[ad_1]

Some questions I’m pondering concerning the financial system in the intervening time:

1. Why do folks maintain spending cash if the financial system is so horrible? We’re breaking information for vacation journey:

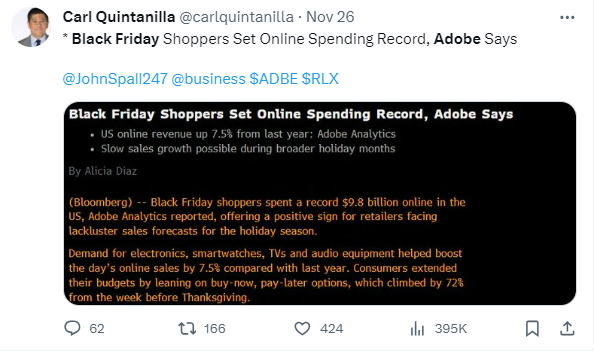

And spending cash on Black Friday like loopy:

Granted, that is vacation journey and spending. It’s not the conventional plan of action.

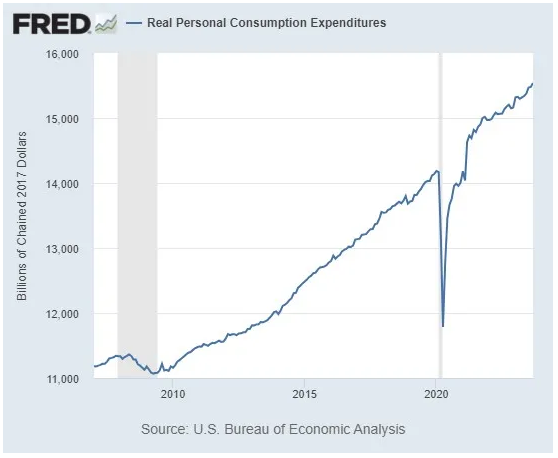

However simply have a look at the inflation-adjusted spending for customers on items and companies:

A lot of folks say they hate this financial system (particularly the upper costs) however folks maintain proper on paying these greater costs and spending cash.

We like to eat on this nation and it’s going to be tough to vary our spending habits even with greater costs.

It’s most likely going to take a recession to cease this.

2. Is debt propping up the financial system? Wonderful, individuals are spending however absolutely it’s all on credit score, proper?

