[ad_1]

That is the second in a three-part collection analyzing a contemporary strategy to digital remittances in Indonesia.

By Angela Ang, Elwyn Panggabean, and Ker Thao

For home employees in Indonesia, remittances present a vital technique of assist for his or her households. As we famous in our first weblog, home employees want safe and assured supply of funds when selecting a remittance channel; nevertheless, many find yourself selecting casual and dangerous channels (for instance, by way of retailers and in money with individuals who journey again residence), which may result in theft and fraud. As such, Girls’s World Banking partnered with DANA, one among Indonesia’s largest e-wallet suppliers, to develop a digital remittance resolution for home employees to soundly ship cash to their households and to extend their engagement with formal monetary providers.

Understanding what’s most vital for home employees and their recipients

To assist within the design and supply of our digital remittance service, we carried out in-depth interviews to know the boundaries, challenges, and wishes of home employees in Indonesia when choosing and utilizing remittance channels and providers. Regardless of their frustrations with present remittance channels and providers (by way of money, counters, and casual channels), home employees understand these as the one choices obtainable to them. Once we requested home employees what a great remittance service would seem like, they reported a service that’s quick and simple to make use of, dependable, and accessible (each for them and their recipients):

- Quick and simple: Home employees are time-poor and need a service that gives quick and simple transactions, with close by easy-to-access service touchpoints. Moreover, they want a service that makes funds immediately obtainable for recipients, one that’s simple to transact with and requires few steps, and one with shorter processing occasions, permitting employees to maximise their free time.

- Dependable: Staff are sending giant lump sums of money residence and like a service that may assure supply with low threat of theft and fraud. Some have reported selecting a channel with increased service charges for the sake of quicker, assured supply of their funds as in comparison with cheaper, slower strategies.

- Accessible: As a result of many employees’ households stay in rural and distant areas of Indonesia, a service with accessible touchpoints for cash-out is crucial. A service that’s simple for digitally and tech illiterate clients creates much less trouble for the cash-in and cash-out course of.

Key boundaries and challenges to digital remittances for home employees

An e-wallet service and platform can present a remittance channel that’s quick and simple, dependable, and accessible for each senders and recipients. Furthermore, it may well present clients with their first formal account within the type of e-wallets and construct their monetary and digital monetary capabilities, permitting them to turn into complicated and multi-case customers. However to spice up inclusivity within the e-wallet market, we should first tackle home employees’ most typical boundaries and challenges in utilizing e-money and digital wallets as a remittance channel:

- Advanced/sophisticated sign-up course of: Staff want help to finish the registration course of, particularly with digital verification procedures corresponding to e-KYC (know your buyer)

- Lack of entry to web/knowledge: Poor infrastructure in distant areas creates connectivity points or lack thereof, stopping senders and recipients from utilizing e-money and digital wallets

- Lack of use instances/underdeveloped digital ecosystem: The absence of a digital ecosystem in rural and distant areas limits transactions

- Overwhelming app selections/interface: Overloaded UX/UI makes navigating an app too sophisticated for digitally illiterate clients

- Lack of belief in digital/e-money: As a result of inexperience (or restricted consciousness) and/or a earlier expertise dropping cash, employees are reluctant to depend on e-money and digital wallets

- Worry of constructing errors: Digitally illiterate clients are reluctant to depend on e-money and digital wallets within the occasion they make expensive errors, corresponding to inputing the incorrect account quantity or cash quantity

Designing an answer that works for home employees

As a result of there are not any central and formal aggregators for Indonesia’s home employees, it’s practically not possible to achieve the home employee inhabitants. As such, we designed and developed a totally digital resolution that leverages DANA’s present customers, who’re additionally employers of home employees. DANA customers/employers thus play a key position in introducing DANA as a payroll technique and as a viable, secure, and dependable remittance service for employees.

Aimed toward constructing the digital and monetary capabilities of home employees, DANA’s five-part resolution teaches them find out how to use the digital platform to make remittance transfers. First, we construct consciousness amongst employers and home employees of DANA and its account advantages by establishing DANA as an accessible, reliable, and easy-to-use remittance channel. To assist clients overcome the hurdles of account registration and the difficult KYC verification course of, we enlist employers to help home employees in signing up for DANA Premium accounts. We then present employees with alternatives to study and apply find out how to transact with DANA. Telephone notifications and reminders, along with gamification and different incentives, assist encourage employees to make use of DANA as a remittance service to ship cash residence. An summary of the answer parts is as follows:

