[ad_1]

[Updated on November 14, 2023 after the release of the inflation number for October 2023.]

Seniors 65 or older can join Medicare. The federal government calls individuals who obtain Medicare beneficiaries. Medicare beneficiaries should pay a premium for Medicare Half B which covers docs’ companies and Medicare Half D which covers prescribed drugs. The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%.

What Is IRMAA?

Medicare imposes surcharges on higher-income beneficiaries. The idea is that higher-income beneficiaries can afford to pay extra for his or her healthcare. As a substitute of doing a 25:75 break up with the federal government, they have to pay a better share of this system prices.

The surcharge is named IRMAA, which stands for Earnings-Associated Month-to-month Adjustment Quantity. This is applicable to each Conventional Medicare (Half B and Half D) and Medicare Benefit plans.

In keeping with the Medicare Trustees Report, 7% of Medicare Half B beneficiaries paid IRMAA. The additional premiums they paid lowered the federal government’s share of the overall Half B and Half D bills by two proportion factors. Large deal?

MAGI

The earnings used to find out IRMAA is your Modified Adjusted Gross Earnings (MAGI) — which is your AGI plus tax-exempt curiosity and dividends from muni bonds — from two years in the past. Your 2021 MAGI determines your IRMAA in 2023. Your 2022 MAGI determines your IRMAA in 2024. Your 2023 MAGI determines your IRMAA in 2025.

There are a lot of definitions of MAGI for various functions. The MAGI for subsidies on medical health insurance from the ACA market consists of untaxed Social Safety advantages. The MAGI for IRMAA doesn’t embody untaxed Social Safety advantages. When you learn elsewhere that claims that untaxed Social Safety advantages are included in MAGI, they’re speaking a few completely different MAGI, not the MAGI for IRMAA.

You should utilize Calculator: How A lot of My Social Safety Advantages Is Taxable? to calculate the taxable portion of your Social Safety advantages.

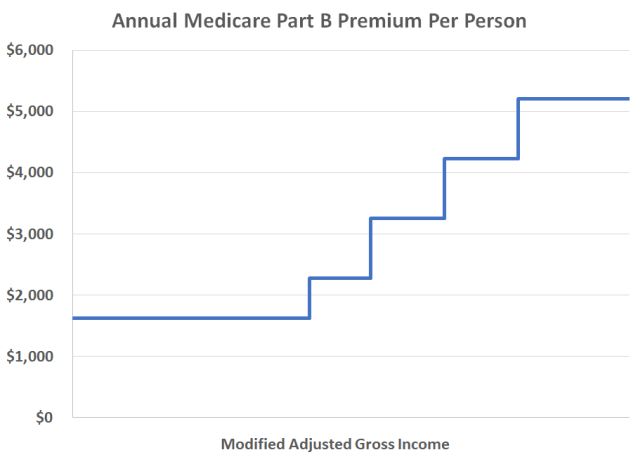

As if it’s not sophisticated sufficient whereas not shifting the needle a lot, IRMAA is split into 5 earnings brackets. Relying on the earnings, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of this system prices as a substitute of 25%. Consequently, they pay 1.4 instances, 2.0 instances, 2.6 instances, 3.2 instances, or 3.4 instances the usual Medicare premium.

The brink for every bracket may cause a sudden bounce within the month-to-month premium quantity you pay. In case your earnings crosses over to the following bracket by $1, abruptly your Medicare premiums can bounce by over $1,000/yr. If you’re married submitting a joint tax return and each of you’re on Medicare, $1 extra in earnings could make the Medicare premiums bounce by over $1,000/yr for every of you.

* The final bracket on the far proper isn’t displayed within the chart.

So in case your earnings is close to a bracket cutoff, see when you can handle to maintain it down and make it keep in a decrease bracket. Utilizing the earnings from two years in the past makes it harder to handle.

2023 IRMAA Brackets

The earnings in your 2021 IRS tax return (filed in 2022) determines the IRMAA you pay in 2023.

| Half B Premium | 2022 Protection (2020 Earnings) | 2023 Protection (2021 Earnings) |

|---|---|---|

| Normal | Single: <= $91,000 Married Submitting Collectively: <= $182,000 Married Submitting Individually <= $91,000 |

Single: <= $97,000 Married Submitting Collectively: <= $194,000 Married Submitting Individually <= $97,000 |

| 1.4x Normal | Single: <= $114,000 Married Submitting Collectively: <= $228,000 |

Single: <= $123,000 Married Submitting Collectively: <= $246,000 |

| 2.0x Normal | Single: <= $142,000 Married Submitting Collectively: <= $284,000 |

Single: <= $153,000 Married Submitting Collectively: <= $306,000 |

| 2.6x Normal | Single: <= $170,000 Married Submitting Collectively: <= $340,000 |

Single: <= $183,000 Married Submitting Collectively: <= $366,000 |

| 3.2x Normal | Single: < $500,000 Married Submitting Collectively: < $750,000 Married Submitting Individually < $409,000 |

Single: < $500,000 Married Submitting Collectively: < $750,000 Married Submitting Individually < $403,000 |

| 3.4x Normal | Single: >= $500,000 Married Submitting Collectively: >= $750,000 Married Submitting Individually >= $409,000 |

Single: >= $500,000 Married Submitting Collectively: >= $750,000 Married Submitting Individually >= $403,000 |

Supply: Medicare Prices, Medicare.gov

The usual Half B premium is $164.90 in 2023.

