[ad_1]

Up to date on January 29, 2024, with up to date screenshots from H&R Block software program for tax 12 months 2023. If you happen to use TurboTax, see:

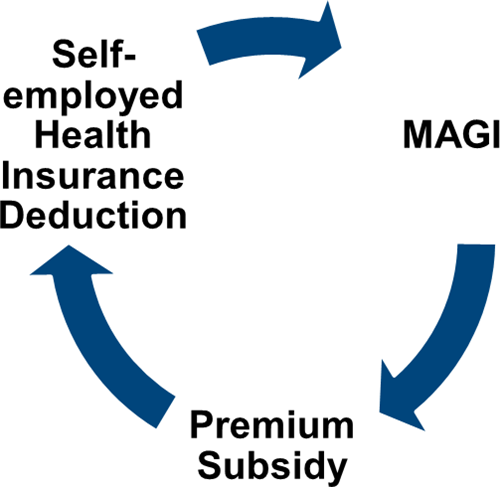

Many self-employed enterprise house owners purchase medical insurance from the Reasonably priced Care Act (ACA) healthcare market. Self-employed medical insurance premiums are tax-deductible. When your earnings is low sufficient, you may also obtain a subsidy within the type of a premium tax credit score. The tax deduction and the subsidy type a round relationship. The maths is tough to do by hand however tax software program simply handles it for most individuals.

Use H&R Block Downloaded Software program

The screenshots beneath are taken from H&R Block downloaded software program. The downloaded software program is manner higher than on-line software program. If you happen to haven’t paid to your H&R Block On-line submitting but, take into account shopping for H&R Block obtain software program from Amazon, Walmart, Newegg, and plenty of different locations. If you happen to’re already too far in getting into your information into H&R Block On-line, make this your final 12 months of utilizing H&R Block On-line. Swap over to H&R Block obtain software program subsequent 12 months.

Self-Employment Revenue

It’s best to enter all of your self-employment earnings and bills into the software program earlier than you begin doing medical insurance associated to your self-employment.

Self-Employed Well being Insurance coverage

I’m utilizing this situation for instance:

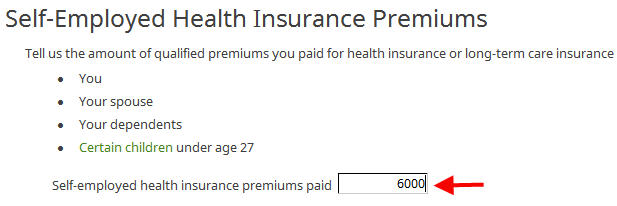

You’re single, self-employed, with no dependent. You had medical insurance from the ACA healthcare market for all 12 months within the 12 months. The second lowest price Silver plan was $600/month. The total unsubsidized premium for the plan you selected was $500/month. Primarily based in your estimated earnings, you bought a $150/month advance credit score. You paid internet $350/month out of pocket.

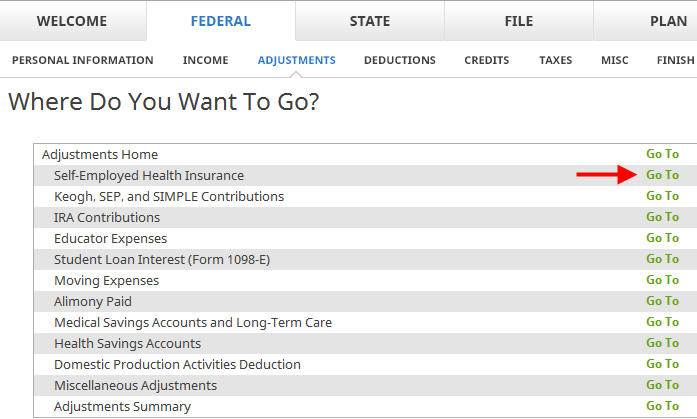

Go to Federal -> Changes -> Self-Employed Well being Insurance coverage.

