[ad_1]

Actual property is among the best methods to diversify an funding portfolio. It has additionally historically been out of attain for a lot of buyers. That is quickly altering. The most effective actual property shares and ETFs let virtually anybody spend money on actual property.

There are a number of methods for small buyers so as to add actual property to their portfolios. One of many easiest is thru Actual Property Funding Trusts (REITs). These funding autos purchase and handle actual property property for his or her shareholders.

As a result of REITs are publicly traded and deal with tons of or hundreds of properties, they’re extra diversified and extra liquid than particular person actual property properties.

REITs are required to pay a minimum of 90% of their taxable earnings to their shareholders, and most buyers personal REITs for the dividend earnings.

The Greatest Actual Property Shares

Most REITs spend money on “classical” properties, like flats, homes, and industrial properties. Different REITs concentrate on a selected sort of actual property, like motels or warehouses, or much more specialised property like information facilities, hospitals, or cellular phone towers.

On this article, we’ll look primarily at “basic” REITs after which talk about a number of the extra attention-grabbing specialised REITs.

We’ll attempt to supply a various view of the sector and concentrate on a couple of of the perfect actual property shares, however we gained’t even come near overlaying all of the probably enticing shares.

This listing of the perfect actual property shares is designed as an introduction; if one thing catches your eye, you’ll wish to do further analysis!

📚 Study extra: When you’re new to property funding, our article outlines begin investing in actual property successfully.

1. Realty Earnings Company (O)

| Market Cap | $39.9B |

| P/E | 42.07 |

| Dividend Yield | 5.48% |

Realty Earnings is a 54-year-old REIT managing 13,118 industrial properties, primarily retail, with shops and eating places making up the majority of the properties. They generate $3.8B in annualized hire from 1,303 shoppers.

The Firm focuses primarily on US properties, with 10% of the portfolio in Europe, primarily within the UK). The most important shoppers of the REIT are Greenback Common, Walgreens, and Greenback Tree.

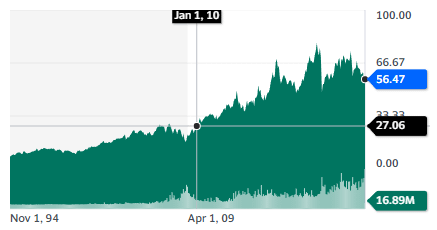

The corporate has grown its dividend for 29 consecutive years, attaining a 4.4% compound annual development fee (CAGR). It has grown its returns at a 14.2% CAGR since itemizing on the NYSE in 1994. This led to Actuality Earnings being included into the S&P 500 Dividend Aristocrats index in 2020.

The corporate has no publicity to the workplace actual property market following its merger with Vereit in 2021 and the spinning off of all workplace properties.

Actuality Earnings’s stability and comparatively excessive dividends are its major sights, with most of its earnings coming from firms with very robust manufacturers and enterprise fashions. This is among the greatest actual property shares for buyers on the lookout for publicity to the retail {industry}.

📚 Study extra: Discover our curated listing of the greatest books on actual property investing to boost your data and expertise.

2. AvalonBay Communities, Inc. (AVB)

| Market Cap | $25.8B |

| P/E | 20.46 |

| Dividend Yield | 3.64% |

AvalonBay is a REIT specializing in properties in “areas characterised by rising employment in excessive wage sectors of the financial system, decrease housing affordability and a various and vibrant high quality of life”. Or, in easier phrases, high-end flats in costly areas. This locations AvalonBay among the many greatest actual property shares for publicity to essentially the most worthwhile phase of the residential sector.

AvalonBay is trying to develop in chosen markets, with 3,600 new deliveries by the tip of 2024, including to the 89,000 house properties it already owns in 295 communities and 12 US areas.

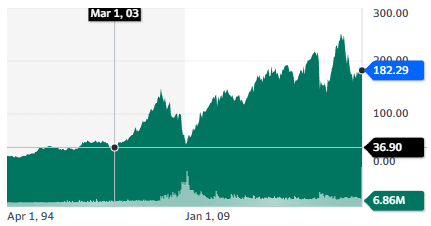

This concentrate on high-end properties has up to now paid off for AvalonBay, with an 11.3% CAGR efficiency since its IPO and a 4.8% annualized dividend development.