Increased-income Medicare beneficiaries additionally pay a surcharge for Half D. The earnings brackets are the identical. The Half D IRMAA surcharges are comparatively smaller in {dollars}.

2024 IRMAA Brackets

The earnings in your 2022 IRS tax return (filed in 2023) determines the IRMAA you pay in 2024.

| Half B Premium | 2023 Protection (2021 Earnings) | 2024 Protection (2022 Earnings) |

|---|---|---|

| Normal | Single: <= $97,000 Married Submitting Collectively: <= $194,000 Married Submitting Individually <= $97,000 |

Single: <= $103,000 Married Submitting Collectively: <= $206,000 Married Submitting Individually <= $103,000 |

| 1.4x Normal | Single: <= $123,000 Married Submitting Collectively: <= $246,000 |

Single: <= $129,000 Married Submitting Collectively: <= $258,000 |

| 2.0x Normal | Single: <= $153,000 Married Submitting Collectively: <= $306,000 |

Single: <= $161,000 Married Submitting Collectively: <= $322,000 |

| 2.6x Normal | Single: <= $183,000 Married Submitting Collectively: <= $366,000 |

Single: <= $193,000 Married Submitting Collectively: <= $386,000 |

| 3.2x Normal | Single: < $500,000 Married Submitting Collectively: < $750,000 Married Submitting Individually < $403,000 |

Single: < $500,000 Married Submitting Collectively: < $750,000 Married Submitting Individually < $397,000 |

| 3.4x Normal | Single: >= $500,000 Married Submitting Collectively: >= $750,000 Married Submitting Individually >= $403,000 |

Single: >= $500,000 Married Submitting Collectively: >= $750,000 Married Submitting Individually >= $397,000 |

Supply: Medicare Prices, Medicare.gov

The usual Half B premium is $174.70 in 2023. Increased-income Medicare beneficiaries additionally pay a surcharge for Half D. The earnings brackets are the identical. The Half D IRMAA surcharges are comparatively smaller in {dollars}.

I even have the Social Safety COLA and the tax brackets for subsequent yr. Please learn 2024 Social Safety Value of Residing Adjustment (COLA) and 2024 Tax Brackets, Normal Deduction, Capital Good points, and many others. when you’re .

2025 IRMAA Brackets

We have now two information factors out of 12 proper now for the IRMAA brackets in 2025 (primarily based on 2023 earnings). Nevertheless, you can also make some preliminary estimates and provides your self some margin to remain away from the cutoff factors.

If annualized inflation from November 2023 by means of August 2024 is 0% (costs staying flat on the newest stage) or 3% (roughly a 0.25% improve each month), these would be the 2025 numbers:

| Half B Premium | 2025 Protection (2023 Earnings) 0% Inflation |

2025 Protection (2023 Earnings) 3% Inflation |

|---|---|---|

| Normal | Single: <= $105,000 Married Submitting Collectively: <= $210,000 Married Submitting Individually <= $105,000 |

Single: <= $106,000 Married Submitting Collectively: <= $212,000 Married Submitting Individually <= $106,000 |

| 1.4x Normal | Single: <= $132,000 Married Submitting Collectively: <= $264,000 |

Single: <= $134,000 Married Submitting Collectively: <= $268,000 |

| 2.0x Normal | Single: <= $165,000 Married Submitting Collectively: <= $330,000 |

Single: <= $167,000 Married Submitting Collectively: <= $334,000 |

| 2.6x Normal | Single: <= $197,000 Married Submitting Collectively: <= $394,000 |

Single: <= $200,000 Married Submitting Collectively: <= $400,000 |

| 3.2x Normal | Single: < $500,000 Married Submitting Collectively: < $750,000 Married Submitting Individually < $395,000 |

Single: < $500,000 Married Submitting Collectively: < $750,000 Married Submitting Individually < $394,000 |

| 3.4x Normal | Single: >= $500,000 Married Submitting Collectively: >= $750,000 Married Submitting Individually >= $395,000 |

Single: >= $500,000 Married Submitting Collectively: >= $750,000 Married Submitting Individually >= $394,000 |

