]

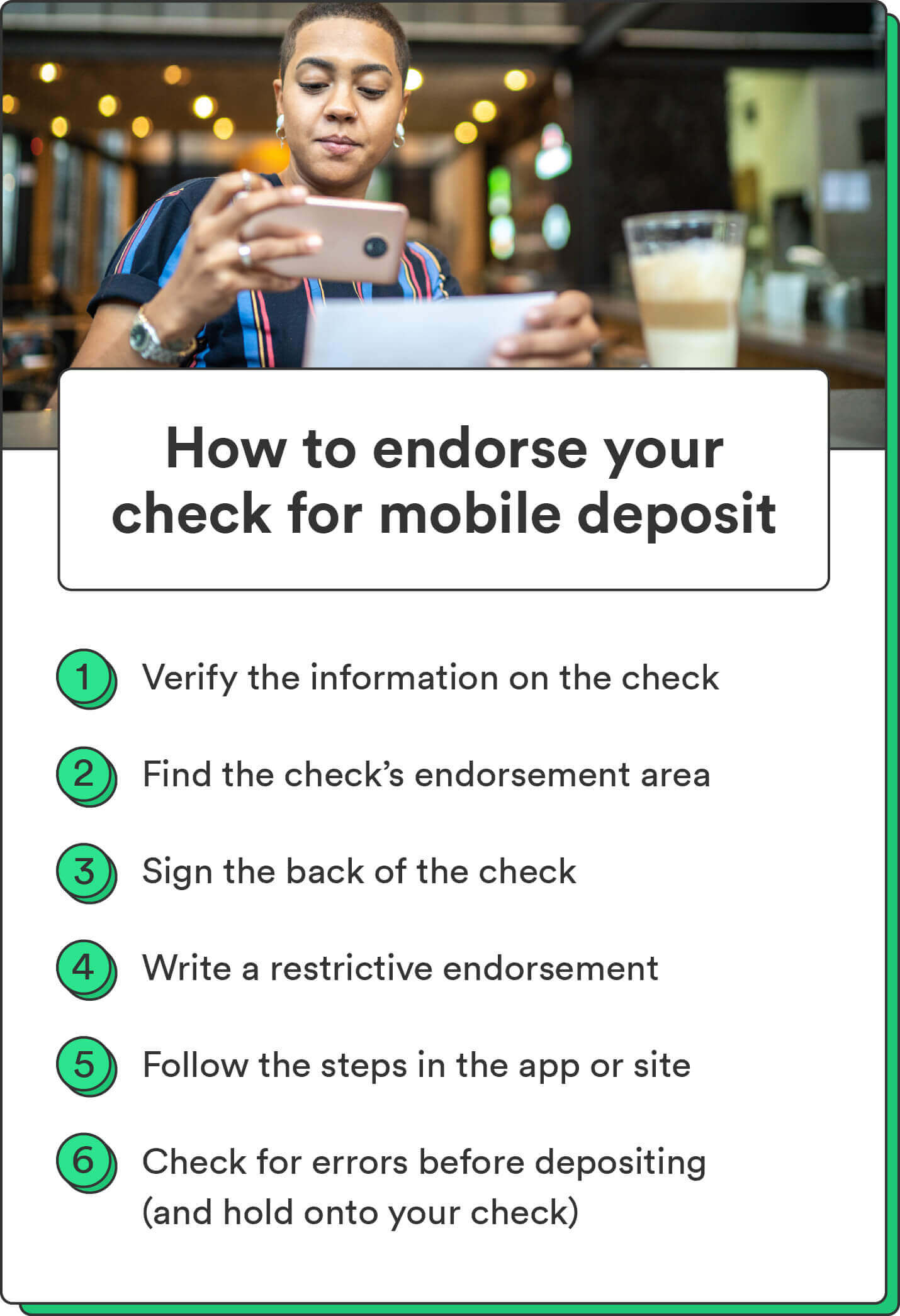

Endorsing a cellular deposit may also help save time when you’ll be able to’t squeeze a financial institution go to into your day. However, if it’s your first time depositing cash by way of a banking app, you could surprise the place to start.

