[ad_1]

Diversification is among the first constructing block portfolio administration ideas I ever realized in my first job within the funding trade.

Our agency would create a Harry Markowitz environment friendly frontier chart for each consumer portfolio. The thought was to point out that threat comes not from particular person holdings however how these holdings work collectively to cut back total portfolio threat.

The fascinating factor to me about producing these charts is how they might change over time. Correlations, co-variances and asset class relationships will not be static. They’re dynamic and always altering relying on the surroundings.

Diversification advantages change over time as nicely.

Some buyers assume negatively correlated belongings needs to be the aim. In any case, wouldn’t it’s fantastic to seek out an asset that at all times goes up when the inventory market goes down?

This is smart when shares go down however shares go up more often than not. Discovering an asset that’s negatively correlated with the inventory market on a regular basis is just not a really perfect funding technique as a result of it’s a cash loser.

What you need is an asset that has a low constructive or destructive correlation to shares with the understanding that correlation will change over time. No less than that’s a extra life like aim.

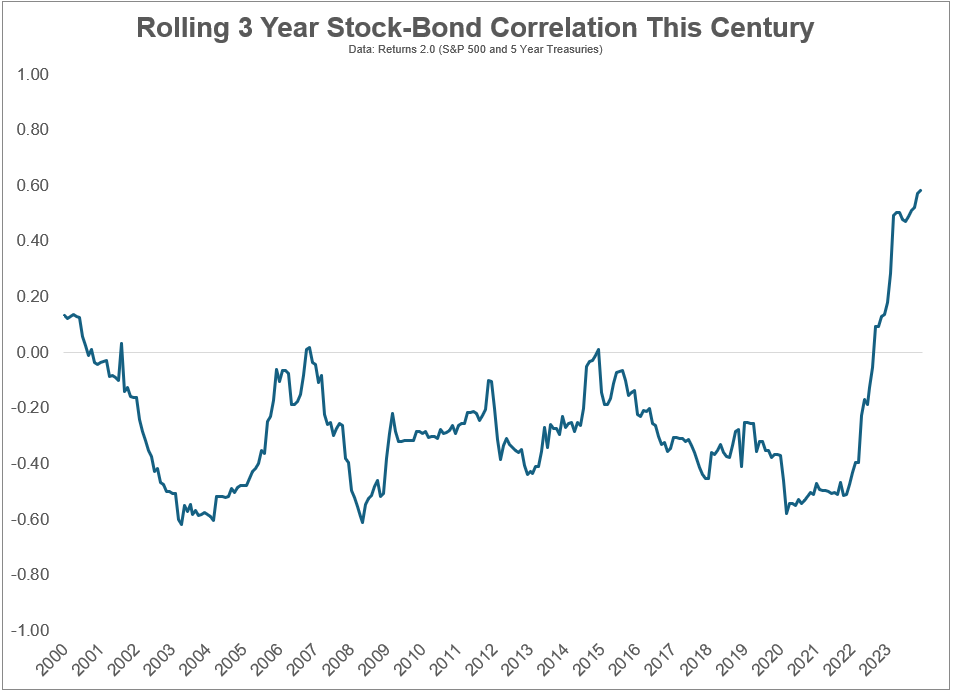

Check out the rolling 36-month correlation between U.S. shares and bonds this century:

It’s been in destructive territory for almost all of this century till it broke into constructive territory in recent times. This tells us inventory and bond returns are actually transferring extra in lock-step with each other. That’s not a nasty factor when shares are going up however shares bought slammed in 2022 whereas bonds had one in every of their worst years on file.

Many buyers fear about shares and bonds having greater correlation as a result of it reduces the diversification advantages.

