[ad_1]

The S&P 500 final hit a brand new all-time excessive on January 3, 2022.

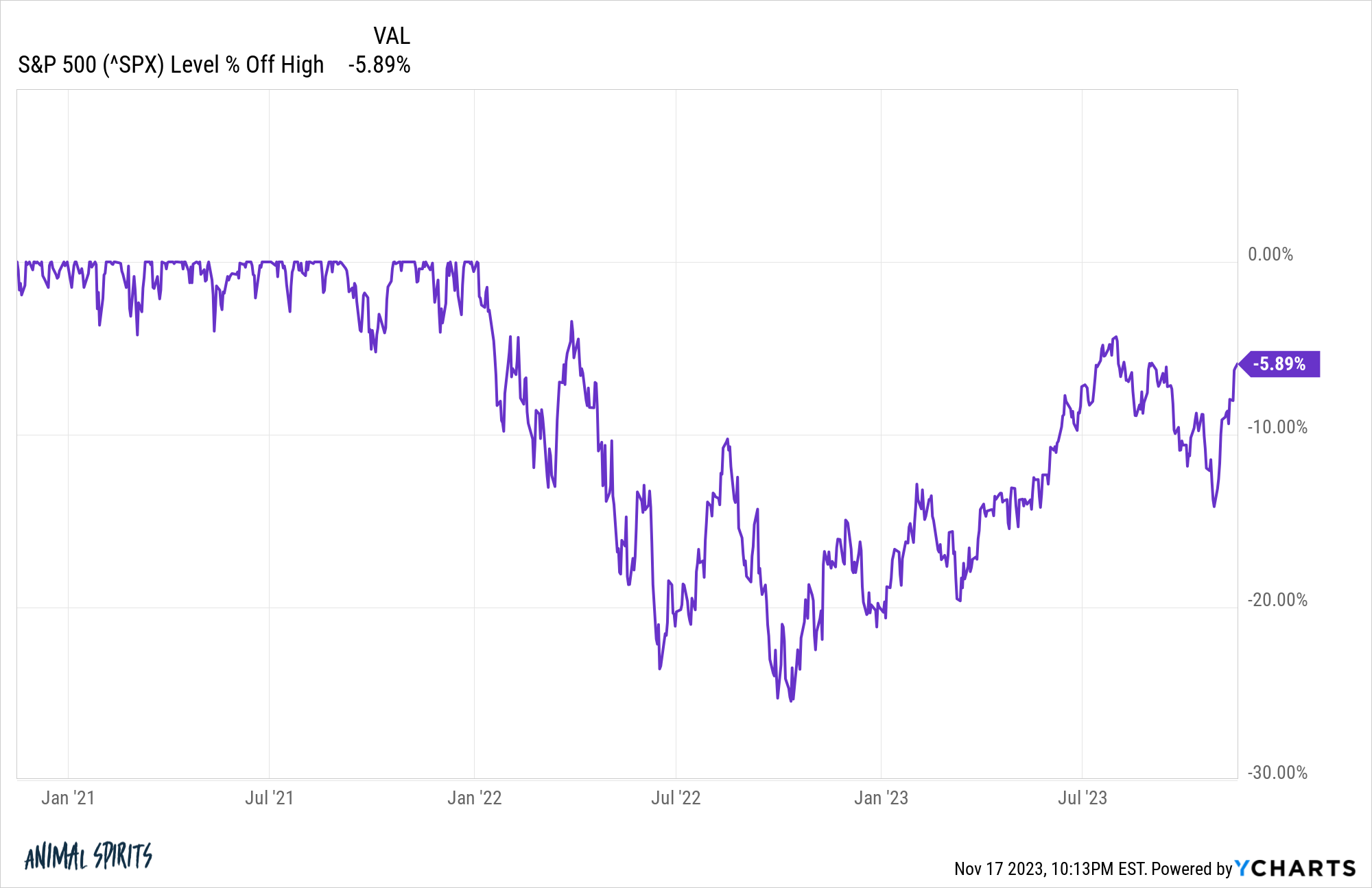

The market has been slowly however absolutely working its approach again to new highs however we’ve been underwater for almost two years now:

The market is inside spitting distance of latest highs however shares have gone nowhere for nearly two years.