Whether or not you’re anxious concerning the cash going via or examine fraud, observe these steps to endorse a examine for cellular deposit correctly.

1. Confirm that the knowledge on the examine is appropriate

Earlier than you try to deposit your examine, first make sure the particular person paying you wrote the examine accurately. Listed below are some widespread errors that individuals may make when writing checks:

- Misspelling a reputation

- Account or routing quantity errors

- Scratching out minor errors with a pen

- Lacking signature

- A date older than six months

Your financial institution might reject the deposit if one thing’s flawed with the knowledge in your examine. Although some banks might enable a minor misspelling in your title or the place the issuer writes out the quantity, others could also be stricter. In case your financial institution denies your deposit, attain out to the issuer and the financial institution to see how one can proceed.

2. Discover the endorsement space on the again of the examine

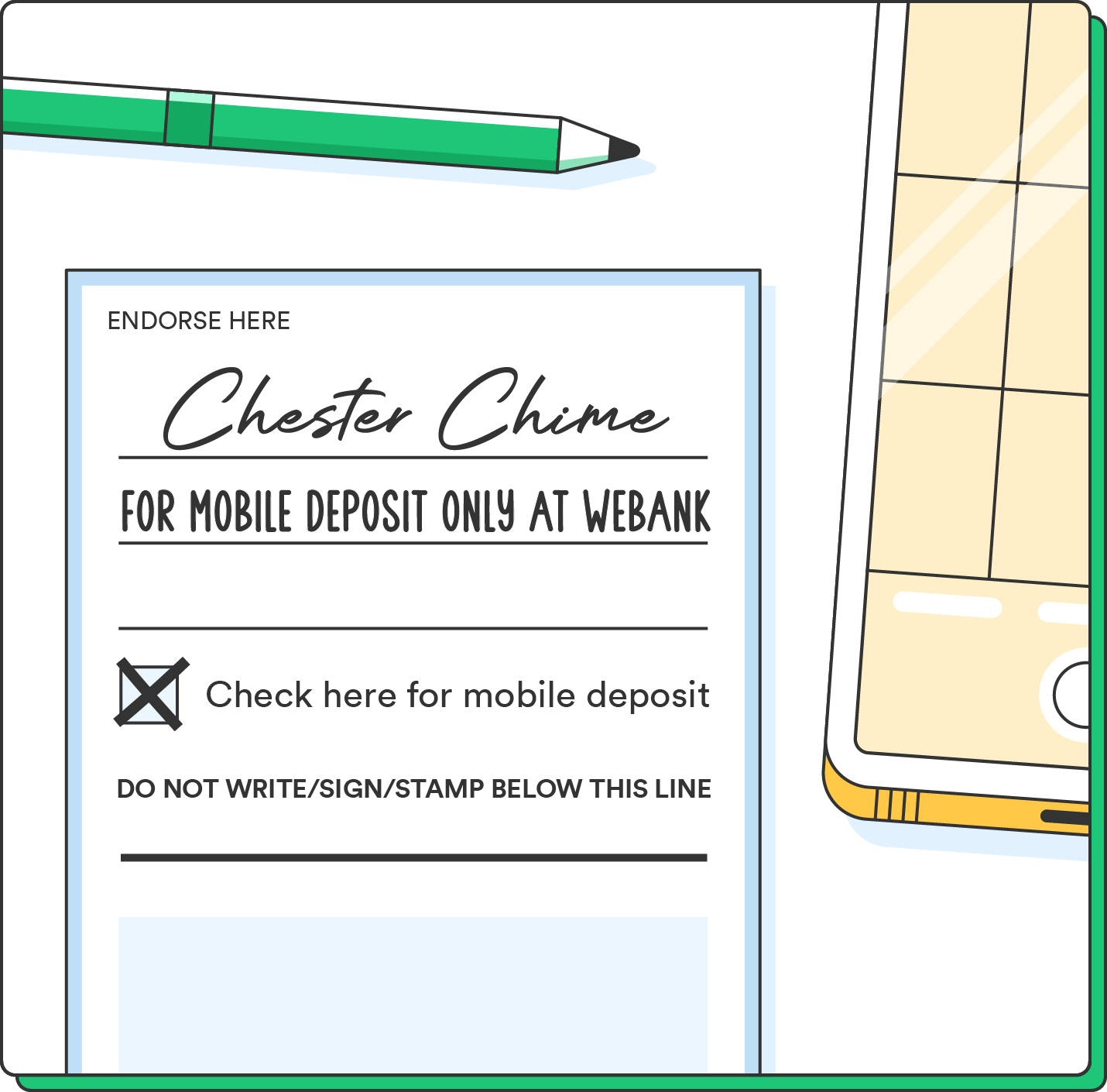

Earlier than making a cellular deposit, write your signature within the examine’s endorsement space. This sometimes seems to be like just a few grey strains underneath textual content that claims, “Endorse examine right here” on the again of the examine.

Endorsement for a cellular deposit ensures that the appropriate particular person will obtain their cash. For those who by chance endorse the examine within the flawed place, contact your financial institution to find out the subsequent steps. You could have to re-endorse it on the financial institution with a teller.

3. Signal the again of the examine

Now that you already know the place the endorsement space is, it’s lastly time to signal your examine for a cellular deposit. Listed below are some greatest practices for endorsing a examine:

- Use blue or black ink: Don’t endorse a examine with purple ink or a pencil. Banking computer systems can learn blue and black ink higher than every other writing methodology.

- Signal within the endorsement space: For those who signal your title above or beneath the endorsement space, you’ll have to observe a re-endorsement course of at your financial institution.

