[ad_1]

Public Provident Fund or PPF is among the greatest and hottest debt devices accessible to us. Nevertheless, it doesn’t imply it’s risk-free. What are the dangers of investing in a Public Provident Fund or PPF?

No asset class on this earth is totally risk-free. In a technique or one other means, they carry a specific amount of dangers. Solely nature or color might change. Therefore, understanding the dangers of investing in a Public Provident Fund is most vital.

Earlier than continuing additional, allow us to recap the options of the Public Provident Fund.

Options of Public Provident Fund or PPF

Who can open it?

(i) a single grownup by a resident Indian.

(ii) a guardian on behalf of a minor/ particular person of unsound thoughts. ?

Notice:- Just one account will be opened all throughout the nation both within the Put up Workplace or any Financial institution.

How a lot to deposit?

(i) Minimal deposit of Rs. 500 in a Monetary 12 months and Most deposit is Rs. 1.50 lakh in an FY

(ii) Most restrict of Rs. 1.50 lakh shall be inclusive of the deposits made in his/her personal account and within the account opened on behalf of a minor.

(iii) Quantity will be deposited in any variety of installments in an FY in a number of of Rs. 50 and a most as much as Rs. 1.50 lakh.

(iv) The Account will be opened by money/cheque and within the case of the cheque the date of realization of the cheque in Govt. the account shall be the date of opening of account/subsequent deposit within the account.

(v) Deposits qualify for deduction below part 80C of the Earnings Tax Act.

What in case you discontinue the account?

(i) If in any monetary 12 months, a minimal deposit of Rs.500/- isn’t made, the mentioned PPF account shall develop into discontinued.

(ii) Mortgage/withdrawal facility isn’t accessible on discontinued accounts.

(iii) Discontinued account will be revived by the depositor earlier than maturity of the account by deposit minimal subscription (i.e. Rs. 500) + Rs. 50 default price for every defaulted 12 months.

(iv) The whole deposit in a 12 months, shall be inclusive of deposits made in respect of years of default of earlier monetary years.

What’s the rate of interest?

(i) Curiosity shall be relevant as notified by the Ministry of Finance on a quarterly foundation. The present rate of interest is 7.1%.

(ii) The curiosity shall be calculated for the calendar month on the bottom stability within the account between the shut of the fifth day and the tip of the month.

(iii) Curiosity shall be credited to the account on the finish of every Monetary 12 months.

(iv) Curiosity shall be credited to the account on the finish of every FY the place the account stands on the finish of FY. (i.e. in case of switch of account from Financial institution to PO or vice versa)

(v) Curiosity earned is tax-free below the Earnings Tax Act.

Can we avail a mortgage?

(i) Mortgage will be taken after the expiry of 1 12 months from the tip of the FY during which the preliminary subscription was made. (i.e. A/c open throughout 2010-11, mortgage will be taken in 2012-13).

(ii) Mortgage will be taken earlier than the expiry of 5 years from the tip of the 12 months during which the preliminary subscription was made.

(iii) Mortgage will be taken as much as 25% of the stability to his credit score on the finish of the second 12 months instantly previous the 12 months during which the mortgage is utilized. (i.e. if the mortgage was taken throughout 2012-13, 25% of the stability credit score on 31.03.2011)

(iv) Just one mortgage will be taken in a Monetary 12 months.

(v) A Second mortgage shall not be offered until the primary mortgage was not repaid.

(vi) If the mortgage is repaid inside 36 months of the mortgage taken, a mortgage rate of interest @ 1% each year shall be relevant.

(vii) If the mortgage is repaid after 36 months of the mortgage taken mortgage rate of interest @ 6% each year shall be relevant from the date of mortgage disbursement.

How a lot withdrawal is allowed? ?

(i) A subscriber can take 1 withdrawal throughout a monetary after 5 years excluding the 12 months of account opening. (if the account was opened throughout 2010-11 the withdrawal will be taken throughout or after 2016-17)

(ii) Quantity of withdrawal will be taken as much as 50% of the stability on the credit score on the finish of the 4th previous 12 months or on the finish of the previous 12 months, whichever is decrease. (i.e. withdrawal will be taken in 2016-17, as much as 50% of stability as on 31.03.2013 or 31.03.2016 whichever is decrease).

When it’ll mature?

(i) Account will likely be maturity after 15 F.Y. years excluding FY of account opening.

(ii) On maturity depositor has the next choices:-

# Can take maturity fee by submitting account closure type together with passbook at involved Put up Workplace.

# Can retain maturity worth in his/her account additional with out deposit, the PPF rate of interest will likely be relevant and fee will be taken any time or can take 1 withdrawal in every FY.

# Can prolong his/her account for an extra block of 5 years and so forth (inside one 12 months of maturity) by submitting a prescribed extension type on the involved Put up Workplace. (Discontinued account can’t be prolonged).

# In an prolonged account with deposits, 1 withdrawal will be taken in every FY topic to a most restrict of 60% of stability credit score on the time of maturity within the block of 5 years.

Whether or not untimely closure allowed?

(i) Untimely closure shall be allowed after 5 years from the tip of the 12 months during which the account was opened topic to the next circumstances.-> In case of life-threatening illness of account holder, partner, or dependent kids.-> In case of upper schooling of account holders or dependent kids.-> In case of a change of resident standing of the account holder ( i.e. turned NRI).?(ii) On the time of untimely closure 1% curiosity shall be deducted from the date of account opening/date of extension because the case could also be.

