[ad_1]

The earlier publish Backdoor Roth in TurboTax: Recharacterize and Convert, 1st 12 months handled contributing to a Conventional IRA for the earlier 12 months and recharacterizing a earlier 12 months’s Roth IRA contribution as a Conventional IRA contribution. This publish handles the conversion half.

Right here’s the primary instance situation:

You contributed $6,500 to a Conventional IRA for 2022 in 2023. The worth elevated to $6,700 if you transformed it to Roth in 2023.

You already reported the contribution half in your 2022 tax return. The IRA custodian despatched you a 1099-R type for the conversion in 2023. This publish reveals you tips on how to put it into TurboTax.

Right here’s the second instance situation:

You contributed $6,500 to a Roth IRA for 2022 in 2022. You realized that your earnings was too excessive if you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Conventional contribution earlier than April 15, 2023. The IRA custodian moved $6,600 out of your Roth IRA to your Conventional IRA as a result of your authentic $6,500 contribution had some earnings. The worth elevated once more to $6,700 if you transformed it to Roth in 2023.

You already reported the recharacterized contribution in your 2022 tax return. The IRA custodian despatched you two 1099-R types, one for the recharacterization, and the opposite for the conversion. This publish reveals you tips on how to put each of them into TurboTax.

If you happen to contributed for 2023 in 2024 or should you recharacterized a 2023 contribution in 2024, you’re nonetheless within the first 12 months of this journey. Please observe Backdoor Roth in TurboTax: Recharacterize and Convert, 1st 12 months.

If neither of those instance situations suits you, please seek the advice of our information for a standard “clear” backdoor Roth: How To Report Backdoor Roth In TurboTax (Up to date).

Use TurboTax Obtain

The screenshots under are from TurboTax Deluxe downloaded software program. The downloaded software program is manner higher than on-line software program. If you happen to haven’t paid to your TurboTax On-line submitting but, you should buy TurboTax obtain from Amazon, Costco, Walmart, and lots of different locations and change from TurboTax On-line to TurboTax obtain (see directions for tips on how to make the change from TurboTax).

1099-R for Recharacterization

This part solely applies to the second instance situation. If you happen to didn’t recharacterize (the primary instance situation), please skip this part and leap over to the conversion part.

We deal with the 1099-R type for recharacterization first. This 1099-R type has a code ‘R’ in Field 7.

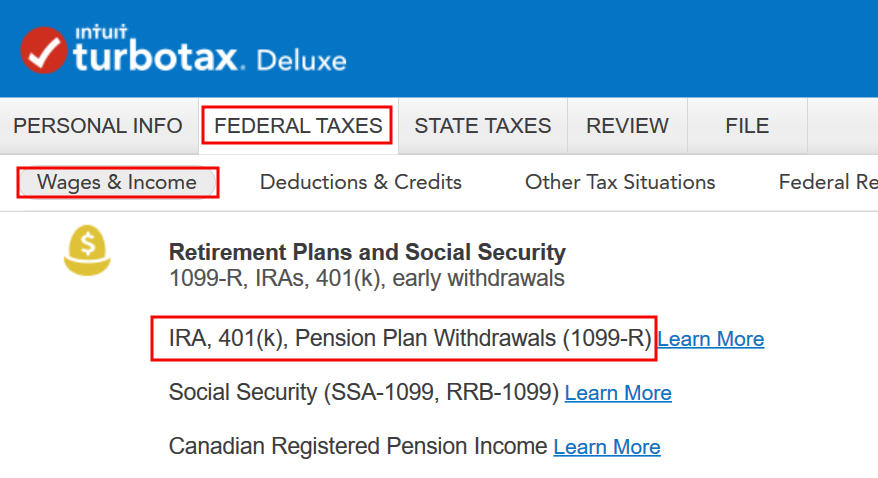

Go to Federal Taxes -> Wages & Earnings -> IRA, 401(ok), Pension Plan Withdrawals (1099-R).

