[ad_1]

By Ommara Raza Ali

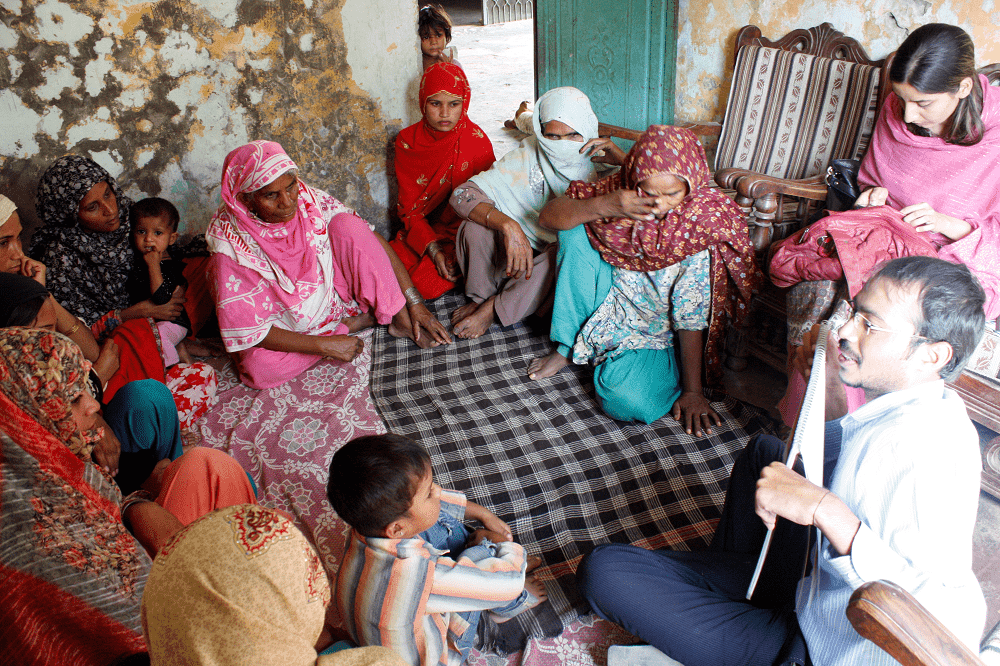

Since its founding in 1996, Kashf Basis has grow to be Pakistan’s premier women-focused microfinance establishment (MFI). We’ve a community of 183 branches and 27 service facilities throughout 41 districts with 2,083 workers reaching greater than 250,000 purchasers. Our gross excellent portfolio is USD 4.513 million rupees and we additionally provide insurance coverage: we at present have 592,473 medical health insurance coverage holders and 499,982 life insurance coverage coverage holders. Kashf was additionally the primary Pakistani MFI to be “Consumer Safety Licensed” by the Good Marketing campaign. We proceed to be pioneers on this discipline, providing quite a lot of monetary merchandise that reply the wants of our purchasers whereas guaranteeing longevity and sustainability of the enterprise. How will we do it? The reply is deceptively easy: it’s all about evidence-based choice making. Making it occur, alternatively, is demandingly complicated.

Understanding purchasers’ wants has been on the coronary heart of Kashf’s operations because the very starting. The primary two years had been devoted to understanding the market and the wants of girls in peri-urban and concrete settings. This analysis went far to dispel myths that ladies don’t work, don’t perceive enterprise administration, don’t know the best way to make the most of loans and aren’t in a position to work as mortgage officers. The insights gleaned from these early years established a number of core ideas of our operations:

- standardized merchandise, programs and insurance policies;

- simplified procedures and reporting necessities;

- clear lower monetary efficiency indicators and

- a definite give attention to shopper satisfaction.

This final level has been particularly essential to our success: by establishing a shopper suggestions system that enables us to include the “voice of the shopper” in all elements of the group’s enterprise operations, services, we’re in a position to provide clients what they need, leading to extra gross sales, elevated shopper loyalty and better income.

Establishing the R&D Division

Regardless of finances constraints, Kashf’s management was dedicated to figuring out our buyer higher and providing customer-centric merchandise. Thus, the group established a analysis division in 2000 with simply two analysts and the assistance of a number of interns and volunteers from native universities. The crew was tasked not simply with conducting the analysis but additionally convincing all their colleagues that analysis was an important ingredient to the group’s success. However the proof is within the pudding, because the expression goes. After simply a few years, what we realized from the analysis had already translated to concrete suggestions that actually responded to what purchasers felt and wanted. For instance, we eliminated screening for excellent repeat purchasers as a result of in-depth interviews with these purchasers revealed that they wished particular advantages that privileged them as loyal purchasers to the group. Surveys with purchasers additionally assist us higher perceive enterprise circumstances on the bottom and alter our merchandise accordingly: present charges of inflation had drastically elevated the price of uncooked supplies for purchasers and so they resorted to a number of borrowing as a way to cope. We elevated the higher restrict to microenterprise mortgage to reply to this actuality.

