[ad_1]

Many individuals purchased I Bonds when inflation was excessive. Many individuals cashed out I Bonds to purchase new I Bonds or TIPS when the mounted price on I Bonds and TIPS yields went up final 12 months. Others merely cashed out I Bonds to do one thing else with the cash.

By default, you pay tax on all of the curiosity earned whenever you money out I Bonds. Right here’s learn how to report the curiosity earnings in tax software program TurboTax, H&R Block, and FreeTaxUSA.

Discover the 1099 Kind

TreasuryDirect sends an electronic mail in late January when the 1099 type is prepared. You have to get the 1099 type on-line out of your TreasuryDirect account. TreasuryDirect doesn’t mail the 1099 type to you. Right here’s learn how to discover the 1099 type within the TreasuryDirect account.

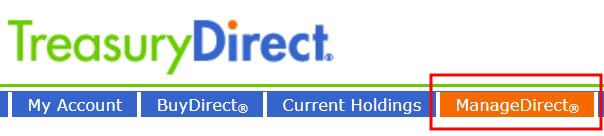

Log in to your TreasuryDirect account and click on on ManageDirect on the highest.

Scroll down to seek out the hyperlink for the earlier 12 months beneath the heading Handle My Taxes.

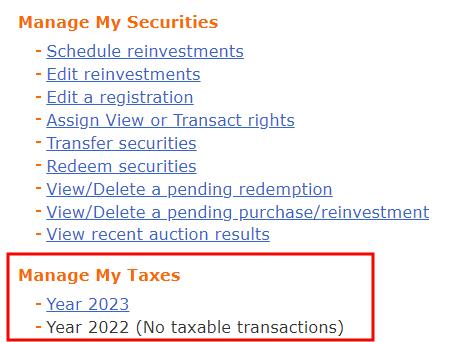

You see a listing of your taxable transactions within the earlier 12 months. Your 1099 type is behind the hyperlink “View your 1099 for tax 12 months 20xx” earlier than the listing begins.

Save the 1099 Kind

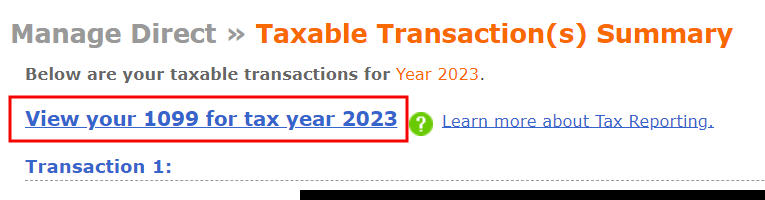

Clicking on that hyperlink brings you to the 1099 type. It’s only a internet web page, not a PDF file. It doesn’t appear like a 1099 type however that’s simply how TreasuryDirect does it.

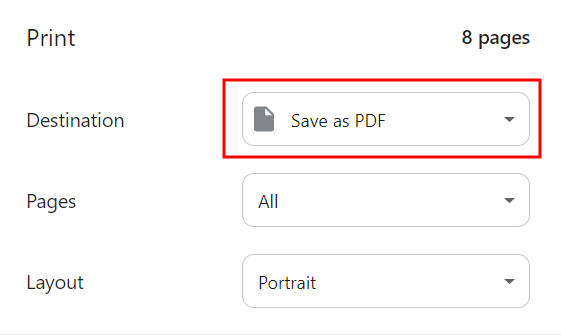

It can save you it as a PDF through the use of the print perform of your browser (Ctrl + P on a Home windows laptop or Command + P on a Mac). The mainstream browsers have a “Save as PDF” characteristic whenever you print (see directions for Chrome, Safari, and Firefox).

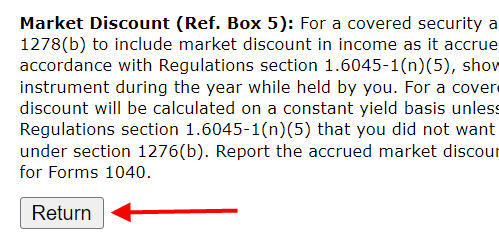

After you save the 1099 type as a PDF, be sure you scroll to the underside of that web page and click on on the Return button. Unhealthy issues will occur in the event you click on on the again button in your browser!