Enter the full unsubsidized premiums to your medical insurance within the 12 months. You discover this quantity on the 1095-A type you obtain from the ACA healthcare market (line 33, column A). Embrace each what you paid out of pocket and the advance premium credit score paid by the healthcare market. You’ll reconcile the advance credit score later.

If you happen to additionally paid premiums for dental and imaginative and prescient insurance coverage, add these as effectively. We don’t have dental and imaginative and prescient premiums in our instance.

Proper now it says 100% of your premium is deductible. It’ll change after you enter extra data out of your 1095-A type.

Enter 1095-A

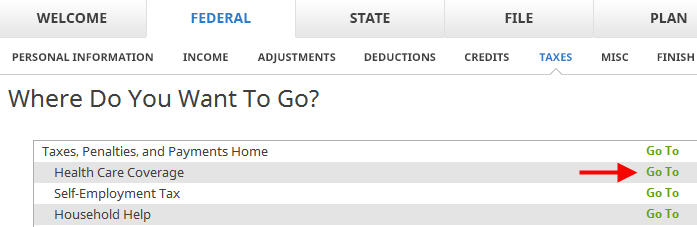

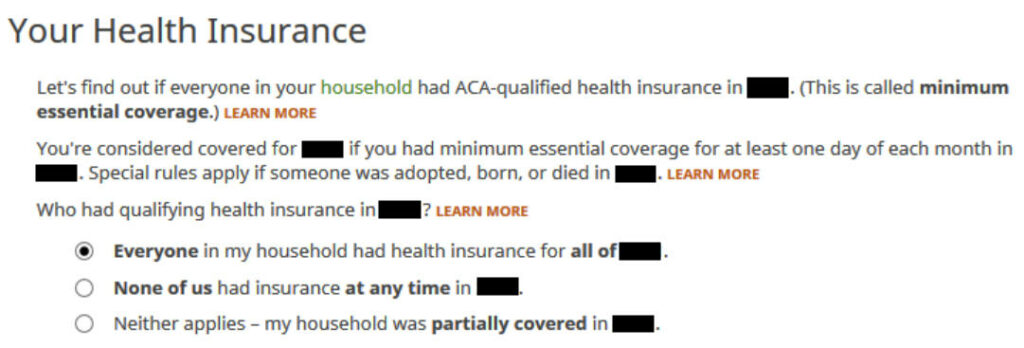

Go to Federal -> Taxes -> Well being Care Protection.

Everybody had insurance coverage in our instance.

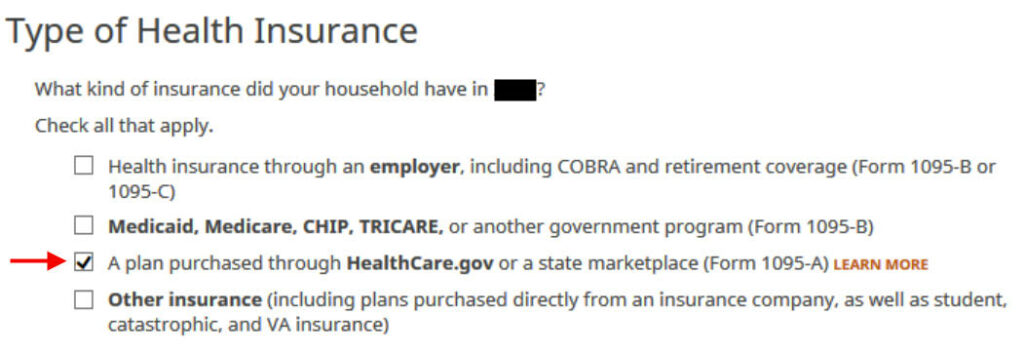

Test the field for a plan from the ACA healthcare market.

