[ad_1]

E*TRADE is a longstanding on-line brokerage that caters to newbie buyers and skilled merchants alike. It additionally presents managed portfolios for these on the lookout for an automatic funding resolution. However with no fractional shares or crypto buying and selling functionality, it might not be the best choice for some buyers.

Our E*TRADE evaluate covers the important thing options, pricing, professionals and cons, and a few E*Commerce alternate options.

Desk of Contents

- What Is E*TRADE?

- Key E*TRADE Options

- Buying and selling Platforms

- Fundamental Buying and selling

- Energy E*TRADE Platform

- Inventory Quotes

- Charting Instruments

- Choices Buying and selling

- Futures Buying and selling

- Paper Buying and selling

- Inventory Screener

- Analyst Experiences

- Portfolio Analyzer

- Academic Assets

- E*Commerce Core Portfolios

- E*TRADE Pricing

- E*TRADE Promo Code

- E*TRADE Professionals and Cons

- E*TRADE Options

- FAQs

- Who Ought to Use E*Commerce?

What Is E*TRADE?

E*Commerce from Morgan Stanley is an internet brokerage that options commission-free inventory or ETF trades, all kinds of funding choices, and managed funding portfolios.

It has roughly 5.2 million clients and $460 billion in belongings below administration, and it’s among the many 5 largest low cost brokerages within the U.S.

E*Commerce started providing internet-based inventory buying and selling in 1996 and was recognized for its inexpensive pricing and funding choices. Morgan Stanley finalized its acquisition of E*Commerce in 2020.

Key E*TRADE Options

E*Commerce is a well-liked platform with newbie buyers, however skilled merchants can profit from its Energy E-Commerce platform. Right here’s a more in-depth have a look at a few of E*Commerce’s key options:

Funding Choices

E*Commerce account holders can commerce the next securities on its platform:

Sadly, E*Commerce doesn’t help fractional shares, so you will have to purchase and promote full shares of shares and ETFs. Nonetheless, you’ll be able to reinvest dividends without cost courtesy of E*Commerce’s dividend reinvestment plan (DRIP).

E*Commerce doesn’t help you commerce crypto tokens, similar to Bitcoin or Ethereum. Nonetheless, you should purchase crypto-linked funds and shares buying and selling on the inventory market just like the Grayscale Bitcoin Belief (GBTC). That mentioned, crypto merchants will need to look elsewhere.

Account Varieties

With E*Commerce, you’ll be able to open the next taxable and tax-advantaged brokerage accounts.

- Brokerage

- Coverdell ESA

- Custodial Account (brokerage account for a minor)

- Core Portfolios (managed investing)

- Conventional IRA

- Roth IRA

- Rollover IRA

- Beneficiary IRA

- E*Commerce Full IRA

- IRA for Minors (kids with earned revenue)

- Premium Financial savings Account

- Max-Charge Checking

As well as, E*Commerce presents a number of funding accounts for enterprise house owners.

Notice that margin merchants can borrow as much as 50% of their eligible fairness to purchase securities. Curiosity costs apply and rely upon the steadiness.

The E*TRADE Premium Financial savings Account via Morgan Stanley Personal Financial institution (FDIC Cert # 34221) earns a excessive financial savings rate of interest and gives as much as $500,000 in FDIC Insurance coverage ($1 million for joint accounts). This manner, you’ll be able to simply park your short-term money whereas allocating the remainder of your portfolio to long-term holdings.

Buying and selling Platforms

All E*Commerce customers have complimentary entry to E*TRADE’s net and cell platforms. Most buyers will discover the options and customizable format greater than adequate for buying and selling inventory, choices, and funds.

Fundamental Buying and selling

E*Commerce’s fundamental buying and selling platform makes it simple to handle your accounts, evaluate market information, and analysis potential investments. Choices merchants can analyze chains, back-test, and use professional-grade screens.