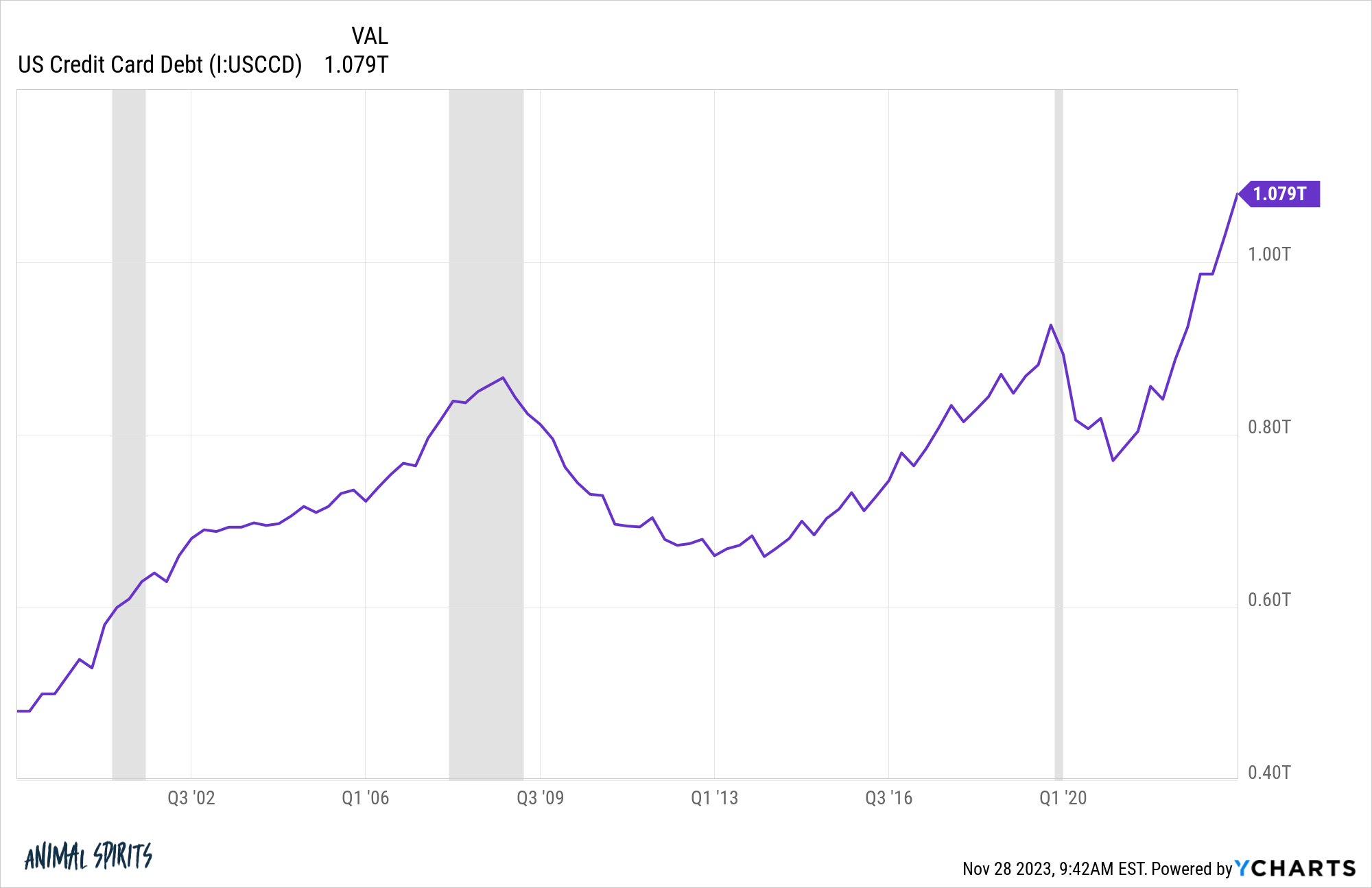

The whole quantity of bank card debt goes greater:

Complete bank card debt going over a spherical quantity like $1 trillion is frightening however we additionally must put these numbers into perspective.

Bear in mind inflation is up 20% or so cumulatively since 2020. In the event you alter bank card debt for inflation we’re principally again to 2018 or 2019 ranges.

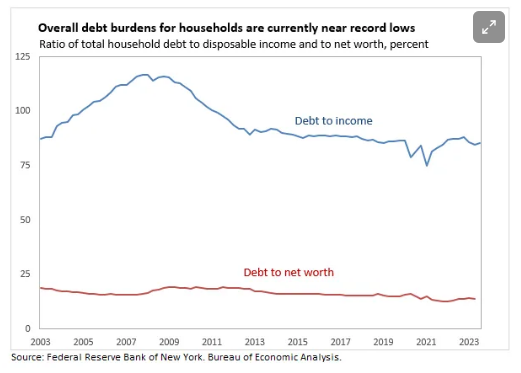

Now have a look at debt relative to revenue and web value (by way of Claudia Sahm):

Not so unhealthy.

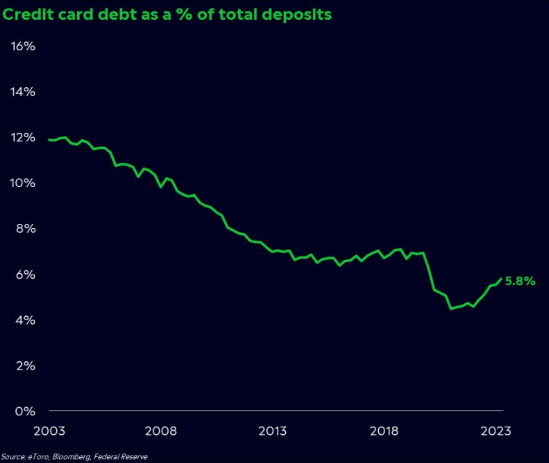

Callie Cox has this nice chart that exhibits bank card debt as a proportion of financial institution deposits:

It’s on the rise however approach decrease than most of this century.

