[ad_1]

Up to date on January 29, 2024 with screenshots from TurboTax Deluxe downloaded software program for 2023 tax submitting. Should you use H&R Block tax software program, please learn:

Many self-employed enterprise homeowners purchase medical insurance by the ACA healthcare market (healthcare.gov or a state-specific change). In case your estimated revenue qualifies for a subsidy, {the marketplace} pays a part of the premium on to the insurance coverage firm.

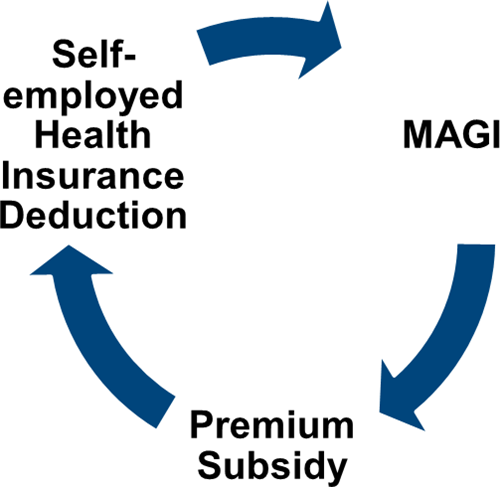

Round Relationship

Nonetheless, the advance subsidy is just an estimate primarily based on the revenue estimate you offered while you signed up. As self-employed folks know full properly, the precise revenue from self-employment can differ enormously from yr to yr.

After the yr is over, you need to sq. up and calculate the precise subsidy you qualify for. If your small business didn’t do in addition to you anticipated, it’s possible you’ll qualify for the next subsidy. Should you had an ideal yr, you might have to pay again a few of it.

Should you’re self-employed, you additionally qualify for a tax deduction for the medical insurance premium. Should you qualify for each a subsidy and a deduction, they type a round relationship.

The IRS prescribed a way to calculate the break up between the subsidy and the deduction. It’s troublesome to calculate by hand however tax software program will handle it for most individuals.

Use TurboTax Obtain

The screenshots beneath are from TurboTax Deluxe downloaded software program. The downloaded software program is means higher than on-line software program. Should you haven’t paid on your TurboTax On-line submitting but, you should buy TurboTax obtain from Amazon, Costco, Walmart, and lots of different locations and swap from TurboTax On-line to TurboTax obtain (see directions for the right way to make the swap from TurboTax).

We are going to use this state of affairs for example:

Self-Employment Revenue

You must enter all of your self-employment revenue and bills into TurboTax earlier than you begin doing medical insurance associated to your self-employment.

TurboTax gives you to improve to the Residence & Enterprise version however the Deluxe version of TurboTax obtain software program works simply fantastic for a easy service enterprise.

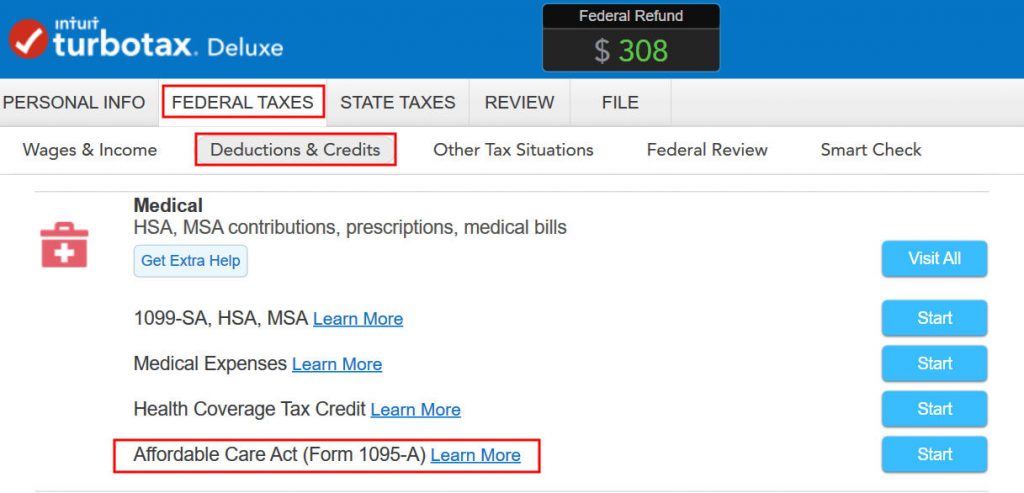

Enter 1095-A

Go to Federal Taxes -> Deductions & Credit. Scroll down and discover Inexpensive Care Act (Kind 1095-A) below Medical.