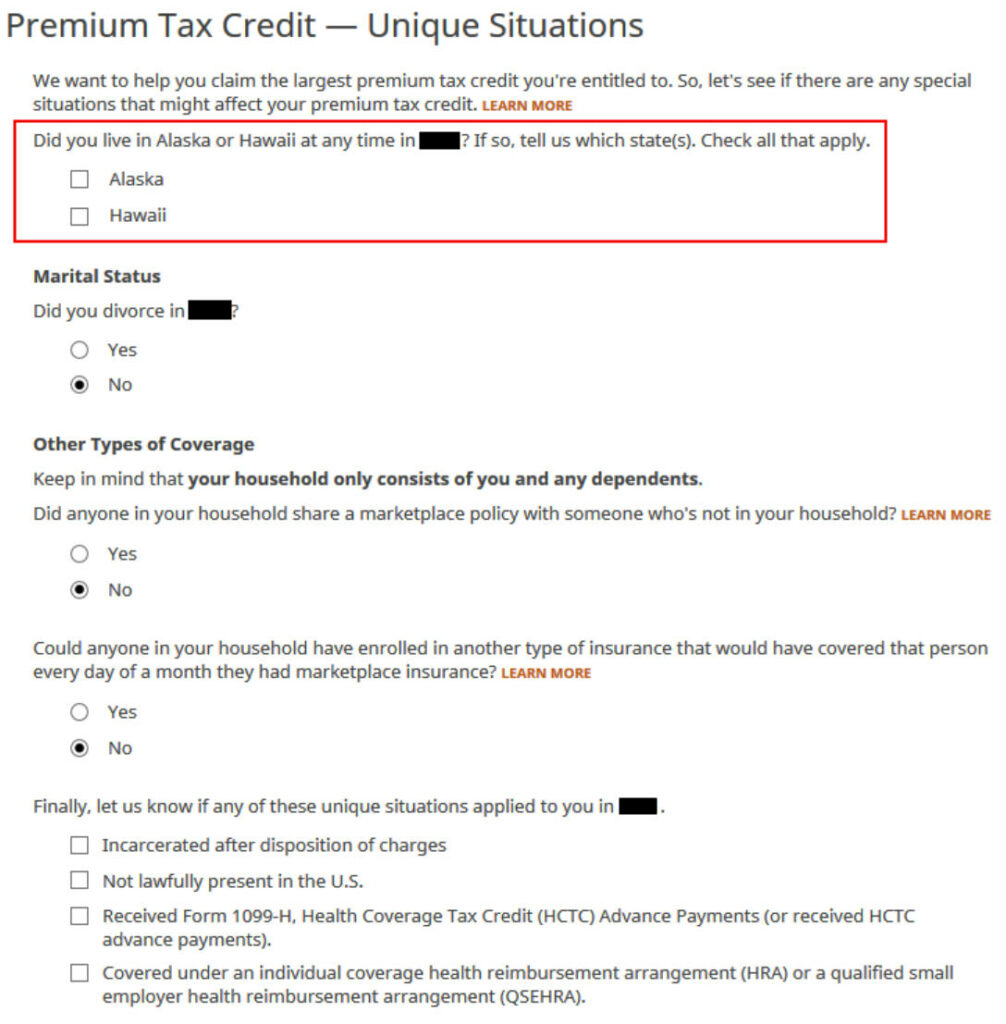

We don’t have any of those distinctive conditions right here. Test the field for Alaska or Hawaii in the event you lived there.

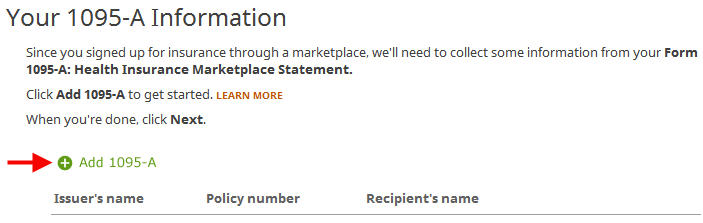

We have to add the 1095-A from the ACA healthcare market.

