[ad_1]

[Updated on February 16, 2024 for 2023 tax filing.]

The earlier put up State Tax-Exempt Treasury Curiosity from Mutual Funds and ETFs coated the best way to get state earnings tax exemption on the portion of mutual fund and ETF dividends which are attributed to curiosity from Treasuries. This put up covers the best way to do the identical on the portion of fund dividends attributed to muni bond curiosity.

Muni Bond Funds and ETFs

Buyers in greater tax brackets typically put money into muni bonds of their taxable accounts. Though muni bonds sometimes have a decrease yield than Treasuries and company bonds, they typically nonetheless pay extra after-tax when the investor is in a excessive tax bracket.

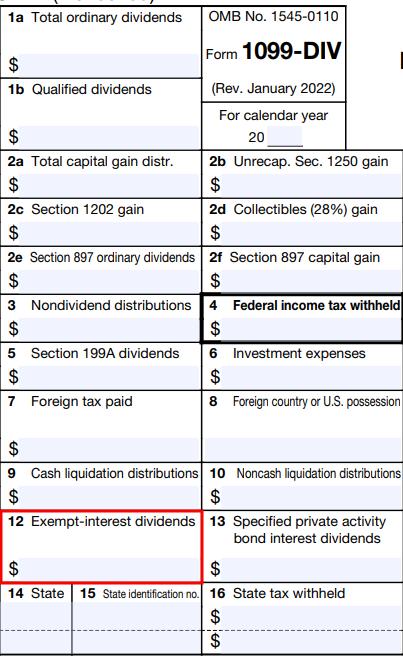

Most individuals put money into muni bonds by way of muni bond funds and ETFs. The dealer experiences fund dividends attributed to muni bond curiosity individually in Field 12 on a 1099-DIV type.

Your tax software program is aware of about this particular field. Whether or not you import your 1099 varieties or enter them manually, the tax software program will mechanically mark the quantity as tax-exempt for federal earnings tax.

Federal Tax-Exempt vs. State Tax-Exempt

It’s a special story for state earnings tax.

How a state taxes muni bond curiosity varies by state. Some jurisdictions akin to Washington DC exempt curiosity from all muni bonds. Most states often exempt curiosity solely from muni bonds issued by entities inside the state or in U.S. territories (Puerto Rico, Guam, Virgin Islands, and American Samoa). Some states have a reciprocal association — “We don’t tax curiosity out of your muni bonds in case you don’t tax curiosity from our muni bonds.”

You should know the way a lot of the federally tax-exempt dividends on the 1099-DIV type can be state tax-exempt. Your tax software program doesn’t comprehend it solely by the quantity on the shape.

The dealer provides a breakdown of the tax-exempt dividends by supply. It’s as much as you to find out how a lot of the federal tax-exempt dividends from every supply got here from state tax-exempt muni bonds.

Suppose you personal two funds in a taxable brokerage account that paid $2,500 in whole tax-exempt dividends as reported in Field 12 of the 1099-DIV type. Your aim is to fill out a desk like this with the proportion of state tax-exempt dividends for every fund and calculate your whole state tax-exempt dividends:

| Fund | Whole Tax-Exempt Dividend | % State Tax-Exempt | State Tax-Exempt Dividend |

|---|---|---|---|

| Fund A | $1,500 | 100% | $1,500 |

| Fund B | $1,000 | 25% | $250 |

| Whole | $2,500 | $1,750 |

Whenever you give the outcome to your tax software program, it then is aware of to exempt that portion of the federal tax-exempt dividends from state earnings tax.

State % from Fund Managers

Though the 1099-DIV type and the dividend breakdown by funds are offered by the dealer, you’ll must get the quantity for the “% State Tax-Exempt” column from the managers of your mutual funds and ETFs.

For those who personal Vanguard mutual funds or ETFs in a Constancy brokerage account, you get this info from Vanguard, not from Constancy. Equally, in case you personal iShares ETFs in a Charles Schwab brokerage account, you get the data from iShares, not from Charles Schwab.

Google “[name of fund management company] tax middle” to search out the data from the fund supervisor.

For example, the Vanguard doc exhibits that dividends from Vanguard New York Municipal Cash Market Fund are 100% tax-exempt in New York in 2023, and 23.93% of the dividends from the Vanguard Tax-Exempt Bond Index Fund got here from New York muni bonds.

Vanguard

Vanguard publishes the data in its Tax Season Calendar. Search for “Tax-exempt curiosity dividends by state for Vanguard Municipal Bond funds and Vanguard Tax-Managed Balanced Fund.”

Constancy

Constancy publishes the data in Constancy Mutual Fund Tax Data. Search for “Tax-Exempt Revenue From Constancy Funds.”

Charles Schwab

Charles Schwab Asset Administration publishes the data in its Distributions and Tax Middle. Search for “2023 Supplementary Tax Data.”

iShares

iShares publishes the data in its Tax Library. Search for “2023 Tax Exempt Curiosity by State.”

State-Particular Necessities

You’ll want to learn the high-quality print. Simply because a fund lists a share on your state doesn’t imply that the proportion of dividends from the fund is state tax-exempt. Some states have further necessities earlier than you possibly can declare the tax exemption.

For example, the Vanguard tax-exempt earnings doc consists of these footnotes:

California and Minnesota require funds to fulfill in-state minimal threshold to be exempt from state tax. The funds in Desk 2 don’t meet this standards [sic].