Verify Each Account

When you’ve got a number of TreasuryDirect accounts (partner, kids, enterprise, belief, …), repeat the steps above in every account. Should you deposited paper bonds into your TreasuryDirect account right into a Conversion Linked Account and also you cashed out bonds within the Conversion Linked Account with out transferring the bonds to your important account, go into the Conversion Linked Account and discover the 1099 type there.

It’s an excellent behavior to only log in to each TreasuryDirect account you might have and search for the 1099 type. You’ll hear from the IRS for under-reporting your earnings when you’ve got a 1099 type sitting there in an account you didn’t verify and also you don’t embody the curiosity in your tax return.

Learn the 1099 Kind

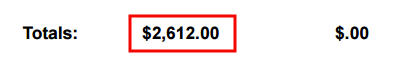

Most banks and brokers current the 1099 type as a abstract adopted by supporting particulars. TreasuryDirect takes the alternative strategy. They current the small print first, adopted by a complete on the finish.

TreasuryDirect’s 1099 type additionally features a bunch of irrelevant info. My 1099 type is 8 pages lengthy once I want just one quantity from it. You need to hunt for the small bits you want.

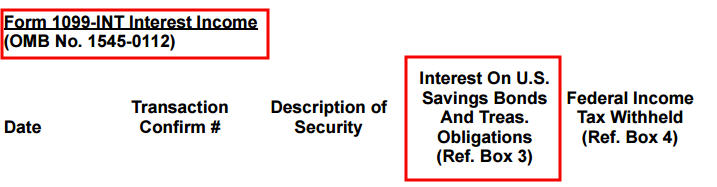

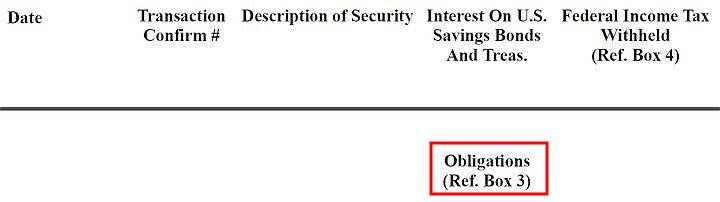

Should you solely had I Bonds within the TreasuryDirect account, not common Treasuries or TIPS, you solely want to have a look at the 1099-INT part. The curiosity is within the column labeled “Curiosity on U.S. Financial savings Bonds And Treas. Obligations (Ref. Field 3).” The Field 3 half is necessary as a result of it tells you the place the quantity goes whenever you enter it into tax software program. As a result of it was an internet web page saved as a PDF, this heading could break throughout two pages. A reader despatched me this screenshot of his 1099 type:

The necessary Field 3 half is definitely missed when it exhibits up on a special web page.

Should you selected to have TreasuryDirect withhold taxes whenever you cashed out I Bonds (see Voluntary Tax Withholding on Promoting I Bonds at TreasuryDirect), the tax withheld quantity is reported within the column after the curiosity. Notice that it goes into Field 4 whenever you enter it into tax software program.

Look previous the detailed itemizing of every sale to seek out the entire on the finish of the 1099-INT part. That’s the quantity you want on your tax software program.

Enter Into Tax Software program

Getting the 1099 type, saving it as a PDF, looking for the quantity you want from the 1099 type, and repeating the method for a number of accounts are essentially the most troublesome elements of this journey. Coming into the quantity into tax software program is comparatively easy.

We begin with TurboTax. Please skip over to H&R Block or FreeTaxUSA in the event you don’t use TurboTax.