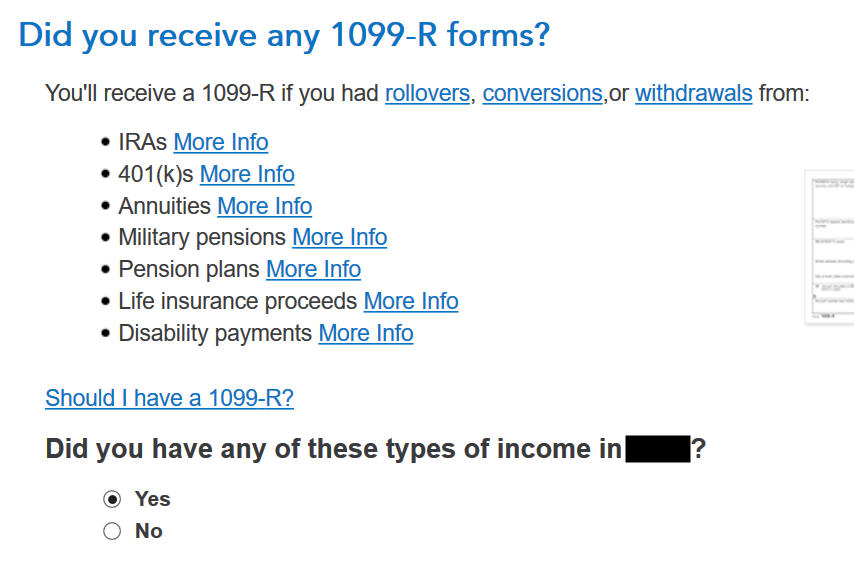

Affirm that you’ve acquired a 1099-R type. Import the 1099-R should you’d like. I’m selecting to kind it myself.

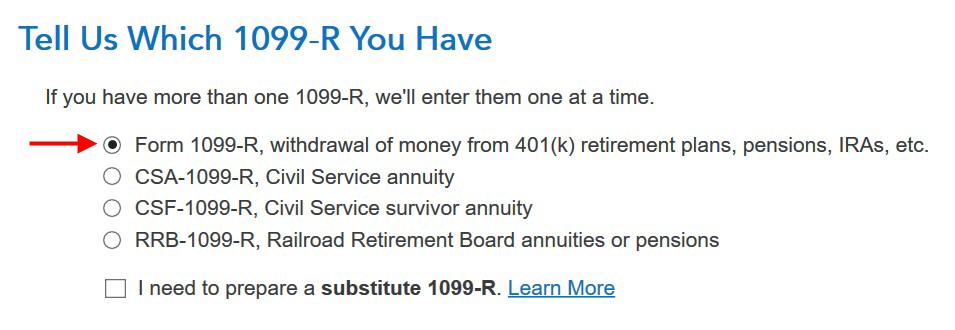

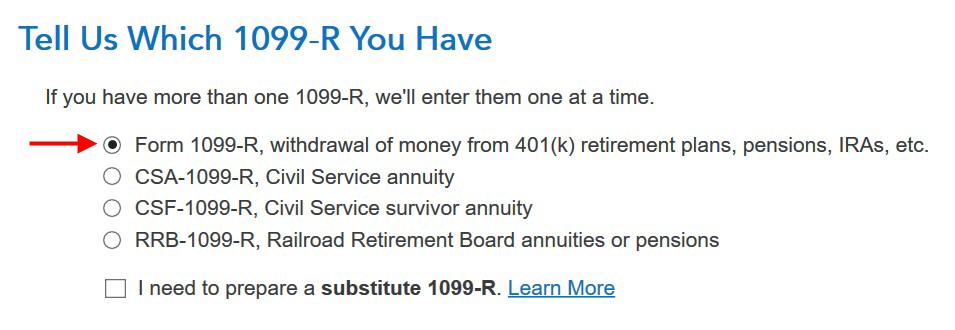

It’s a daily 1099-R.