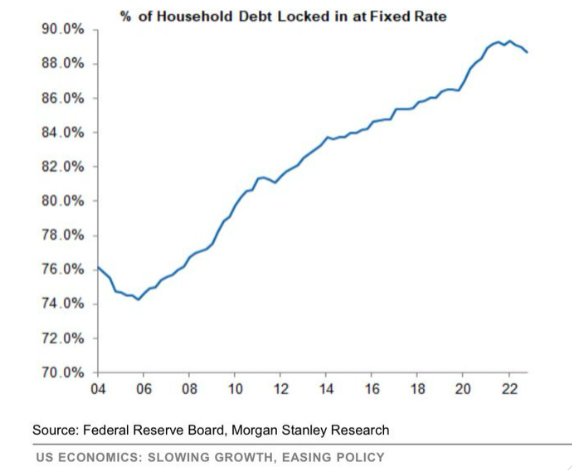

Or how concerning the quantity of family debt that it locked in at a hard and fast charge:

Increased borrowing prices are clearly having an affect on some customers proper now. It’s a painful expertise if you happen to’re borrowing for a home or automotive proper now.

And I’m certain there are many households who’re taking over bank card debt they’ll’t deal with.

However issues aren’t uncontrolled…but.

3. Who has the most important gripe concerning the financial system proper now? There are at all times winners and losers within the financial system but it surely feels just like the haves and haven’t are much more magnified than ever within the info age.

Increased costs have strained many family stability sheets for many who haven’t seen their incomes sustain with inflation. And people working in rate of interest delicate industries (like actual property) are actually feeling the ache proper now.

