[ad_1]

2022 was one of many worst years ever for monetary markets.

Over the previous 100 years:

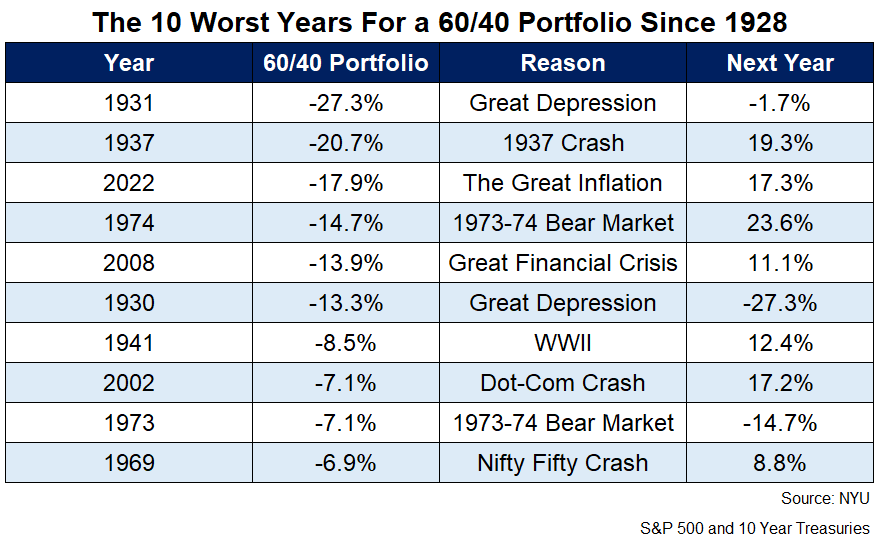

It was the third worst 12 months for a 60/40 portfolio.

It was the seventh worst 12 months for the S&P 500.

It was the worst 12 months ever for the Barclays Combination Bond Market Index.

It was the worst 12 months ever for the ten 12 months Treasury bond.

Right here’s what I wrote final 12 months at the moment:

Anticipated returns at the moment are greater.

I don’t have the power to foretell the timing or magnitude of these greater anticipated returns however there’s now a a lot greater cushion for buyers than there was in years so far as yields are involved.

The opposite excellent news is each time we’ve ever had unhealthy occasions prior to now they turned out to be great alternatives for long-term buyers.

There aren’t any ensures however issues needs to be higher for buyers sooner or later so long as you may have sufficient persistence and perspective.

There are usually two outcomes as to what occurs after an terrible 12 months like 2022 — you get a bounce-back restoration, or the unhealthy occasions proceed.

Fortunately, 2023 was the previous not the latter. Anticipated returns had been greater and precise returns adopted swimsuit.

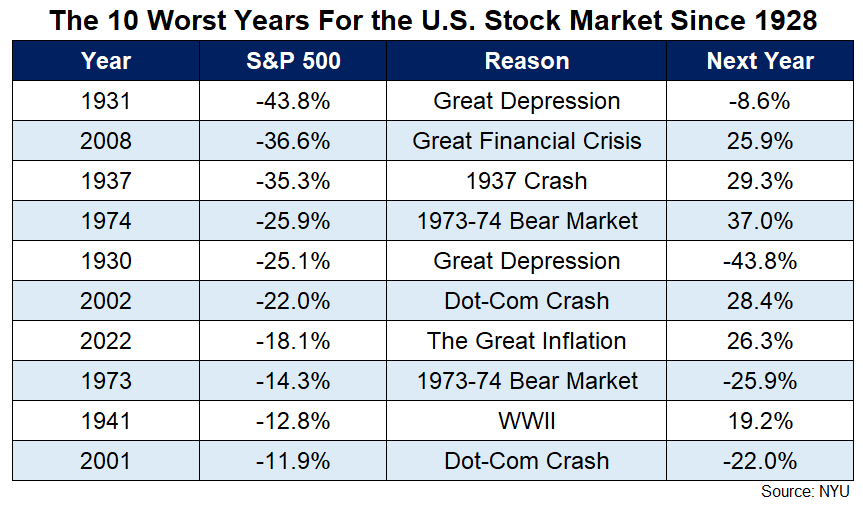

Right here’s a have a look at the worst annual returns for the S&P 500 over the previous 100 years or so together with efficiency within the ensuing 12 months:

And here’s a have a look at what occurs to a 60/40 portfolio following a foul 12 months:

2023 was 12 months.

The inventory market did a lot of the heavy lifting however bonds did alright too.

The ten 12 months Treasury bond had a good 12 months which is form of a miracle contemplating what occurred to rates of interest in 2023.

The ten-year yield began the 12 months at 3.9%. It bought as little as 3.3% then shot all the way in which as much as 5% by the tip of October. Charges fell from there to complete the 12 months proper again at 3.9%. It was a roundtrip.

The ten 12 months returned near 4% on the 12 months1 which helped a 60/40 portfolio of U.S. shares and Treasury bonds return greater than 17% in 2023.

I assume the 60/40 portfolio wasn’t useless in spite of everything.

Tech shares had been up a ton this 12 months after getting crushed final 12 months.

The Nasdaq 100 fell 33% in 2022. In 2023, it was up 55%, considered one of its finest years ever.

The most important shares actually made a distinction this 12 months nevertheless it wasn’t simply the Magnificent 7 that had been up in 2023.

The Russell 2000 Index of small cap shares was up 17%.

The S&P 400 Mid Cap Index gained greater than 16%.

The S&P 500 Equal Weight completed the 12 months with a acquire of virtually 14%.

Even worldwide shares got here to life in 2023. The MSCI EAFE Index of worldwide developed nation shares elevated by almost 19%.

The MSCI Rising Markets Index grew greater than 10%.

Final 12 months it was almost not possible to generate income.

This 12 months it could have been troublesome to lose cash.

There was no recession. The inflation charge fell. The unemployment charge didn’t rise previous 4%. Fuel costs dropped.

It was 12 months.

So what does that imply for 2024?

In a follow-up piece I’ll have a look at the historic data of excellent years and what comes subsequent.

Completely satisfied New 12 months.

Additional Studying:

2022 Was One of many Worst Years Ever For Monetary Markets

1The complete return was clearly all revenue since yields ended the place they began.

[ad_2]