Innovation from perception: our work with Girls’s World Banking

Due to our proactive strategy in “listening to the voice of purchasers,” Kashf grew to become the primary MFI in Pakistan to supply a dedication financial savings product catering to the wants of low-income girls. We partnered with Girls’s World Banking in 2007 to assist us perceive and develop the type of financial savings product low-income Pakistani girls need and wish. Via the analysis, we uncovered that purchasers wished entry to formal financial savings sure, however particularly, one which ensured confidentiality, flexibility to withdraw, safety and comfort. Inside a 12 months of pilot testing, 6,175 accounts had been opened.

The expertise and suggestions from this product additionally enabled Kashf to comprehend that as a way to guarantee giant scale, sustainable outreach, we would have liked to make use of the branchless banking mannequin. Primarily based on these findings, Kashf collaborated with UBL Omni (one of many main branchless banking suppliers in Pakistan) this 12 months to roll out a specifically designed dedication financial savings product for our purchasers constructed on this handy platform.

The method: gathering “proof”

First, the establishment should perceive the product it needs to supply as a complete and reply the questions: what’s the buyer shopping for? Why will the client pay for the product? And lastly, how will the client obtain or entry the product? Subsequent, it’s essential to collect as a lot info as potential concerning the present market and its goal phase by means of secondary market analysis, and if in a position, major analysis to substantiate the preliminary market scan. As soon as a prototype has been designed, it’s time to solicit shopper suggestions by means of focus teams or one-on-one interviews. Some inquiries to ask embrace:

- Do the product phrases (worth, size, compensation schedule, and so forth) meet shopper wants?

- How does the product evaluate with the prevailing merchandise being provided available in the market to the purchasers?

- What are the advantages and shortcomings of the present product design?

- How can the product design be improved?

Consumer suggestions will also be acquired exterior a selected analysis undertaking. For instance, Kashf has a particular toll-free quantity purchasers can name for complaints and/or info whereas permitting us to evaluate buyer satisfaction. Weekly stories enable Kashf to trace the traits of those calls and guarantee accountability of accountable individuals or departments which are the topic of complaints. Month-to-month shopper visits are one other supply of details about buyer satisfaction, wants and points. Present neighborhood organizations are one other obtainable supply of buyer suggestions: the Girls Entrepreneurs Council (WEC) has shopper representatives from every Kashf space and meets on a quarterly foundation to articulate suggestions and calls for of Kashf purchasers.

Closing the loop

Gathering proof is simply step one. A strong client-centric strategy will need to have commonplace working procedures for receiving and responding to the findings from the analysis and recommending an motion plan to handle them.

Right here is an instance of closing the loop on product improvement: Primarily based on an in-depth evaluation of shopper wants, Kashf launched a pilot the place feminine post-dated checks had been accepted and they didn’t should rely on their male counterparts to offer checks. We took the product prototype to purchasers and tweaked the product based mostly on their suggestions. On this case, we lowered the upfront service cost to extend its enchantment and accessibility to purchasers.

Many shopper ideas have translated into higher merchandise. For instance, Kashf has launched the start-up mortgage, catering to the precise funding wants for women-led start-up companies and makes use of a particular pre-feasibility examine report to find out mortgage quantities and gauge enterprise dangers. We’ve additionally launched an Training Finance product which offers entry to credit score and capacity-building help to low-cost non-public faculties to enhance high quality of training within the communities. Different ideas are within the analysis or pilot part: Kashf is at present researching the viability of providing sector-specific loans whose phrases will replicate cash-flows of various enterprise sectors.

Kashf Basis has embedded a sturdy client-centric strategy in all elements of its operations to make sure that there’s a constant give attention to the wants of our purchasers. Our strategy to client-centricity is distinctive within the sector as a result of it’s a part of our institutional tradition, product improvement course of, and reporting priorities. This client-centric strategy has knowledgeable the selections taken by Kashf to benefit from market alternatives, deal with constraints and enhance services vis-à-vis the competitors.

Immediately, true to its which means and due to the help and belief prolonged by companions similar to Girls’s World Banking, Kashf is a corporation that has grow to be the technique of a ‘miracle’ or a ‘revelation’ for its purchasers breaking and shattering all of the myths and preconceived notions of girls. Purchasers have overcome their destitution by discovering that poverty is assailable by means of willpower and enterprise and that dependence readily available outs and charity is just not the one possibility for sustaining their livelihood.

[ad_2]