[ad_1]

[Updated on January 30, 2024 with screenshots for 2023 tax filing.]

Many householders refinanced to a sub-3% mortgage when rates of interest had been low a few years in the past. The mortgage curiosity most individuals pay isn’t massive sufficient to make them itemize their deductions. They only take the usual deduction. Those that can nonetheless deduct their mortgage curiosity are inclined to have a big mortgage.

Restrict on Deduction

The Tax Cuts and Jobs Act of 2017 diminished the restrict on the mortgage steadiness on which you’ll deduct the mortgage curiosity from $1 million to $750,000. The decrease restrict applies to properties acquired after December 15, 2017. The big enhance in residence costs in recent times makes not too long ago purchased properties in high-price areas extra more likely to exceed the $750,000 restrict.

Nonetheless, lenders nonetheless report 100% of the mortgage curiosity paid on the 1098 type with out adjusting for both the outdated $1 million restrict or the brand new $750,000 restrict. In case your mortgage steadiness is over the restrict, deducting the mortgage curiosity is extra difficult than simply utilizing the quantity from the 1098 type.

It isn’t merely multiplying $750,000 by your rate of interest both when your mortgage steadiness began above $750,000 and ended beneath $750,000 or whenever you took out the mortgage in the course of the 12 months.

Common Mortgage Steadiness

A key idea is your common mortgage steadiness in the course of the 12 months. When your common mortgage steadiness exceeds the restrict, your deductible mortgage curiosity is:

Mortgage Restrict / Common Mortgage Steadiness * Precise Mortage Curiosity Paid

In case you paid $30,000 in mortgage curiosity on a mean mortgage steadiness of $1,000,000 and also you’re topic to the $750,000 restrict, your deductible mortgage curiosity is pro-rated to:

$750,000 / $1,000,000 * $30,000 = $22,500

IRS Publication 936 offers a number of methods to calculate your common mortgage steadiness:

- Common of first and final steadiness methodology

- Curiosity paid divided by rate of interest methodology

- Mortgage statements methodology

The primary methodology is less complicated and it offers you a barely bigger deduction however you should utilize it provided that you didn’t prepay multiple month’s principal in the course of the 12 months.

Right here’s the way it works in TurboTax, H&R Block, and FreeTaxUSA tax software program.

TurboTax

The screenshots beneath are taken from TurboTax Deluxe downloaded software program. The TurboTax downloaded software program is each cheaper and extra highly effective than TurboTax on-line software program. In case you haven’t paid in your TurboTax on-line submitting but, you should buy TurboTax obtain from Amazon, Costco, Walmart, and plenty of different locations and swap from TurboTax on-line to TurboTax obtain (see directions for the right way to make the swap from TurboTax).

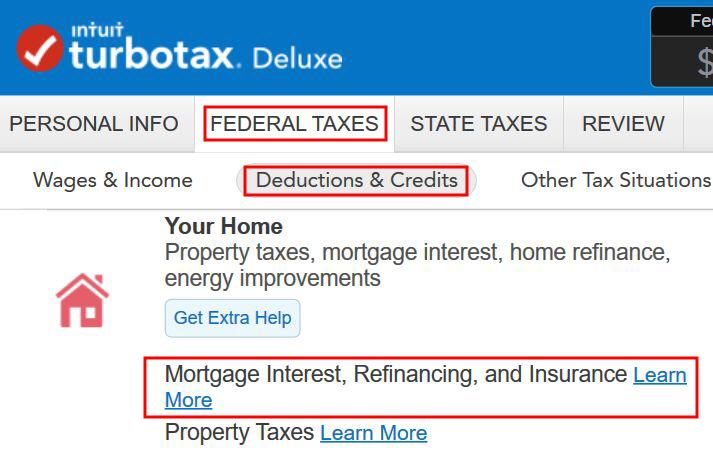

Discover the mortgage curiosity subject within the Your Residence part underneath Federal Taxes -> Deduction & Credit.

