[ad_1]

In 2012, an estimated 64 % of Nigerians have been unbanked and had by no means accessed any formal monetary providers or merchandise, a quantity that’s larger for ladies: almost 73 % of all Nigerian girls are unbanked. This quantity doesn’t embody figures for the underbanked—women and men who’ve had interplay with a financial institution however not persistently.

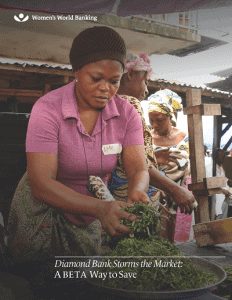

In Africa, and in lots of locations in Nigeria, bodily proximity to a department is an important barrier. Nevertheless, in Balogun market, and in lots of city areas throughout Nigeria, the space is emotional as an alternative of bodily. The men and women who run companies in Nigeria’s bustling Balogun market are conversant in banks but they don’t see them as related or accessible. Even those that have accounts normally place most of their cash in conventional, although extra casual, monetary instruments. Diamond Financial institution and Ladies’s World Banking, supported by Visa and EFInA, got down to shut this hole by creating an progressive and related financial savings product that crosses the obstacles stopping low-income Nigerians from accessing formal monetary providers.

Diamond Financial institution PLC is a common financial institution providing a spread of banking services and products in retail, industrial, company and funding. As know-how and the arrival of cellular cash drives down the price of doing enterprise with purchasers, Diamond Financial institution noticed an amazing alternative to develop their consumer base by serving the under-banked and financially excluded.

Diamond Financial institution labored with Ladies’s World Banking to deepen its understanding of this potential market and ship a product effectively and at low value. As Diamond Financial institution discovered, it isn’t that Nigerians don’t wish to hold their cash at a financial institution, however that they want extra handy providers than banks have beforehand supplied. And most Nigerians wish to have interaction with financial institution—61 % of the unbanked would really like an account. Bridging this hole requires a brand new mannequin of easy, inexpensive and accessible merchandise that meet the wants of low-income folks. Given Ladies’s World Banking expertise creating financial savings merchandise for establishments all around the world, the partnership with Diamond Financial institution supplied Ladies’s World Banking a possibility to adapt this experience to make sure that girls have been a part of the financial institution’s progress technique.BETA (which means “good” in pidgin English) will be opened in lower than 5 minutes and has no minimal stability and no charges. The account is focused at self-employed market men and women who wish to save steadily (day by day or weekly). As a result of we all know that these clients, particularly girls, worth comfort, the product is constructed round serving girls available in the market the place they work. Brokers, often known as BETA Pals, go to a buyer’s enterprise to open accounts and deal with transactions, together with deposit and withdrawal, utilizing a cell phone utility.

Pilot Overview

- In March 2013, the BETA financial savings account rolled out in 21 of Diamond Financial institution’s 240 branches.

- 38,600 accounts have been opened throughout the six-month pilot, 40 % of them belonging to girls, exceeding the aim of 16,000 accounts.

- 74 % of BETA purchasers transact greater than as soon as a month, saving an mixture $1.5 million (US) in deposits within the first six months from the pilot launch.

[ad_2]