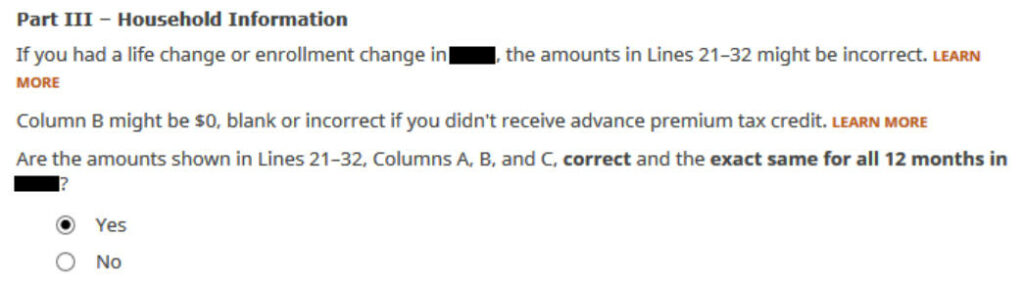

Enter the knowledge as requested. Scroll all the way down to Half III. The numbers on our 1095-A are the identical for all 12 months and proper in our instance. When you’ve got totally different numbers for some months, select ‘No’ and enter the month-by-month numbers out of your Type 1095-A.

Enter the month-to-month quantities from the 1095-A. The total unsubsidized premium was $500/month. The total unsubsidized premium for the second lowest price Silver plan was $600/month. The ACA healthcare market paid $150/month upfront subsidy to the insurance coverage firm on our behalf.

We solely have one 1095-A type in our instance. When you’ve got multiple, repeat and add all of them.

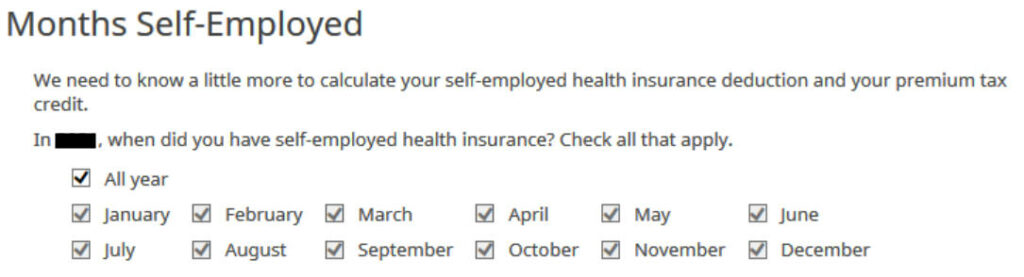

Which months you had been self-employed determines how a lot counts as deductible self-employed medical insurance. We had been self-employed in all 12 months in our instance.

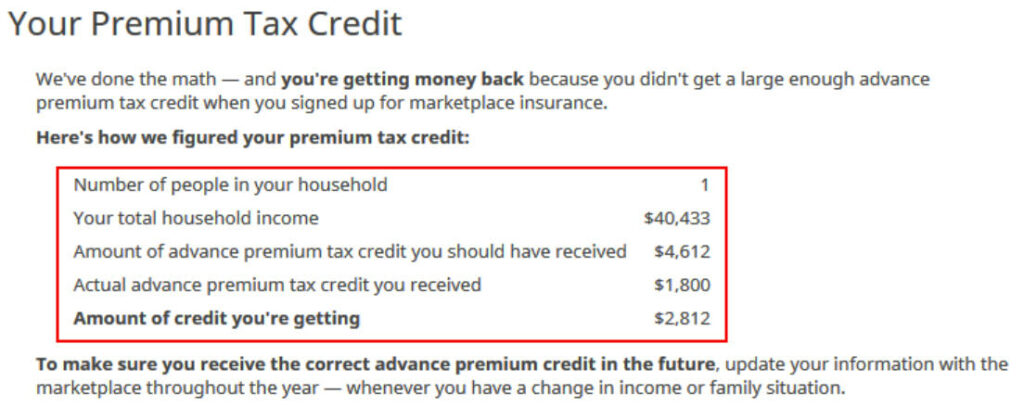

The software program crunches the numbers. It says we’re eligible for extra premium tax credit score than the advance subsidy the ACA healthcare market already paid to the insurance coverage firm.

