[ad_1]

In a rational world each investor would set their asset allocation based mostly on their willingness, skill and must take threat.

One would stability a spread of expectations for the assorted asset lessons and match these potentialities with their objectives and goals.

Certain, loads of traders think about their threat profile and time horizon when constructing a portfolio.

However we stay in an irrational world — one through which experiences, feelings, circumstances, luck and timing form each emotions and portfolios.

The Economist just lately had a wonderful profile on how younger folks ought to take into consideration investing and why they shouldn’t freak out due to the inflationary bear market of 2022.

They level to analysis from Vanguard that reveals your early expertise within the markets can form your asset allocation and funding posture for years to come back:

Ordering the portfolios of Vanguard’s retail traders by the yr their accounts had been opened, his group has calculated the median fairness allocation for every classic (see chart 3). The outcomes present that traders who opened accounts throughout a growth retain considerably larger fairness allocations even a long time later. The median investor who began out in 1999, because the dotcom bubble swelled, nonetheless held 86% of their portfolio in shares in 2022. For individuals who started in 2004, when reminiscences of the bubble bursting had been nonetheless contemporary, the equal determine was simply 72%.

Due to this fact it is extremely doable immediately’s younger traders are selecting methods they’ll observe for many years to come back.

That is the aforementioned chart:

These outcomes are considerably stunning. Most individuals assume residing by the inevitable bust that follows a growth would go away a bitter style in your mouth.

However the reverse is true. Buyers who opened accounts throughout growth instances truly retained a larger allocation to shares for years to come back.

Perhaps it’s inertia however it’s apparent inventory market returns in your early life as an investor can have an effect on the way you make investments.

The exhausting half about all of that is you don’t get to decide on when your returns come as an investor. Generally you get good returns if you’re younger, typically if you’re outdated.

Some retirees get fabulous bull markets proper once they depart the working world whereas some retire into the tooth of a bear market.

Timing and luck — each good and dangerous — play an enormous position in your expertise as an investor.

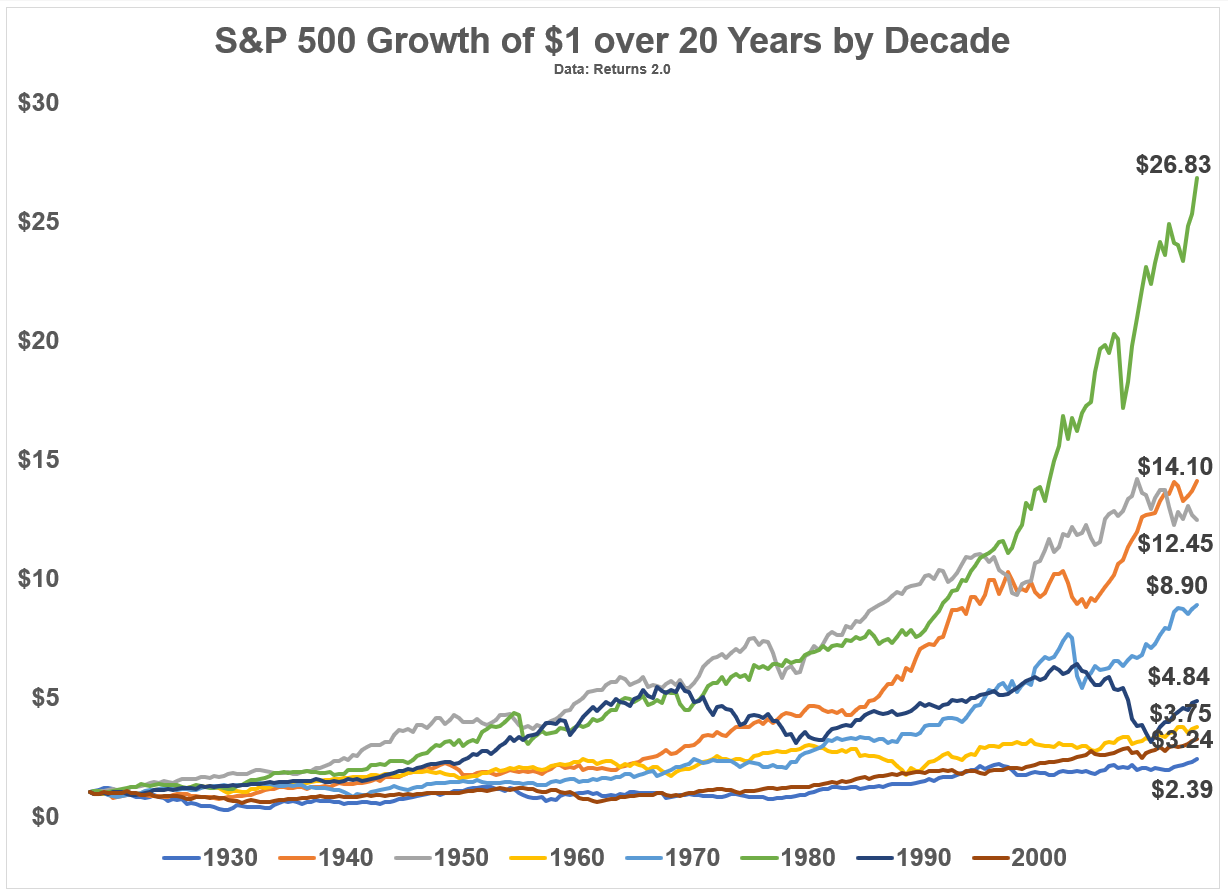

I calculated the expansion of $1 invested within the S&P 500 over a 20 yr interval firstly of every decade going again to the Nineteen Thirties:

There’s a variety of outcomes, to say the least.

