[ad_1]

Some issues I’ve been enthusiastic about currently:

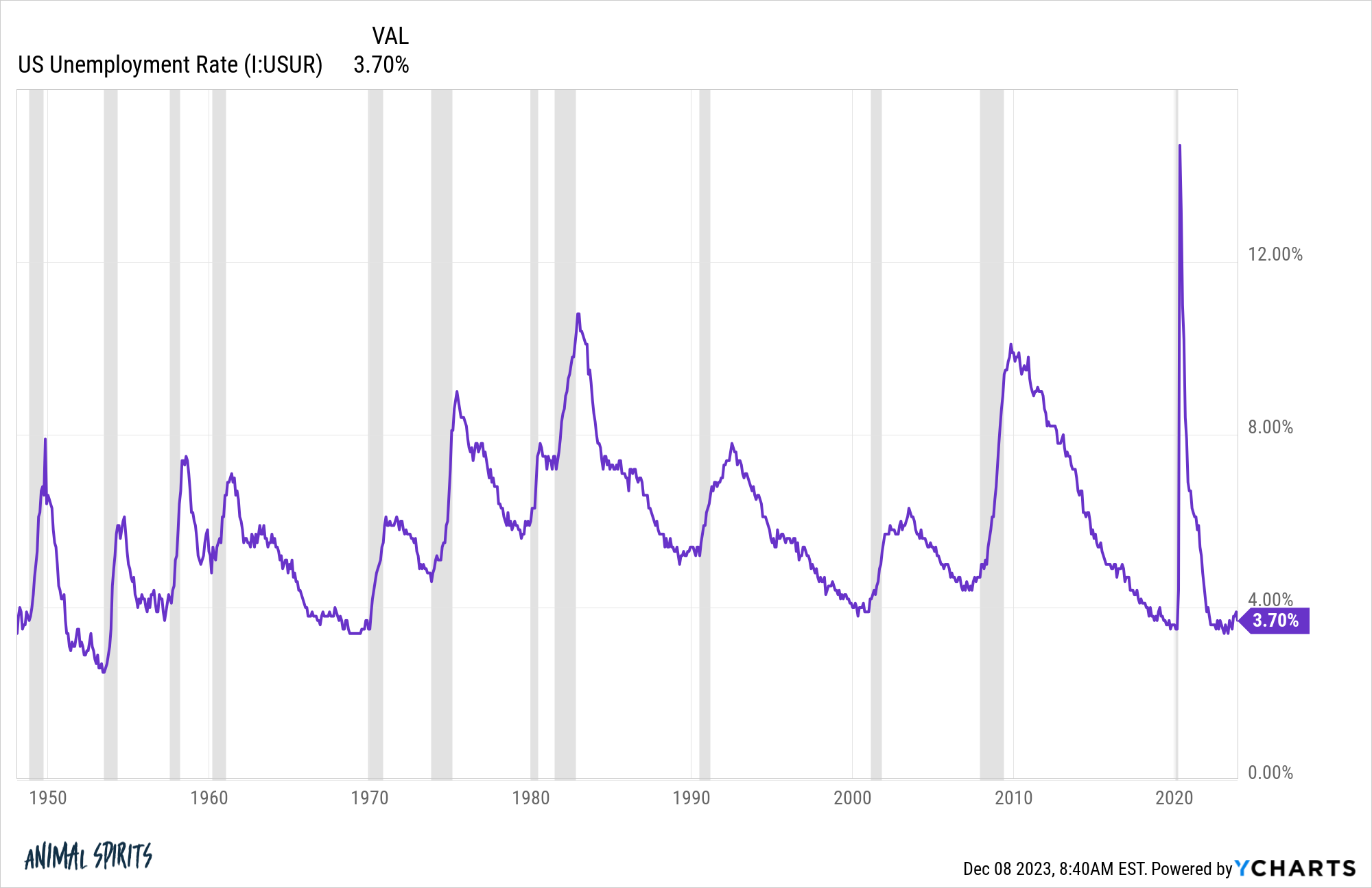

1. I feel that is the strongest labor market we’ll see in my lifetime. Because the Fed started elevating charges in March 2022, the U.S. financial system has added greater than 6 million new jobs. This 12 months we’ve added 2.5 million jobs.

The entire thought of fee will increase was to gradual client demand which might trigger corporations to chop again which might result in job cuts which might gradual inflation.

And but…

We’ve now skilled 22 months straight with the unemployment fee under 4%.

That hasn’t occurred because the Sixties. The unemployment fee was by no means under 4% even as soon as in the course of the Nineteen Seventies, Nineteen Eighties or Nineties.

We would by no means see a labor market like this once more for a very long time.

Get pleasure from it whereas it lasts.

2. I feel we might see a lot greater client sentiment numbers in 2024. Economists have been closely debating why client sentiment is so wretched regardless of a resilient financial system.

As enjoyable as this debate has been, I’m hopeful 2024 will see a spike in client sentiment in direction of the financial system.

Gasoline costs are falling. The inflation fee is steadying. Mortgage charges are falling (and can hopefully fall additional). The Fed might be going to chop charges within the first half of 2024. Wages are rising sooner than inflation once more.

Assuming we avert a recession but once more, I’m bullish on client sentiment in 2024.

3. I feel the right variety of beers in a single evening is 3. Only a random thought I had on Twitter:

Deep ideas with Ben.