Kind 1098

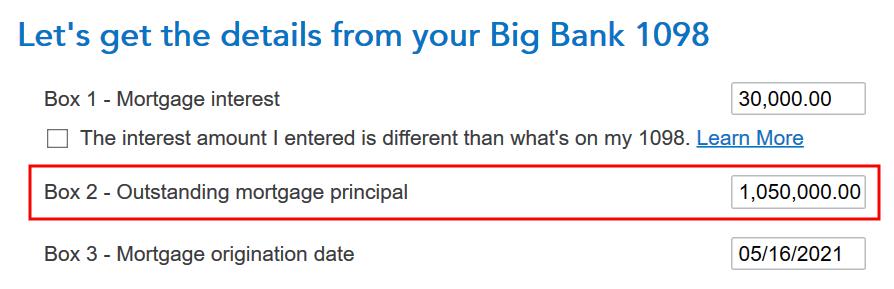

When it asks you to enter info out of your 1098 type, enter the numbers as they seem in your type. If Field 2 is clean in your 1098, enter the mortgage steadiness on the starting of the 12 months (or your starting mortgage steadiness in the event you took out the mortgage in the course of the 12 months).

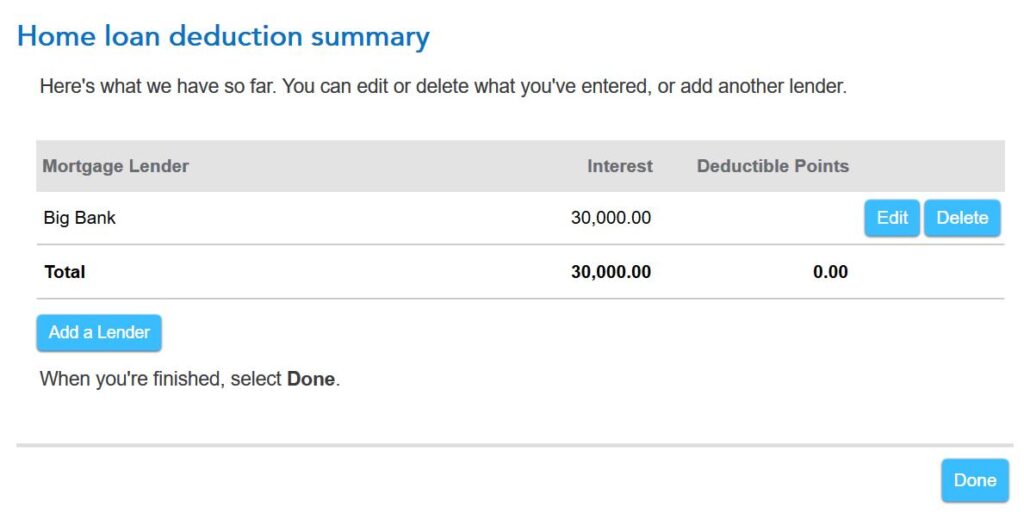

You get to this abstract after you reply just a few extra questions. Click on on Achieved however you’re not accomplished but.

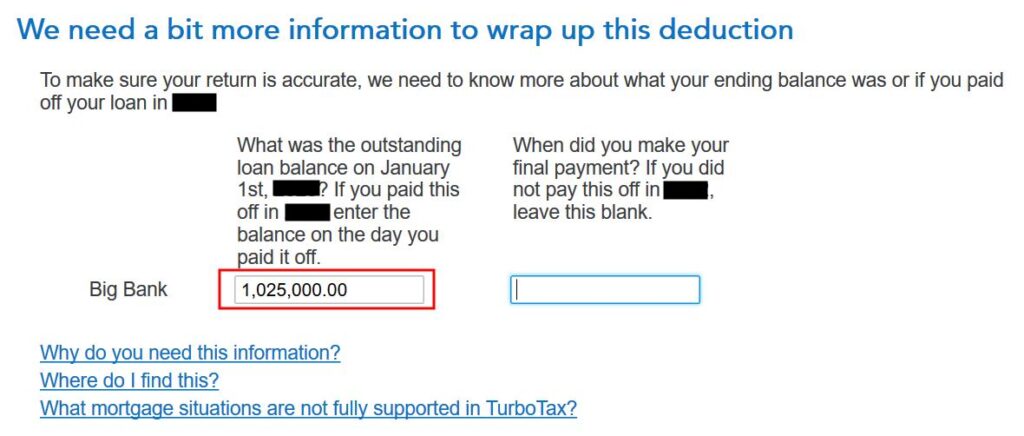

Buy Date and Ending Steadiness

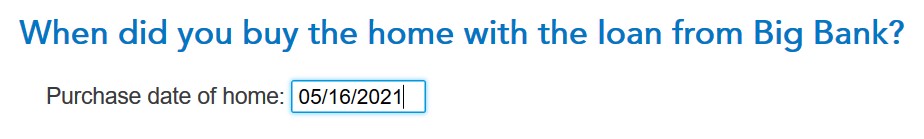

The acquisition date of the house determines whether or not you’ve gotten a $1 million restrict or a $750,000 restrict for the mortgage curiosity deduction. If this mortgage was from a refinance, you continue to enter the date whenever you initially purchased the house.