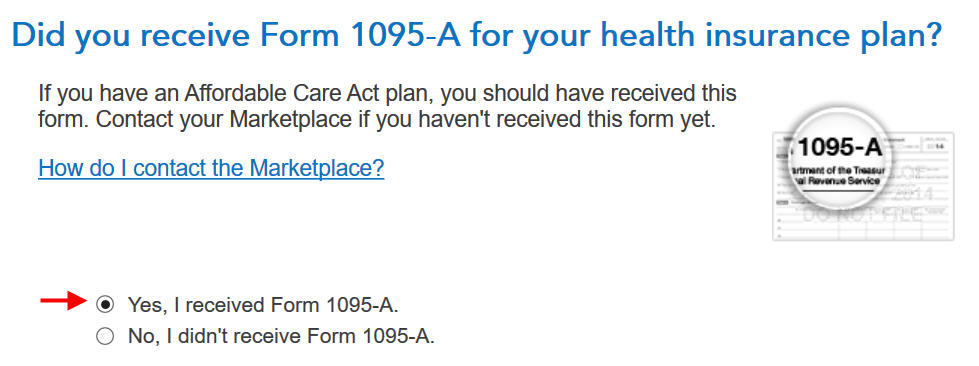

You must have a Kind 1095-A from the ACA healthcare market. Should you didn’t get it within the mail, log in to your on-line account and search for a doc obtain.

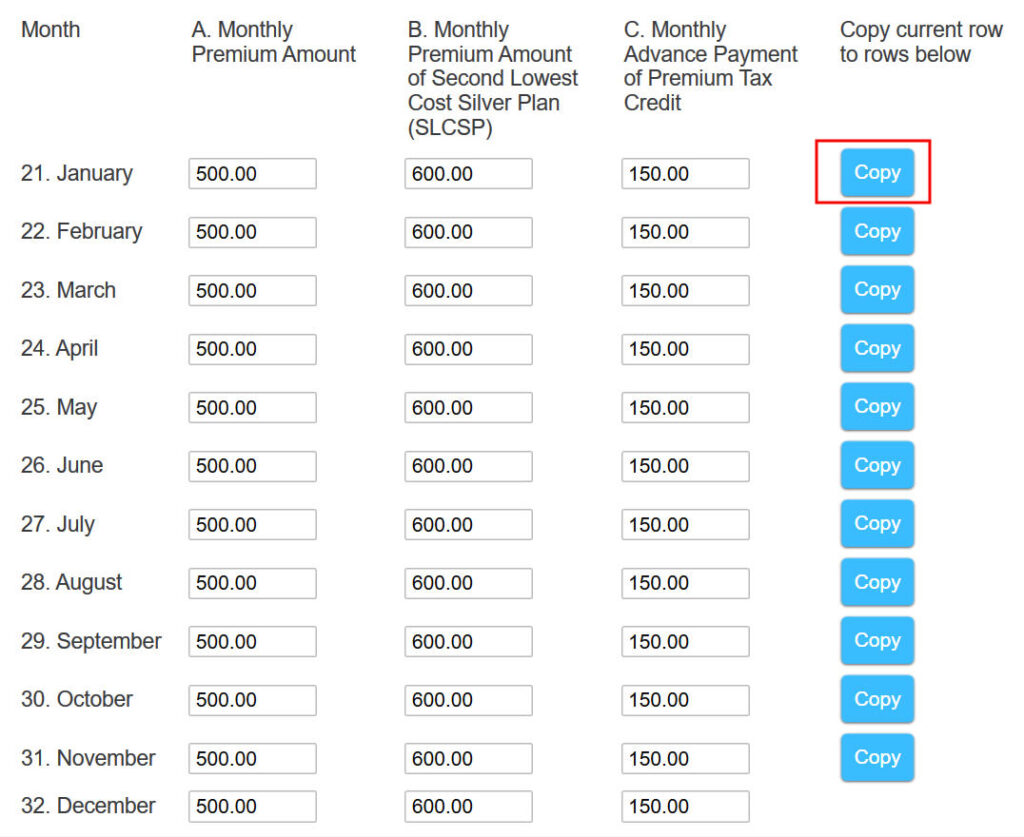

Enter the premium numbers out of your Kind 1095-A. If the numbers are the identical for all months, enter the row for January and click on on the Copy button subsequent to it. It’ll put the identical numbers for all different months.

