[ad_1]

A reader asks:

Investing in any respect time highs is counterintuitive. Does it produce nice returns as a result of the market is forward-looking and traders are momentum traders? It doesn’t appear to make sense to purchase simply earlier than an extended extreme bear market.

I perceive the fear right here.

All-time highs appear scary as a result of each inventory market crash in historical past began from one.

The factor it’s a must to perceive about markets is they’re all the time and eternally cyclical. Typically these cycles activate a dime however more often than not markets overshoot to each the upside and the draw back. The pendulum swings too far in each instructions.

Why is that this the case?

People are those controlling the markets, and our feelings can get the perfect of us when issues are going splendidly or terribly.

For this reason volatility tends to cluster throughout downturns.

And new all-time highs are inclined to cluster throughout upturns.

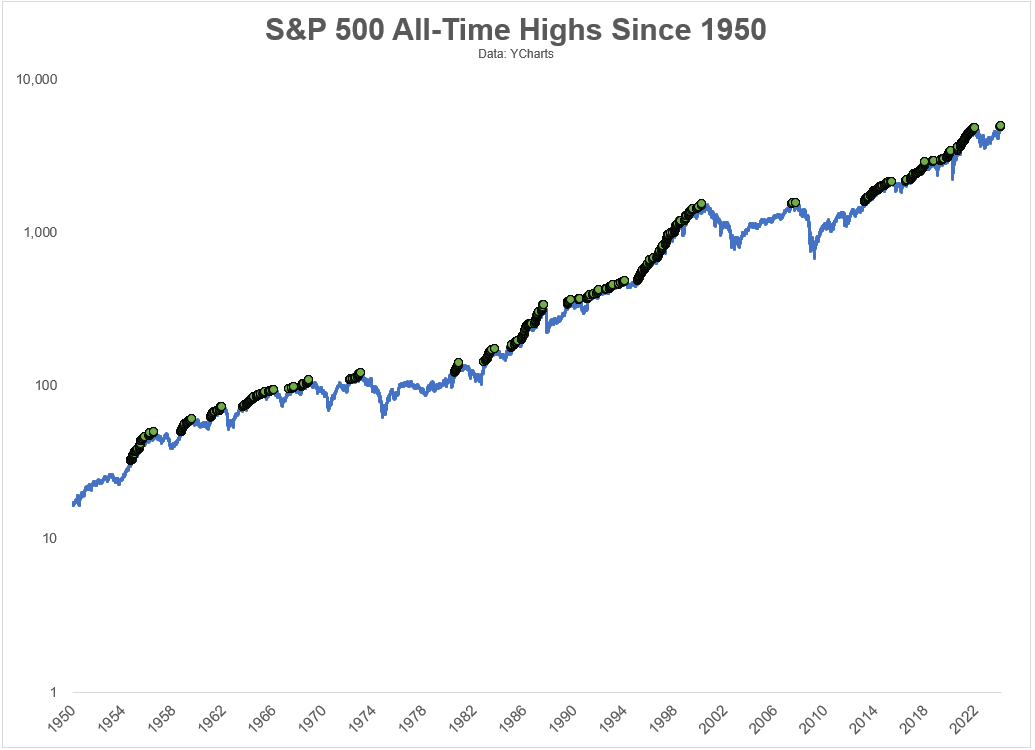

Check out this chart of the S&P 500 with new all-time highs plotted in inexperienced going again to 1950:

Take a look at all of these clusters of recent highs!

Since 1950, there have been new all-time highs on 6.7% of all buying and selling days.

However these percentages have been a lot greater throughout bull markets.

Within the Nineties it was greater than 12% of all buying and selling days. After the 1929 highs have been lastly taken out in 1954, there was a brand new excessive in one among of each 10 buying and selling days for the rest of the last decade. From 2013-2019, it occurred on 14% of all buying and selling days. Regardless of two bear markets this decade, the S&P 500 has hit new all-time highs on 11% of all buying and selling days within the 2020s.

There have been situations when there have been only a handful of recent all-time highs and an instantaneous crash however it’s uncommon. In 2007, there have been simply 9 new all-time highs earlier than the height that led to the Nice Monetary Disaster.

There are not any ensures with these items however new highs are nothing to be afraid of. In reality, new highs are a bullish sign more often than not.

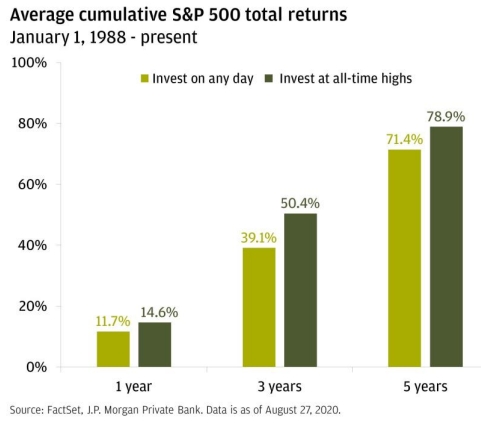

Try this chart from JP Morgan:

They discovered that for those who had invested within the S&P 500 on any given day since 1988, your common complete return a yr later would have been simply shy of 12%.1

Nonetheless, for those who solely invested on days the place the S&P 500 closed at an all-time excessive your common complete return would have been practically 15%.2

The typical returns have been higher from all-time highs!

These outcomes are counterintuitive, however they make sense when you think about all the behavioral biases we exhibit as a species.

Analysis reveals that traders maintain onto shedding shares too lengthy in hopes they’ll come again to their authentic value whereas promoting their winners too quickly.

Traders additionally anchor to current outcomes, so initially markets underreact to information, occasions or knowledge releases. As soon as issues turn into extra obvious, traders then transfer into extra of a herd mentality. This overreaction could cause an overshoot to the upside or draw back.

Concern, greed, overconfidence and affirmation bias can lead traders to pile into successful areas of the market after they’ve risen or pile out after they’ve fallen.

Add all of it up and that is why cycles can persist longer than most traders assume potential. Nothing lasts eternally within the markets however human nature is an efficient clarification for the clustering of each volatility to the draw back and new all-time highs to the upside.

Then there’s the straightforward clarification that the inventory market goes up more often than not.

When you’re a long-term investor, you need to count on to see loads of new highs over the course of your investing lifecycle.

A handful of them will result in a market crash.

Most of them will result in extra new highs.

We mentioned this query on the most recent Ask the Compound:

Blair duQuesnay joined me once more this week to reply questions on monetary planning when you could have children, coping with skyrocketing residence insurance coverage, planning for an inheritance and the way a lot you want for a home down cost.

Additional Studying:

New All-Time Highs After a Bear Market

1And you’d have made cash 83% of the time on these 12-month time frames.

2Returns have been constructive 88% of the time.

[ad_2]