TurboTax asks for the steadiness as of January 1 of the next 12 months as a result of it makes use of the “common of first and final steadiness methodology” to calculate your common mortgage steadiness for the 12 months. This works whenever you didn’t make additional principal funds in the course of the 12 months.

TurboTax calculates a deduction utilizing the “common of first and final steadiness methodology” however you’ll be able to’t legally use that methodology in the event you pay as you go multiple month’s principal in the course of the 12 months. You need to calculate your common mortgage steadiness another way and provides the pro-rated deductible mortgage curiosity to TurboTax.

If You Pay as you go Principal

In case you had the mortgage for all 12 months and your rate of interest didn’t change in the course of the 12 months, which is the case for most individuals with a fixed-rate mortgage, you should utilize the “curiosity paid divided by rate of interest methodology” to calculate your common mortgage steadiness. Suppose you paid $30,000 in mortgage curiosity and your price is 2.875%, your common mortgage steadiness is:

$30,000 / 0.02875 = $1,043,478

Your deductible mortgage curiosity is:

$750,000 / $1,043,478 * $30,000 = $21,562

In case your curiosity modified in the course of the 12 months, you’re higher off utilizing the “mortgage statements methodology.” Obtain the month-to-month statements out of your lender. Add up your steadiness from January to December and divide by 12. That’s your common mortgage steadiness in the course of the 12 months. Use that quantity to calculate your pro-rated deductible mortgage curiosity and provides it to TurboTax:

Mortgage Restrict / Common Mortgage Steadiness * Precise Mortage Curiosity Paid

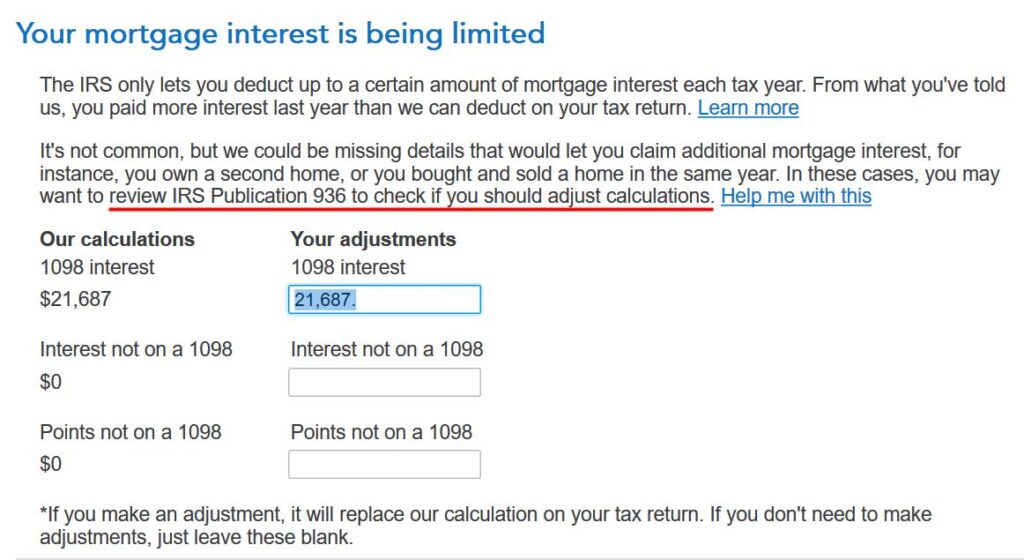

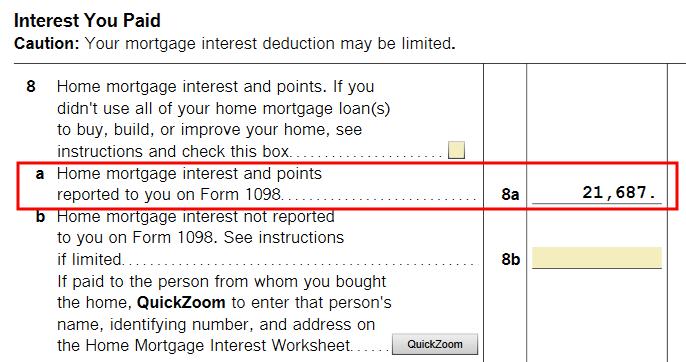

Confirm on Schedule A

To substantiate how a lot mortgage curiosity deduction you’re getting, click on on Varieties on the highest proper and discover Schedule A within the listing of kinds within the left panel.