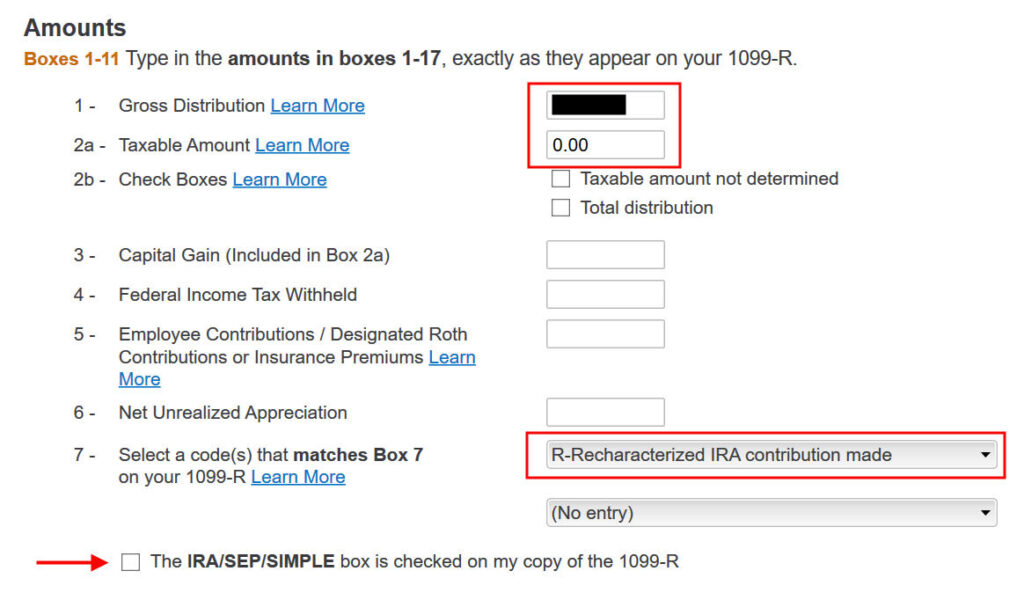

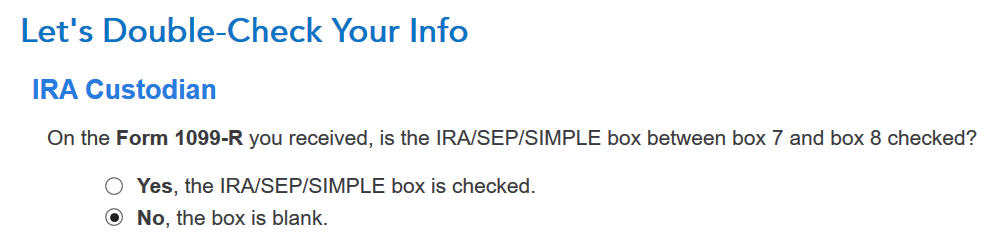

The quantity that moved out of your Roth IRA to your Conventional IRA reveals in Field 1. The taxable quantity in Field 2a is zero. The 2 checkboxes in Field 2b aren’t checked. The code in Field 7 is “R.” The “IRA/SEP/SIMPLE” field underneath Field 7 could or might not be checked. It’s not checked in our pattern 1099-R.

That field is clean in our 1099-R, and that’s OK.

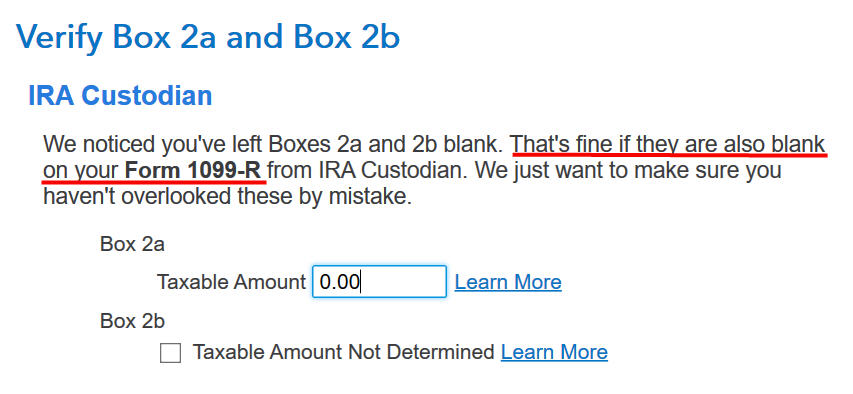

It’s regular to see zero in Field 2a and clean in Field 2b. TurboTax simply needs to double-check.