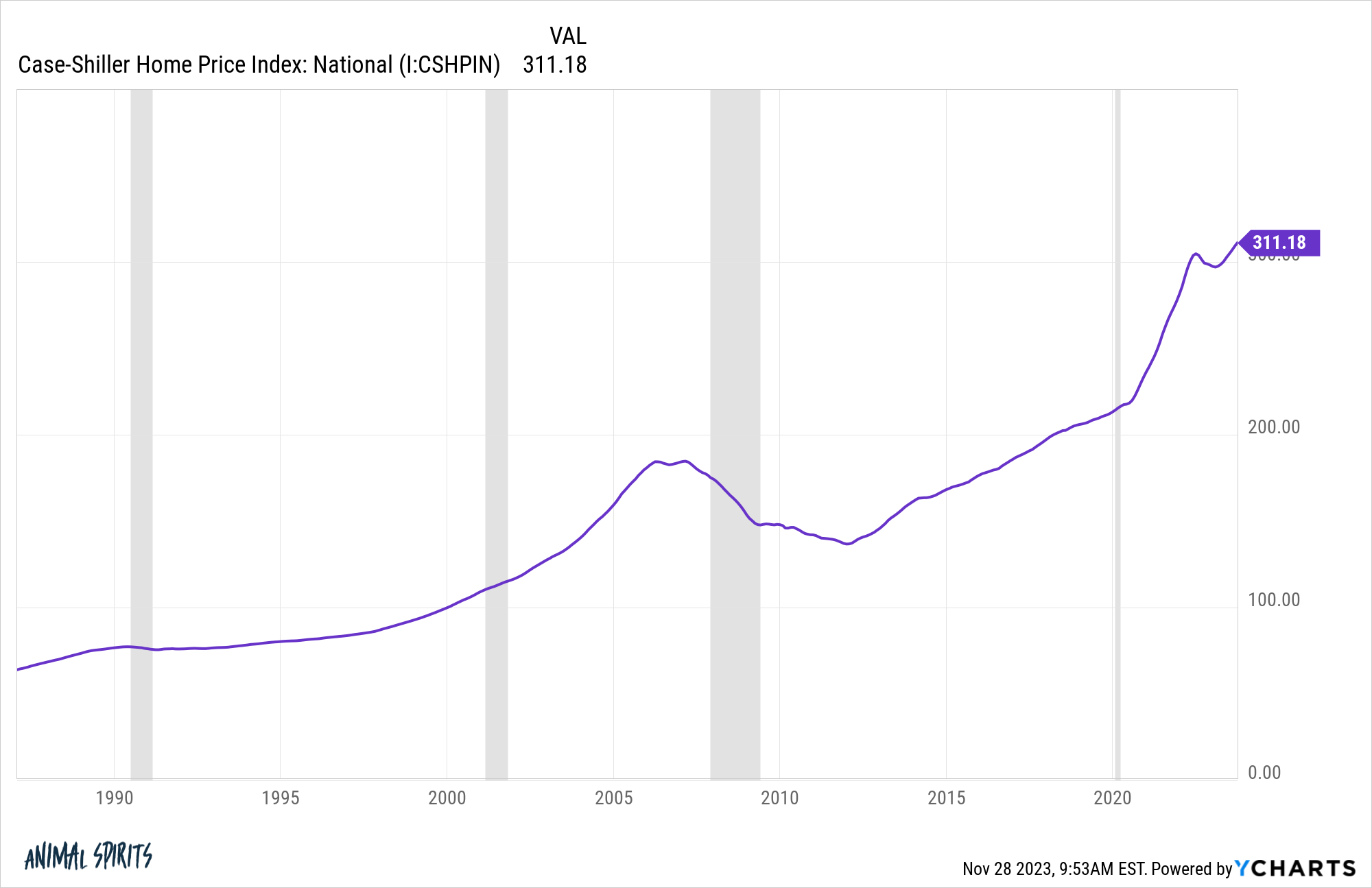

However younger folks within the first-time homebuyer stage of life may need the precise to air probably the most grievances this Festivus season. Housing costs hit one other new all-time excessive in information launched from Case-Shiller this morning:

In the event you missed the ~50% rise in costs for the reason that begin of the pandemic and the three% mortgage charge cycle and noticed your rents improve you will have each purpose to be disenchanted with this financial system.

4. Will we ever see an excellent time to purchase a home once more? Annie Lowrey at The Atlantic asks if it’s going to ever be an excellent time to purchase a home once more:

It’s a horrible time to purchase a home. However that information, unhealthy as it’s, appears to convey some promise: Sometime, issues will change and it’ll as soon as once more be an excellent second to purchase. You simply have to attend. I’m sorry to inform you that the unhealthy information is even worse than it sounds. It’s not going to be an excellent time to purchase a home for a extremely very long time.

Demographics are future within the housing market, so I used to be pretty assured within the 2010s that we’d see a 2020s housing growth when millennials reached their family formation years.

However demographics couldn’t have predicted a pandemic would trigger a decade’s value of good points to happen in lower than three years.

Child boomers are possible going so as to add provide to the housing market someday within the 2030s as they promote or die off. We simply don’t know what unexpected components may trigger this pattern to hurry up or decelerate within the years forward.

Every part is cyclical so I’m assured it will likely be a purchaser’s market once more sooner or later. You may simply must be affected person.

5. Are financial sentiment gauges damaged without end? It’s no thriller that individuals hate inflation and financial volatility. That’s an enormous purpose why shopper sentiment is in the bathroom even within the face of sturdy financial progress and a low unemployment charge.

However there’s extra to the sentiment piece than greater costs.