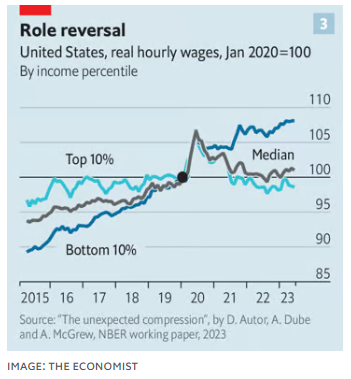

4. I feel nobody might have predicted a pandemic would scale back inequality. The Economist shared the outcomes of a brand new analysis paper that reveals an unintended consequence of the robust labor market from the pandemic is a discount in earnings inequality:

In a current paper, Mr Autor and colleagues show that tight American labour markets are resulting in quick wage progress, as employees swap jobs for higher pay, and that poorer staff are benefiting most of all (see chart 3). The researchers reckon that, since 2020, some two-fifths of the rise in wage inequality over the previous 4 many years has been undone.

Right here’s the chart talked about:

Wage progress for the underside 10% has outpaced wage progress from the highest 10% since 2020 by a wholesome margin.

I do know issues aren’t excellent however this can be a good factor!

5. I feel pizza is a superb hedge in opposition to inflation. Considered one of my favourite components of getting children is introducing them to household traditions and beginning new ones.

We watch House Alone collectively yearly now.

I’ve seen it so many occasions now that I’m all the time on the lookout for minor particulars to maintain me entertained.

There’s this interplay originally of the film when the Little Nero’s supply man reveals up with 10 pies for the McCallisters:

Peter McCallister: Honey, the pizza boy wants $122.50 plus a tip.

Kate McCallister: For pizza?

Uncle Frank: Ten pizzas occasions 12 bucks.

This film got here out in 1990. A good pizza was 12 bucks greater than 30 years in the past. Adjusted for inflation, that’s practically $30.

You will get a high-quality pizza for one thing like $15-20 today. Dominos nonetheless sells a high quality pizza for $7.99.

How is pizza nonetheless so comparatively cheap?

An enormous win for the patron.

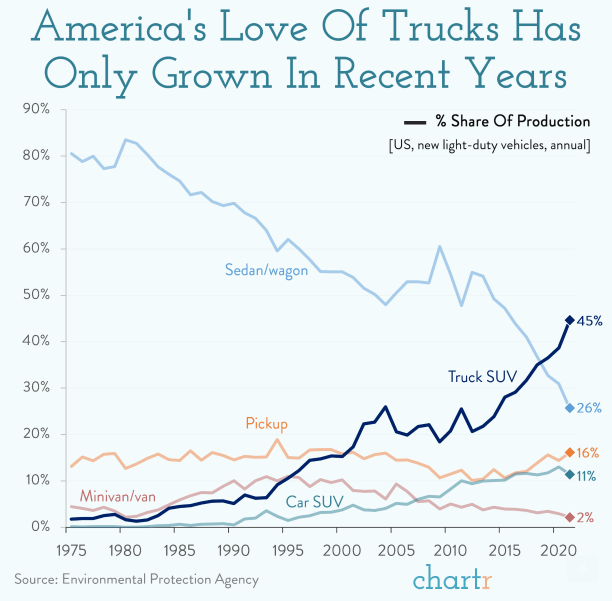

6. I feel we purchase too many vans and SUVs on this nation. Have a look at this chart:

The loopy factor right here is folks had extra children again within the Nineteen Seventies and Nineteen Eighties than we do now. In some way they survived with out a type of large boats with three rows and a large trunk.

The most important SUVs and vans can run $70k or $80k. It’s ridiculous!

I do know I’m a damaged file on this matter however I feel individuals are crushing their funds to finance automobiles they don’t want.

Some folks clearly want a truck or large SUV however far too many shoppers are paying manner an excessive amount of for his or her automobiles.

Full disclosure: I drive an SUV! I’m (type of) a hypocrite.1

7. I feel now just isn’t a nasty time to purchase a home (if you happen to can afford it). I’m not a fan of timing the housing market.

In case you can afford the month-to-month fee together with the ancillary prices and also you need/want to purchase a home you must do it. A home is in contrast to another monetary asset as a result of it’s the roof over your head.

However I’m certain many potential homebuyers are determining the most effective time to purchase contemplating the terrible affordability numbers proper now.

It’s robust as a result of provide is so low, making it tough to seek out the home you need. But when mortgage charges fall to five% or 6% we’re going to see a flood of exercise from pent-up demand and pent-up provide from those that didn’t wish to promote.

There are going to be a number of supply conditions once more.

In case you might purchase now and refinance later, you’re most likely in a greater negotiating place than you’d be in if/when charges fall.

The housing market continues to be very unhealthy however just a few meals for thought if you happen to’re available in the market.

8. I feel now is a good time to extend your charitable giving if you happen to can afford it. Whatever the robust labor market and financial system, there are folks on the market who’re hurting.

In case your internet price is at new all-time highs and inflation just isn’t placing a significant dent in your funds, the vacations are an exquisite time to offer again or rethink your charitable giving.

Quite a lot of years in the past I automated my charitable giving to varied organizations but it surely’s most likely time to extend these quantities.

I’m not on the lookout for a pat on the again or something, but when your funds are in an excellent place, now is an efficient time to offer to these much less lucky.

Additional Studying:

5 Questions I Have In regards to the Economic system

1To be honest, I drive a Ford Explorer. That’s just like the Honda Accord of SUVs.

[ad_2]