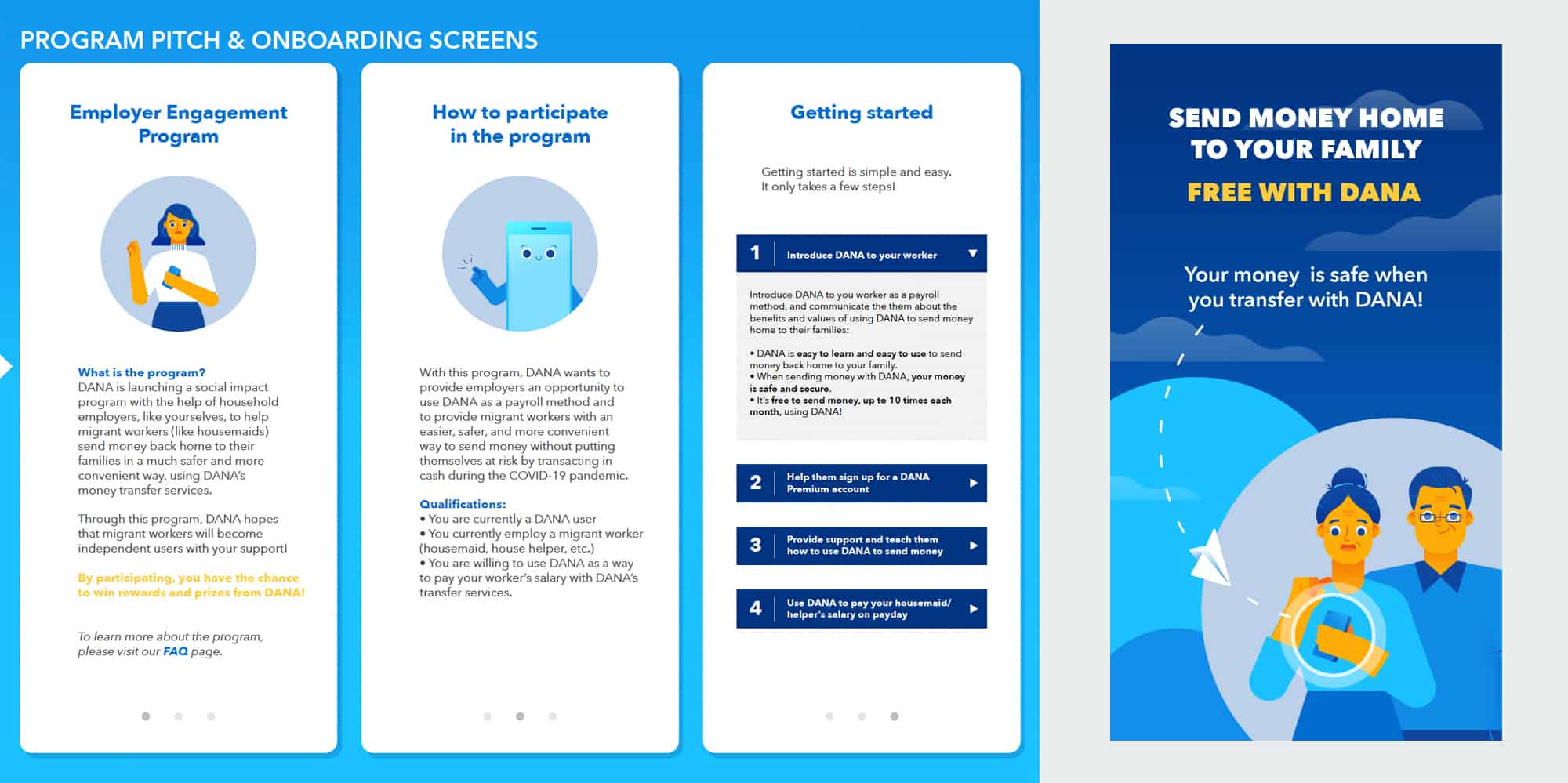

- Program pitch and onboarding: Promote this system amongst employers and home employees and construct belief and confidence in DANA as a remittance service by speaking its values and advantages.

- Transaction tutorials: Present step-by-step visible guides to assist home employees who’re much less tech savvy discover ways to make transactions with their DANA accounts and supply alternatives for them to apply.

- Key buyer advertising and marketing and messaging: Develop advertising and marketing supplies for patrons with messaging that communicates the important thing worth and advantages of utilizing DANA and emphasizes that the service is straightforward, handy, secure, and safe.

- Well timed notifications and reminders: Ship notifications and reminders round payday to maintain DANA high of thoughts for patrons and enhance using DANA to ship cash residence.

- Gamification and incentives: Use gamification to assist clients ship remittances and full different transactions on DANA’s e-wallet platform and supply related incentives and rewards to encourage clients who efficiently attain milestones.

Piloting the answer and subsequent steps

In September 2021, we launched a three-month check pilot of the answer, obtainable to all of DANA’s KYC and non-KYC clients. With this program pilot, we hope to know:

- How nicely did the answer attain home clients, and what number of employees had entry to the answer (obtained promotional, advertising and marketing, and related program supplies and communications)?

- What number of girls home employees accessed the answer total and began utilizing DANA’s remittance providers to ship a reimbursement residence?

Based mostly on the outcomes and learnings of the pilot, we are going to iterate and modify the answer as wanted earlier than rolling-out to DANA’s total buyer base. In Half 3 of this weblog collection, we are going to share our learnings from this system pilot, in addition to our suggestions to successfully design and attain home migrant employees with a digital remittance resolution.

[ad_2]