[ad_1]

Mortgage Q&A: “Are mortgage factors price it?”

When taking out a mortgage, whether or not for a brand new dwelling buy or to refinance an present mortgage, one choice you’ll must make is that if it’s price paying mortgage factors to acquire an excellent decrease rate of interest.

Earlier than we get into that, it’s necessary to notice that the time period “factors” will get thrown round loosely, and might confer with the mortgage origination payment and/or low cost factors.

The mortgage origination payment is the fee charged by the financial institution or mortgage officer in alternate for working in your mortgage, whereas low cost factors are elective prices used to purchase down your rate of interest.

It’s an necessary distinction as a result of the mortgage origination cost is principally unavoidable (they should eat, proper?).

Whereas paying low cost factors (pay as you go curiosity) is totally elective relying on the rate of interest you need.

Notice that not all lenders cost mortgage origination charges, however that might simply imply the price is already baked into the (increased) rate of interest.

Both approach, take the time to check lenders’ charges and costs to make sure you get the very best mixture of each.

Leap to paying mortgage factors matters:

– When You Break Even Determines If Factors Are Value It

– Consider Your Tax Bracket and Financial savings Charges

– It Would possibly Not Be a Good Concept to Pay Mortgage Factors in 2024

– Make Positive Paying Factors Really Lowers Your Charge

– Conditions The place Paying Mortgage Factors Can Be Well worth the Value

– Advantages of Shopping for Mortgage Factors

– Disadvantages of Shopping for Mortgage Factors

Do You Need an Even Decrease Mortgage Charge? Pay Factors!

- You may acquire a below-market mortgage price in the event you pay factors at closing

- Factors are a type of pay as you go curiosity that scale back your curiosity expense on the mortgage

- As a substitute of paying extra every month, you pay extra upfront

- This can prevent cash over the lifetime of the mortgage through diminished curiosity

Let’s assume you’re purchasing for a $300,000 mortgage.

Whereas mortgage price buying, you’ll in all probability pay essentially the most consideration to the large, obtrusive price in entrance of you, corresponding to 5.99%.

However in the event you look below that price, or within the small, high-quality print, you must see extra particulars concerning the price, corresponding to the truth that it requires you to pay two mortgage factors!

[Watch out for rates you have to pay for!]

On this case, these two factors are mortgage low cost factors, which decrease the speed to that amazingly low 5.99% you see marketed.

However these two factors will price you $6,000, utilizing our $300,000 mortgage instance, as every level is the same as one p.c of the mortgage quantity.

If we’re speaking a couple of bigger mortgage quantity, corresponding to $500,000, it’s abruptly $10,000. Ouch!

Assuming you don’t need to pay these two factors, your precise mortgage price will in all probability be markedly increased, maybe 6.75% as a substitute.

And the financial institution or lender might inform you that it’s important to pay “factors” to get that low, marketed rate of interest in your mortgage.

Sort of Like a Automobile Lease The place You Pay for a Decrease Month-to-month Cost

It jogs my memory of a automobile lease the place you’re instructed funds are solely $299 monthly for 36 months, but it surely requires $2,500 money at signing. Is it actually simply $299?

If you wish to precisely gauge the deal, it’s essential contemplate that upfront price. Within the case of the automobile lease, it’s one other $69 monthly, or about $368 monthly as soon as factored in.

Your buddy might need scored the identical month-to-month fee with nothing down, so it’s not likely apples-to-apples.

The identical goes for mortgages – how a lot are you paying to get the speed you need to brag about?

Anyway, again to our mortgage instance, when distinction in fee, we’d be speaking about financial savings of $150 monthly in the event you opted for the decrease 5.99% price whereas paying two factors.

Tip: Remember that the low cost factors are paid along with any lender charges charged for origination, processing, underwriting, and so forth.

When You Break Even Determines If Factors Are Value It

- When paying factors it’s essential contemplate the “break-even level”

- That is the date by which you recoup the upfront price of the factors

- How lengthy it takes will depend upon the speed discount and worth paid

- Make sure to contemplate how lengthy you intend on staying within the dwelling/mortgage whereas making the choice

Whereas 5.99% actually sounds lots higher than 6.75%, it’s really solely a $150 distinction once you make your mortgage fee every month.

Not as superior because it regarded, eh. And guess what? You simply paid $6,000 upfront, out-of-pocket for that $150 month-to-month low cost.

And cash spent in the present day is costlier than the identical cash spent sooner or later due to our good friend inflation.

It’s additionally lengthy gone the minute you spend it, trapped in your house at a time when cash could also be tight due to different closing prices and housing-related expenditures.

So why would somebody need to drop a number of thousand bucks for a comparatively small fee discount? Properly, assuming they keep on with the mortgage long-term, the financial savings will come. It’ll simply take some time…

The month at which you begin saving cash and basically make these factors definitely worth the upfront price is named your “break-even level.”

Consider Tax Bracket and Financial savings Charges to Calculate Break-Even Level

- It’s essential contemplate your particular person tax bracket to correctly decide the break-even date for paying mortgage factors

- This fashion you possibly can determine the precise financial savings assuming you itemize your taxes

- You additionally want to take a look at financial savings account yields or what your cash would earn elsewhere

- Maybe the $10,000 is best off in an funding account

The right break-even level components in your earnings tax bracket and present financial savings charges, not simply the distinction in month-to-month fee. It additionally accounts for quicker principal compensation.

Keep in mind, a decrease rate of interest means extra of every fee goes towards whittling down the excellent steadiness. That is one other perk to paying factors.

After all, in the event you make investments the cash in shares or bonds or no matter else, it may shift the break-even level tremendously.