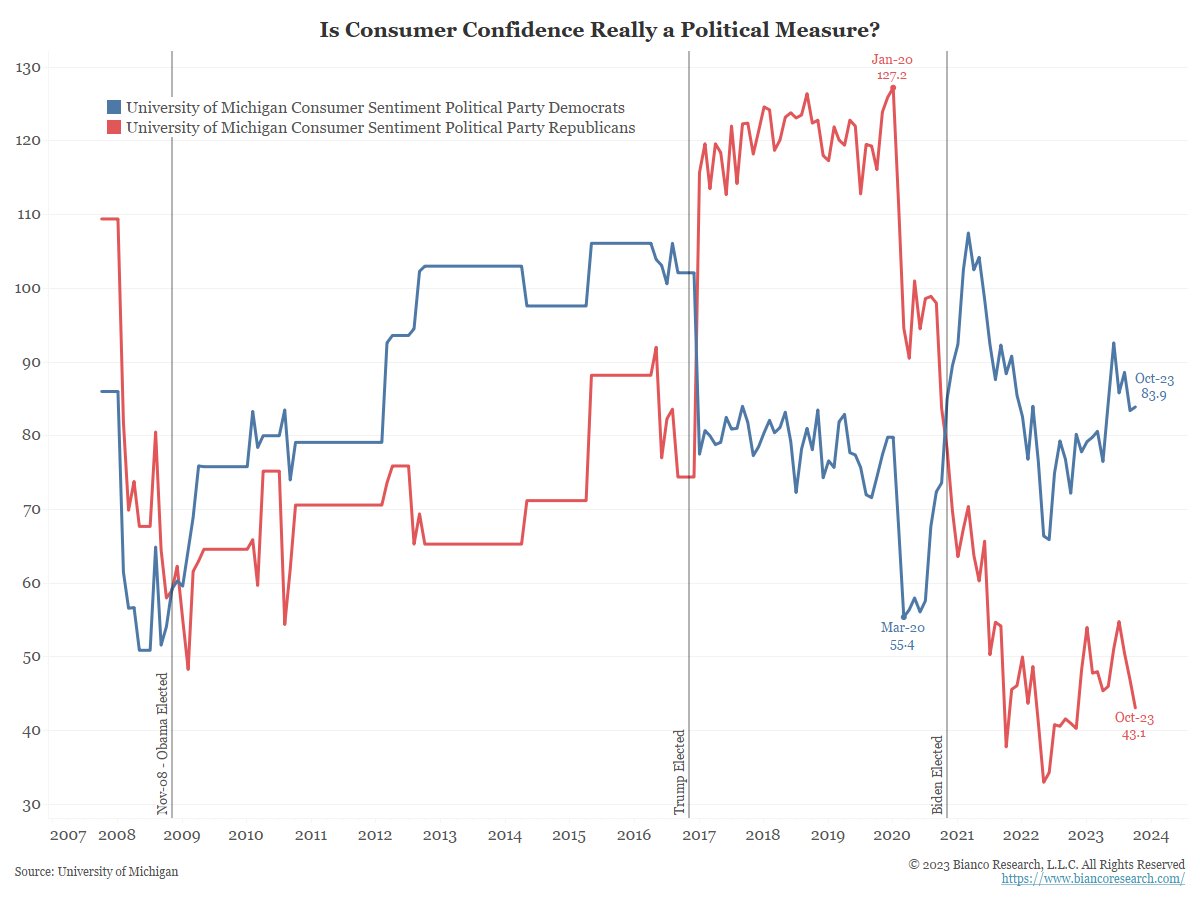

Jim Bianco has a chart that exhibits sentiment damaged out by Democrats and Republicans over time:

When Obama was president Democrats thought the financial system was higher. When Trump was president Republicans thought the financial system was higher. When Biden grew to become president it flipped once more.

These aren’t reasonable reflections of the financial system. It’s how folks really feel about their group.

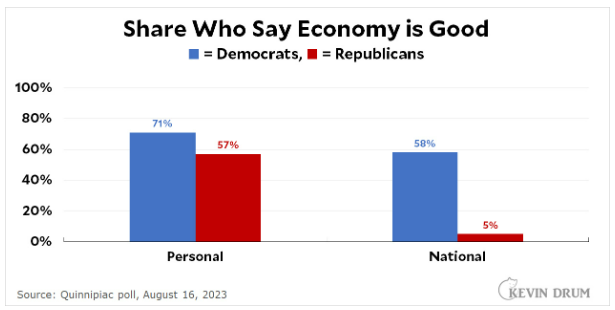

Individuals even have a tough time reconciling their very own state of affairs with how they really feel concerning the financial system (by way of Kevin Drum):

I’m doing high-quality however everybody else is doing horrible.

Social media and 24 hour information networks make it so much tougher to belief sentiment readings as we speak.

It’s most likely solely going to worsen no matter how the financial system is doing.

Watch what they don’t what they are saying.

Additional Studying:

Seeing Each Sides of the U.S. Economic system

[ad_2]