[ad_1]

Sydney, Melbourne, and Perth most affected

Marketed rental costs have witnessed a substantial improve, placing further stress on these in Sydney, Melbourne, and Perth, PropTrack reported.

New evaluation by PropTrack has revealed startling tendencies within the rental market, highlighting an upward trajectory in rents amidst different progress charges throughout totally different cities and dwelling sorts.

Rental value hikes

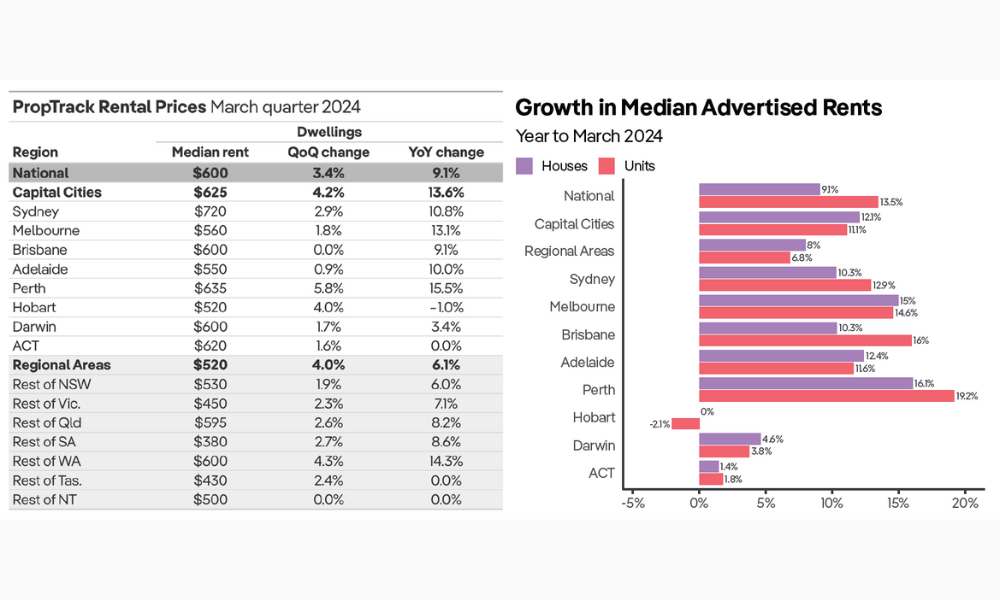

In keeping with current PropTrack knowledge, the nationwide median rental value has surged by 3.4% within the first quarter alone, reaching a brand new excessive of $600 per week. This era, identified for its seasonal power within the rental market, recorded the second-highest progress charge for a primary quarter, trailing solely behind the 2023 12 months.

“Marketed rental costs rose considerably within the first quarter of 2024, up 3.4% in comparison with 1.8% within the earlier quarter,” stated Paul Ryan (pictured above), a senior economist at PropTrack.

Ryan added that whereas the primary quarter typically sees heightened exercise, the broader pattern indicated a moderation in lease progress, with the previous 12 months’s 9.1% improve marking the slowest since December 2021.

Capital cities bear the brunt

The brunt of the rental value will increase has been most acutely felt in Australia’s capital cities, the place rents have climbed by 13.6% over the previous 12 months. Amongst these, Perth (+15.5%), Melbourne (+13.1%), and Sydney (+10.8%) recorded the very best jumps.

Ryan highlighted the actual pressure on renters in these cities, stating, “Lease stress stays agency in most capitals, with weekly rents leaping $75 over the previous 12 months.”

A silver lining in Brisbane and Adelaide

In distinction, Brisbane (flat) and Adelaide (+0.9%) supplied some aid, exhibiting minimal will increase over the quarter. The respite comes after each cities skilled sustained lease hikes post-pandemic.

The info urged a slowing momentum in lease progress, albeit within the context of a market that is still tight and aggressive, particularly for extra reasonably priced housing choices comparable to models, which have seen a 13.5% improve in rents over the previous 12 months.

“Lease progress is slowing, however rental market circumstances stay very tight,” Ryan stated. “This means continued affordability pressures for renters in 2024.”

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE day by day e-newsletter.

Sustain with the newest information and occasions

Be part of our mailing record, it’s free!

[ad_2]