TurboTax

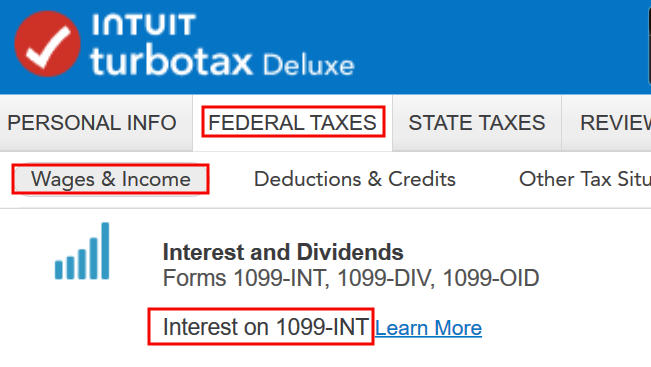

Go to Federal Taxes -> Wages & Revenue -> Curiosity on 1099-INT in TurboTax. You’ll must sort it in your self as a result of TreasuryDirect doesn’t assist importing the 1099 type.

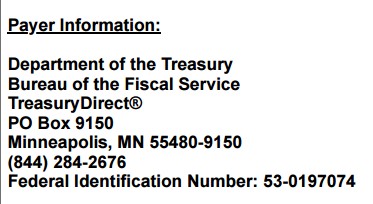

Enter the payer as “Division of the Treasury” as a result of that’s how the Payer Data exhibits on the 1099 type from TreasuryDirect.

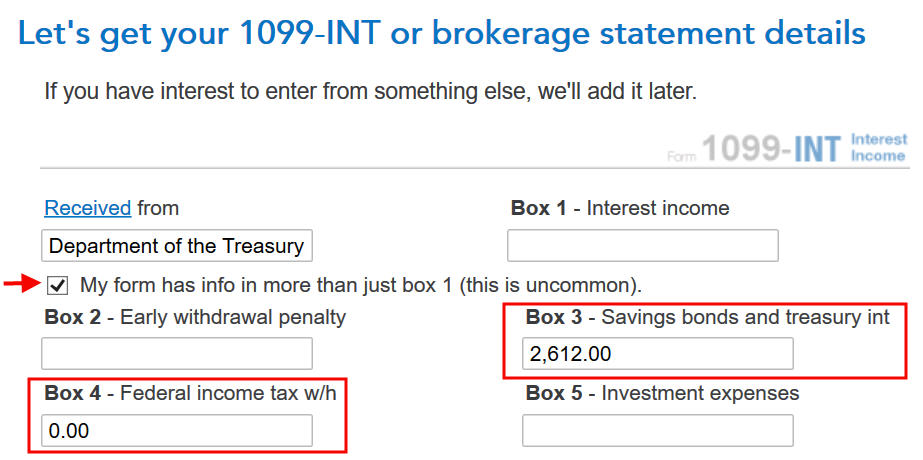

Verify that field “My type has data in additional than simply field 1 (that is unusual).” to increase the shape as a result of we have to put our quantity in Field 3 (and Field 4 in the event you had taxes withheld). Enter the totals in Field 3 and Field 4. Go away Field 1 clean. Click on on Proceed on the backside.

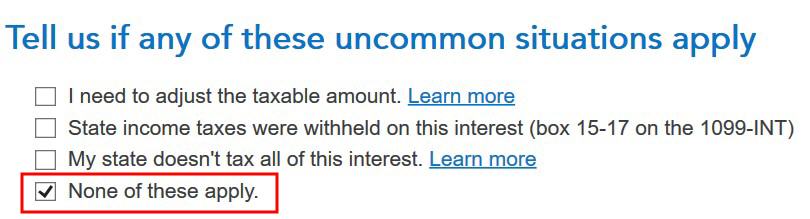

Verify on the field “None of those apply.” on the subsequent display screen. The state earnings tax exemption is automated whenever you enter the curiosity in Field 3 on the earlier display screen.

Repeat the above steps when you’ve got a number of 1099-INT varieties from TreasuryDirect. Click on on Executed on the 1099-INT abstract display screen after you’re carried out with all of the 1099-INT varieties.