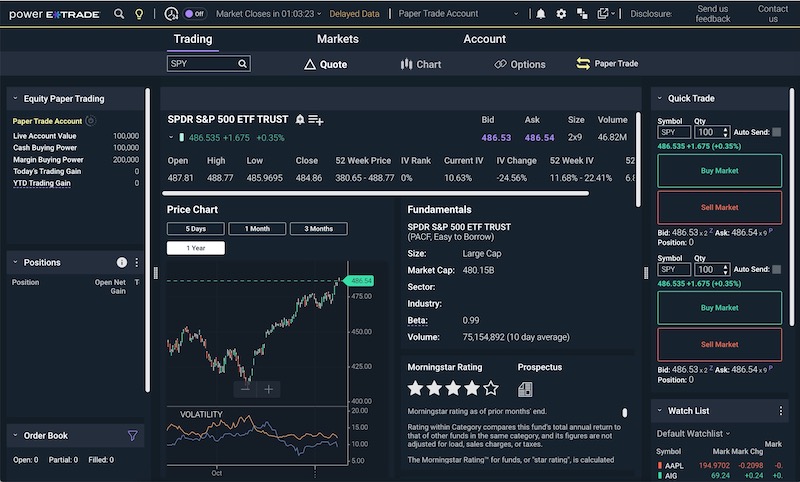

Energy E*TRADE Platform

Devoted merchants who make the most of extra complicated buying and selling methods ought to go for the superior Energy E*TRADE platform, which presents extra sturdy charting instruments and technical screeners. It’s complimentary and obtainable for net, Android, and iOS units.

A few of the platform’s options embody:

- Earnings transfer analyzer

- Exit plan (enter revenue goal and cease loss whereas creating orders)

- Over 145 chart research and drawing instruments

- Threat/reward chances

- Technical sample recognition

After logging in, you’ll be able to launch Energy E*Commerce by tapping “Launch” to open a brand new streaming window.

You may customise the format by dragging knowledge feeds. You may as well select between a white or black background. Frequent merchants might desire a downloadable platform, however the net version and cell app are fast and supply a seamless expertise from the house, workplace, or on the go.

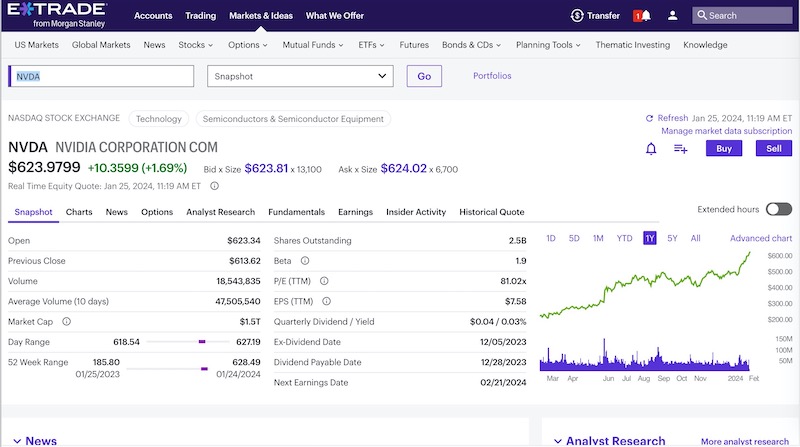

Inventory Quotes

Yow will discover loads of elementary, technical, and company-specific particulars with the inventory quote analysis tabs. There are a lot of completely different indicators and knowledge feeds, together with:

- Value historical past

- Charts

- Earnings

- Fundamentals

- Insider exercise

- Value evaluation

- Information

- Analyst rankings

- Social sentiment

Most of those options are aggressive with most full-service on-line brokerages, like Constancy or Schwab. Evidently, the instruments are way more intensive than micro-investing apps similar to M1 Finance or Robinhood, which paved the best way without cost buying and selling however lack in-depth analysis capability.

