[ad_1]

A latest report has discovered Canadian seniors are selecting to age of their houses for longer, with many not promoting their house till their 80s and 90s.

The findings had been revealed within the Housing Market Perception Report by the Canada Mortgage and Housing Company (CMHC), which explored a number of the anticipated implications on housing provide within the coming years.

In response to the CMHC, extra seniors are doubtlessly staying householders properly into their later years as a result of many are merely dwelling longer, more healthy lives and might deal with the upkeep of a house.

The examine, which centered on aged Canadian households within the nation’s six largest cities, additionally recognized variations based mostly on location. For instance, households in Toronto and Vancouver are the most probably to transition to condominiums as they age, the place in Montreal there’s a choice for transferring to rental housing.

“In Canada, the monetary wealth of aged households may additionally fluctuate from one city centre to a different,” says the CMHC in its report. “Prosperous households might subsequently be capable of stay householders and buy a house that meets their wants, relatively than hire one.”

Canadian seniors are most probably to promote of their nineties

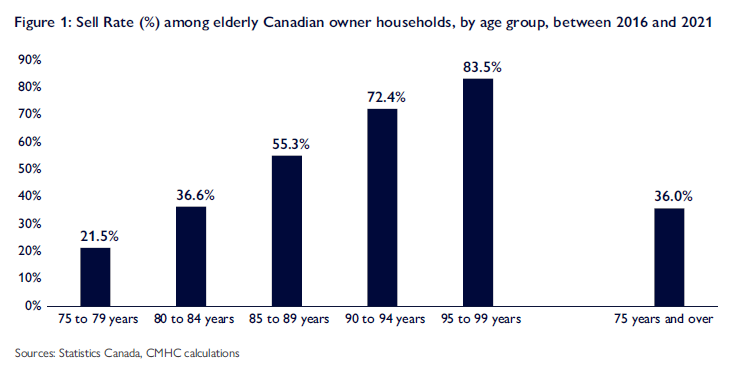

Canadian family census information present an estimated exponential promote charge development amongst seniors from 2016 to 2021. Following consecutive cohorts over time, the information present a better prevalence of considerably older seniors promoting or giving up their houses in comparison with youthful seniors.

CMHC defines the promote charge because the ratio of house owners who bought their properties to the whole variety of householders for that individual demographic. For instance, between 2016 and 2021, 100,500 householders aged 75 to 79 let go of their properties out of an preliminary complete of 466,775 proprietor households, leading to a promote charge of 21.5%.

CMHC provides that the promote charge for households aged 75 and above has been trending downward because the early Nineties, falling on common six proportion factors in that point.

Primarily based on these calculations, the information present most Canadians wait till they’re of their nineties to surrender their house.

Cohorts which might be approaching or of their 90s are anticipated to promote their houses and doubtlessly open up extra housing provide to the market within the coming years.

“They could, for instance, determine to hire personal housing or, for well being causes, transfer into public housing (similar to a care centre for seniors),” the CMHC report says. “Deaths are one other issue that brings properties onto the market.”

What does this imply for Canadian housing availability?

Whereas CMHC says it’ll nonetheless take just a few years to have older seniors checklist their houses available on the market, the outcome has the potential to finally improve housing provide and subsequently slim the affordability hole in Canada.

The outcome “appears to point that the variety of items bought by aged households may improve extra quickly as soon as inhabitants ageing in Canada is extra superior,” CMHC mentioned. “In different phrases, when the variety of households over age 85 grows bigger.”

In response to projections from Statistics Canada, inhabitants development within the 85-and-over age group will rise extra quickly from 2030 to round 2040 as a result of first child boomer cohorts reaching this age group.

For now, it might be a ready recreation to see if and when housing provide will increase as anticipated.

“The massive query is whether or not, within the coming a long time, aged households will comply with within the footsteps of earlier generations or go their very own method,” says CMHC. “For instance, will ageing in place grow to be extra standard with seniors? Will the latest rise in rental housing begins in varied CMAs throughout the nation encourage extra senior households to go for renting?”

Till then, restoring housing affordability in Canada will largely depend upon how senior family gross sales unfold within the close to future.

[ad_2]