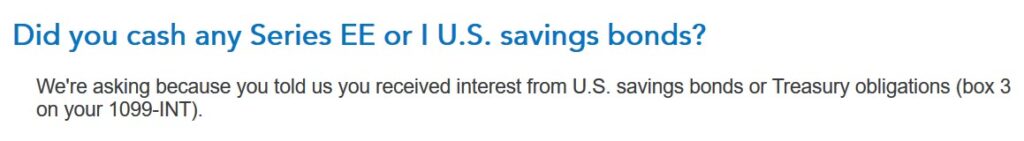

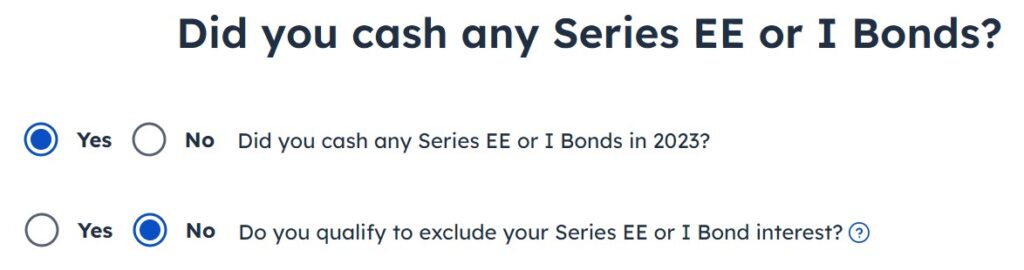

TurboTax asks whether or not you cashed Sequence EE or I U.S. financial savings bonds in case you qualify for the tax exemption (see Money Out I Bonds Tax Free For Faculty Bills Or 529 Plan). Reply Sure if you would like TurboTax to verify your eligibility. Reply No in the event you didn’t use the cash for school bills or put it right into a 529 plan or if you realize for certain you don’t qualify as a result of your earnings is above the restrict.

H&R Block

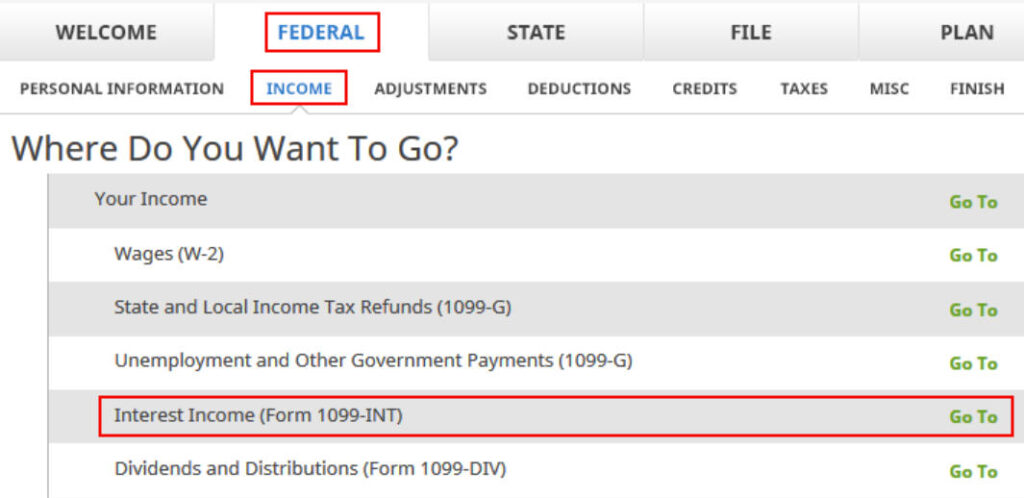

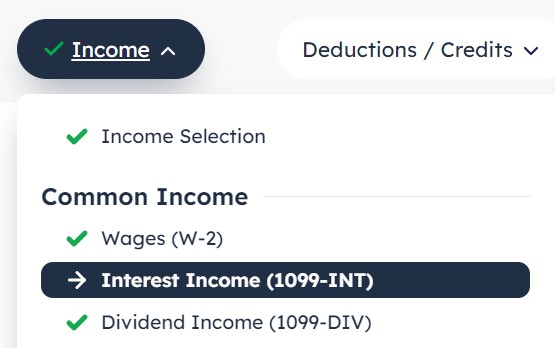

H&R Block tax software program has it beneath Federal -> Revenue -> Curiosity Revenue (Kind 1099-INT). Enter one manually as a result of TreasuryDirect doesn’t assist importing the shape.

