[ad_1]

Mortgage Q&A: “Does refinancing harm your credit score rating?”

Everybody appear to be obsessive about their credit score scores and what affect sure actions could have on them.

Maybe the credit score bureaus are accountable, as they’re continually urging us to test our scores for any adjustments.

Let’s lower proper to the chase. Relating to mortgage refinancing, your credit score rating most likely received’t be negatively impacted except you’re a serial refinancer. Like the rest, moderation is essential right here.

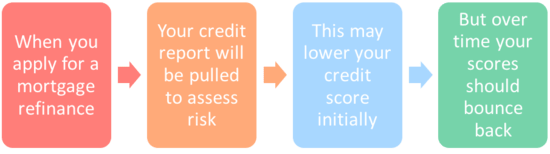

A Mortgage Refinance Will Lead to a Credit score Pull

If you refinance your private home mortgage, the financial institution or mortgage lender will pull your credit score report and also you’ll be hit with a tough credit score inquiry in consequence.

It’ll keep in your credit score report for 2 years, however solely have an effect on your scores for the primary 12 months.

What’s extra, it’s going to present up on all three credit score stories with all three credit score bureaus. This consists of Equifax, Experian, and TransUnion.

The credit score inquiry alone may decrease your credit score rating 5-10 factors. However when you’re continually refinancing and/or making use of for different forms of new credit score, the inquiries could possibly be much more impactful.

As famous, moderation is the secret right here. In the event that they add up to a degree the place they’re deemed unhealthy, the credit score hit could possibly be bigger.

The credit score rating scientists came upon way back that people who apply for a ton of recent credit score are sometimes extra prone to default on their obligations.

However that doesn’t imply you’ll be able to’t apply for mortgages and different forms of credit score if and once you really feel it’s vital.

You Might See a Credit score Rating Ding When Refinancing Your Mortgage

- All 3 of your credit score scores could fall quickly resulting from a mortgage refinance software

- However the affect is normally fairly minimal, maybe solely 5-10 factors for many customers

- And the results are sometimes fleeting, with rating reversals occurring in a month or so

- So it’s usually only a non permanent credit score hit that received’t have any materials affect

As a result of a mortgage refinance is technically a brand new credit score software (it’s a brand new mortgage in spite of everything), your credit score rating(s) might see a little bit of a ding.

However it most likely received’t be something substantial except you’ve been making use of anyplace and in all places for brand new credit score.

By a “ding,” I imply a drop of 5-10 factors or so. After all, it’s unattainable to say how a lot your credit score rating will drop, or if it’s going to in any respect, as a result of every credit score profile is totally distinctive.

Merely put, these with deeper credit score histories will likely be much less affected by any credit score hurt associated to the mortgage refinance inquiry, whereas these with restricted credit score historical past could also be see an even bigger affect.

Consider throwing a rock in an ocean vs. a pond, respectively. The ripples will likely be loads larger within the pond.

However in both case, the ripple shouldn’t be a lot of a ripple in any respect, and nowhere near say a late fee as a result of it’s not a adverse occasion in and of itself.

It’s extra of a comfortable warning to different collectors that you just’re presently searching for new credit score.

[What credit score is needed to buy a house?]

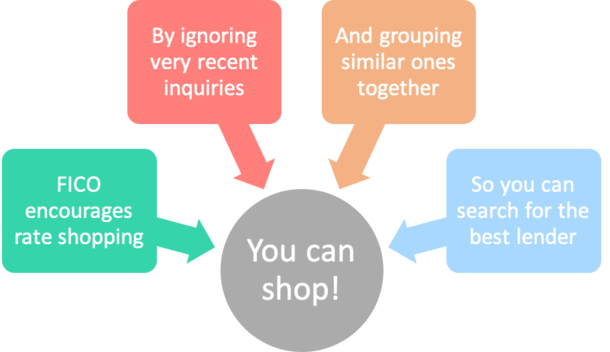

You Get a Particular Purchasing Interval for Mortgages

- FICO ignores mortgage-related inquiries made within the 30 days previous to scoring

- And treats related inquiries made in a brief interval (14-45 day window) as a single laborious inquiry

- As an alternative of counting a number of inquiries in opposition to you for a similar mortgage

- This may increasingly aid you keep away from any adverse credit score affect associated to your mortgage search

First off, notice that on the subject of FICO scores, mortgage-related inquiries lower than 30 days outdated received’t rely in opposition to you.

And for mortgage inquiries older than 30 days, they might be handled as a single inquiry if a number of ones happen in a small window.