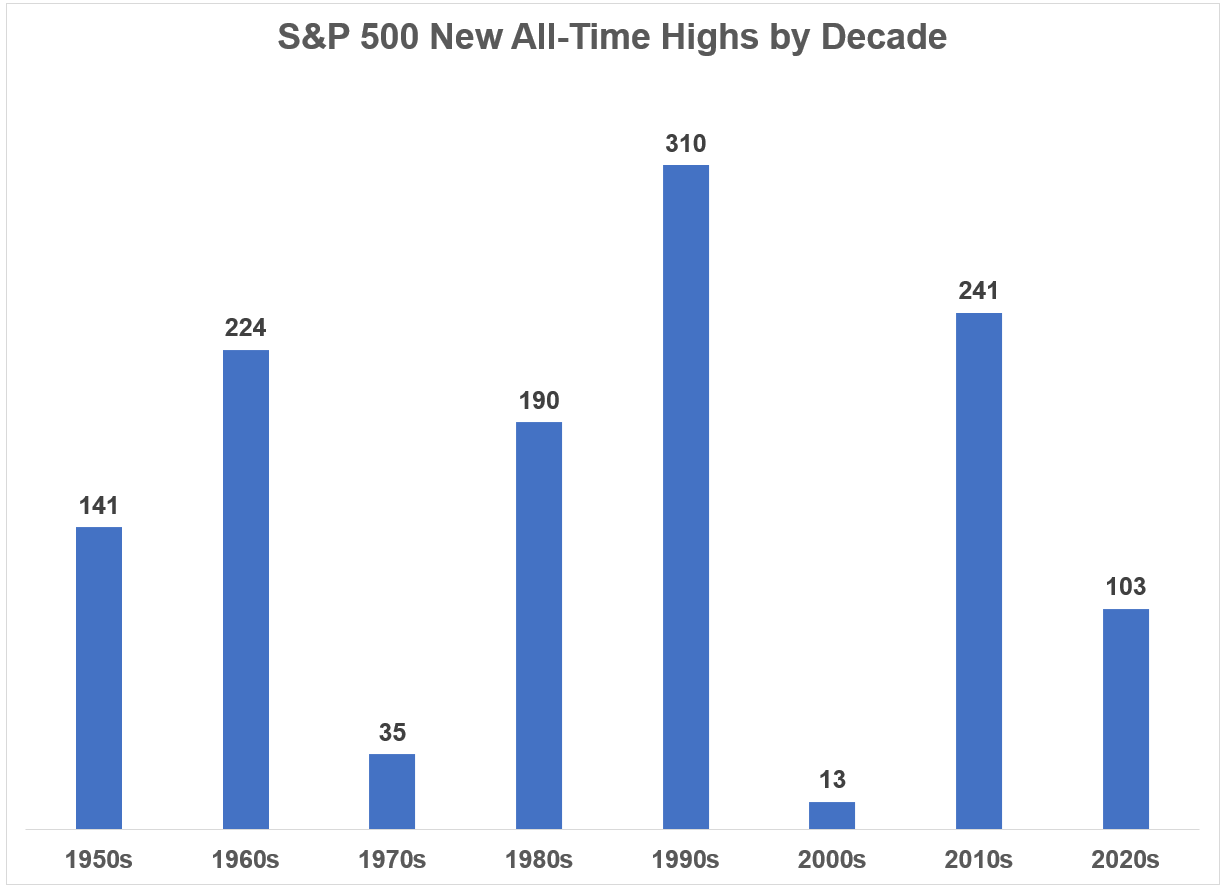

We’re rather less than 4 years into the 2020s and half of these years have seen no new highs however there have already been loads of them this decade.

Listed below are the variety of new all-time highs by decade1 going again to the Nineteen Fifties:

The inventory market is erratic so some a long time we get a number of new highs whereas others we get only a few.