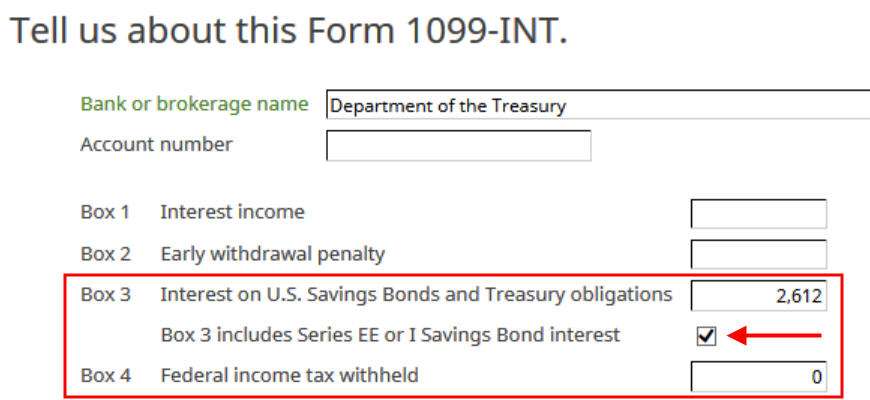

Enter “Division of the Treasury” because the financial institution or brokerage identify. The account quantity could also be elective however you’ll discover it on the 1099 type in the event you want it. Enter the totals from the 1099 type into Field 3 and Field 4 and verify that field “Field 3 consists of Sequence EE or I Financial savings Bond curiosity.”

Go away Field 1 clean. The state earnings tax exemption is automated whenever you enter the curiosity in Field 3.

Repeat the method when you’ve got a number of 1099 varieties from TreasuryDirect.