It is usually creating AvalonConnect, an built-in Web, WiFi, and Sensible House supply, rising the worth and comfort of the house it’s renting.

This technique additionally implies that AvalonBay’s outcomes are probably going to be fairly tightly correlated with the general monetary well being of the US, particularly the inventory market and tech {industry}, contemplating its presence in California and the Northern East Coast.

📚 Study extra: Uncover the perfect actual property funding apps that may assist streamline your funding journey.

3. Fairness Residential (EQR)

| Market Cap | $24.4B |

| P/E | 30.31 |

| Dividend Yield | 4.12% |

Fairness Residential was based in 1968 by legendary actual property investor Sam Zell, a pioneer of REITs and public actual property firms, offering main tax benefits to its buyers.

I didn’t invent the fashionable REIT {industry}, however I helped make it dance…

Sam Zell

The corporate is at present managing 304 properties with a complete of 80,212 house items. The corporate is concentrated on main US city facilities in California, Boston, NY, Washington DC, and Seattle.

Fairness Residential focuses on prosperous renters with excessive ranges of schooling and earnings, with most residents having fun with a median annual earnings of $172,000 and paying solely 20% of their earnings in hire. This enables the corporate to indicate a really robust 96% occupancy fee and a hire development fee of three.9% in April 2023.

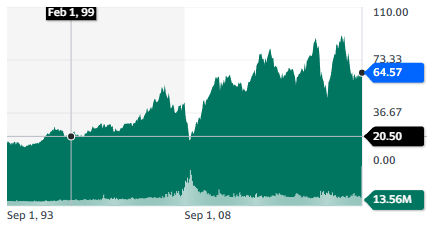

Fairness Residential has grown returns at an 11.1% CAGR since its 1993 IPO, with dividends rising at a 6.4% CAGR.

The corporate has additionally been on the forefront of innovation in actual property, adopting digital lease signing in 2008 and cloud-based providers and self-guided excursions in 2012. It’s now investing in EV chargers, building-wide WiFi, good properties, and IoT (Web of Issues).

Since its basis, Fairness Residential has been a pacesetter in innovation in actual property, and it’s probably that even with the demise of its founder, this entrepreneurial DNA will proceed to make this firm stand out in the perfect actual property shares market.

With a big publicity to the Californian and Seattle markets, the corporate is more likely to do nicely so long as its tenants working within the tech {industry} are prospering.

4. Simon Property Group, Inc. (SPG)

| Market Cap | $42B |

| P/E | 17.05 |

| Dividend Yield | 6.86% |

Simon Property is concentrated on industrial actual property, primarily purchasing malls. It holds 250 properties in 37 states and 14 nations. The worldwide publicity is from 34 shops, 4 malls in Asia, and 22.4% possession in Klépierre (130 properties in Europe – ticker: LI.PA).

Revenues reached $5.3B in 2022, and the corporate paid $2.6B in dividends.

Malls have been a troubled sector of the US actual property markets for some time, however high quality additionally performs a task. Occupancy at Simon’s properties was standing at a excessive stage of 94.7% in June 2023, up from 93.9% a 12 months earlier than. So, whereas some malls could be struggling, Simon doesn’t appear considerably affected by it.

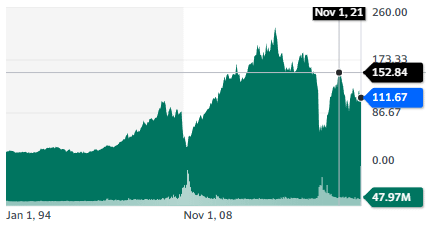

Nonetheless, the inventory worth has been affected by the pessimism about US malls, resulting in the corporate’s worth per share dropping by virtually 50% since 2016, leaving a reasonably excessive dividend yield.

This can make Simon among the best actual property shares for buyers attempting to find larger yield and prepared to take a guess that high-quality purchasing malls aren’t going wherever.