Not a Public Security Officer.

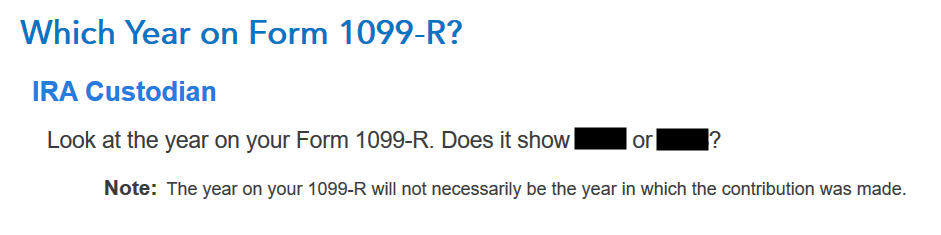

Whenever you’re doing taxes for 2023, chances are high the 1099-R type is for 2023. Click on on the button that matches the 12 months on the shape.

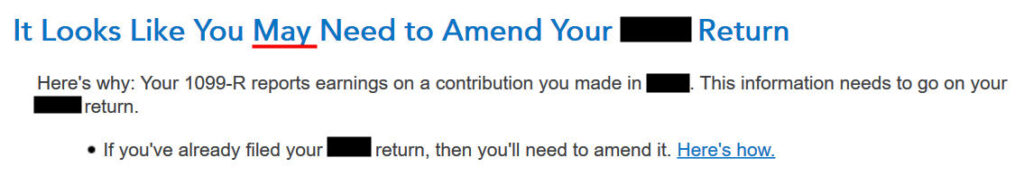

No Must Amend

That is deceptive. You already reported the recharacterization within the earlier 12 months’s tax return should you adopted our earlier publish. You solely have to amend your earlier tax return should you didn’t observe these steps.