Scroll all the way down to the center and discover Line 8. You’ll see the mortgage curiosity deduction.

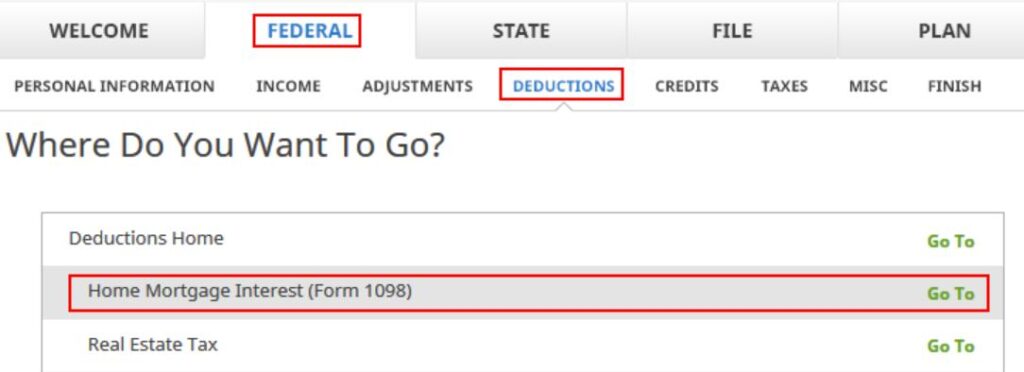

H&R Block

Mortgage curiosity deduction works in a different way within the H&R Block software program.

Discover “Residence Mortgage Curiosity (Kind 1098)” underneath Federal -> Deductions.

1098 Entries

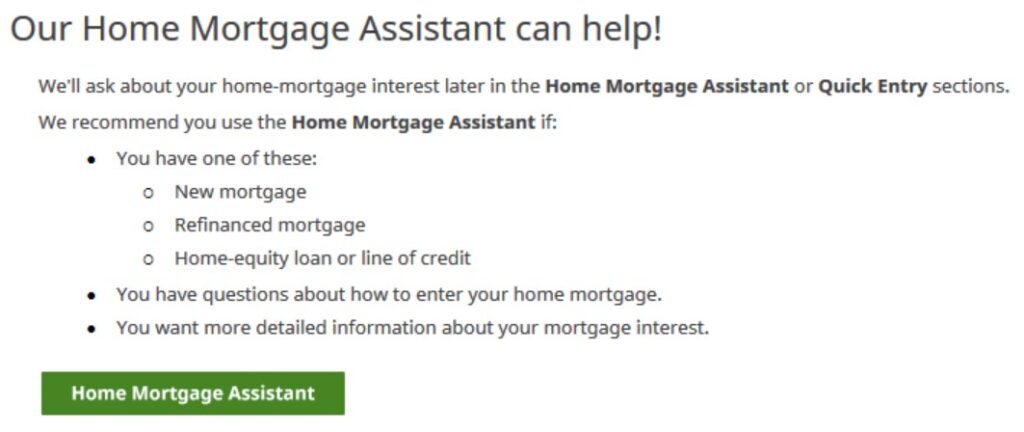

H&R Block presents a Residence Mortgage Assistant. Click on on that.