📚 Study extra: Discover sensible methods on how a lot that you must make investments to comfortably reside off dividends and safe your retirement.

5. Vornado Realty Belief (VNO)

| Market Cap | $4.74M |

| P/E | – N/A |

| Dividend Yield | 10.5% |

Vornado is one other among the best actual property shares on the market. This REIT is concentrated on Manhattan actual property, with a predilection for workplace house and retail property.

It owns 19.9 million sq. toes (Mqf) of workplace in New York, 2.5Mqf of retail house, and 1,663 residential items, in addition to 3.7Mqf in Chicago and 70% of a 1.8Mqf workplace complicated in San Francisco.

Within the context of the pandemic and the work-from-home (WFH) tendencies, the concentrate on workplace house has pushed buyers away from Vornado in the previous few years.

It is usually price noticing that regardless of monetary metric aggregators like Yahoo Finance exhibiting no dividend yield, the corporate has really distributed $2.45/share in 2023 up to now, with the following ex-dividend date on the 14th of September (used to calculate the dividend yield above).

Regardless of the downturn in workplace actual property, Vornado has registered a web earnings of $0.24/share in Q2 2023 and FFO (Funds from Operations) of $0.74/share.

Whereas WFH & hybrid work formulation are probably right here to remain post-pandemic, it is usually probably that giant companies like tech and monetary firms will nonetheless be on the lookout for high-quality, central NYC workplace house.

Investing in Vornado is a guess that the disaster has pushed the corporate’s shares under their truthful worth and displays extra uncertainty than everlasting impairment to Vornado property. The redevelopment of the Penn Station space might generate further upside as nicely.

Speciality & Industrial REITs

Not all REITs deal in properties, workplaces, or industrial areas. Extra specialised provides can present buyers with publicity to sectors the place they may by no means purchase actual property immediately themselves.

6. American Tower Company (AMT)

This REIT is specialised in cellular phone towers and telecommunication infrastructure. They construct the towers after which hire the house to a number of telecom firms. Its inventory worth has grown by 6x since 2009, not together with dividend returns. This is among the greatest actual property shares for buyers trying to acquire publicity to the telecommunications {industry}.

7. Equinix, Inc. (EQIX)

One other one on our listing of greatest actual property shares is Equinix. This REIT gives and manages 250 information facilities and associated infrastructure with an industry-leading 99.9999% uptime. It’s planning to open one other 57 information facilities. It generated revenues from the Americas ($890M in Q2 2023), the EMEA area (Europe, Center East, Africa – $687M), and Asia ($442M).

8. Prologis, Inc. (PLD)

This REIT is concentrated on logistics actual property, with most of its property within the US and Europe and a few in South America and Asia. The corporate has enormously benefited from the expansion of e-commerce, which makes use of virtually 3x extra logistics services than brick-and-mortar retail. Occupancy is at an all-time excessive of 98%. With hire at simply 3-6% of provide chain value, that is additionally not essentially the most price-sensitive value for logistical firms.

9. Welltower Inc. (WELL)

Welltower is a healthcare infrastructure REIT, with property like senior housing, medical workplaces, and post-acute care rehabilitation facilities (out of hospitals). The corporate is benefitting from the pattern of an ageing inhabitants and the newborn boomer technology retiring and “downsizing” their dwelling house.

10. VICI Properties Inc. (VICI)

VICI is a REIT specializing in playing actual property (50 properties – 60,300 resort rooms & 450+ eating places, bars, nightclubs, and sportsbooks), in addition to golf programs (54 areas). Its properties embrace the Caesars Palace Las Vegas, MGM Grand, and the Venetian Resort Las Vegas. It additionally owns 34 acres of undeveloped Las Vegas land.

11. Modern Industrial Properties, Inc. (IIPR)

The commercial REIT focuses on providing greenhouses for the hashish {industry} and related services. By doing so, it gives capital to an {industry} in dire want of it and in addition gives experience in hashish rising and greenhouse administration at scale. It has one of many highest dividend yields within the REIT {industry}, at 9.41% on the time of writing of this text.

