[ad_1]

MaxMyInterest

Strengths

- Earn aggressive rates of interest from a number of high-yield financial savings accounts

- Entry increased FDIC insurance coverage limits

- Robotically optimizes high-yield financial savings balances

- Customizable switch guidelines and steadiness limits

- No minimal steadiness necessities

Weaknesses

- 0.04% quarterly membership charge ($20 minimal per quarter)

- Should open a Max Checking account to hyperlink to most financial institution accounts

- Is a third-party banking app as an alternative of an precise financial institution

- Can take a number of days for transfers to course of

Incomes the best attainable rate of interest in your financial savings can really feel like taking part in a sport of Whac-A-Mole when you’re continuously transferring funds to chase increased yields. However MaxMyInterest might help you discover extra productive methods to spend your time.

The platform companions with a number of on-line banks so you possibly can entry a number of financial savings accounts with the best APYs whereas sustaining FDIC protection. Max appears to be like for the best APYs being provided and might shift your funds month-to-month in your behalf.

Our MaxMyInterest assessment appears to be like at how this on-line banking service works and if the comfort is price the price.

Desk of Contents

- What Is MaxMyInterest?

- MaxMyInterest Charges

- Who Ought to Use MaxMyInterest?

- How MaxMyInterest Works

- Max Checking Account

- Max Sweep Account

- Month-to-month Optimizations

- Clever Funds Transfers

- FDIC Insurance coverage

- MaxMyInterest Execs and Cons

- MaxMyInterest Options

- FAQs

- The Backside Line on MaxMyInterest

What Is MaxMyInterest?

MaxMyInterest is a fintech platform that particular person traders can use to seek out the finest high-yield financial savings account rates of interest. Every month, MaxMyInterest will offer you the optimum allocation to your financial savings balances that will help you earn the best APYs. It’s going to then routinely ship your switch directions to your banks so you will get the best attainable charges. There’s a charge concerned, which we’ll cowl later.

It’s a handy technique to reap the benefits of the latest surge in rates of interest, which has enabled traders to earn a gorgeous return on short-term investments whereas avoiding the volatility of shares and bonds.

MaxMyInterest was launched initially by Six Bushes Capital in 2013 as a money administration service for high-net-worth people. It’s now open to most of the people with out an account minimal. Nevertheless, there’s a minimal $20 service charge per quarter, so it’s finest to deposit a minimum of $50,000.

On the time of this writing, Max members can earn as much as 5.36% APY on deposits, whereas many competing high-yield financial savings accounts yield 4.60% or much less. The yield is considerably increased than the nationwide common financial savings account fee of 0.60%. All numbers are present for January 3, 2023.

You’ll be able to hyperlink your current banking and brokerage accounts from over 18 monetary establishments. It’s additionally attainable to open a Max Checking account to consolidate your balances and achieve simpler entry to your money reserves.

Study Extra About MaxMyInterest

MaxMyInterest Charges

A 0.04% quarterly membership charge applies to all balances, which equates to $40 per $100,000 in property. As every account is topic to a $20 minimal charge each three months, your steadiness must be a minimum of $50,000 to realize 0.04%.

Should you’re keen to place within the further work, you possibly can earn related yields by manually transferring funds between banks that don’t cost month-to-month service charges. However in our opinion, MaxMyInterest’s charge is a small worth to pay with rates of interest at their highest ranges in a technology and nonetheless earn compound curiosity.

There are not any further service charges, though you’ll obtain a 1099-INT tax type after incomes a minimum of $10 in annual curiosity. Whereas your funds will probably be held at a number of companion banks, you solely obtain one year-end tax type, which streamlines the tax prep course of.

A 3rd non-obligatory charge is for wire transfers for same-day withdrawals as an alternative of ready a number of enterprise days for the funds to deposit into your linked checking or brokerage account.

Who Ought to Use MaxMyInterest?

Think about using MaxMyInterest once you don’t wish to self-manage your financial savings deposits to seek out one of the best charges. This service makes it simple to earn curiosity from the finest high-interest financial savings account with out dropping sleep about an underperforming financial savings account.

People and companies can open accounts to spice up their curiosity revenue effortlessly. Nevertheless, you have to be comfy utilizing a third-party app that’s not truly a financial institution that will help you lower your expenses. Don’t fear; MaxMyInterest companions with FDIC-insured banks to save lots of your cash and earn curiosity. These charges can be found to most of the people in lots of conditions.