The primary column is the complete unsubsidized month-to-month premium on your plan. The center column is the complete unsubsidized premium of the second lowest-cost Silver plan, which is used to calculate your subsidy. The final column is the advance subsidy the ACA market already paid in your behalf to the insurance coverage firm.

Hyperlink to Self-Employment

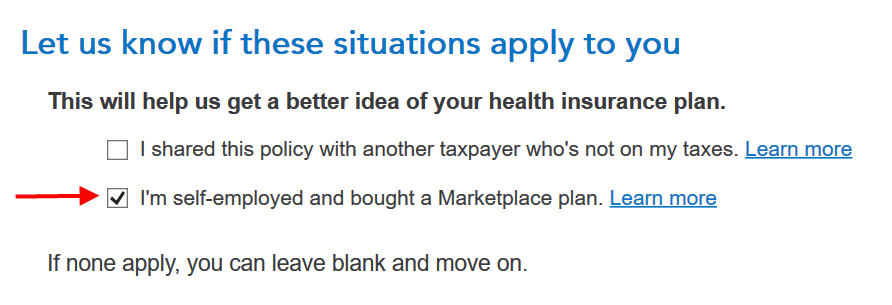

You get a tax deduction solely when the insurance coverage is linked to self-employment. TurboTax doesn’t realize it solely from the 1095-A type. You must inform TurboTax it’s linked to your self-employment.

That is vital however simple to overlook. Though TurboTax is aware of you’re self-employed and you’ve got the 1095-A type from the ACA healthcare market, you continue to should verify this field.

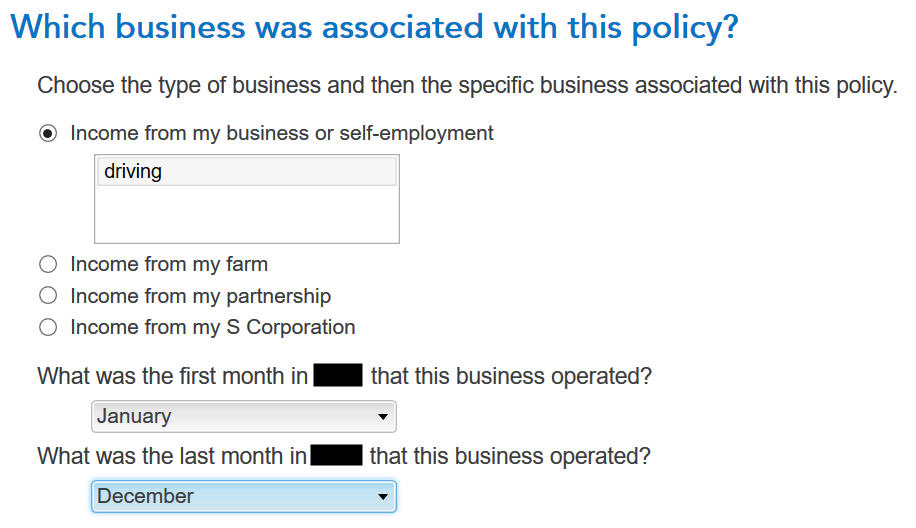

Affiliate the medical insurance together with your self-employment. Select the partnership or the S-Corp possibility if your small business revenue is from a partnership or an S-Corp. Say throughout which months you had enterprise revenue.

When you have a couple of Kind 1095-A, repeat and add all of them. We solely have one in our instance.