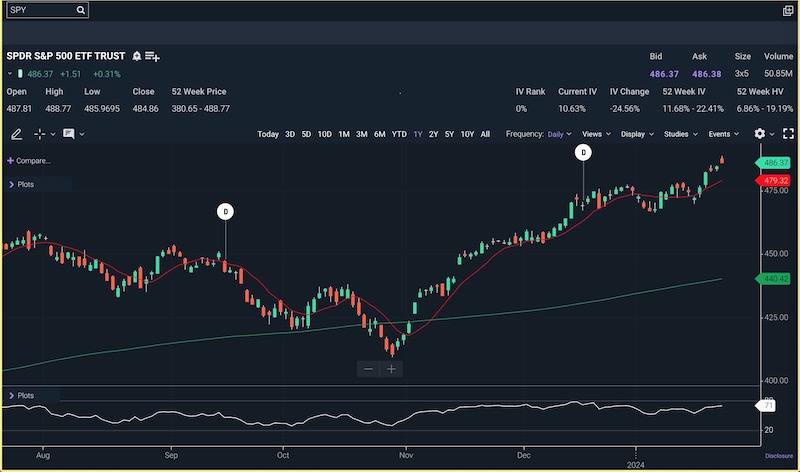

Charting Instruments

I discover studying inventory charts simple with the usual and Energy platforms. You may draw trendlines together with choosing a number of higher and decrease indicators. The software program allows you to examine a number of tickers in the identical chart and add key occasions and dividend dates rapidly. There’s additionally an possibility to supply printer-friendly charts.

The Energy E*TRADE charts rival the greatest inventory charting software program and may also help you discover technical patterns. Frequent charters will naturally gravitate to this platform for shares and funds.

Choices Buying and selling

Should you’re on the lookout for intensive choices buying and selling instruments, this is a wonderful platform. They embody:

- Choices chain

- Choices analyzer

- Revenue backtester

- Revenue finder

- Choices screener

- Chance calculator

- Technique optimizer

You may analysis choices with the usual and Energy platforms. In some regards, I discover the Energy E*Commerce choices evaluation instruments extra simple to make use of than the highly-accoladed thinkorswim platform. Nonetheless that conclusion might rely upon private preferences.

Futures Buying and selling

E*Commerce presents futures buying and selling in its brokerage and eligible IRA accounts. This lets you diversify your holdings into metals, energies, rates of interest, and currencies. You may commerce futures listed on CME, ICE, US, and CFE, practically across the clock, with entry 24 hours a day, six days per week. E*Commerce additionally presents help from licensed Futures Specialists.

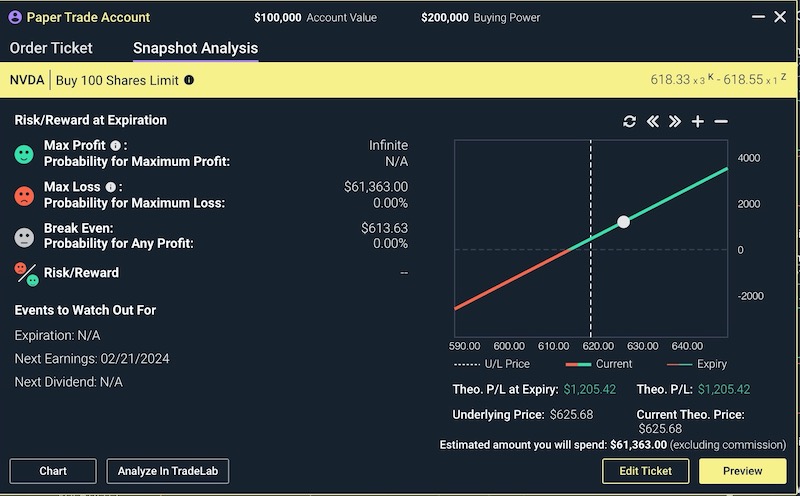

Paper Buying and selling

The Energy E*TRADE platform presents a free paper buying and selling account, which lets you observe completely different inventory and choices methods. I like that you could simulate trades and calculate chances with the snapshot evaluation and TradeLab instruments.