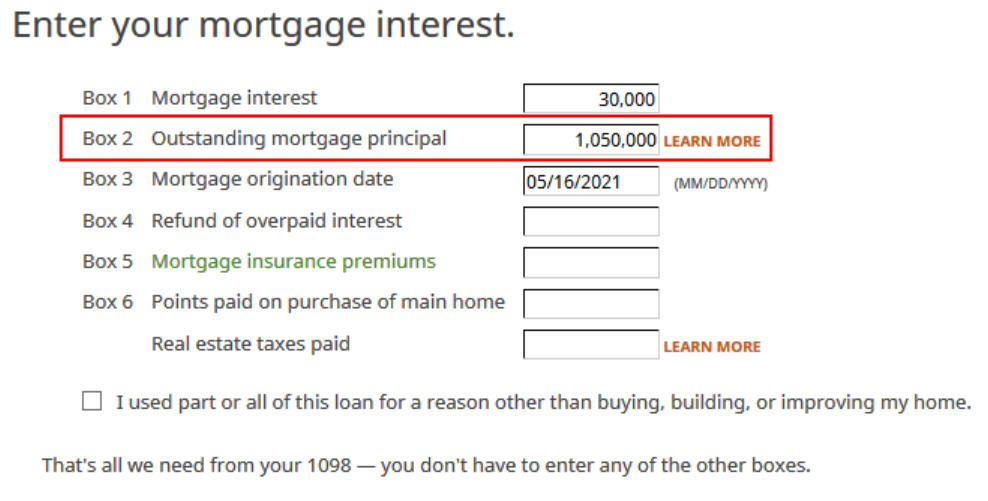

After saying now we have a 1098 type and coming into the identify of the lender, we come to this manner to enter the numbers on the 1098 type.

The IRS instructs banks to place in Field 2 your mortgage steadiness as of the starting of the 12 months (or your starting mortgage steadiness in the event you took out the mortgage in the course of the 12 months) however H&R Block treats it as your common steadiness in the course of the 12 months. That is improper and it reduces your mortgage curiosity deduction.

Calculate Common Mortgage Steadiness

It is best to calculate the typical mortgage steadiness your self and put it in Field 2.

- In case you didn’t prepay multiple month’s principal, get the start steadiness and the ending steadiness. Take a mean.

- In case you pay as you go multiple month’s principal however your rate of interest didn’t change, divide the curiosity paid by your rate of interest.

- In case you pay as you go multiple month’s principal and your rate of interest modified in the course of the 12 months, get your steadiness as of the start of every month and take a mean.

Suppose your starting steadiness was $1,100,000 and your ending steadiness was $1,000,000, and also you didn’t prepay multiple month’s principal in the course of the 12 months, your common steadiness utilizing the primary methodology is

( $1,100,000 + $1,000,000 ) / 2 = $1,050,000

You additionally must enter the date whenever you bought the house in Field 3. This date determines whether or not you’ve gotten a $1 million restrict or a $750,000 restrict for the mortgage curiosity deduction. If this mortgage was from a refinance and the financial institution put the refinance date in Field 3, you need to overwrite it with the date whenever you initially purchased the house.

Mortgage Curiosity Deduction

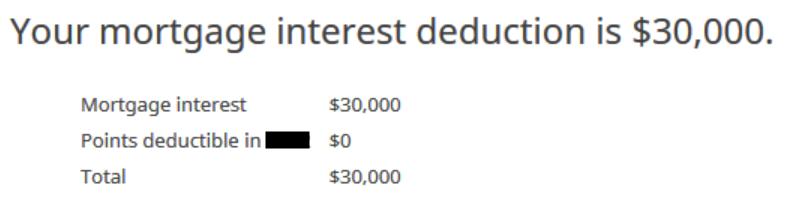

After answering some extra questions on factors and mortgage insurance coverage premiums, which we don’t have, H&R Block says we will deduct 100% of the mortgage curiosity paid. This could’t be proper. We entered a steadiness above $1 million on the 1098 type. H&R Block simply makes use of the curiosity paid quantity from the 1098 type as if the mortgage restrict doesn’t exist.

