[ad_1]

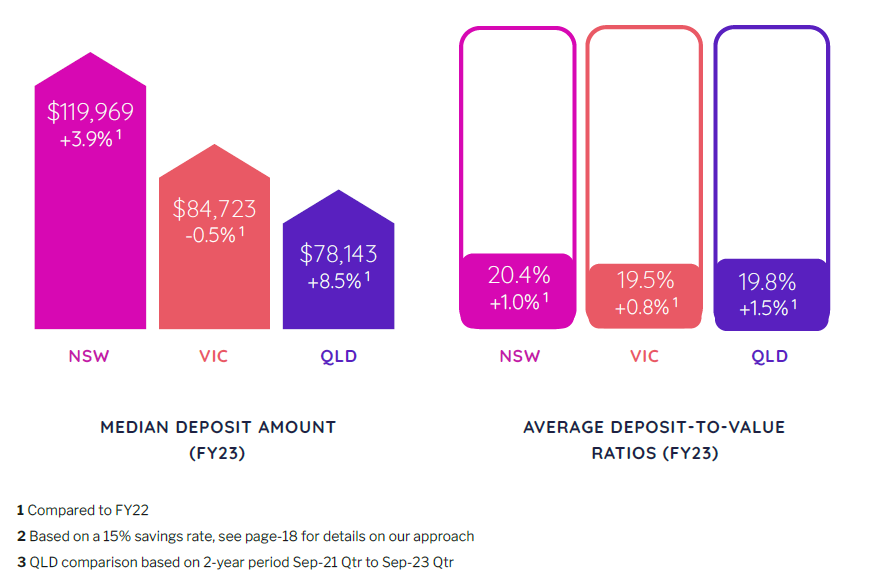

Median deposits in New South Wales surged in FY23, reaching just below $120K, a 3.9% improve from FY22, outpacing Victoria ($84,723, -0.5%), and Queensland ($78,143, +8.5%), based on a brand new PEXA report.

The PEXA Purchaser Deposits Report for November, which explored the deposits utilized by dwelling consumers in Australia’s three largest states, additionally confirmed that common deposit-to-value ratios (DVRs) rose to round 20% throughout the japanese states as lenders tightened credit score requirements.

In NSW, consumers contributed 20.4% of the property worth as a deposit (+1% on FY22), whereas VIC and QLD recorded DVRs of 19.5% (+0.8%) and 19.8% (+1.5%), respectively.

“As property costs have elevated throughout the nation, the deposits required by consumers have risen proportionally. This has impacted housing affordability, notably for sure cohorts of consumers, akin to first-home consumers,” mentioned Mike Gill (pictured above), PEXA head of analysis.

Gill mentioned PEXA outlined deposits as “all of the funds contributed by consumers to settle their property buy, together with any preliminary money deposits supplied at time of sale, in addition to another money funds added previous to settlement.”

PEXA estimated that NSW consumers will take almost eight years to save lots of the median deposit, an 83.2% rise up to now three years. Victoria and Queensland consumers are estimated to take simply over 5 years and just below 5 years, respectively, with time to save lots of growing by 64.2% and 36.9% up to now three and two years.

Regional LMI, LVR traits

Greater than half of dwelling consumers within the japanese states required lenders mortgage insurance coverage (LMI) to buy a residential property within the 2023 monetary 12 months, with common LVR round 80% for information loans, PEXA reported.

Common LVRs for brand new loans throughout the japanese states hovered round 80% in FY23, with particular figures various barely: 79.6% in NSW, 80.5% in Victoria, and 80.2% in Queensland. All states witnessed a decline in common LVRs since FY22, with Queensland experiencing the most important drop at 1.5%.

Main banks averaged greater LVRs than non-major lenders, recording 81.2% in NSW, 81.9% in VIC, and 81.9% in QLD in FY23. Regardless of a year-on-year decline starting from 1.2% to 1.6%, main banks’ LVRs remained greater than non-majors, which ranged between 76.2% and 77.6%.

Victoria had the very best share of recent debtors requiring LMI in FY23 at 56.5%. The upper common LVRs of main banks led to a better proportion of their prospects requiring LMI, notably in VIC, the place 63.9% of main financial institution prospects had an LVR greater than 80%.

Go to the PEXA web site to learn the total report.

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE each day e-newsletter.

[ad_2]