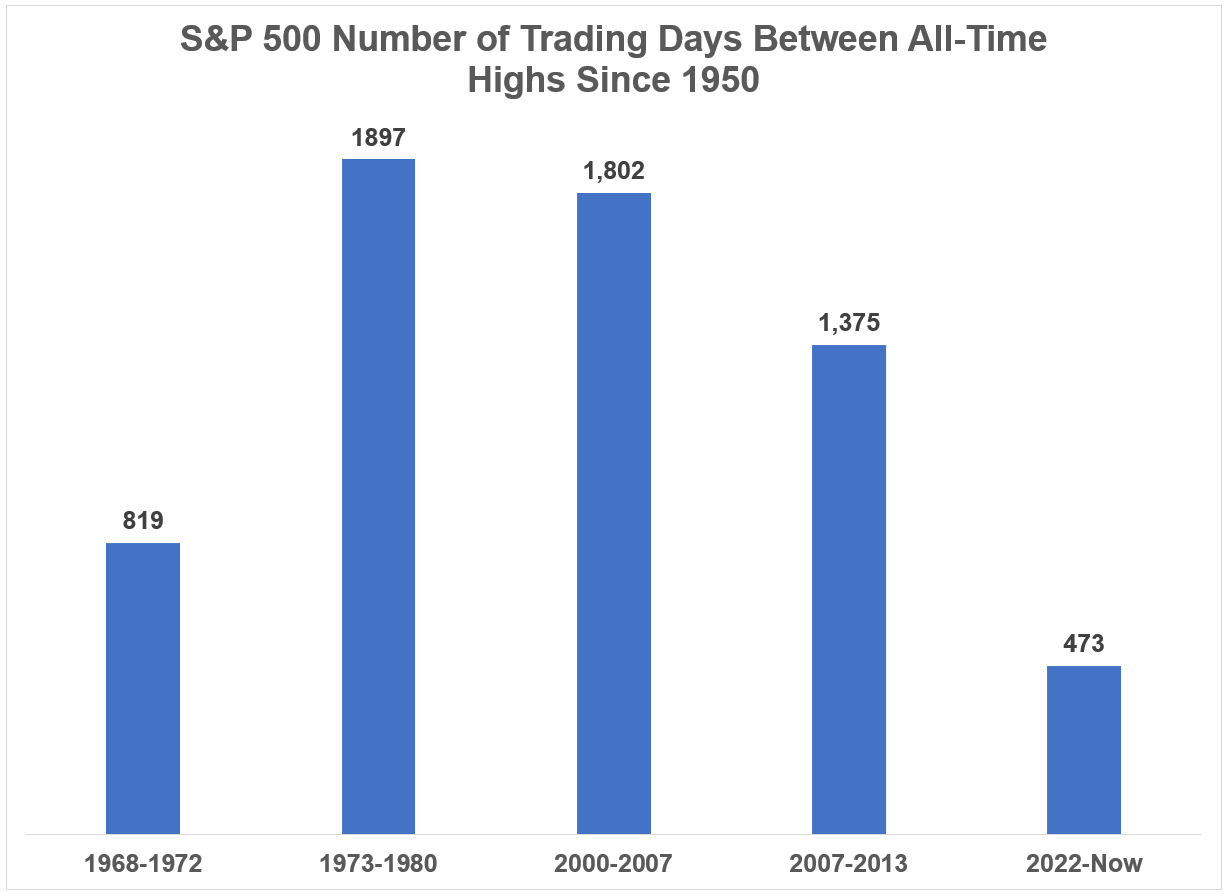

By my calculations, we’ve now gone 473 buying and selling days with out new highs for the S&P 500.

That’s really the fifth longer streak since 1950:

The craziest factor about these different streaks is how shut they have been in proximity.

In every occasion, you had a downturn, adopted by a short reprieve bull market after which a good larger downturn in brief order.

Each durations noticed the inventory market roughly tread water for 13 years.

The bear market at the top of the go-go years from 1968-1970 is without doubt one of the extra forgotten crashes in historical past, adopted just a few quick years later by the nasty 1973-1974 bear market.2

And everyone knows about the misplaced decade that kicked off this century which noticed the inventory market get reduce in half twice.

The S&P 500 was up 6.8% per 12 months from 1968-1980 however that return was utterly eaten up by the 7% inflation fee in that point.

The market was up a complete of 23% from 2000-2013, an annual return of 1.6% per 12 months.

Even though you had two prolonged durations the place buyers noticed few new all-time highs, if we have a look at the returns from 1968-2013, the inventory market was nonetheless up nearly 10% per 12 months.3

This is without doubt one of the causes the inventory market could be so maddening. Returns are lumpy. They are often horrifying for prolonged durations of time. You might be underwater for years at a time.

It’s doable we might see new all-time highs on the S&P 500 by the top of this 12 months or early subsequent 12 months. After which we might expertise one other bear market that sees shares go nowhere for even longer. Or we could possibly be witnessing the start of a brand new bull market.

The reality is nobody is aware of what comes subsequent for inventory costs.

This is without doubt one of the causes shares provide a danger premium over different asset lessons.

There may be all the time the opportunity of a misplaced decade or a raging bull market.

The necessary factor for buyers is your monetary plan ought to construct within the expectation that each of those eventualities are possible over your investing lifecycle.

You simply don’t know when.

Additional Studying:

All-Time Highs, Threat & Penalties

1I began right here within the Nineteen Fifties as a result of there weren’t any new all-time highs within the Nineteen Thirties or Forties. It took till the early-Nineteen Fifties to roundtrip from the 1929 highs following the Nice Despair.

2The 1973-1974 bear market wants to rent a publicist. I don’t know the way this near-50% crash (worse after inflation) didn’t get a nickname. The Nice Inflation is OK however I’m open to strategies.

3Actual returns have been shut to six% per 12 months after inflation.

[ad_2]