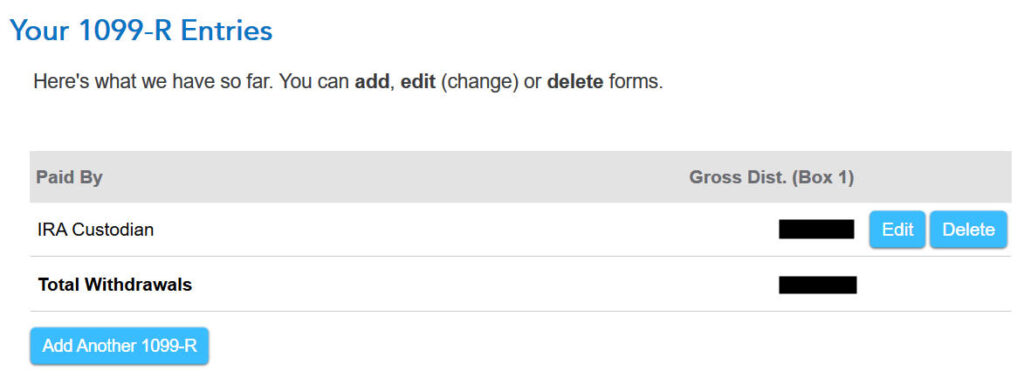

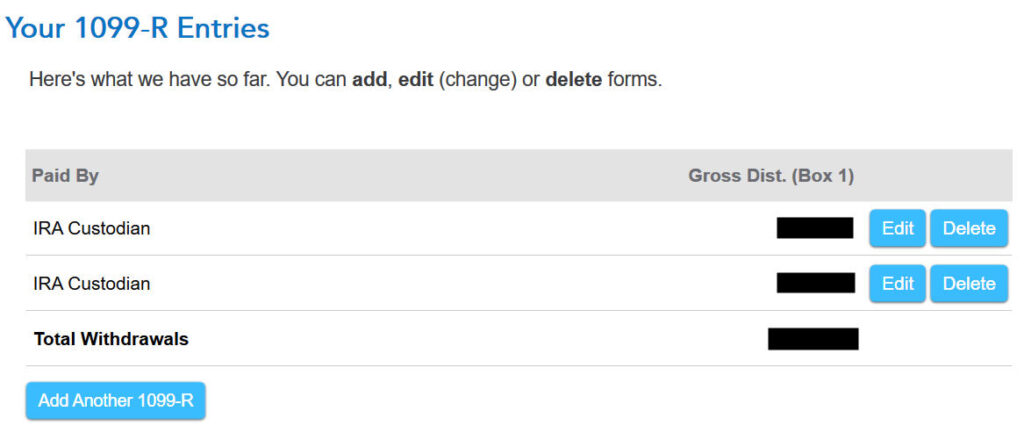

You’re performed with the primary 1099-R type. Click on on “Add One other 1099-R” so as to add the second should you don’t have already got each 1099-R types imported.

1099-R for Conversion

The second 1099-R type can also be a daily 1099-R.

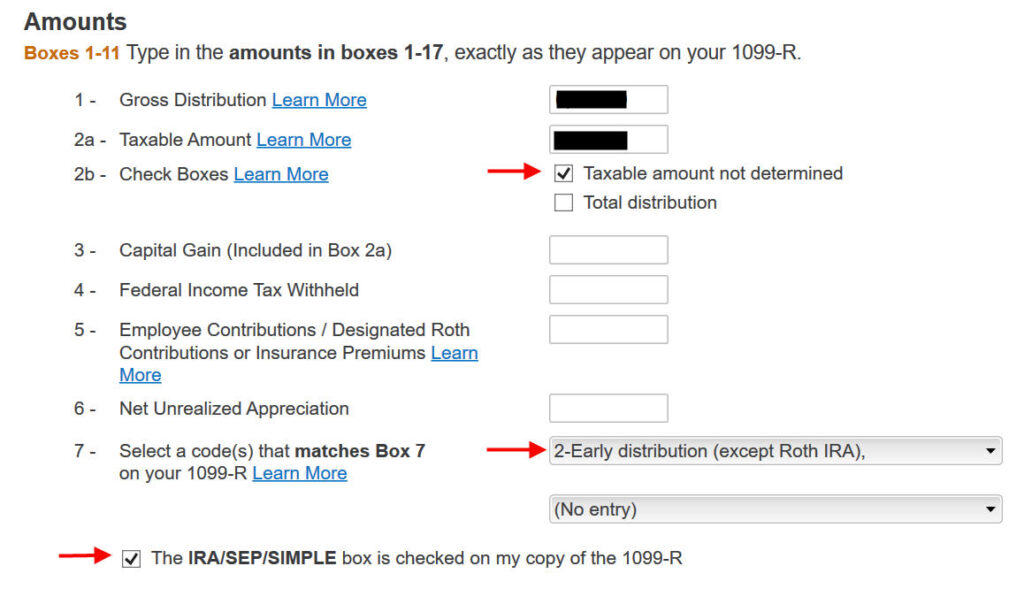

It’s regular to see the conversion reported in Field 2a because the taxable quantity when Field 2b is checked to say “Taxable quantity not decided.” The code in Field 7 is ‘2’ if you’re underneath 59-1/2. It’s ‘7’ if you’re over 59-1/2. The “IRA/SEP/SIMPLE” field is checked on this 1099-R type for the conversion.

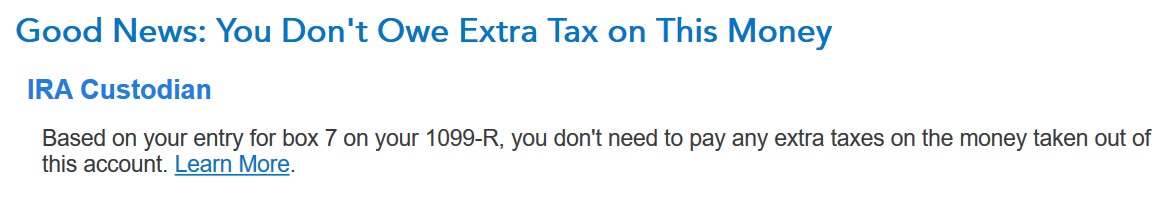

It says that you simply don’t owe additional tax on this cash. In case your refund meter drops, don’t panic. It’s regular and momentary.

