[ad_1]

MAY 6, 2019

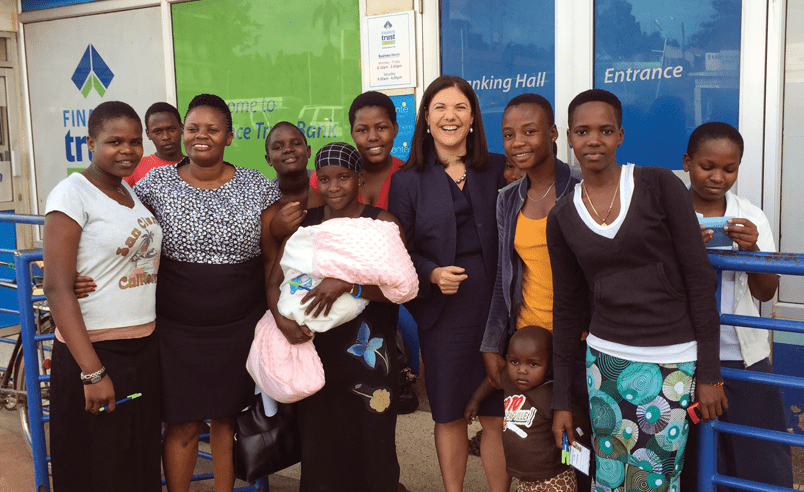

BY MARY ELLEN ISKENDERIAN, PRESIDENT AND CEO OF WOMEN’S WORLD BANKING

The teachings we’ve discovered from this work have shaped the muse for our new technique to advance monetary inclusion for girls at scale globally.

By means of the help of Monetary Sector Deepening Africa (FSDA), during the last 5 years, Girls’s World Banking partnered with three giant African banks — in Nigeria (Diamond Financial institution), Tanzania (NMB) and Malawi (NBS Financial institution) — on an array of initiatives to achieve low-income ladies and women with credit score and financial savings initiatives, accompanied by monetary schooling.

This work represented a few of our largest and most sustained engagements with mainstream business banks so far and we discovered an infinite quantity. The initiatives confirmed as soon as once more {that a} well-designed monetary product that’s accessible and simple to make use of is interesting to women and men alike. As such it has the potential to broaden a monetary establishment’s buyer base exponentially.

I’m so proud to say that we had been in a position to attain greater than 1.5 million un- and underbanked ladies, males and youth with monetary providers, lots of them with digital parts of their supply. And the teachings we’ve discovered from this work have shaped the muse for our new technique to advance monetary inclusion for girls at scale globally.

There have been just a few notably essential insights that stood out to me.

About merchandise designed for girls:

- Even the perfect designed digital financial savings product doesn’t substitute a consumer’s want for human interplay; quite the opposite, the human contact is important for accounts for use actively.

- Reaching the ladies’s market requires sustained institutional dedication not simply from the management staff however from all components of the group together with advertising and marketing, gross sales, operations, danger administration and human sources.

Study extra Beta Financial savings on this brief video!

About youth financial savings merchandise:

- Any youth proposition should embrace each youth and fogeys/guardians to be able to achieve success; bringing each youth and adults alongside within the consumer journey creates higher buyer loyalty and sustainability for the establishment. (And, moms and daughters saving collectively yielded the biggest balances and most sustained dedication to saving!)

- Gender variations in financial savings conduct amongst youth begin early. As an example, women in Tanzania had been extra more likely to deposit in a financial institution whereas boys had been extra more likely to be comfy participating with financial institution workers and asking questions.

- Youth aspire to have the safety of a checking account; they perceive the advantages of a financial institution as a protected place to avoid wasting over a cell account.

About entry to credit score for girls:

- Girls’s lack of collateral shouldn’t preclude them from borrowing to develop their companies. A cash-flow based mostly lending strategy is an efficient strategy to achieve low-income ladies enterprise house owners.

- Entry to various information units corresponding to financial savings conduct and cellphone “prime up” charges can be utilized to evaluate credit score worthiness, thus making credit score extra accessible to ladies purchasers who’re much less more likely to have the documentation and credit score historical past vital to ascertain a standard credit score rating.

We hope that each one stakeholders dedicated to increasing monetary inclusion will take these classes to coronary heart. The tales and information behind these insights (and lots of extra!) will be discovered on this newly printed digital anthology: https://www.womensworldbanking.org/insights-and-impact/engaging-women-customers-in-nigeria-tanzania-and-malawi/

As well as, I’d like to spotlight one among our most essential findings: the worth of bringing a neighborhood perspective to product design, advertising and marketing, coverage advocacy – actually each side of our work. Girls’s World Banking’s work in Sub-Saharan Africa was immeasurably strengthened and our impression magnified by means of the steering and encouragement of our Africa Advisory Council. Drawing on the Council members’ insights allowed us to refine Girls’s World Banking’s technique on the continent and members served as ambassadors for girls’s monetary inclusion inside their private {and professional} circles.

I’m so grateful for the imaginative and prescient and dedication of each one among our Africa Advisory Council Members. Going ahead, I do know they’ll proceed to be essential allies for Girls’s World Banking and advocates for increasing ladies’s monetary inclusion.

[ad_2]