12. Farmland Companions Inc. (FPI)

The most important American farmland REIT by acreage, Farmland Companions owns or manages 190,000 acres in 20 states, with a document 0% emptiness throughout the portfolio. The fund counts on lowering arable floor mixed with rising inhabitants and the world’s GDP to extend durably farmland worth. 10% of the portfolio (30% by worth) is everlasting crops like orchards or vineyards.

13. Alexandria Actual Property Equities, Inc. (ARE)

Alexandria rents out services for the life sciences industries, like analysis labs, testing services, campuses, and so on., already outfitted with superior equipment and gear. By doing so, it builds clusters of innovation, bringing in a single spot: innovation, capital, and human assets. The corporate has 825 tenants. This is among the greatest actual property shares for buyers who’re additionally within the life sciences industries.

Greatest Actual Property ETFs

Investing in the perfect actual property shares can carry some dangers as a result of debt or particular sectors and techniques, so buyers on the lookout for broad publicity to actual property as an asset class can use ETFs whereas decreasing buying and selling prices.

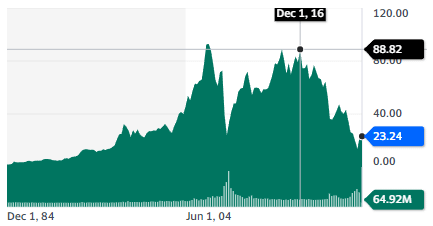

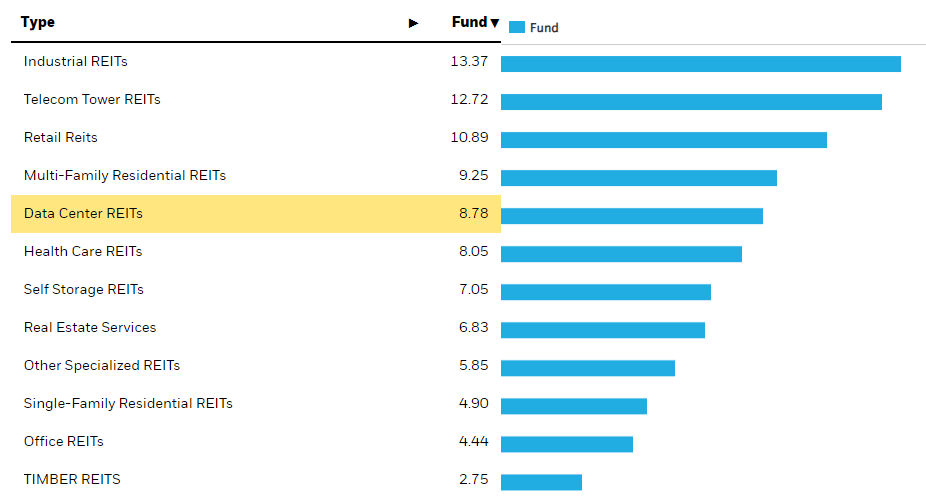

14. iShares U.S. Actual Property ETF (IYR)

This ETF offers a variety of US REITs, with a desire for area of interest and specialised industrial REITs like its high 5 holdings of Prologis, American Tower, Equinix, Public Storage, and Crown Fortress.

15. Invesco KBW Premium Yield Fairness REIT ETF (KBWY)

This ETF is concentrated on small and mid-cap REITs to be able to goal the next dividend yield, at present standing at 8.2%.

16. Inexperienced Constructing ETF (GRNR)

This ETF focuses on firms using the increase in additional energy-efficient buildings. Greater than half of the ETF is product of actual property firms, with the remainder overlaying gear and producers.

17. iShares Residential and Multisector Actual Property ETF (REZ)

This ETF contains all kinds of US actual property, together with in its high 10 holdings residential actual property REITs like AvalonBay, Fairness Residential, Invites Properties, and Mid-America House Group. That is most likely among the best ETFs to characterize your entire US REIT {industry}.

18. Pacer Information & Infrastructure Actual Property ETF (SRVR)

This ETF is centered round information facilities, cellular towers, and different REITs specialised in telecommunications. This enables buyers to spend money on the sector as a complete with out having to choose which expertise or technique is the perfect on this extremely technical sector.