Inventory Screener

The E*TRADE inventory screener allows you to construct customized screens or select from predefined methods. Filters embody firm dimension, score by evaluation service, fundamentals, technical, earnings, and dividends.

This device competes with the greatest inventory screeners, permitting you to rapidly examine shares and funds that you could be resolve to analysis additional.

Analyst Experiences

Should you like studying analyst analysis stories, you’ll be able to view recurring publications from Argus, Morgan Stanley, SmartConsensus, TipRanks, and others. You may as well entry market commentary and get normal knowledge on market statistics, upcoming market calendar occasions, and sector evaluation.

These elementary and technical stories are a pleasant complement to inventory newsletters for locating funding concepts.

Portfolio Analyzer

In contrast to extra fundamental buying and selling apps, E*Commerce has a built-in portfolio analyzer. This allows you to evaluate your asset allocation, danger grade (conservative, average, and aggressive), and revenue estimator.

The portfolio instruments additionally make it simple to observe inventory efficiency for present holdings and people in your watchlist.

Academic Assets

Newbie buyers will recognize E*Commerce’s data middle, which introduces fundamental investing ideas together with superior methods via movies and articles. Reside and on-demand webcasts are performed all year long too. These sources are just like most longstanding on-line brokers.

E*Commerce Core Portfolios

Along with its inventory buying and selling platform, E*Commerce presents its pre-built Core Portfolios for buyers preferring a extra hands-off strategy. You can begin with as little as $500, and E*Commerce will maintain observe of your portfolio and do all the rebalancing for you. The next account varieties are eligible for Core Portfolios:

Brokerage Accounts:

- Particular person

- Joint

- Custodial

Retirement Accounts:

- Rollover IRA

- Conventional IRA

- Roth IRA

Core Portfolios are comprised of low-cost ETFs, together with tax-efficient choices for taxable accounts. Traders can customise their portfolios with SRI and ESG choices.

E*TRADE Pricing

As talked about, E*Commerce presents commission-free inventory, choices, mutual funds, and ETF trades. Here’s a full record of buying and selling charges:

- Shares, choices, mutual funds, and ETFs: $0 per commerce

- Choices contracts: $0.65 per contract ($0.50 per contract with at the very least 30 trades per quarter)

- OTC shares: $6.95 ($4.95 when executing at the very least 30 inventory, ETF, and choices trades per quarter)

- Bonds: $1 per bond ($10 minimal and $250 most)

- Futures: $1.50 per contract plus charges ($2.50 for cryptocurrency futures)

- Core Portfolios: 0.30% annual charge on balances above $500

- Dealer-assisted trades: $20 to $25 per commerce

E*Commerce’s pricing is just like most on-line brokerages. Moreover, there are not any funding minimums or ongoing steadiness necessities. Two notable exceptions are a $500 minimal to open a totally automated Core Portfolio and a $25,000 minimal to keep away from sample day dealer restrictions.

Chances are you’ll encounter some account upkeep charges. The commonest costs embody:

- Account closing switch charge: $75 for full transfers

- Pressured margin liquidation: $25

- Paper assertion charge: $2 per month-to-month assertion

- Wire transfers: $0 incoming and $25 outgoing

There are steady E*TRADE promotions for brand new clients to earn bonus money by making qualifying deposits inside the first 60 days.

You should definitely enter the present promo code through the signup course of to develop into eligible. You may take a look at our record of the greatest new brokerage account promotions right here.