Calculation End result

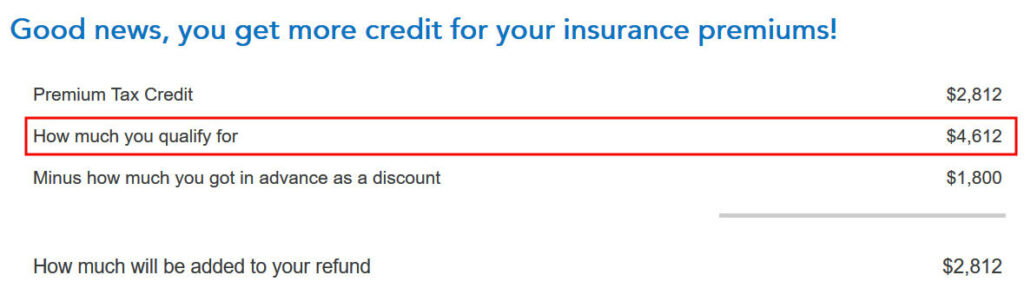

TurboTax crunches the numbers in a break up second. It says we’re eligible for extra tax credit score than the ACA healthcare market already paid on to the insurance coverage firm. We’ll get the distinction in our tax refund.

Should you qualify for much less subsidy than the advance already paid, you’ll pay again the distinction, topic to a cap (see Cap On Paying Again ACA Well being Insurance coverage Subsidy Premium Tax Credit score).

Self-Employed Well being Insurance coverage Deduction

We’re additionally eligible for a tax deduction for the portion not coated by the premium tax credit score.

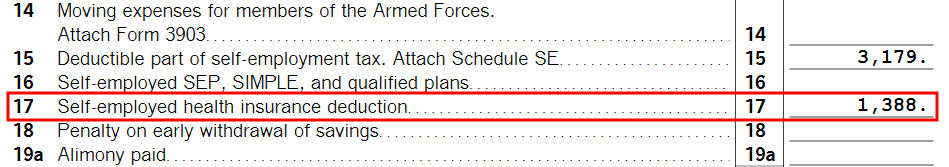

To see your self-employed medical insurance deduction, click on on Kinds on the highest proper. Discover Schedule 1 within the left navigation pane. Have a look at Line 17. It exhibits we’re getting a $1,388 tax deduction for self-employed medical insurance.

S-Corp Shareholder

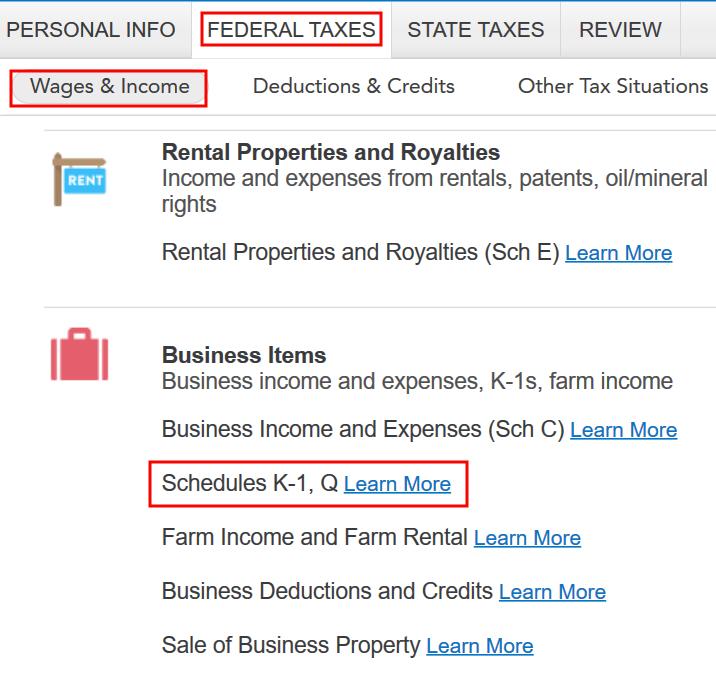

Go to the Schedule Ok-1 from the S-Corp. Create a dummy Ok-1 even should you didn’t take any distribution from the S-Corp.