19. World X MSCI China Actual Property ETF (CHIR)

This ETF seems to be at actual property past the US and focuses on China. This can be a sector that has suffered enormously, as illustrated by the current chapter of developer Evergrande. So, that is probably an ETF just for contrarian buyers trying to guess on a rebound of China’s actual property sector.

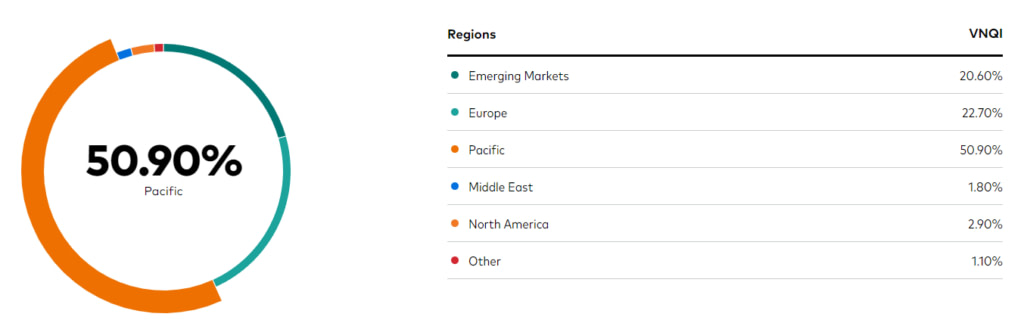

20. Vanguard World ex-U.S. Actual Property ETF (VNQI)

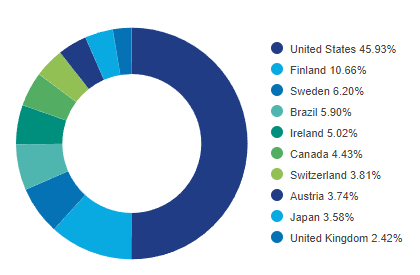

This ETF invests in actual property in every single place BUT within the USA. It’s largely energetic in Asia, Japan, and Korea, adopted by rising markets and Europe. It could supply diversification from US actual property investments, giving international publicity to actual property markets.

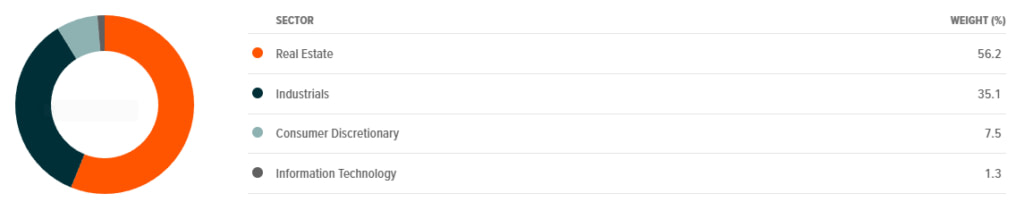

21. Invesco MSCI World Timber ETF (CUT)

Land can be utilized for farming, residential, or industrial functions. Or it might “merely” develop a forest, which turns over time into helpful timber and wooden and grows irrespective of the financial circumstances. This ETF permits buyers to get international publicity to the timber {industry}, with a lot of the land managed with accountable forestry practices within the USA and Europe.

Conclusion

Actual property is an asset class as massive, various, and sophisticated as shares or bonds. It is usually characterised by excessive illiquidity and substantial administration calls for.

REITs present hassle-free returns and liquidity along with much-needed diversification. The fashionable REIT {industry} gives ample alternative for personalized publicity to a selected area, actual property sort, or financial sector.

Actual property ETFs can present much more diversification, permitting one to create an actual property portfolio that may be actually personalized to 1’s wants.

In any case, buyers on the lookout for the perfect actual property shares will must be cautious, particularly in a rising fee setting that may make refinancing troublesome. So, a low stage of debt and strong money move ought to be most well-liked over extra leveraged REITs and funds. And, in fact, like for any actual property funding, solely 3 issues will in the end matter: location, location, and … location.

[ad_2]