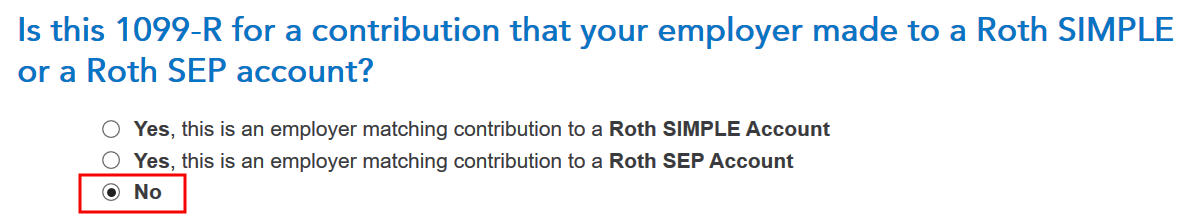

It’s not a Roth SIMPLE or a Roth SEP.

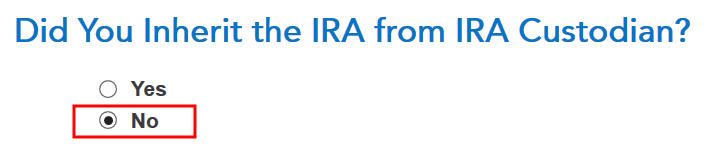

Didn’t inherit it.

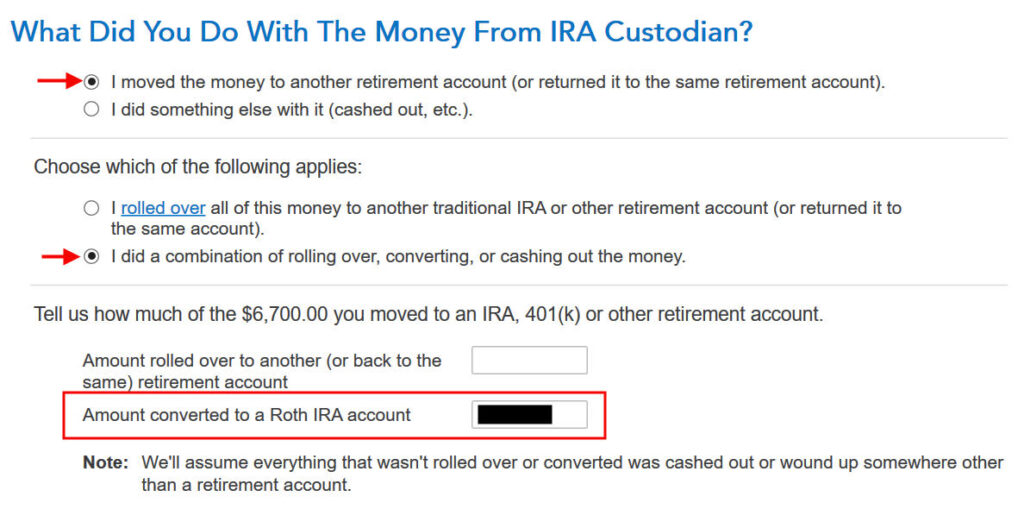

Transformed

First click on on “I moved …” then click on on “I did a mix …” Enter the quantity you transformed to Roth within the field. Don’t select the “I rolled over …” choice. A rollover means Conventional-to-Conventional. Changing to Roth isn’t a rollover.