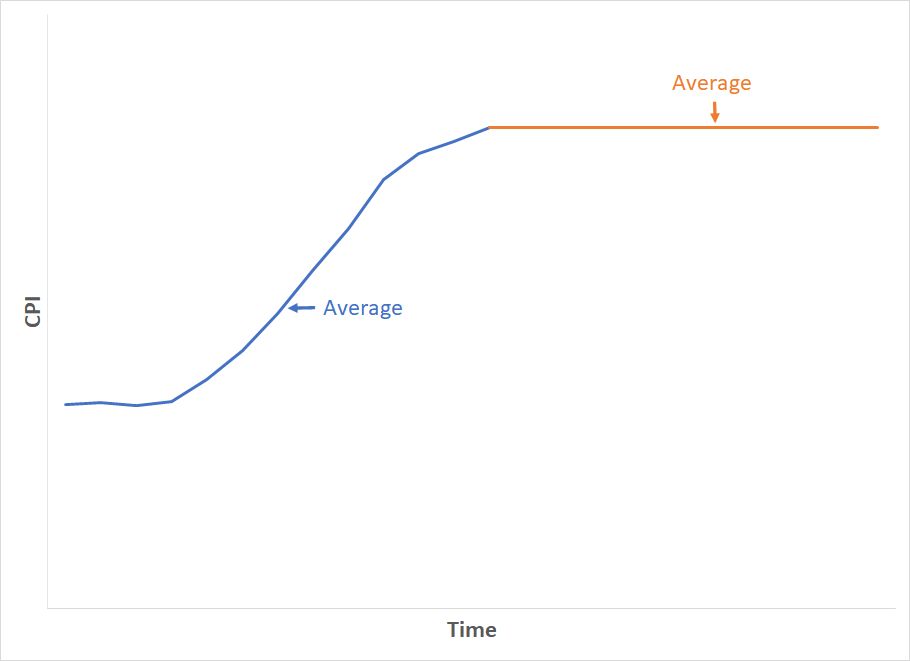

As a result of the components compares the common of 12 month-to-month CPI numbers over the common of 12 month-to-month CPI numbers in a base interval, even when costs keep the identical within the following months, the typical of the following 12 months will nonetheless be larger than the typical within the earlier 12 months.

To make use of exaggerated numbers, suppose fuel costs went up from $3/gallon to $3.50/gallon during the last 12 months. The common fuel value within the final 12 numbers was perhaps $3.20/gallon. When fuel value inflation turns into 0%, it means it stays on the present value of $3.50/gallon. The common for the following 12 months is $3.50/gallon. Brackets primarily based on a median fuel value of $3.50/gallon within the subsequent 12 months can be larger than brackets primarily based on a median fuel value of $3.20/gallon within the earlier 12 months.

When you actually need to get into the weeds of the methodology for these calculations, please learn remark #79 and remark #164.

Nickel and Dime

The usual Medicare Half B premium is $174.70/month in 2024. A 40% surcharge on the Medicare Half B premium is about $840/yr per individual or about $1,700/yr for a married couple each on Medicare.

Within the grand scheme, when a pair on Medicare has over $206,000 in earnings, they’re already paying a big quantity in taxes. Does making them pay one other $1,700 make that a lot distinction? It’s lower than 1% of their earnings however nickel-and-diming simply makes folks mad. Individuals caught unexpectedly when their earnings crosses over to a better bracket by only a small quantity are offended on the authorities. Rolling all of it into the earnings tax can be way more efficient.

Oh properly, in case you are on Medicare, watch your earnings and don’t unintentionally cross a line for IRMAA.

IRMAA Enchantment

In case your earnings two years in the past was larger since you had been working at the moment and now your earnings is considerably decrease since you retired (“work discount” or “work stoppage”), you may enchantment the IRMAA preliminary willpower. The “life-changing occasions” that make you eligible for an enchantment embody:

- Demise of partner

- Marriage

- Divorce or annulment

- Work discount

- Work stoppage

- Lack of earnings from earnings producing property

- Loss or discount of sure sorts of pension earnings

You file an enchantment with the Social Safety Administration by filling out the shape SSA-44 to indicate that though your earnings was larger two years in the past, you had a discount in earnings now resulting from one of many life-changing occasions above. For extra info on the enchantment, see Medicare Half B Premium Appeals.

Not Penalized For Life

In case your earnings two years in the past was larger and also you don’t have a life-changing occasion that makes you qualify for an enchantment, you’ll pay the upper Medicare premiums for one yr. IRMAA is re-evaluated yearly as your earnings adjustments. In case your larger earnings two years in the past was resulting from a one-time occasion, corresponding to realizing capital beneficial properties or taking a big withdrawal out of your IRA, when your earnings comes down within the following yr, your IRMAA will even come down routinely. It’s not the top of the world to pay IRMAA for one yr.

If you handle your earnings by doing Roth conversions, it’s essential to watch your MAGI rigorously to keep away from unintentionally crossing considered one of these IRMAA thresholds by a small quantity and triggering larger Medicare premiums.

I take advantage of two instruments to assist with calculating how a lot to transform to Roth. I wrote about these instruments in Roth Conversion with Social Safety and Medicare IRMAA and Roth Conversion with TurboTax What-If Worksheet.

Say No To Administration Charges

If you’re paying an advisor a proportion of your belongings, you’re paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.

[ad_2]