[ad_1]

4 issues I’m fascinated by in the meanwhile:

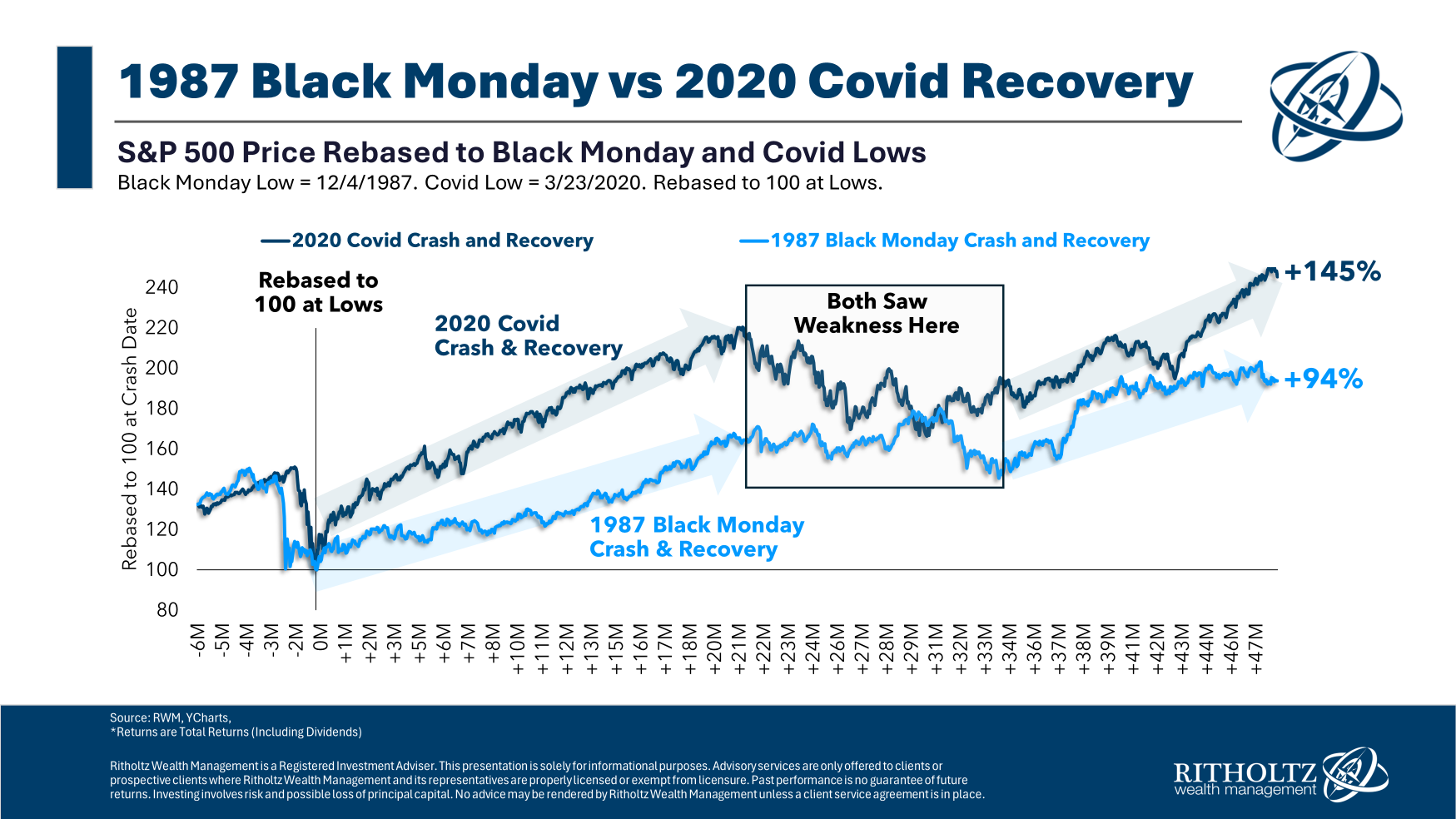

1. The Covid Crash was our 1987 crash. Within the 15 buying and selling days from October sixth by means of October twenty sixth in 1987, the S&P 500 was down 31%. That plunge consists of Black Monday which noticed the market fall greater than 20% in a single day.

Over the subsequent 4 years from the underside the S&P 500 was up rather less than 110% in whole. It was a beautiful shopping for alternative.

Within the 26 buying and selling days from late February twentieth by means of March twenty third in 2020, the S&P 500 was down 34%.

Within the 4 years or so for the reason that backside of the Covid Crash in March 2020, the S&P 500 is now up almost 150% in whole. It was a beautiful shopping for alternative.

The bull market lasted properly over one other decade following the 1987 debacle. I don’t assume we’ll be that fortunate this time round however the Covid Crash is eerily just like Black Monday.

2. Folks with cash proceed to spend cash. I’m on spring break this week with my household in Florida.

Like many locations, costs listed here are noticeably increased. Meals, drinks, accommodations, experiences — every little thing is costlier than it was only a few quick years in the past.

However that’s not stopping folks (me included) from spending cash.

I do know spring break will not be actual life, however folks with cash are prepared to maintain spending even at elevated costs. This helps clarify a lot of what’s been taking place within the economic system in recent times.