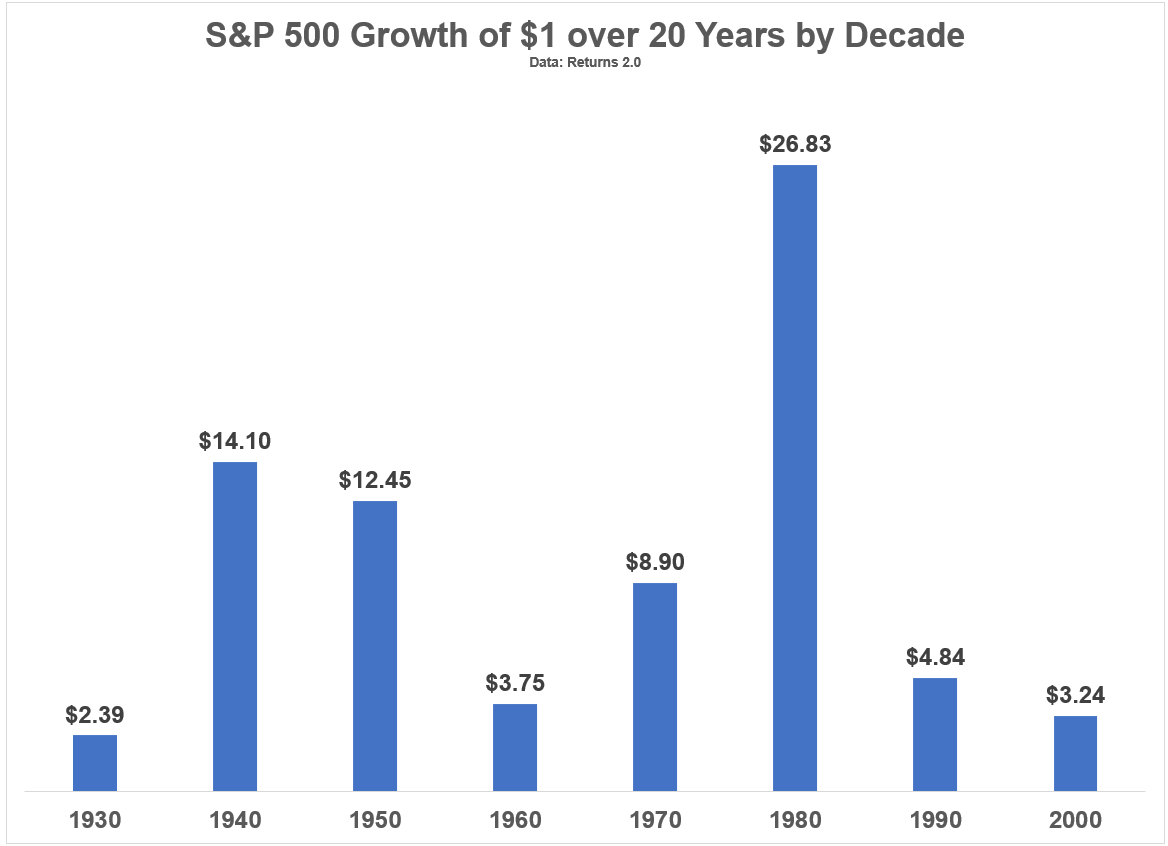

Right here’s one other method of these numbers:

Begin investing in 1980 and it seems simple. Begin within the Nineteen Thirties and also you most likely need nothing to do with shares.1

It’s additionally necessary to notice “dangerous” markets with poor returns aren’t essentially a poor final result for everybody.

If you happen to’re a internet saver, you must need crappy returns, particularly early in your profession.

Threat means various things to totally different traders relying on their stage in life.

Sadly, there are various variables exterior of your management relating to investing.

You possibly can’t management the timing or magnitude of returns the markets supply. You additionally don’t management rates of interest or inflation or financial progress or tax charges or the labor market or the actions of the Fed and politicians.

Life could be simpler in the event you did however nobody stated life is straightforward.

One of the best you are able to do is give attention to what you possibly can management — your habits, your financial savings price, your asset allocation, your prices, your time horizon — and play the hand you’re dealt.

Additional Studying:

The Psychological Account of Asset Allocation

1I may have adjusted these outcomes for inflation as a result of that’s what everybody asks me for today however you get the thought.

[ad_2]