(iii) The Account will be closed on the above circumstances by submitting the prescribed type together with the e-book on the involved Put up Workplace.

What’s going to occur if the account holder dies?

(i) In case of the loss of life of the account holder, the account shall be closed and the nominee or authorized inheritor(s) shall not be allowed to proceed deposits within the account.

(ii) On the time of closure as a consequence of loss of life PPF fee of curiosity shall be paid until the tip of the previous month during which the account is closed.

Dangers Of Investing in Public Provident Fund (PPF)

Allow us to now attempt to perceive the dangers of investing in public provident fund (PPF).

# Liquidity Danger

One of many greatest threat related to Public Provident Fund (PPF) is the liquidity threat. Despite the fact that mortgage and withdrawal facility is out there, however they arrive with their very own algorithm and laws. You possibly can’t withdraw as per your individual necessities. Therefore, understanding this threat earlier than blind funding is a should for all traders.

This threat will ease after a 12 months (to avail mortgage) and particularly after fiver years (to avail withdrawal). Nevertheless, the true liquidity threat will vanish to sure extent publish 15 years completion. As a result of after 15 years completion, 1 withdrawal will be taken in every FY topic to most restrict 60% of stability credit score on the time of maturity within the block of 5 years.

Refer my earlier publish on this regard – “PPF-Mortgage And Withdrawal” and “PPF Withdrawal Guidelines & Choices After 15 Years Maturity“.

# Curiosity Fee Danger

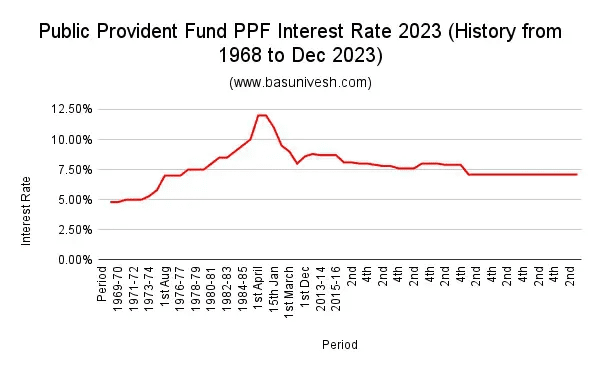

As I discussed above, PPF rate of interest will change as soon as in 1 / 4. Have a look at beneath chart to know the historical past of the PPF rate of interest.

You discover that in preliminary years, it was round 5%, then touched the height of round 12% in round 2000 and now at 7.1%. Therefore, in case you are investing and assuming the identical present 7.1% curiosity you’re going to get all through your funding cycle is a whole MYTH. Refer my publish on this regard “Public Provident Fund PPF Curiosity Fee 2023 (Historical past From 1968 To Current)“.

# Aim Mismatch Danger

Many individuals blindly spend money on PPF with out understanding their precise want. When you want the cash inside 15 years, then obiviously PPF isn’t an appropriate product for you. Ensure that your monetary aim ought to match your PPF maturity date. In any other case, although you invested in PPF, as a consequence of its liquidity threat, chances are you’ll not fund in the direction of your aim totally.

Therefore, by no means make investments blindly. As a substitute perceive your requirement after which make investments.

# Coverage Danger

The key motive for PPF traders is security and tax free nature of curiosity and maturity. Nevertheless, when the policymakers change the principles is unknown to us. When you invested at this time with an assumption that it’s going to stay tax free however afterward if the principles modified, then it’s important to undergo in a giant means. The basic instance is of EPF. Earlier no matter you earn as curiosity in your contribution (worker contribution) and your employer contribution was tax free. Nevertheless, now the restrict set in your contribution (Rs.2,50,000) a 12 months. When you contribute past this, then regardless of the curiosity earned by such extra contribution will likely be taxable earnings for the worker on yearly foundation. Refer my earlier publish “Taxation Of EPF Contribution Above Rs.2.5 Lakh – CBDT Clarification“.

Therefore, by no means be in a flawed perception that the tax guidelines or the advantages of PPF will proceed ceaselessly like how they’re at this time.

# Inflation Danger

PPF is one of the best debt instrument. Little doubt in that. Nevertheless, PPF alone isn’t sufficeint to fullfill your future long run monetary targets. Therefore, by no means make investments full quantity in PPF. As a substitute, you want the fairness half additionally to generate inflation adjusted return.

Sadly many individuals not perceive this. As a substitute, blindly they fill the Rs.1.5 lakh hole with out fail. As a substitute, based mostly in your targets, you should do the asset allocation and a part of your debt needs to be invested in PPF. Actually in case you are following the aim based mostly investing, and PPF is a debt a part of your portfoio, then by no means make investments all debt half in PPF. Primarily as a result of in case of rebalancing, you possibly can’t partially withdraw (as per your phrases) to stability the portfolio. In such a scenario, debt funds will likely be useful for you.

Conclusion – The concept behind this publish is to not convey the negativity of a product. Nevertheless, the thought is to recommend that DON’T INVEST BLIDNLY simply because PPF gives tax advantages and security of cash. As a substitute, assume past this and in case you understood the above talked about dangers of investing in public provident fund (PPF), then go forward. BLIND EMPTIONAL INVESTMENT IS ALWAYS RISKY.

[ad_2]