[ad_1]

Globally, the rising youth inhabitants presents a possible for financial development. Nonetheless, youth in growing international locations additionally nonetheless face obstacles to entry monetary companies, comparable to three of 10 million Cambodian younger adults who stay financially underserved.

Youth financial savings, particularly, has immense potential for enhancing a rustic’s gross financial savings price, asset-building and instilling wholesome monetary habits in clients. At Girls’s World Banking (WWB), we now have seen repeatedly the social and monetary returns for monetary service suppliers that acknowledge this chance.

In Cambodia, WWB and AMK Microfinance Establishment designed and piloted options to drive younger grownup buyer engagement and financial savings, leveraging WWB’s women-centered design methodology. On this weblog, we share 5 design rules which might be efficient in rising product consciousness, account acquisition and activation amongst Cambodian younger adults (YA).

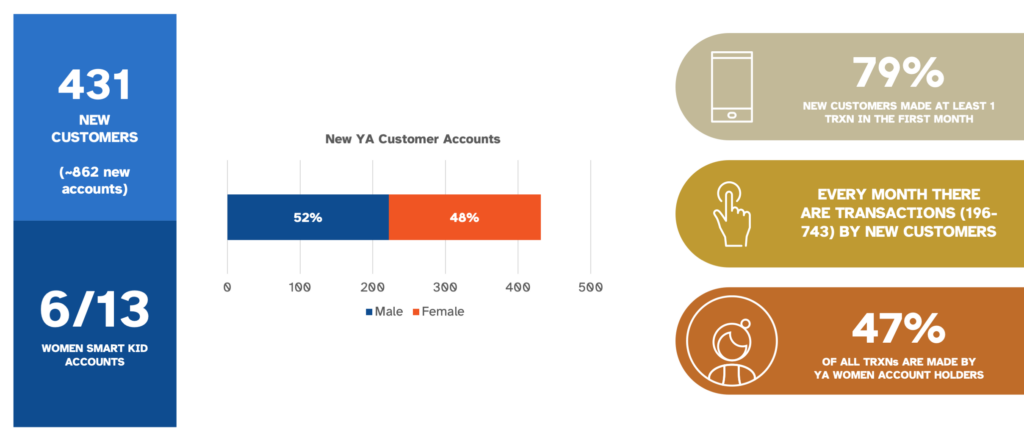

These 5 guiding rules led to 431 new YA clients (ages 18-35) between February-Could 2023, with 79% of latest clients making at the least one transaction within the first month. Of those new clients, 48% (209) have been feminine clients. With our methodology, we proceed to see product adoption charges on common are the identical for women and men, whereas with out this system ladies clients are usually left behind.

Pilot Outcomes and Analysis: Elevated Consciousness and Engagement

Our earlier buyer analysis has knowledgeable us that monetary literacy and capabilities amongst low-income Cambodian younger adults are low. Nonetheless, there’s a demand for elevated digital literacy, accessible, and reliable digital monetary companies.

On account of these learnings, we piloted our monetary options between February-Could 2023 and focused non-student YA and YA College college students between the ages of 18 and 35.

The general pilot reached a complete of 71,144 younger adults via on-line (digital advertising by way of Fb) and offline (on-site sales space activation at universities) campaigns and engagement actions, of which 431 new clients opened an AMK account, with 79% of latest clients making at the least one transaction within the first month. Of those new clients, 48% (209) have been feminine clients.

The 5 Design Rules that Led to 431 New AMK Prospects

Based mostly on prior buyer analysis, we created resolution parts that targeted on elevating buyer consciousness via campaigns, learn-by-doing approaches to construct digital monetary capabilities, and incentives to assist construct monetary behaviors and inspire clients.

These parts boiled down to 5 core design rules. With these rules, we search to assist monetary service suppliers attain out to YA ladies clients and supply them with accessible digital monetary options.

1. Increate general visibility and model

The general pilot reached a complete of 71,144 younger adults via on-line (digital advertising) and offline (on-site sales space activation at universities) campaigns and engagement actions, rising model consciousness amongst YA, particularly YA ladies. Leveraging channels that YA want and use, comparable to Fb, YouTube, and Instagram, will help attain the correct viewers and assist them make knowledgeable choices on what monetary services and products can be found to them. Via the social media campaigns alone, we reached 35,958 ladies clients via static and video posts on Fb.

2. Present Clear worth proposition

For monetary establishments who haven’t served YA ladies segments beforehand, there’s a have to re-position themselves to achieve these clients. It requires speaking its advantages and values that talk to the potential youthful clients. We took an lively method by establishing college cubicles to introduce AMK as a reliable monetary supplier, the place YA college students might be taught extra about AMK and in regards to the financial savings account focused in direction of them.

“I wished to have a separate account for my financial savings. I additionally seen that AMK provides Loyalty Factors on high of a excessive rate of interest. So, I believe it’s a good match and relevant for college kids to save lots of up.” – 24-year-old Kampung Cham Province feminine pupil

3. Guarantee quick access and value of digital accounts

YA are usually extra tech-savvy and sometimes want to transact digitally. Making certain a simple and accessible transaction expertise is taken into account a top-of-funnel purpose. Our resolution offered simple cash-in and cash-out factors that helped clients fund their digital accounts and actively use, whereas additionally making certain clients might retrieve their cash when wanted. That is essential for pupil cashflow and wishes, particularly for varsity charges, provides, and every day wants.

4. Be taught-by-doing session

In-person assist is confirmed efficient in buying new clients. Different useful instruments are video tutorials to teach new clients about merchandise, the best way to use them, and might promote wholesome monetary habits. Our resolution offered each in-person studying periods together with video tutorials obtainable straight by way of the cellular banking utility. We see that YA are extra tech-savvy and sometimes in a position to navigate and like studying by themselves. Offering accessible studying tutorials assist help of their curiosity to discover extra digital use circumstances.

5. Construct digital monetary capabilities

Given the prevalence of digital banking, the answer helped YA ladies acquire confidence in utilizing cellular banking for top-ups and transfers. We used a number of channels to remind and inspire clients, comparable to Fb posts and push-notifications conveying messages which might be related to their wants to make use of their cellular banking app.

As core buyer bases start to age, as in AMK’s case, understanding the wants, challenges, and alternatives of serving YA, particularly YA ladies clients, can be an essential step to make sure that also they are financially included. Whereas low-income YA ladies clients face related challenges with digital and monetary literacy and abilities, our learnings and design rules present a pathway in direction of creating sustainable merchandise and techniques to achieve, educate, and assist younger grownup ladies clients use digital monetary companies and merchandise. If monetary service suppliers can present monetary companies, comparable to financial savings, for YA earlier than they attain maturity, they will domesticate a brand new technology of financially included, knowledgeable and empowered clients who can higher plan for and spend money on their futures. On the enterprise facet, monetary service suppliers have the chance to be the financial institution of selection for this buyer over their lifetime.

This work has been made attainable because of funding assist from the Australian Authorities’s Division of Overseas Affairs and Commerce (DFAT).

[ad_2]