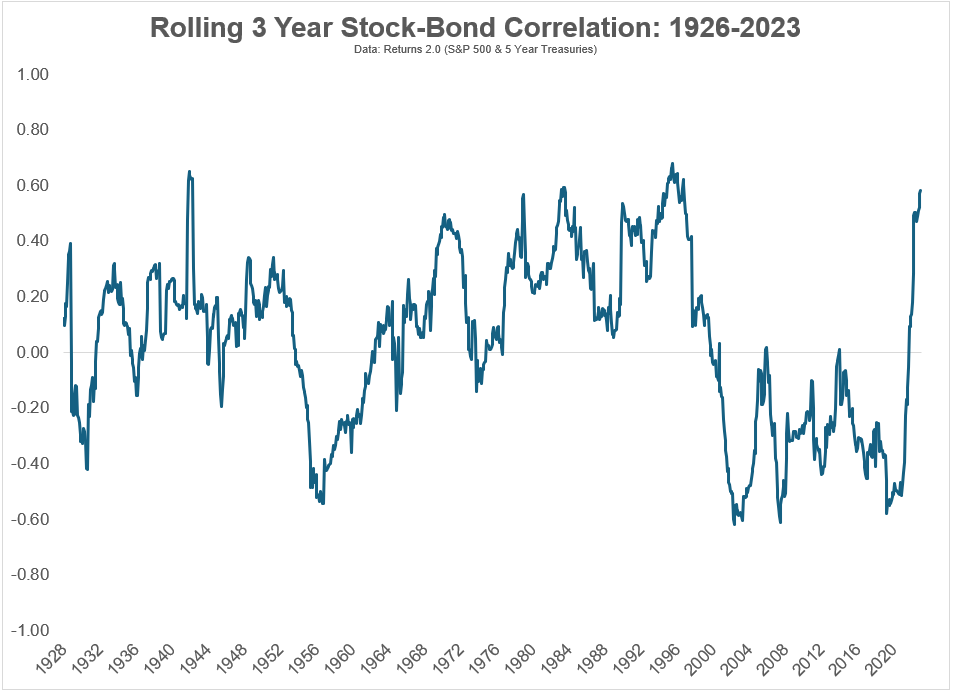

I perceive this fear nevertheless it’s vital to notice these correlations flip from constructive to destructive greater than you suppose. Let’s zoom out a bit of additional:

Shares and bonds have been positively correlated 61% of the time and negatively correlated 39% of the time. So it’s completely regular for these two belongings to maneuver in the identical course concurrently.1

It’s additionally vital to differentiate between short-term and long-term correlations.

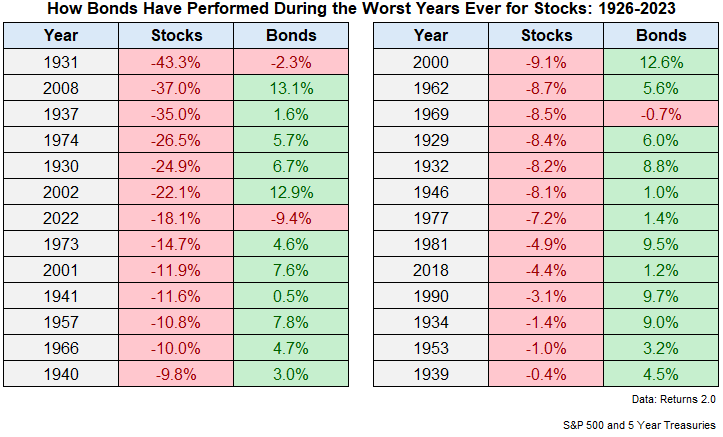

Sure, shares and bonds each fell in 2022 however that’s a historic outlier. Check out the returns for bonds throughout each down yr for the U.S. inventory market since 1926:

The common loss for a down yr within the inventory market is -13.4%. In those self same years the typical return for five yr Treasuries was +4.9%. That’s a reasonably good unfold.

5 yr treasuries have been down in the identical yr as shares simply thrice out of 26 situations on this timeframe (together with 2022). Nothing works on a regular basis relating to investing however that’s an excellent batting common.

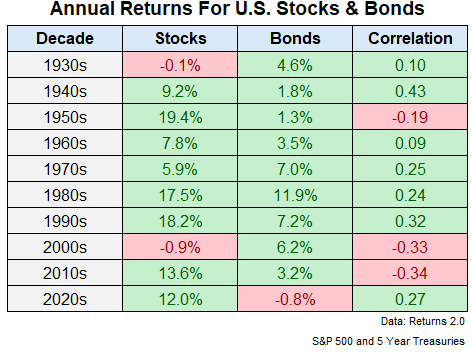

Correlations look totally different by decade as nicely:

There are occasions when a constructive correlation helped (just like the Eighties and Nineteen Nineties). There are occasions when a destructive correlation helped (just like the 2000s and 2010s).

And despite the fact that shares and bonds have been extra positively correlated of late, and bonds are having a tough go at it within the 2020s, shares are nonetheless up fairly a bit to start out this decade.

There is no such thing as a Holy Grail of asset allocation that permits you to sustain when shares are rising and completely hedges your portfolio when shares are falling.

The most effective you’ll be able to hope for is a portfolio that’s sturdy sufficient to your psyche to deal with a wide range of financial and market environments.

My greatest takeaway from learning Markowitz and portfolio concept is you need to diversify into asset courses and methods that may go into and out of favor with the broader inventory market.

I feel bonds nonetheless match that invoice regardless of the 2020s bear market.

Additional Studying:

Historic Returns For Shares, Bonds & Money

1Though it’s value mentioning the present correlation of +0.59 is within the high 3% of constructive correlation readings since 1926.

This content material, which accommodates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here will probably be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or provide to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

Wealthcast Media, an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.

[ad_2]