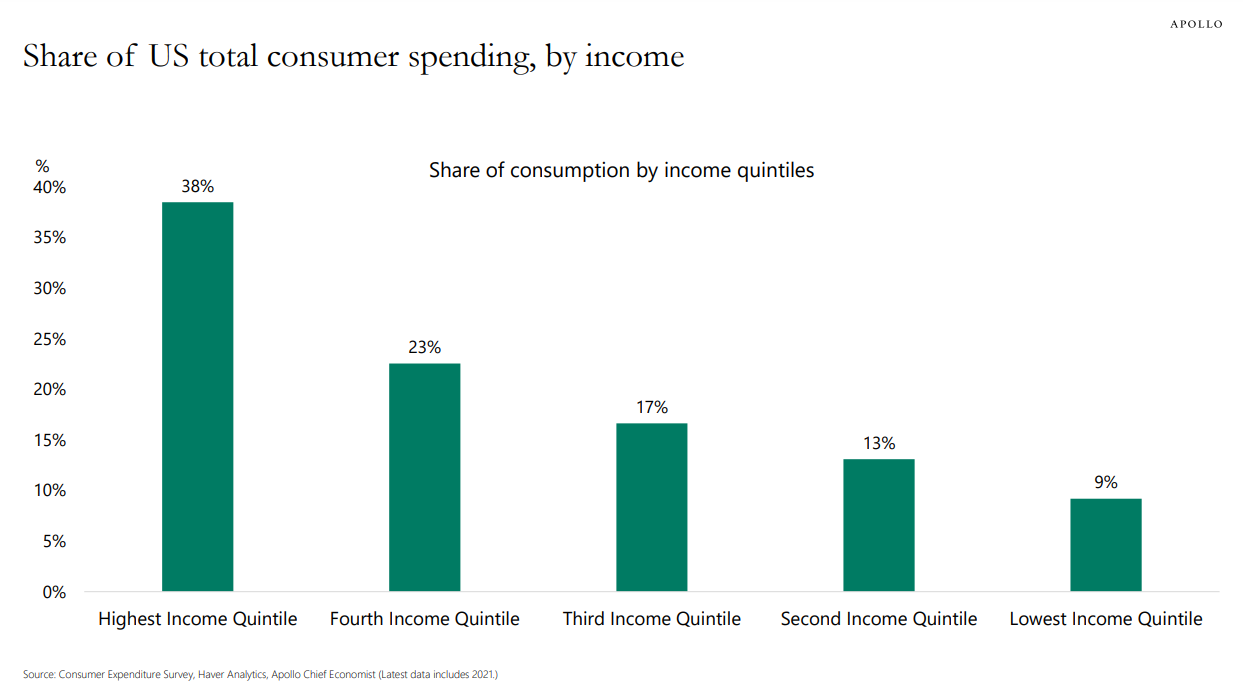

This chart from Torsten Slok exhibits the share of spending damaged out by revenue:

Folks with cash maintain spending it.

Companies know they’ve pricing energy over customers and are taking benefit.

Who’s going to blink first?

3. Nothing ages properly within the markets. I’ve spent the previous few years writing positively in regards to the U.S. economic system. I’ve accomplished so to not predict what is going to occur sooner or later however to investigate what is going on within the current.

Final week, I made the case that we’re residing in our personal model of the Roaring 20s.

A completely bearish man who wears a bow tie1 even poked enjoyable at my analogy by mentioning the unique Roaring 20s ended within the Nice Melancholy.

Jeez, I by no means considered that.

I get it. I’m in all probability too glass-is-half-full more often than not.

However mentioning that good instances are often adopted by unhealthy instances will not be an unique thought.

In fact as we speak’s good instances will finish badly in some unspecified time in the future!

There’s going to be a recession. There’s going to be a inventory market crash. We’re going to seek out out who’s been swimming bare when Mike Tyson punches you within the face and all of that stuff.

Many individuals stated my piece wouldn’t age properly. The individuals who have been forecasting a recession for 3 straight years didn’t age properly both.

The factor is, nothing ages properly within the markets as a result of they’re consistently altering. Markets are at all times and endlessly cyclical.

However the booms at all times greater than make up for the busts.

Always predicting the tip instances may allow you to achieve subscribers nevertheless it doesn’t assist folks generate income.

For those who don’t benefit from the booms since you’re at all times apprehensive in regards to the busts you’re by no means going to get forward.

4. I might wager on climate & water within the housing market. With the caveat that long-term developments are notoriously onerous to foretell, the 2 housing themes I’m most bullish on within the coming many years are good climate and water.

I’ve traveled to Florida a handful of instances previously few years, and each time I examine Zillow, the housing costs appear to maintain rising.

The pandemic had one thing to do with this however you even have 10,00 child boomers retiring daily and plenty of of them need heat climate.

There are 70 million child boomers and so they management one thing like $70 trillion in property. We’re taking a look at 10-15 years of boomers shopping for locations in Florida, Arizona, the Carolinas and different heat locations.

Most of them have paid off mortgages and an obscene quantity of residence fairness. Good luck betting in opposition to this pattern.

They’ve some huge cash cash and are able to take pleasure in retirement so most boomers gained’t fear about sky-rocketing insurance coverage premiums. They’ll roll the cube.

By the point the child boomers die off the oldest millennials will begin fascinated by early retirement and Gen X will already be there.2

At that time we might truly see a reverse migration to the north and extra average local weather as the warmth within the south turns into extra insufferable within the summers.

Proudly owning actual property by the Nice Lakes is my private local weather change hedge for the subsequent 10-30 years.

Michael and I talked the inventory market, client spending, financial commentary, wealth inequality, Florida and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Are We Dwelling within the Roaring 20s?

Now right here’s what I’ve been studying recently:

Books:

1For those who’re in finance and put on a bow tie there’s a 95% likelihood you’re a permabear. These are the foundations.

2Loopy however true. I’m 42 (occurring 43) and technically the oldest millennial alive. The child boomers have 20-30 years in retirement. By the point most boomers are of their 90s, the oldest millennials like me will probably be of their 60s and fascinated by retirement.

[ad_2]