E*TRADE Professionals and Cons

Professionals

- No charges to commerce shares, ETFs, and mutual funds

- Simple-to-use net and cell platforms

- Loads of elementary and technical analysis instruments

- Paper buying and selling and choices analyzers

- Managed investing with E*Commerce Core Portfolios

Cons

- Can’t buy fractional shares

- Can’t commerce crypto tokens, e.g., Bitcoin, Ethereum

- No downloadable desktop software program

E*TRADE Options

These highly effective E*TRADE alternate options might present completely different funding choices, analysis instruments, and platform options that may be a greater match. For instance, most supply fractional investing.

Constancy Investments

Constancy is the biggest on-line dealer by belongings below administration, and it’s an ideal possibility for buyers with any expertise stage or technique. The online platform gives analyst stories, glorious charting instruments, and superior buying and selling software program.

Members can get pleasure from index mutual funds with no minimal funding or administration charges.

Moreover, you should purchase fractional shares of U.S. shares and ETFs with a minimal $1 funding via the Constancy cell app. There are not any buying and selling charges for many investments.

👉 Listed below are the most recent Constancy Investments promotions

Schwab

Schwab is one other massive low cost brokerage providing commission-free buying and selling and the power to purchase S&P 500 shares for as little as $5. Its buying and selling platforms and analysis instruments are among the many greatest within the enterprise, particularly after its latest acquisition of TD Ameritrade.

This consists of thinkorswim, Ameritrade’s absolutely customizable buying and selling platform that’s obtainable through desktop, net, or cell app.

👉 Try the most recent Charles Schwab promotions.

Interactive Brokers

Interactive Brokers is right for technical merchants who want sturdy charting software program. Pricing begins as little as $0 on inventory trades with the IBKR Lite plan, though frequent merchants might pay small charges per share. There are desktop, cell, and net platforms.

TradeStation

Newbie and superior merchants can profit from the TradeStation charting and buying and selling instruments. There are desktop, cell, and net apps.

Along with shares and ETFs, you’ll be able to commerce futures and crypto that E*TRADE might not supply.

Learn our TradeStation evaluate for extra.

👉 Get began with TradeStation.

WeBull

WeBull presents shares, choices, ETFs, futures, and margin buying and selling. Fractional shares begin at $5 and are tradeable via the net, cell app, and desktop model. You may as well get pleasure from free paper buying and selling and buy superior market knowledge streams.

The WeBull free inventory promotions are additionally value having a look at as you’ll be able to acquire a number of free shares with qualifying deposits.

Learn our WeBull evaluate for extra.

👉 Get began with Webull.

FAQs

Sure, E*TRADE is among the higher decisions for brand new buyers as you gained’t pay buying and selling charges for shares, ETFs, and index funds. There are many analysis instruments, funding choices, and an intensive but easy-to-navigate person expertise that extra fundamental investing apps don’t supply.

Sure, E*TRADE is among the oldest on-line brokerages with a big person neighborhood of latest and skilled buyers. Moreover, accounts are SIPC-insured and FDIC-insured if the brokerage closes, though regular market losses are non-reimbursable.

Cellphone-based customer support is offered 24/7 by telephone. Reside chat can also be accessible after logging into your account. Electronic mail help and a data library can be found for non-urgent issues.

Prebuilt Core Portfolios can be found with a minimal $500 steadiness. Obtain a customized asset allocation utilizing your danger tolerance and funding targets via taxable and retirement accounts. Customers additionally get pleasure from computerized rebalancing and tax-loss harvesting.

Who Ought to Use E*Commerce?

E*Commerce is a well-rounded buying and selling app, making our record of the greatest on-line brokers for brand new buyers whereas additionally being a stable selection for skilled merchants. It presents instruments and sources to serve short-term or long-term methods and free inventory trades. And its buying and selling platform routinely wins awards for its expertise and choices.

E*Commerce’s core portfolios are one other good function if you’d like entry to managed funding portfolios.

E*Commerce’s largest downside could also be that it doesn’t supply fractional investing, which makes it simple to take a position with small quantities of cash. Additional, you can not commerce crypto, which can flip off merchants who need to maintain all of their investments below one roof.

[ad_2]