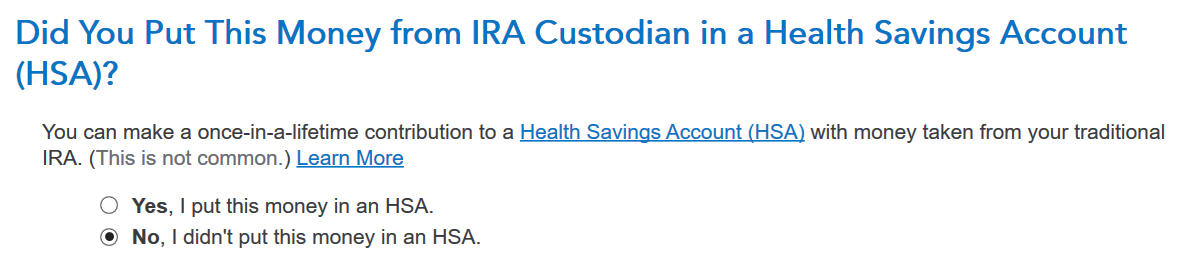

Didn’t put it in an HSA.

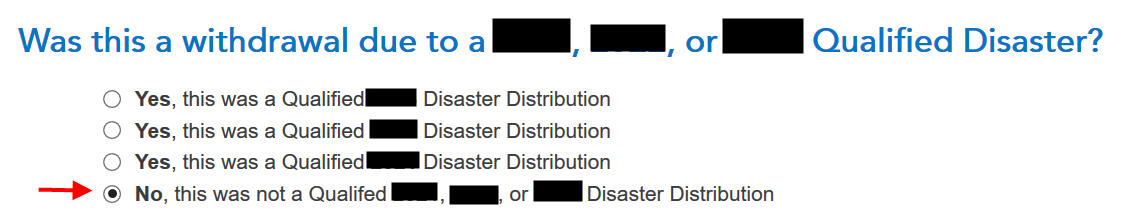

Not because of a catastrophe.

Now the 1099-R abstract consists of each 1099-R types. Hold going by clicking on “Proceed.”

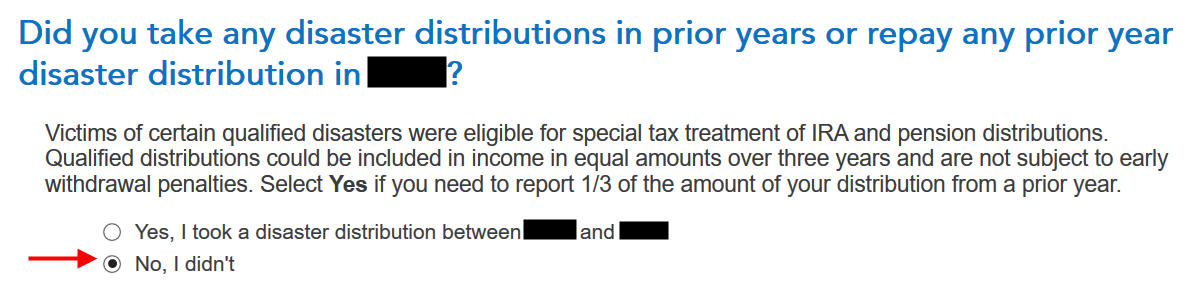

No catastrophe distributions.