Whereas there are not any minimal steadiness necessities, the 0.04% quarterly service charge and $20 minimal per three months are deterrents for accounts smaller than $50,000. This charge can be a headache for yield-chasers who’re comfy dedicating a number of minutes every month to switch funds to one of the best financial savings account rate of interest manually.

Associated Publish: Are banks providing 7% financial savings accounts now?

Study Extra About MaxMyInterest

How MaxMyInterest Works

The next MaxMyInterest options might help you begin incomes extra curiosity in your hard-earned cash.

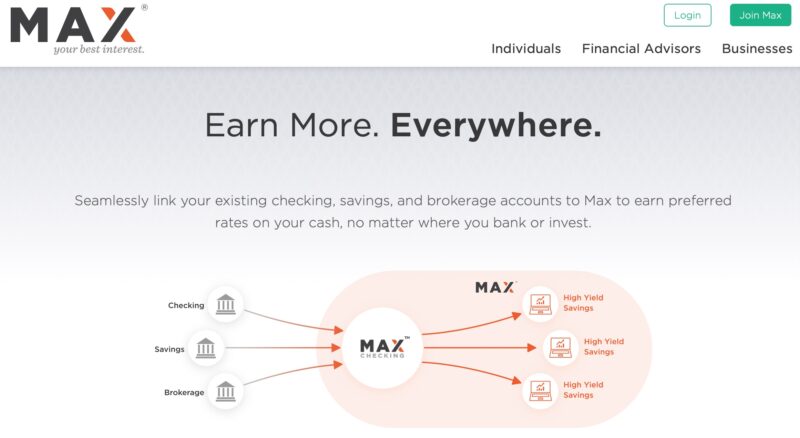

Max Checking Account

First, you’ll hyperlink your major financial institution accounts and brokerage accounts to calculate your money reserves and provoke a switch. Most individuals are higher off opening a Max Checking account because it hyperlinks to only about any checking, financial savings, or brokerage account by a service hyperlink Plaid. You’ll be able to hyperlink a number of exterior accounts whereas the sweep function solely connects one account.

You’ll be able to create a person or joint account. There are not any further charges to open a Max Checking account, which incorporates the next advantages:

This account is FDIC-insured and managed by Prospects Financial institution (Member FDIC #34444).

Should you preserve a minimal $10,000 steadiness, you’ll earn a $25 quarterly rebate (as much as $100 per 12 months) in your Max membership charge. A steadiness exceeding $20,000 triggers a $50 quarterly rebate (as much as $200 per 12 months). You’ll be able to crunch the numbers and consider the chance price versus conserving this steadiness in a high-yield financial savings account.

Max Sweep Account

It’s additionally attainable to hyperlink one exterior account with the Max Sweep function. You might want this selection to keep away from opening one other banking account, though you gained’t qualify for the charge rebate.

MaxMyInterest hyperlinks to banking and brokerage accounts from over 18 monetary establishments:

- Financial institution of America

- J.P. Morgan/Chase Financial institution

- Capital One

- Charles Schwab Financial institution

- Citibank

- Metropolis Nationwide Financial institution

- E*Commerce Financial institution

- Constancy CMA

- Fifth Third Financial institution

- First Republic Financial institution

- Huntington Financial institution

- PNC Financial institution

- TD Financial institution

- Truist Financial institution

- USAA Financial institution

- US Financial institution

- Wells Fargo

- Zions Financial institution

As you possibly can see, most nationwide banks make the record. This will prevent from establishing one other checking account which may require adjusting your direct deposit particulars and different missed actions.

Month-to-month Optimizations

When you’ve linked your accounts, Max evaluates your present account steadiness and units up a high-interest financial savings technique. You’ll be able to set up a goal steadiness to keep away from having your spending account steadiness dip under a certain amount.

By default, MaxMyInterest evaluates rates of interest as soon as a month and suggests an optimization plan. You get to decide on which day the evaluation happens, set up personalized guidelines to safeguard your steadiness and select which exterior account to fund your new deposits from.

On this method, MaxMyInterest is just like an funding robo-advisor, nevertheless it focuses on high-interest FDIC-insured financial savings accounts as an alternative of funding funds.

