[ad_1]

Uncovering the Secrets and techniques of Cash and Love

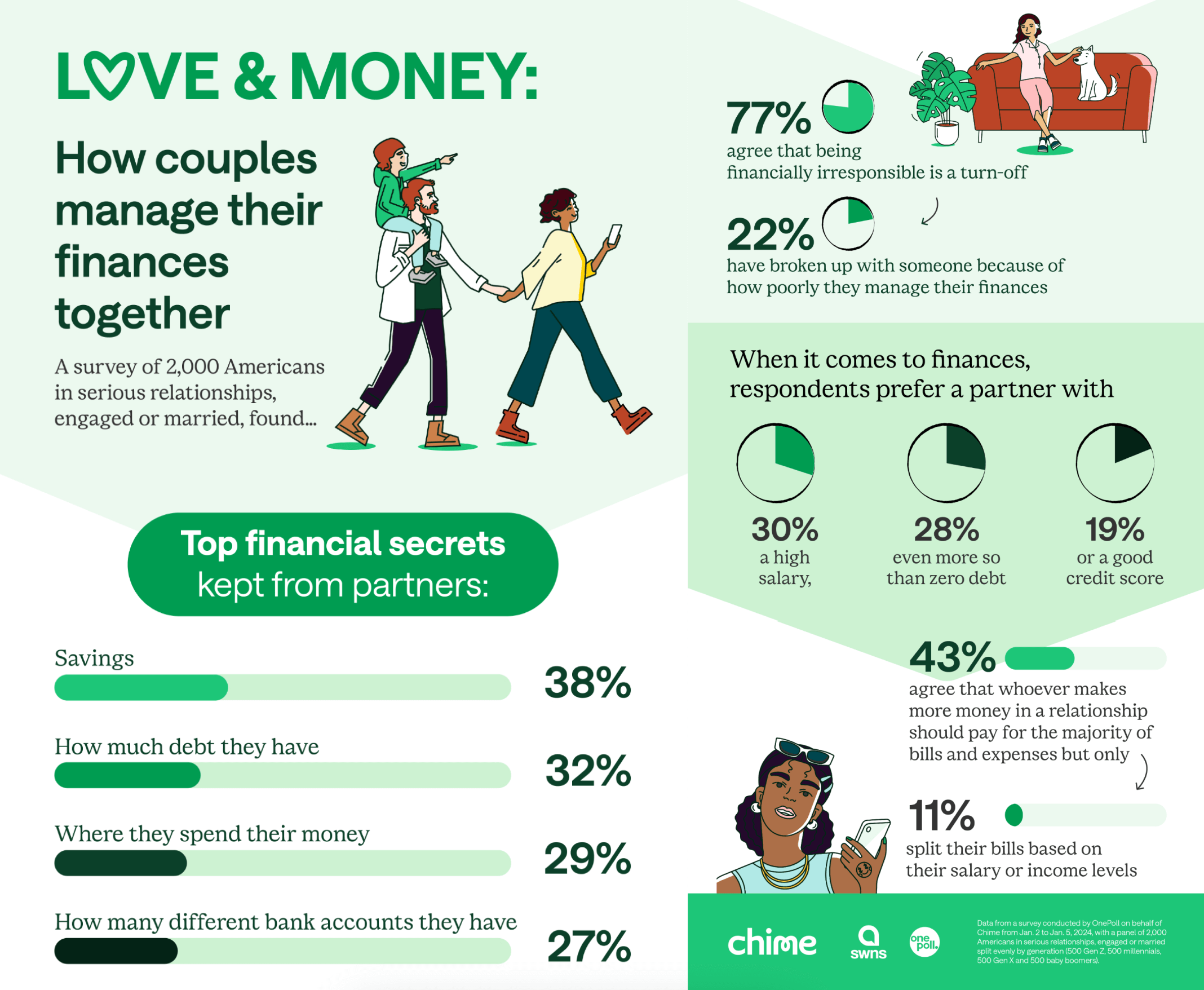

As we step into a brand new 12 months full of resolutions and tax preparations, Chime’s current survey, performed in partnership with OnePoll, provides a revealing glimpse into the monetary dynamics of romantic relationships. This deep dive exposes each the hidden complexities of economic administration and the emotional undertones of cash in relationships.

The Monetary Facade and Attractiveness in Relationships

Curiously, greater than 1 in 5 people aren’t as open about their funds with their companions as one may suppose, doubtlessly due to the 77% of people that agree that being financially irresponsible is a turn-off. About 21% of survey members admitted to having their very own monetary secrets and techniques, largely surrounding Financial savings (38%), Debt (32%), and Spending (29%).

In the meantime, 22% of respondents admit to breaking apart with somebody due to how poorly they handle their funds. In relation to ensuring you might be stacking up, respondents want a excessive wage (30%) in a associate, much more than zero debt (28%), or a superb credit score rating (19%).

“How effectively somebody manages their cash can divulge to you ways accountable and secure they is perhaps. For folks contemplating a long-term partnership, monetary duty could be a inexperienced flag!”

– Dr. Traci Williams, Licensed Monetary Therapist

Navigating the ‘Cash Speak’ and Monetary Discussions

The survey highlights the vital timing of economic conversations in relationships, with most Individuals preferring to provoke the ‘cash discuss’ round six and a half months into courting. This era sometimes signifies a shift from the preliminary romantic section to extra severe contemplation of a long-term future collectively. When these conversations happen, they usually begin with much less intimidating matters like present bills, monetary targets, and budgeting. These discussions lay the inspiration for constructing belief and navigating the monetary facet of relationships with larger ease and understanding.

“Approaching monetary discussions with instruments like {Dollars} and Sense can considerably ease {couples} into significant conversations, setting the stage for a clear and collaborative monetary relationship.”

– Jennifer Dohm, Head of Client Communications at Chime

Aligning Monetary Targets for Relationship Concord

Regardless of variations in particular person monetary habits, Licensed Monetary Therapist Dr. Traci Williams emphasizes the significance of aligning monetary targets and values. The typical couple fights about cash about as soon as per 30 days, although millennials and GenXers are inclined to argue twice every month.

“{Couples} can get on the identical web page by engaged on their monetary targets collectively, discussing the values they share, and planning for his or her future.”

– Dr. Traci Williams, Licensed Monetary Therapist

However it’s not all rocky roads forward, in relation to setting monetary targets, we see greater than half of {couples} (52%) do keep on with a finances. And of the two,000 Individuals polled -all in severe relationships- virtually two-thirds (63%) discover it simple to handle their funds with their associate.

About Dr. Traci Williams, Licensed Monetary Therapist

Dr. Traci Williams combines psychological experience with monetary counseling to assist {couples} navigate the complexities of economic decision-making. Her follow, Wholesome Rich Roots, is devoted to fostering wholesome relationships and monetary wellness.

Survey methodology: The survey, which was performed by OnePoll on behalf of banking app Chime, was a random double-opt-in survey of two,000 Individuals in a severe relationship, engaged or married, cut up evenly by era (500 Gen Z, 500 millennials, 500 Gen X and 500 child boomers) was commissioned by Chime between Jan. 2 and Jan. 5, 2024. It was performed by market analysis firm OnePoll, whose crew members are members of the Market Analysis Society and have company membership to the American Affiliation for Public Opinion Analysis (AAPOR) and the European Society for Opinion and Advertising and marketing Analysis (ESOMAR).

[ad_2]