If you need a good suggestion of once you’ll hit this magical level, search for a break-even calculator on-line that takes into consideration all these necessary particulars.

In our instance, with a tax bracket of 24% and a present financial savings account yield of 4.75%, it could take roughly 34 months to interrupt even. Or for paying mortgage factors to be price it (make sense financially).

Merely put, in the event you don’t plan on spending not less than three years in your house, or extra importantly, with the mortgage, it’s not price paying the factors.

Nonetheless, in the event you’re the sort who desires to pay as little curiosity as potential over the lifetime of your mortgage since you’re in it for the long-haul, paying mortgage factors generally is a good transfer.

In truth, in the event you see the mortgage out to its full time period, you’d pay roughly $50,000 much less in curiosity versus the upper price mortgage. That’s the place you “win.”

However earlier than you get too excited, there’s one other issue to think about. What it charges drop by a substantial quantity after you are taking out your mortgage?

It Would possibly Not Be a Good Concept to Pay Mortgage Factors in 2024

- Mortgage charges are predicted to go down between now and the top of 2024

- The 30-year mounted is forecast to fall from round 6.75% to beneath 6% later this yr

- In case you pay factors now you may go away cash on the desk in the event you refinance later

- It may make extra sense to pay as little as potential at closing in the event you anticipate refinancing

Now may not be a good time to pay factors seeing that charges are nonetheless near their 21-century highs and can seemingly transfer decrease all through 2024.

After all, all of us thought mortgage charges would go down final yr, and the yr earlier than that.

That means lots of householders who anticipated to refinance their mortgage didn’t. And those that didn’t pay factors proceed to be caught with bigger month-to-month funds.

However the newest 2024 mortgage price predictions put the 30-year mounted about 1% decrease by the top of the yr.

So a price and time period refinance could possibly be within the playing cards for individuals who take out a mortgage in the present day.

As a substitute of paying mortgage factors, a short-term buydown could possibly be the higher transfer. Any funds that aren’t used are usually simply refunded in the event you refinance.

The one actual disadvantage is in the event you’re unable to refinance for no matter purpose. One fear is that if dwelling costs fall, you may not have the required fairness to qualify.

Make Positive Paying Factors Really Lowers Your Mortgage Charge

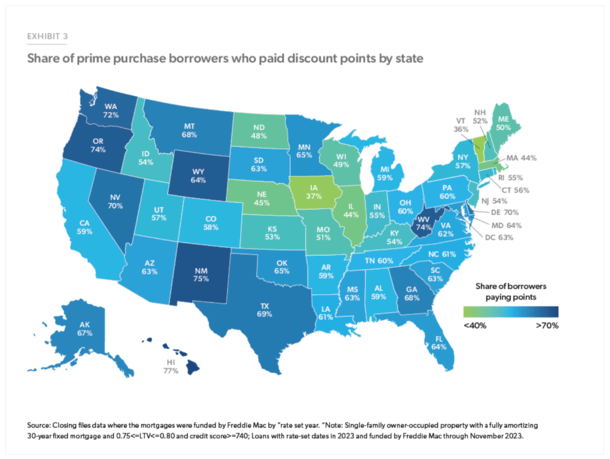

One remaining be aware. Freddie Mac simply carried out a examine centered on low cost factors as a result of they’ve turn out to be much more widespread recently.

In truth, roughly 58.8% of buy mortgage debtors paid low cost factors in 2023, in comparison with simply 31.3% in 2021.

The share was even increased for price and time period and cash-out refinance debtors at 59.9% and 82.4%, respectively.

Most significantly, they found that “the rate of interest differential between debtors who pay low cost factors and people who don’t pay low cost factors may be very small.”

In different phrases, many dwelling consumers are paying factors however not getting a a lot decrease price.

They discovered that the common efficient price on dwelling buy loans for debtors who paid low cost factors was 6.69% versus 6.86% for individuals who didn’t pay factors. That’s a distinction of simply 0.17%.

To sum issues up, the choice to pay mortgage factors is a fancy one which requires some thought. And a few future planning. It’s additionally not a one-size-fits-all reply.

If mortgage charges are anticipated to fall, paying factors is mostly a foul thought. But when charges are low and never anticipated to get a lot better, and even rise, it could possibly make lots of sense.

Simply be certain you really safe a decrease rate of interest when paying factors.

Those that don’t store round may wind up with the next price in comparison with those that averted paying factors altogether.

In different phrases, store each charges and factors! It’s potential to get a great deal on each in the event you put within the effort and time.

Conditions The place Paying Mortgage Factors Can Be Well worth the Value

- Whereas charges are low (much less prone to refinance as a result of it gained’t get a lot better)

- If it’s your eternally dwelling (might be free and clear finally for lots much less cash)

- If in case you have a retirement objective to repay the mortgage (versus promote/refi it)

- On a property you occupy now however will hire out sooner or later (can lock-in a low price now)

- If deducting factors from taxes can prevent cash in a given yr

Advantages of Shopping for Mortgage Factors

- You get a decrease rate of interest

- Your month-to-month fee will likely be smaller

- You’ll pay much less curiosity over time

- You’ll construct fairness quicker

- Factors are typically tax deductible

- You may brag to pals about your low price

Disadvantages of Shopping for Mortgage Factors

- You must pay a big upfront price for a decrease rate of interest

- The month-to-month financial savings could also be negligible

- It may take a very long time to interrupt even

- You’ll lose cash in the event you promote/refinance earlier than breaking even

- You’ll have much less money readily available for different bills

- Cash might earn a greater return elsewhere

- Smaller mortgage curiosity deduction

- Cash loses worth over time because of inflation

Learn extra: Are mortgage factors tax deductible?

[ad_2]