Illinois doesn’t exempt the portion of dividends from state or native obligations held not directly by way of a mutual fund.

This implies regardless that the desk exhibits {that a} portion of the dividends from Vanguard Tax-Exempt Bond Index Fund got here from California muni bonds, California exempts none of it as a result of the fund didn’t meet the state’s further necessities. For those who stay in Illinois, you possibly can’t declare any Illinois tax exemption on muni fund dividends, interval.

Tax Software program

You should give the outcome to your tax software program after you get the “% State Tax-Exempt” for every fund and calculate your State Tax-Exempt dividend with a desk like this:

| Fund | Whole Tax-Exempt Dividend | % State Tax-Exempt | State Tax-Exempt Dividend |

|---|---|---|---|

| Fund A | $1,500 | 100% | $1,500 |

| Fund B | $1,000 | 25% | $250 |

| Whole | $2,500 | | $1,750 |

TurboTax

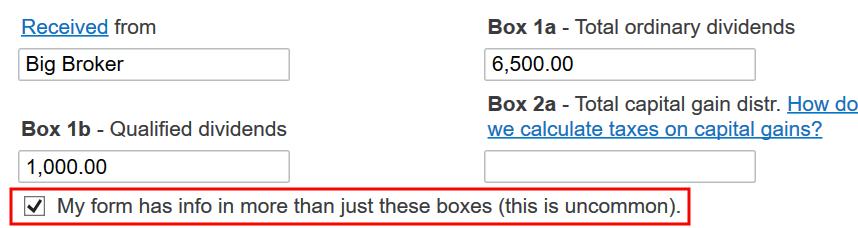

For those who enter your 1099-DIV type manually, make sure the examine the field for extra inputs to enter tax-exempt dividends in Field 12.

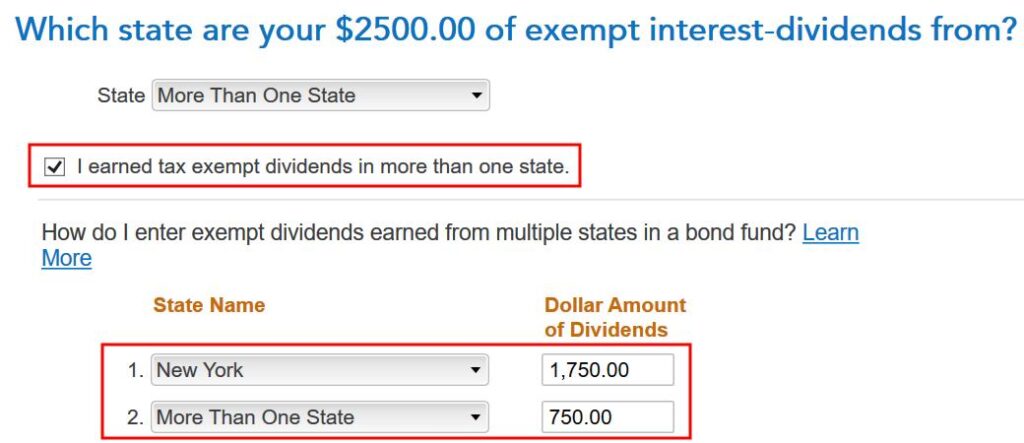

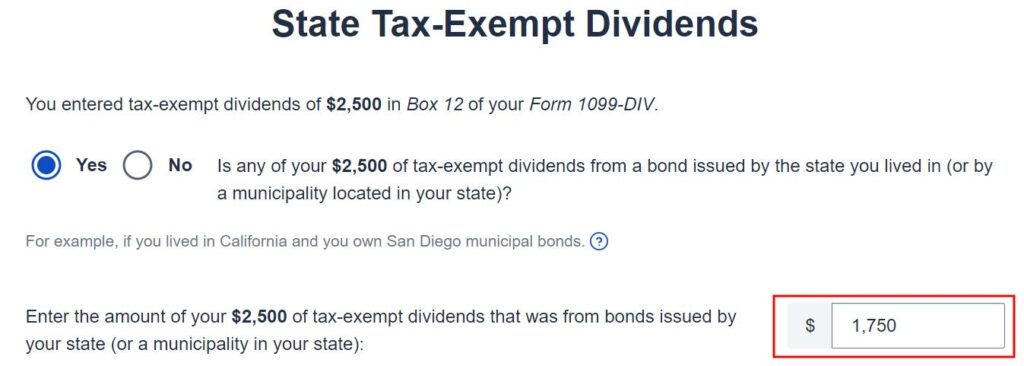

Until your tax-exempt dividends got here from a state-specific fund that’s 100% tax-exempt in your state, examine the field “I earned tax exempt dividends in a couple of state” and break it down between your state and “Extra Than One State.” TurboTax will exempt the portion on your state in your state earnings tax return.

H&R Block

After you enter the tax-exempt dividends in Field 12 of a 1099-DIV type, H&R Block asks you the way a lot of it’s also state tax-exempt.

FreeTaxUSA

After you enter the tax-exempt dividends in Field 12 of a 1099-DIV type, FreeTaxUSA asks you the way a lot of it’s also state tax-exempt.

***

A lot of the work in calculating the quantity of fund dividends exempt from state taxes is in looking down the proportion of state tax-exempt earnings for every fund and ETF in your taxable brokerage account. Tax software program doesn’t comprehend it solely from the tax varieties.

Say No To Administration Charges

In case you are paying an advisor a share of your property, you might be paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.

[ad_2]