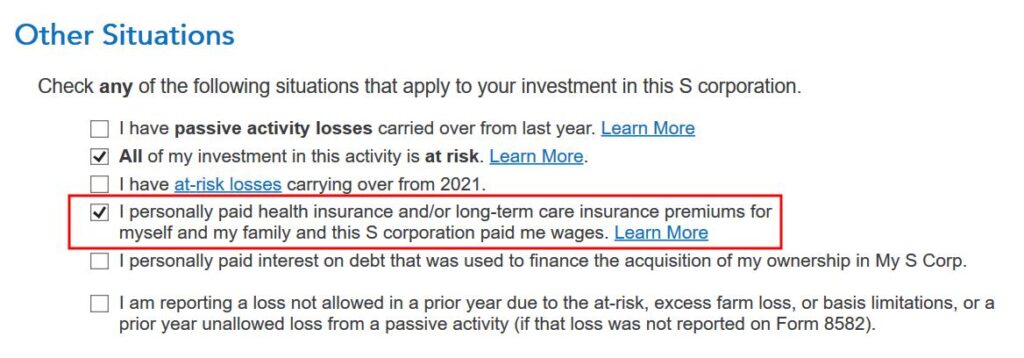

Be sure you verify the field “I personally paid medical insurance …” even when the S-Corp paid it straight.

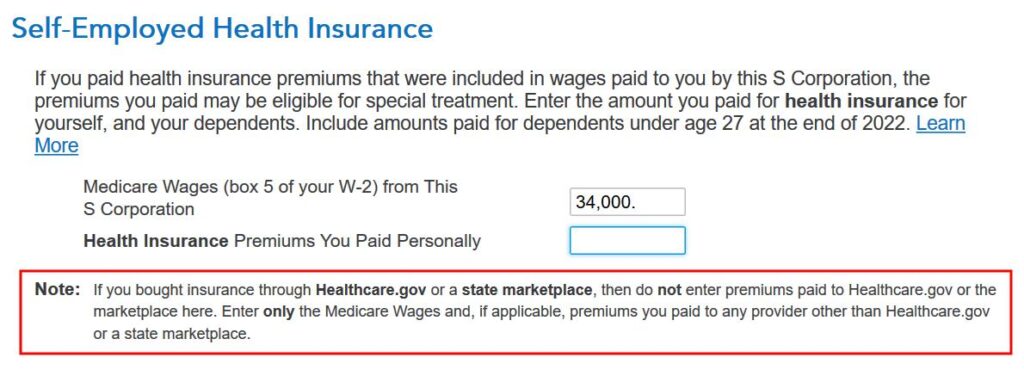

Enter the Medicare Wages from Field 5 of your W-2 from the S-Corp. Learn the notice rigorously. Go away the second field clean if the S-Corp solely paid for an ACA market medical insurance coverage. Enter a quantity for any coverage paid outdoors the ACA market, similar to any dental or imaginative and prescient premiums.

Premium Tax Credit score

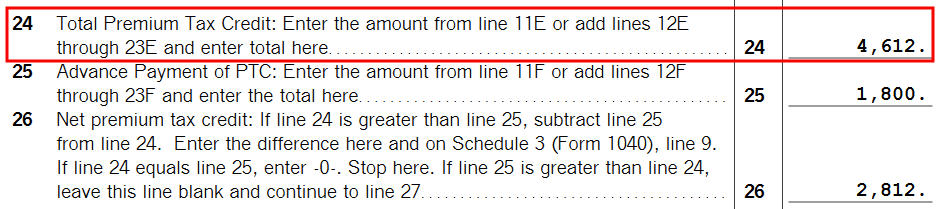

To see the subsidy you qualify for primarily based in your precise revenue, discover Kind 8962 within the varieties record navigation pane. Scroll down and have a look at Line 24. Whenever you’re executed in search of the shape, click on on Step-by-Step on the highest proper to get again to the interview.

$1,388 in self-employed medical insurance tax deduction plus $4,612 in premium tax credit score equals $6,000 ($500/month), which is the complete unsubsidized premium for our well being plan (plus any dental and imaginative and prescient insurance coverage premium, which we didn’t have in our instance). The numbers add up!

TurboTax found out the break up between the tax deduction and the tax credit score. It additionally matched the outcome from H&R Block software program for a similar instance.

Edge Instances

TurboTax works for many instances nevertheless it doesn’t work for everybody. You recognize you’re working into one of many edge instances for which the software program doesn’t work when the numbers from the software program fail this equation (aside from a small distinction as a consequence of rounding):

When this occurs, you want a greater calculator. See When TurboTax and H&R Block Give Self-Employed Incorrect ACA Subsidy.

Say No To Administration Charges

In case you are paying an advisor a share of your property, you’re paying 5-10x an excessive amount of. Discover ways to discover an unbiased advisor, pay for recommendation, and solely the recommendation.

[ad_2]