For instance, looking for a refinance in a brief time frame (say a month) could end in a lot of credit score pulls from totally different lenders (when you store round).

However they are going to solely rely as one credit score hit as a result of the credit score bureaus know the routine on the subject of looking for a mortgage.

They usually truly wish to promote procuring round, versus scaring debtors out of it.

In spite of everything, when you’re solely trying to apply for one house mortgage, it shouldn’t rely in opposition to you a number of occasions, even when your credit score report is pulled with a number of lenders.

It’s Completely different for Different Varieties of Credit score

This differs from looking for a number of, totally different bank cards in a brief time frame. This might harm your credit score rating(s) extra since you’re making use of for various merchandise with totally different card issuers.

So somebody going nuts attempting to open three bank cards within the span of a month might see their scores tank (I’m you bank card churners).

Even when you store for a mortgage refinance with totally different lenders, if it’s for the similar single goal, you shouldn’t be hit greater than as soon as.

Nevertheless, notice that this procuring interval could also be as quick as 14 days for older variations of FICO and so long as 45 days for newer variations.

Should you area out your refinance functions an excessive amount of you may get dinged twice. Even so, it shouldn’t be too damaging, and definitely not sufficient to forestall you from procuring totally different lenders.

The potential financial savings from a decrease mortgage price ought to positively trump any minor credit score rating affect, which as famous, is short-lived.

The mortgage, then again, might stick with you for the following 30 years!

You Lose the Credit score Historical past As soon as the Previous Mortgage Is Paid Off

- If you refinance your mortgage it pays off the outdated mortgage

- That account will finally fall off your credit score report (in 10 years)

- And closed accounts are much less helpful than lively ones

- However the brand new account ought to make up for the misplaced historical past on the outdated account

One other potential adverse to refinancing is you lose the credit score historical past good thing about the outdated mortgage account, as it will be paid off by way of the brand new refinance.

So in case your prior mortgage had been with you for say 10 years or extra, that account would change into inactive when you refinanced, which might price you a couple of factors within the credit score division as effectively.

Keep in mind, older, extra established tradelines are your credit score rating’s greatest asset. So wiping all of them out by changing them with new strains of credit score might do you hurt within the short-term.

Moreover, it might have an effect on the typical age of all of your credit score accounts (credit score age), which can be seen as a adverse.

However the financial savings related to the refi ought to outweigh any potential credit score rating ding, and so long as you apply wholesome credit score habits, any adverse impact needs to be minimal.

[Does having a mortgage help your credit score?]

Money Out Refinance Means Extra Debt, Probably a Decrease Credit score Rating

- A money out refinance might harm your credit score scores much more

- Because you’re taking out a brand new, larger mortgage within the course of

- Bigger quantities of debt and better month-to-month funds naturally enhance default threat

- So it’s potential your credit score scores could also be impacted extra when you faucet your fairness

Additionally think about the affect of a refinance that leads to a bigger mortgage stability, reminiscent of a cash-out refinance.

For instance, in case your present mortgage stability is $350,000, and you are taking out an extra $50,000, you’ve now obtained $400,000 in excellent debt.

The bigger mortgage stability will enhance your credit score utilization, and it might end in the next month-to-month fee, each of which might push your credit score rating decrease.

In brief, the extra credit score you’ve obtained excellent, the better threat you current to collectors, even when you by no means truly miss a month-to-month fee.

Refinance Financial savings Ought to Impression Credit score Rating Ding

In abstract, a refinance ought to have a compelling sufficient motive behind it to eclipse any credit score rating considerations.

Concentrate on why you’re refinancing your mortgage first earlier than worrying about your credit score rating.

Finally, I’d put it on the no-worry shelf as a result of likelihood is the refinance received’t decrease your credit score rating a lot, if in any respect. And rating drops associated to new credit score usually reverse in a short time.

So even when your credit score rating fell 20 factors post-refi, it will most likely achieve these factors again inside a couple of months so long as you made on-time funds on the brand new mortgage.

And most of the people are solely involved about their credit score scores proper earlier than making use of for a mortgage, so what occurs shortly after your private home mortgage funds could not matter a lot to you.

However to make sure you don’t get denied on account of a credit score rating drop, it’s useful to have a buffer, reminiscent of an 800 credit score rating in case your rating does drop a bit whereas procuring round.

Should you’re proper on the cusp of a credit score scoring threshold and your rating dips barely, you may wind up with the next curiosity, or at worst, be denied a mortgage outright.

Learn extra: When to refinance a house mortgage.

[ad_2]