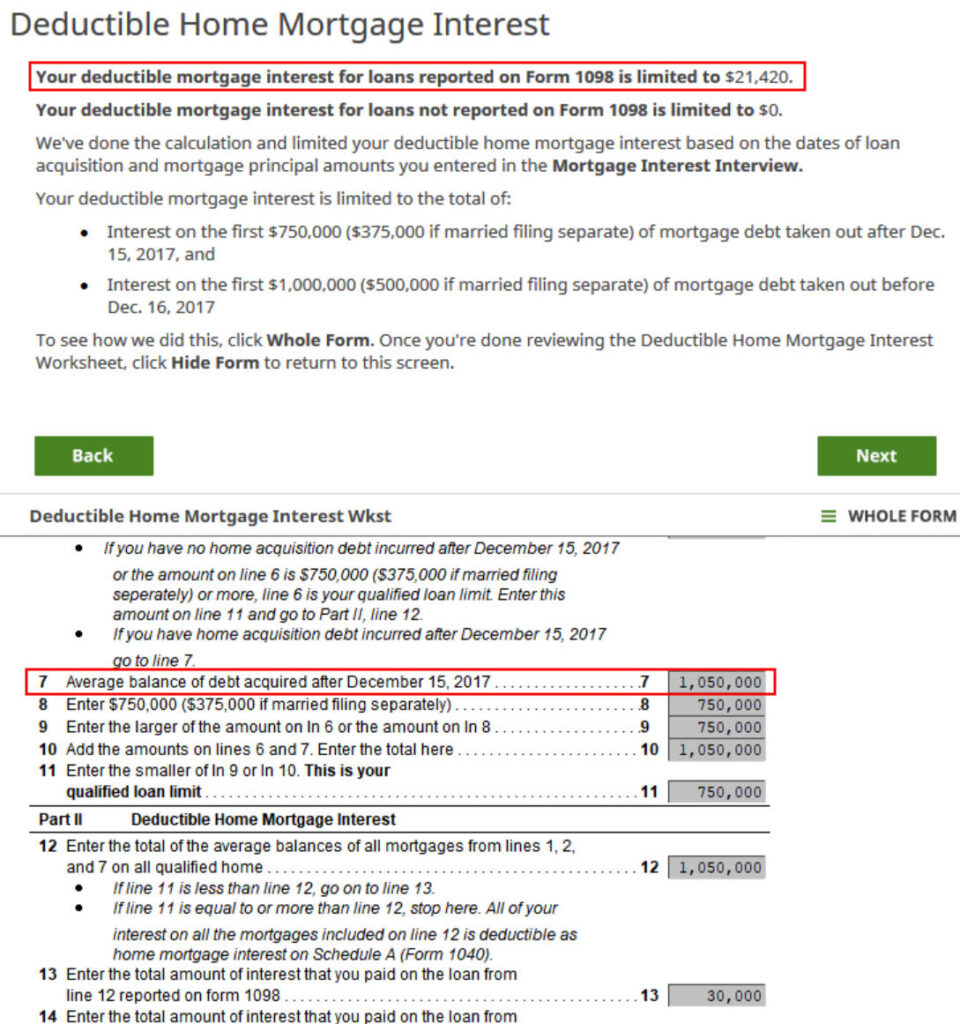

You see this whenever you click on on “Completed” after you’re accomplished with all of your 1098 kinds. H&R Block calculates a mortgage curiosity deduction topic to the mortgage restrict. You may see it’s utilizing the quantity from the 1098 type because the common mortgage steadiness. It could use the bigger starting steadiness reported by the financial institution and offer you a smaller deduction in the event you didn’t overwrite the quantity with the typical steadiness you calculated your self.

Granted that TurboTax doesn’t cowl all conditions however not less than it makes an try and cowl the most typical state of affairs (solely common funds with out additional principal funds). H&R Block simply makes use of a improper quantity with out telling you. That’s unhealthy. Though solely a small proportion of individuals deduct their mortgage curiosity now, amongst those that can nonetheless deduct, many have a mortgage above the restrict.

FreeTaxUSA

I additionally checked how the net tax software program FreeTaxUSA does it.

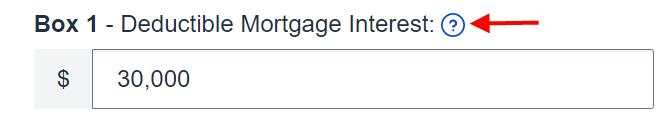

FreeTaxUSA places a small query mark hyperlink subsequent to the mortgage curiosity entry. Clicking on the query mark opens a pop-up, which says towards the tip:

In case your debt is greater than the bounds, use Publication 936 to determine your deductible residence mortgage curiosity quantity and cut back the mortgage curiosity you enter accordingly.

You’re by yourself whenever you use FreeTaxUSA. It doesn’t inform you clearly that you have to do some additional work. You’ll’ve claimed extra deduction that you just’re eligible for in the event you didn’t know to click on on that query mark and browse the entire pop-up.

***

H&R Block tax software program is cheaper than TurboTax however utilizing a improper quantity to calculate your mortgage curiosity deduction can price you a lot instances greater than the worth of the software program. See one other instance in Easy methods to Enter Overseas Tax Credit score Kind 1116 in H&R Block. You actually should know the place it cuts corners whenever you use H&R Block software program. It really works effectively solely when these reduce corners don’t have an effect on you. The identical additionally applies to FreeTaxUSA.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you might be paying 5-10x an excessive amount of. Discover ways to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]