Clever Funds Transfers

MaxMyInterest’s Clever Funds Switch℠ function enables you to arrange fund transfers in between the scheduled month-to-month optimizations. Max suggests which accounts to drag from to optimize your yield whereas sustaining a wholesome money cushion in your linked accounts.

All transfers are completed through ACH to keep away from financial institution nuisance charges, though it will possibly take 2-3 days to your funds to grow to be accessible.

FDIC Insurance coverage

People can qualify for as much as $2 million in further FDIC protection, and {couples} can qualify for as much as $8 million. The usual FDIC insurance coverage restrict is $250,000 per financial institution companion, however you might be eligible for extra by spreading your property throughout a number of establishments.

The MaxMyInterest-supported on-line financial savings accounts embrace:

Rates of interest range for every establishment and might change at any time. The auto-optimization ensures you obtain one of the best yield together with your FDIC-insured property.

Study Extra About MaxMyInterest

MaxMyInterest Execs and Cons

There are particular execs and cons to utilizing MaxMyInterest to pursue increased financial institution charges. Right here’s the record we got here up with:

Execs

- Earn aggressive rates of interest from a number of high-yield financial savings accounts

- Entry increased FDIC insurance coverage limits

- Robotically optimizes your high-yield financial savings balances

- Customizable switch guidelines and steadiness limits

- No minimal steadiness necessities

Cons

- 0.04% quarterly membership charge ($20 minimal per quarter)

- Should open a Max Checking account to hyperlink to most financial institution accounts

- It’s a third-party fintech app and never an precise financial institution

- It will possibly take a number of days for transfers to course of

MaxMyInterest Options

You’ll be able to earn related yields by leveraging a number of MaxMyInterest options. in reality, the next high-interest financial savings platforms could supply extra interesting account choices or cost fewer charges.

Raisin

Raisin (previously SaveBetter) companions with federally insured banks and credit score unions to supply high-yield financial savings accounts, time period CDs, and no-penalty CDs.

There are not any service charges, and the deposits minimal are as little as $1. Just like MaxMyInterest, this can be a third-party app with many financial institution companions, so that you obtain a consolidated 1099-INT tax type to show your whole curiosity revenue on one piece of paper. Learn our Raisin assessment for extra data.

MySavingsDirect

MySavingsDirect presents a high-yield curiosity financial savings account, aggressive CD charges, and valuable metals storage. There are zero minimal steadiness necessities for the web financial savings account, and you’ll take pleasure in different perks that brick-and-mortar banks have a tendency to stint on.

Learn our MySavingsDirect assessment for extra.

Study Extra About MySavingsDirect

Financial institution Account Bonuses

Because you’re almost definitely shifting cash month-to-month to earn essentially the most curiosity, you might wish to think about checking account signup bonuses. Simply be sure you meet the supply necessities, which usually embrace receiving qualifying direct deposits or sustaining a minimal steadiness of latest cash.

Additionally, take a look at these financial institution bonuses that don’t require a direct deposit.

FAQs

MaxMyInterest is a third-party monetary app that companions with FDIC-insured banks providing a number of the highest financial savings account charges. Working with a go-between provides a layer of complexity, however your accounts hyperlink securely, and the companion banks maintain your property.

There’s a potential threat of financial institution failure, however the app makes it simple to earn essentially the most curiosity with a managed portfolio.

On-line and e-mail assist is out there for members. On-demand cellphone assist isn’t obtainable like an enormous financial institution presents, though contacting the holding financial institution for account-specific inquiries is feasible.

Sure, there’s a devoted platform for monetary advisors to supply MaxMyInterest to their purchasers. Moreover, particular person and joint accounts can add their monetary advisor’s identify and e-mail handle to their profile web page to grant read-only entry.

Study Extra About MaxMyInterest

The Backside Line on MaxMyInterest

MaxMyInterest makes incomes a aggressive high-yield financial savings fee simpler because the platform has many financial institution companions and might optimize your account as soon as a month or extra incessantly. Customizable guidelines and banking options make it simple to handle your Max and exterior account balances. Sadly, the quarterly service charges are costly for small account balances and should encourage savers to self-manage their financial savings to earn the same rate of interest.

[ad_2]