Self-Employed Well being Insurance coverage Deduction

We’re eligible for a tax deduction on the quantity not coated by the re-calculated premium tax credit score.

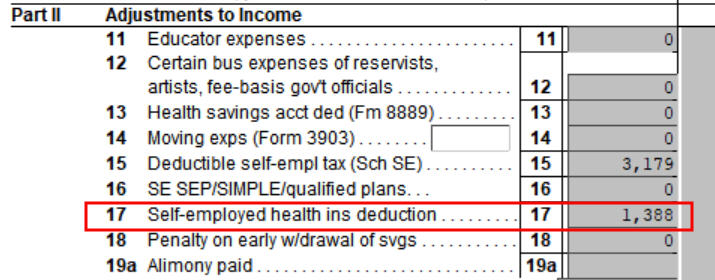

You’ll be able to confirm how a lot you’re receiving a tax deduction. Click on on Types on the high. Double-click on Type 1040 and Schedules 1-3. Scroll all the way down to Schedule 1 and take a look at line 17. That’s your self-employed medical insurance deduction.

Premium Tax Credit score

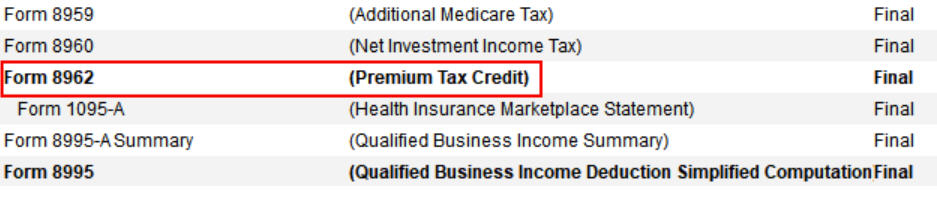

Shut Type 1040 and Schedules 1-3 and discover Type 8962 within the kinds record. Double-click on it.

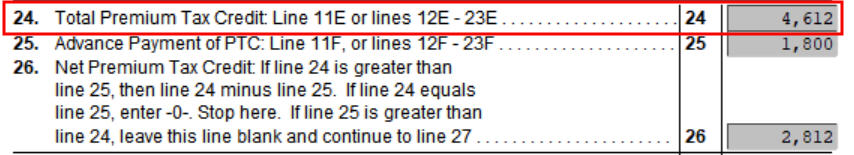

Scroll all the way down to Line 24 on Type 8962. That’s our premium tax credit score primarily based on our precise earnings. As a result of we acquired much less upfront subsidy, we’re getting the distinction in our tax refund. If you happen to acquired extra upfront subsidy, you’ll should pay again the distinction (topic to a cap, see Cap On Paying Again ACA Well being Insurance coverage Subsidy Premium Tax Credit score).

$1,388 in self-employed medical insurance deduction plus $4,612 in premium tax credit score equals $6,000. That’s the entire unsubsidized premium for our medical insurance (plus any dental and imaginative and prescient insurance coverage premium, which we didn’t have in our instance). The numbers add up!

The software program found out the break up between the tax deduction and the tax credit score. It additionally matched the end result from TurboTax for a similar instance. That is the place software program does its greatest. If you happen to take this to a tax skilled, they should use their software program to calculate the break up anyway. I wager they aren’t in a position to do it by hand.

Edge Circumstances

Tax software program works for many circumstances however it doesn’t work for everybody. you’re operating into one of many edge circumstances for which the tax software program doesn’t work when the numbers from the software program fail this equation (aside from a small distinction as a result of rounding):

Self-Employed Well being Insurance coverage Deduction + Premium Tax Credit score = Unsubsidized Well being Insurance coverage Premium (together with any dental and imaginative and prescient premiums)

When this occurs, you want a greater calculator. See When TurboTax and H&R Block Give Self-Employed Unsuitable ACA Subsidy.

Say No To Administration Charges

In case you are paying an advisor a share of your property, you’re paying 5-10x an excessive amount of. Discover ways to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]