[ad_1]

With the winter break now lastly behind us, it’s time to speak mortgage charges once more.

These days, they’ve been on the minds of anybody even remotely taken with shopping for a house.

Or promoting a house for that matter, as that may have an effect on residence purchaser demand as properly.

The excellent news is most forecasts are calling for decrease mortgage charges all through 2024.

And now there’s one other piece of favorable information from Fannie Mae relating to mortgage charges and client sentiment.

Survey-Excessive 31% of Customers Count on Mortgage Charges to Fall This Yr

A report launched by Fannie Mae this morning revealed that customers are rising more and more bullish on mortgage charges in 2024.

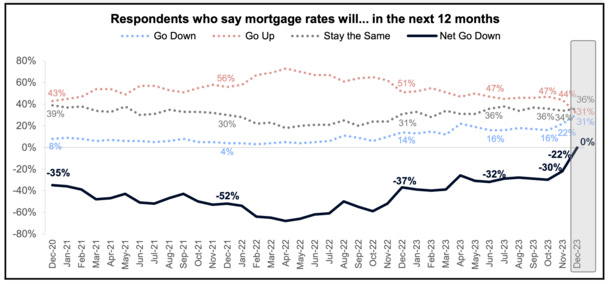

Their Residence Buy Sentiment Index (HPSI), which displays each present views and future expectations for the housing market, asks respondents which means mortgage charges will go.

Within the newest survey, a report 31% stated they imagine mortgage charges will fall over the following 12 months.

Whereas 31% could not sound like quite a bit, think about this share was round 16% in October, and simply 4% in December 2021!

In different phrases, sentiment has shifted huge time, with mortgage charge expectations doing a digital 180.

Merely put, customers now not anticipate mortgage charges to rise, however reasonably see them drifting decrease after peaking final fall.

That is essential for the housing market, which suffered mightily in 2023 as transactions plummeted within the face of 8% mortgage charges.

However with the expectation that the worst is now behind us and a return to charges within the 5% vary (and even 4% vary) is feasible, it might reinvigorate residence gross sales.

Apart from boosting affordability, merely as a consequence of a decrease month-to-month housing cost, it might get some potential consumers off the fence in the event that they imagine higher instances lie forward.

Granted, not everyone seems to be satisfied.

Almost a Third Nonetheless Assume Mortgage Charges Will Transfer Larger This Yr

Regardless of client optimism on mortgage charges hitting a brand new survey-high, 31% of respondents stay unconvinced.

Sure, the identical proportion that suppose they’ll go down additionally suppose they’ll go up.

So it’s a little bit of a standoff in the mean time, although this pessimistic group has shrunk significantly.

Within the prior survey, 44% of respondents anticipated mortgage charges to extend. And this share hovered round 50% for a lot of 2023.

It appeared to peak at 60% in mid-2022 and has since steadily fallen. Once more, this might sign that the worst is behind us relating to excessive mortgage charges.

However it doesn’t imply they’ll drop again to their report lows, or wherever close to it.

The remaining 36% of respondents imagine charges will merely keep put the place they’re over the following 12 months.

Ultimately look, this implies a 30-year mounted mortgage charge someplace between 6.5% to six.75%.

Whereas it’s not essentially a low charge, it’s not as unhealthy because it as soon as was. And that alone may very well be considerably of a recreation changer.

Search for Mortgage Charges to Expertise Volatility in 2024

As famous in my 2024 mortgage charge predictions submit, I imagine rates of interest will expertise a bumpy trip because the 12 months performs out.

Nevertheless, I do anticipate charges to development considerably decrease and finish the 12 months slightly below 6%.

These ups and downs aren’t distinctive to 2024, however issues may very well be much more risky than traditional given the contentious presidential election on the horizon.

And an financial system that continues to shock us, making the Fed’s inflation flight a bit of extra difficult than it seems.

Whereas the Fed remains to be anticipated to chop its federal funds charge a number of instances this 12 months, which ought to result in decrease client mortgage charges, it probably gained’t be linear.

There can be good months and unhealthy months, and instances when charges rise greater than they fall. It’s going to principally rely upon the information, whether or not it’s CPI or the jobs report.

And as all the time, curveballs like geopolitical occasions, or just politics on the whole, might additionally play a serious position.

2024 Residence Value Expectations Worsening Regardless of Decrease Curiosity Charges

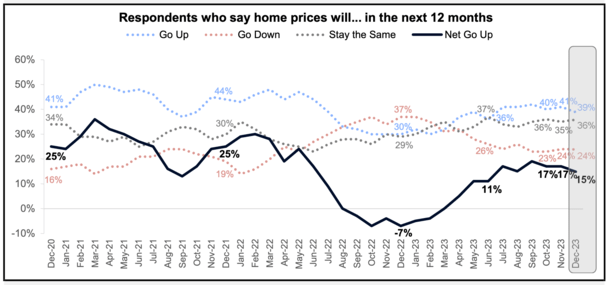

Lastly, regardless of a giant enchancment in mortgage charge sentiment, residence worth expectations took a flip for the more serious.

Whereas it’s logical to imagine that mortgage charges and residential costs have an inverse relationship, the information doesn’t help it.

Residence costs and mortgage charges can fall collectively, go up collectively (as they did in 2022 and 2023), or go in reverse instructions.

However there’s no clear correlation and simply because charges are anticipated to fall in 2024 doesn’t imply residence costs will surge once more.

In actual fact, extra of the identical customers surveyed by Fannie Mae anticipate residence costs to go down over the following 12 months.

Simply 39% of customers anticipate residence costs to go up in 2024, whereas 24% anticipate costs to go down, and 36% anticipate them to remain the identical.

This implies the online share of customers who imagine residence costs will go up fell two proportion factors to fifteen%.

So there’s nonetheless loads of uncertainty, regardless of some current constructive developments. However maybe if mortgage charges proceed to float decrease, sentiment will enhance.

In fact, if charges fall as a consequence of a recession or related financial strife, fewer will imagine it’s an excellent time to purchase a house.

Talking of, a whopping 83% imagine it’s a nasty time to purchase a house whereas solely 17% imagine it’s an excellent time to take action.

[ad_2]