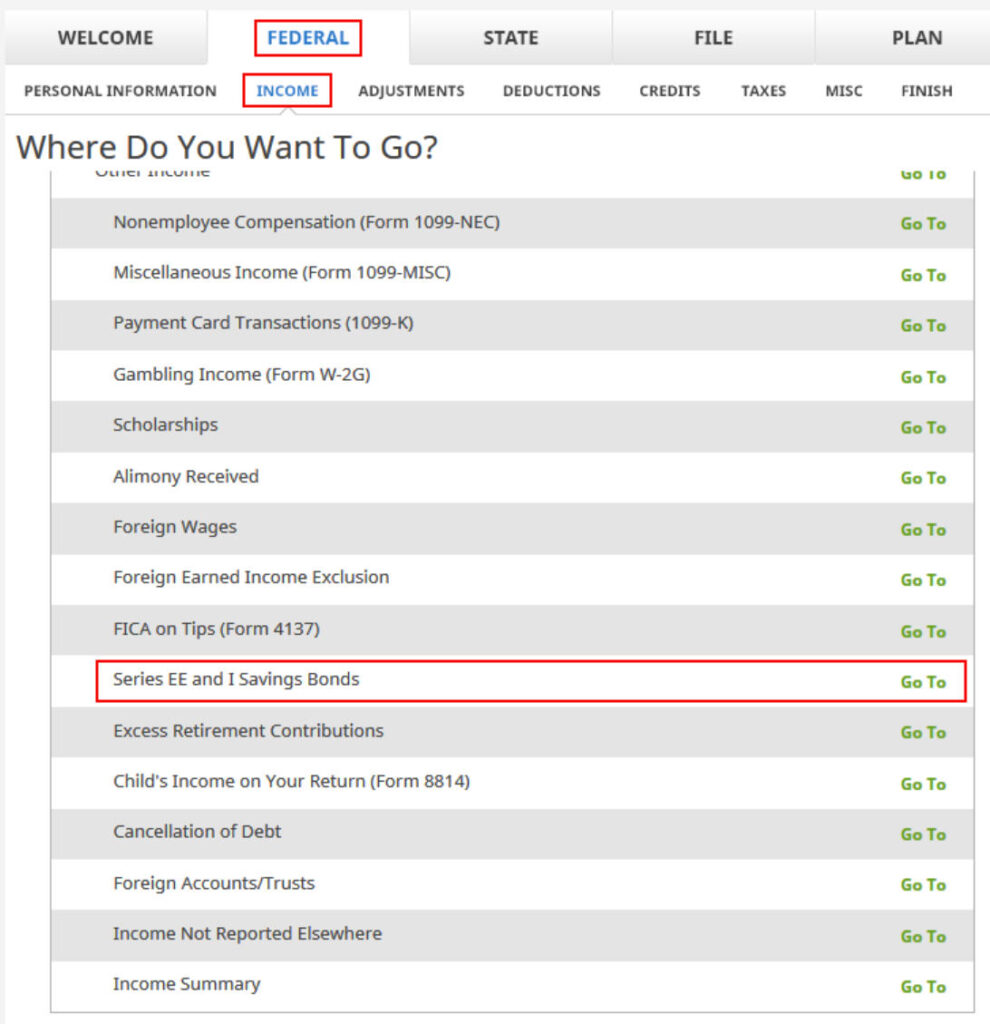

H&R Block doesn’t ask you about utilizing cash from financial savings bonds for school bills or placing it right into a 529 plan instantly. Should you assume you would possibly qualify for the tax exemption (see Money Out I Bonds Tax Free For Faculty Bills Or 529 Plan), scroll down towards the underside of the Revenue part and go into “Sequence EE and I Financial savings Bonds.”

FreeTaxUSA

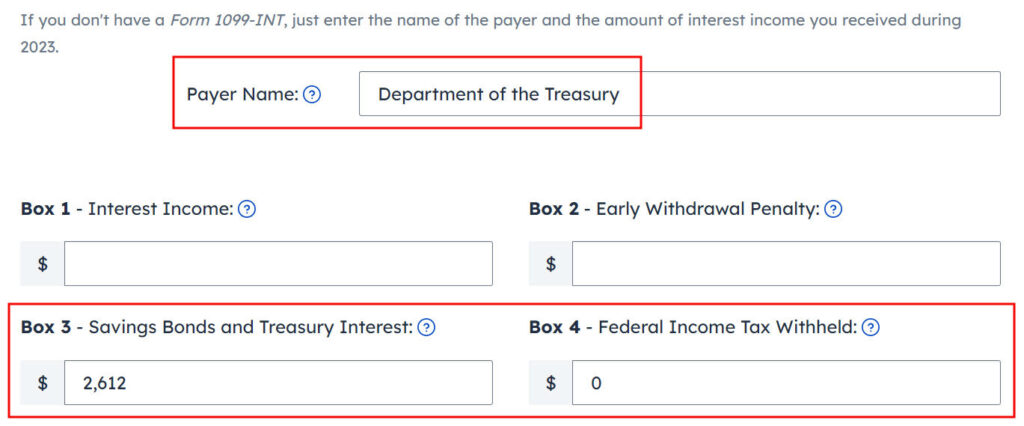

Go to the “Curiosity Revenue (1099-INT)” part beneath Frequent Revenue. Click on on “Add Curiosity Revenue” on that web page.

Enter “Division of the Treasury” because the Payer Title, the entire curiosity in Field 3, and the tax withheld in Field 4. Go away Field 1 clean. The state earnings tax exemption is automated whenever you enter the curiosity in Field 3.

Repeat the method when you’ve got multiple 1099-INT from TreasuryDirect.

FreeTaxUSA asks whether or not you probably qualify for the tax exemption (see Money Out I Bonds Tax Free For Faculty Bills Or 529 Plan). Reply Sure to the second query in the event you used the cash for school bills or put it right into a 529 plan. Reply No in the event you didn’t do this or if you realize for certain you don’t qualify as a result of your earnings is simply too excessive.

Pay Tax Yearly

You’re by yourself if select to pay tax on I Bonds curiosity yearly versus ready till you money out (see I Bonds Tax Therapy Throughout Your Lifetime and After You Die). You gained’t get a 1099 type from TreasuryDirect whenever you don’t promote your I Bonds. You’ll must make up a 1099 type for the tax software program.

Use the Financial savings Bond Calculator to calculate the change in redemption worth for every bond from the prior December to final December. Report the entire change as your curiosity for the 12 months in Field 3 of the made-up 1099-INT.

Say No To Administration Charges

If you’re paying an advisor a share of your property, you’re paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]