- Use your signature: The endorsement space isn’t a spot to experiment with a brand new and distinctive John Hancock. Preserve it easy and use your recognizable signature.

4. Write a restrictive endorsement

Cell examine deposits sometimes require a restrictive endorsement for the financial institution to acknowledge them.

Banks might ask you to jot down out a customized restrictive endorsement that appears like the next:

- “For cellular deposit solely.”

- “For deposit into checking account [Account Number] solely.”

- “For cellular deposit at [Bank Name] solely.”

- “For cellular deposit solely on [insert date].”

Some checks actually have a checkbox within the endorsement space that signifies you might be depositing it by way of a cellular app. Nonetheless, many banks will nonetheless require a restrictive endorsement in your individual handwriting.

5. Observe the steps within the app or website

Now, you’ll be able to lastly deposit your examine into your checking account. Although the method will fluctuate relying in your financial institution and cellular app, listed below are the standard steps for methods to make a cellular deposit:

- Open up your banking app the place you wish to deposit the cash.

- Navigate to a tab that claims “Deposit” or “Cell Deposit.”

- Enter the examine’s data, just like the amount of cash.

- Endorse your examine and write a restrictive endorsement when you haven’t already.

- Be sure you put your examine on a stable floor and have first rate lighting.

- Within the app, take an image of the back and front of the examine.

- Observe the directions to get to the submission view.

6. Verify for errors earlier than depositing (and maintain onto your examine)

Double-check that each one the knowledge you set into the cellular app is appropriate, particularly the deposit quantity. Evaluate your enter quantity to the examine to make sure the deposit goes via.

- Confirm that the financial institution is depositing your cash.

- Maintain onto the examine till the cash lands in your account.

It might take time for the cellular deposit to hit your checking account.Some bigger monetary establishments can probably ship you the cash rapidly, however others might take just a few days. If the examine doesn’t seem in your account inside three days, contact your financial institution and see how one can repair the problem.

[ad_2]