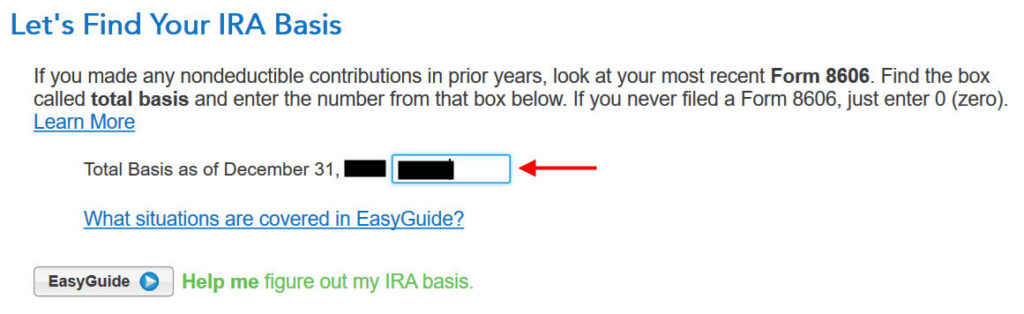

Foundation

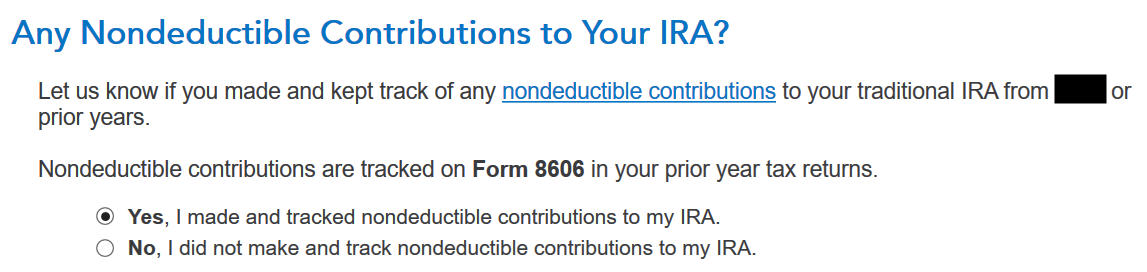

Select “Sure” as a result of the 2022 Roth IRA contribution you recharacterized in 2023 counts as a nondeductible Conventional IRA contribution for 2022.

TurboTax ought to populate this worth from final 12 months’s return. If it doesn’t, get the worth out of your final 12 months’s Type 8606 Line 14, which you generated should you adopted the earlier publish Backdoor Roth in TurboTax: Recharacterize and Convert, 1st 12 months.

The refund meter goes again up after you enter the overall foundation.

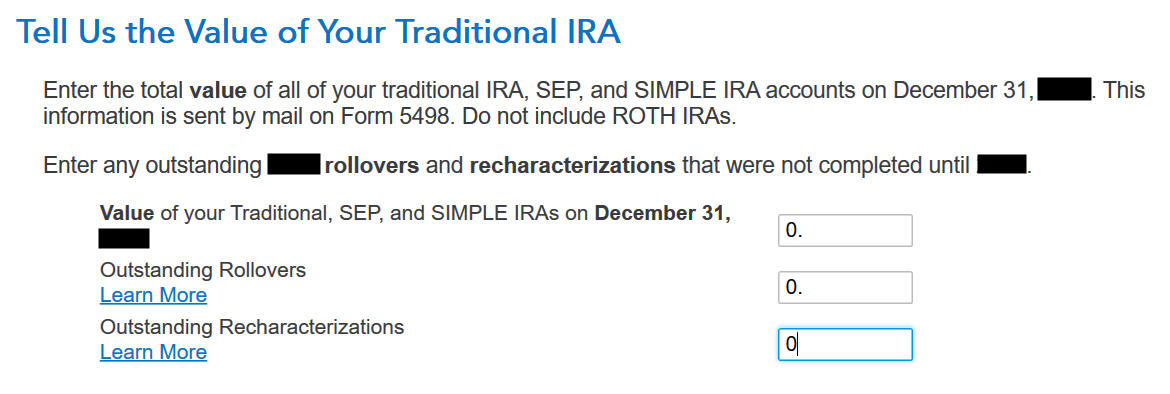

That is usually zero should you transformed every part. When you’ve got just a few {dollars} left within the account from earnings posted after you transformed, enter the worth out of your year-end assertion within the first field.

Clear Conventional IRA Contribution

If you happen to additionally did a “clear” backdoor Roth in 2023 on prime of changing your contribution for 2022, in different phrases, you contributed to a Conventional IRA for 2023 in 2023 and transformed in 2023, your 1099-R consists of changing two 12 months’s value of contributions in a single 12 months. All of the steps within the earlier part are nonetheless the identical besides that you’ve a bigger quantity in your 1099-R type.

The premise from the earlier 12 months’s tax return took care of one-half of the conversion. You additionally have to report your 2023 Conventional IRA contribution. Please observe the steps within the Non-Deductible Contribution to Conventional IRA part in our walkthrough for a clear backdoor Roth for 2023.

Say No To Administration Charges

If you’re paying an advisor a share of your property, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]